Addressing High Stock Market Valuations: Insights From BofA For Investors

Table of Contents

BofA's Assessment of Current High Stock Market Valuations

BofA's recent reports paint a picture of a market characterized by elevated valuations. They aren't necessarily predicting an immediate crash, but they do highlight the risks associated with these historically high levels. Their analysis uses several key metrics to assess the situation:

-

Price-to-Earnings (P/E) Ratio: BofA analyzes the P/E ratios across various sectors and the overall market, comparing them to historical averages and industry benchmarks. Elevated P/E ratios often suggest that stocks might be overvalued relative to their earnings potential.

-

Shiller PE Ratio (CAPE): This cyclically adjusted price-to-earnings ratio provides a longer-term perspective on valuation, smoothing out short-term earnings fluctuations. BofA uses this metric to gauge whether current valuations are truly exceptional compared to historical norms.

-

Other Valuation Metrics: BofA likely incorporates additional metrics, such as Price-to-Sales (P/S) ratios and Price-to-Book (P/B) ratios, to gain a more comprehensive understanding of valuation across different sectors and company types.

BofA's projections for future market performance, considering these high stock market valuations, are cautious. While continued growth is possible, the firm suggests that the potential for significant returns may be lower than in previous periods of lower valuations. This underscores the increased importance of careful risk management in the current environment. The comparison of current valuations to historical averages reveals that we are currently operating in uncharted territory, particularly in certain sectors.

Identifying Potential Risks Associated with High Stock Market Valuations

Investing in a market characterized by high stock market valuations presents several inherent risks. While the market may continue to climb in the short term, the potential for a significant correction or downturn looms large.

-

Risk of Significant Market Corrections: High valuations often precede market corrections, as investors begin to reassess the sustainability of current price levels. A correction could lead to significant losses in portfolio value.

-

Increased Volatility and Uncertainty: Markets with high valuations tend to be more volatile, meaning prices can fluctuate more dramatically in response to news and events. This heightened uncertainty makes it challenging to time the market effectively.

-

Potential Impact on Investor Portfolios: Investors heavily invested in overvalued assets could experience substantial losses if a correction occurs. This risk is amplified for those nearing retirement or with shorter-term investment horizons. Proper diversification becomes crucial here.

Understanding and acknowledging these risks is the first step in developing a robust investment strategy.

BofA's Recommended Strategies for Navigating High Stock Market Valuations

BofA likely recommends a diversified approach to mitigate the risks associated with high stock market valuations. This involves spreading investments across various asset classes and employing strategies that reduce overall portfolio volatility.

-

Diversification Across Asset Classes: Reducing exposure to equities alone is key. Diversification into assets like bonds, real estate, or alternative investments can help cushion against potential stock market declines.

-

Focus on Value Investing and Undervalued Stocks: Rather than chasing high-growth stocks with already inflated prices, focusing on companies with strong fundamentals but relatively lower valuations can be a prudent approach.

-

Strategic Asset Allocation Based on Risk Tolerance: Investors should align their portfolio allocation with their risk tolerance and investment goals. A more conservative approach with lower equity exposure might be appropriate in the current environment.

-

Consideration of Defensive Investment Strategies: Defensive stocks, typically less volatile than growth stocks, could play a more prominent role in a portfolio seeking to weather potential market downturns.

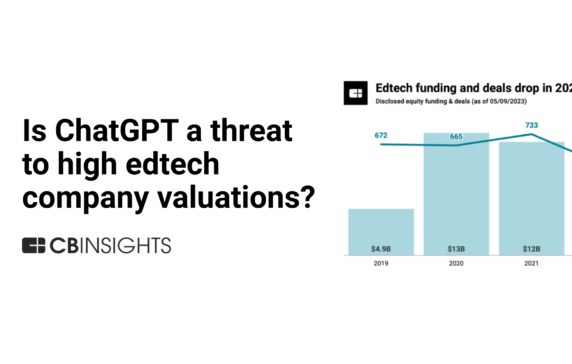

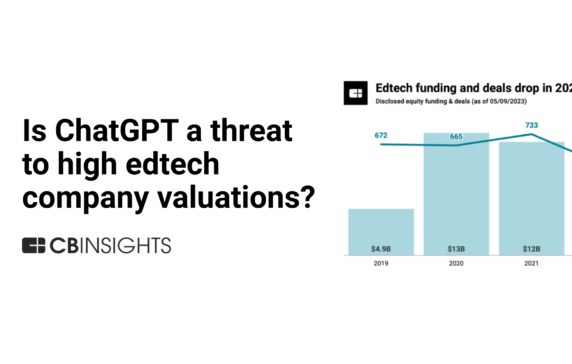

Analyzing Specific Sectors and their Vulnerability to High Valuations

BofA's analysis likely identifies specific sectors with particularly high valuations, making them potentially more vulnerable to corrections. This sector-specific analysis provides a granular understanding of the risks within different parts of the market.

-

Sectors with High Growth Potential but Also High Valuations: Technology, for example, often shows high growth and high valuations, which means it's a sector that requires careful scrutiny in this market environment.

-

Sectors with Lower Valuations and Potentially Better Risk-Reward Profiles: Sectors with lower valuations might offer better risk-adjusted returns, depending on their growth prospects. A thorough understanding of individual sector performance is important here.

-

BofA's Outlook for Each Highlighted Sector: BofA's reports likely offer specific outlooks and recommendations for different sectors, providing investors with valuable information to guide their investment decisions. Closely reviewing these sector-specific analyses is critical.

Conclusion

BofA's analysis of high stock market valuations underscores the importance of cautious optimism in the current market. Understanding the inherent risks associated with these valuations is crucial for developing a robust and resilient investment strategy. BofA's recommended strategies – including diversification, value investing, and careful asset allocation – provide a framework for navigating this challenging market environment. To gain a deeper understanding of managing high stock market valuations, consult BofA's research and reports for detailed analysis and sector-specific insights. By understanding and proactively addressing the complexities of high stock market valuations, you can build a portfolio that is better prepared to withstand market fluctuations and achieve your long-term financial goals. Remember, informed decision-making is paramount when facing the challenges presented by these high stock market valuations.

Featured Posts

-

The Who Bandmate Dispute Roger Daltreys Public Confession

May 23, 2025

The Who Bandmate Dispute Roger Daltreys Public Confession

May 23, 2025 -

Eric Andre Reveals Why He Passed On Kieran Culkin For A Role

May 23, 2025

Eric Andre Reveals Why He Passed On Kieran Culkin For A Role

May 23, 2025 -

Milly Alcocks House Of The Dragon Acting Coach The Story Behind The Scenes

May 23, 2025

Milly Alcocks House Of The Dragon Acting Coach The Story Behind The Scenes

May 23, 2025 -

New Claims About Dc Jewish Museum Suspect Elias Rodriguez And Psl Chicago

May 23, 2025

New Claims About Dc Jewish Museum Suspect Elias Rodriguez And Psl Chicago

May 23, 2025 -

Allaeb Ebd Alqadr W Ntyjt Mbarat Qtr W Alkhwr

May 23, 2025

Allaeb Ebd Alqadr W Ntyjt Mbarat Qtr W Alkhwr

May 23, 2025

Latest Posts

-

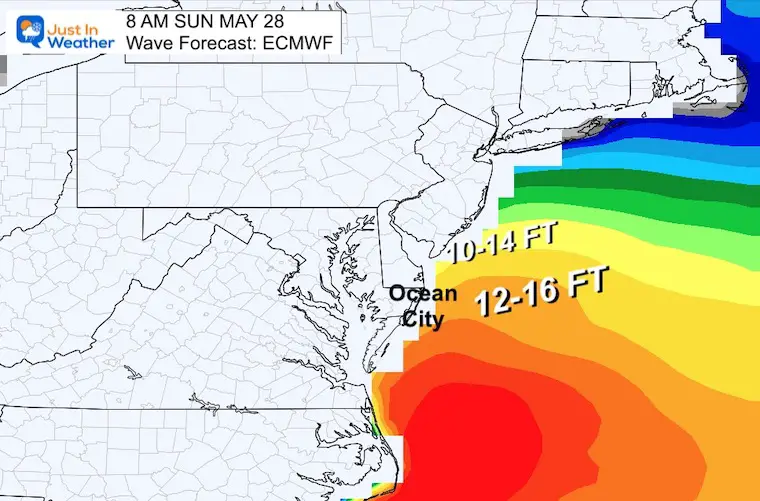

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 23, 2025

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 23, 2025 -

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 23, 2025

Ocean City Rehoboth Sandy Point Beach Weather Memorial Day Weekend 2025 Forecast

May 23, 2025 -

Commencement Speaker A World Famous Amphibian At University Of Maryland

May 23, 2025

Commencement Speaker A World Famous Amphibian At University Of Maryland

May 23, 2025 -

Renowned Amphibian To Give Commencement Speech University Of Maryland

May 23, 2025

Renowned Amphibian To Give Commencement Speech University Of Maryland

May 23, 2025 -

Kermits Words Of Wisdom University Of Maryland Commencement Speech Analysis

May 23, 2025

Kermits Words Of Wisdom University Of Maryland Commencement Speech Analysis

May 23, 2025