Addressing Investor Concerns: BofA On Elevated Stock Market Valuations

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA's assessment of current stock market valuations is cautiously optimistic, leaning towards neutral. While acknowledging the historically high valuations, they aren't predicting an immediate crash. Their analysis utilizes various valuation metrics to paint a nuanced picture.

-

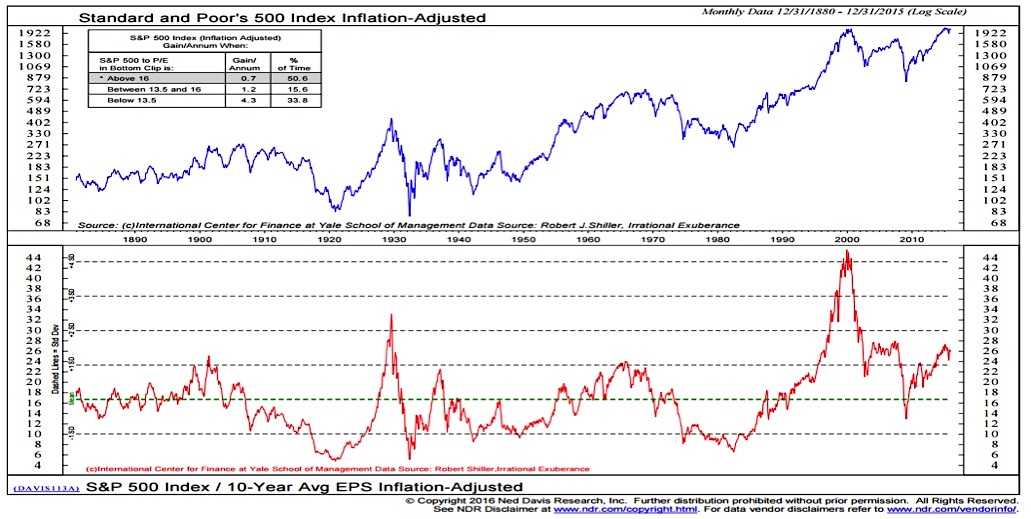

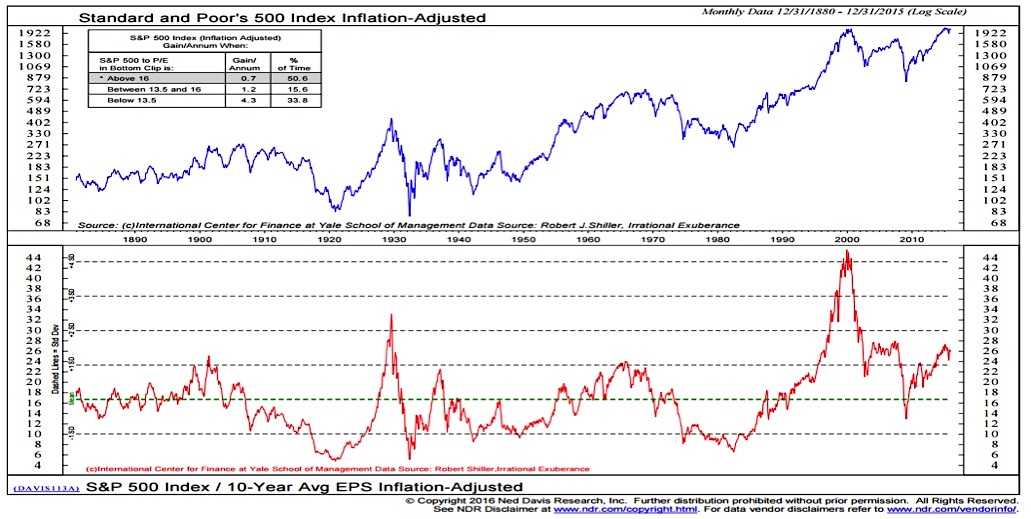

Valuation Metrics: BofA employs a range of metrics, including the Price-to-Earnings ratio (P/E), the Price-to-Sales ratio (P/S), and the cyclically adjusted price-to-earnings ratio (Shiller PE), to assess valuations across different sectors. They consider the historical context of these ratios and compare them to current economic conditions.

-

Sector-Specific Analysis: While the overall market shows elevated valuations, BofA’s analysis often highlights specific sectors. Certain technology stocks, for instance, might be deemed overvalued based on their P/E ratios relative to their growth prospects, while some traditionally undervalued sectors might be considered more attractive. This highlights the importance of a diversified investment approach.

-

Key Economic Indicators: BofA closely monitors several economic indicators to inform their market outlook. These include inflation rates, interest rate movements set by the Federal Reserve, GDP growth figures, and consumer confidence indices. Changes in these indicators significantly impact their valuation assessments and future projections.

Factors Contributing to Elevated Stock Market Valuations

Several factors contribute to the current elevated stock market valuations, according to BofA's analysis. These factors are interconnected and influence each other.

-

Low Interest Rates: Historically low interest rates make borrowing cheaper for companies and individuals. This increased liquidity fuels investment, driving up demand and consequently stock prices. However, as interest rates rise, this effect can reverse.

-

Quantitative Easing and Monetary Policy: The Federal Reserve's quantitative easing (QE) programs and other monetary policies injected significant liquidity into the market, further boosting demand and asset prices. The unwinding of QE has become a key factor in their current outlook.

-

Corporate Earnings (and Future Expectations): Strong corporate earnings, especially in certain sectors, contribute to higher stock valuations. However, future earnings expectations are also crucial. If investors anticipate slower growth or profit declines, it can impact market sentiment and lead to corrections.

-

Technological Advancements and Innovation: Breakthroughs in technology and innovation frequently drive significant investment into high-growth sectors, further influencing stock market valuations. The continued investment in technology presents both opportunities and risks, as valuations in this sector remain vulnerable to shifting investor sentiment.

-

Geopolitical Factors and Uncertainty: Global geopolitical events, trade tensions, and political instability always introduce uncertainty into the market. These factors can affect investor sentiment and create volatility, sometimes pushing valuations higher as investors seek safer assets, or lower as risk aversion increases.

BofA's Recommendations for Investors

Navigating this environment requires a strategic approach. BofA's advice to investors often emphasizes caution and diversification.

-

Value Investing: While not exclusively advocating for value stocks, BofA generally suggests carefully evaluating valuations across different asset classes and sectors, favoring those with more reasonable price-to-earnings or price-to-sales multiples relative to their growth prospects.

-

Diversification: A diversified investment portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors reduces the overall risk exposure, especially crucial during periods of high valuations.

-

Risk Reduction: Investors are often advised to consider reducing overall risk exposure. This might involve shifting a larger portion of their portfolio towards less volatile investments.

-

Sector-Specific Strategies: BofA often suggests taking sector-specific approaches, potentially favoring sectors they deem undervalued or strategically positioned for long-term growth.

-

Market Corrections: BofA emphasizes the possibility of future market corrections, advising investors to maintain a long-term perspective and avoid impulsive reactions to short-term market volatility.

Managing Risk in a High-Valuation Market

Even with BofA's insights, managing risk remains paramount. These strategies are crucial:

-

Long-Term Investment Strategies: Adopting a long-term investment approach minimizes the impact of short-term market fluctuations.

-

Risk Mitigation Strategies: Diversification and dollar-cost averaging (investing a fixed amount regularly regardless of market conditions) are effective risk mitigation strategies.

-

Due Diligence: Thoroughly researching and understanding any investment before committing capital remains crucial, regardless of market conditions.

-

Regular Portfolio Review: Regularly reviewing and adjusting your investment portfolio to reflect changing market conditions and your financial goals is essential.

-

Professional Advice: Consulting with a qualified financial advisor allows for personalized guidance tailored to your individual circumstances and risk tolerance.

Conclusion

BofA's analysis reveals a market with elevated valuations, driven by a confluence of factors including low interest rates, quantitative easing, and strong corporate earnings in certain sectors. However, they don't necessarily predict an imminent market crash, emphasizing the need for careful consideration and a balanced approach. Their recommendations prioritize diversification, risk management, and a long-term investment strategy. Understanding and addressing investor concerns about high stock market valuations is crucial. Stay updated on BofA's ongoing analysis and market insights to refine your investment strategy and effectively navigate the complexities of elevated valuations. Consider consulting a financial advisor to develop a personalized investment plan that aligns with your individual risk tolerance and financial goals.

Featured Posts

-

Impact Of Us Tariffs Chinas Growing Reliance On Middle Eastern Lpg

Apr 24, 2025

Impact Of Us Tariffs Chinas Growing Reliance On Middle Eastern Lpg

Apr 24, 2025 -

Utac Sale Chinese Buyout Firm Weighs Options

Apr 24, 2025

Utac Sale Chinese Buyout Firm Weighs Options

Apr 24, 2025 -

Working As A Chalet Girl Responsibilities And Realities In The European Ski Industry

Apr 24, 2025

Working As A Chalet Girl Responsibilities And Realities In The European Ski Industry

Apr 24, 2025 -

Trumps Budget Cuts Increase Tornado Risk As Season Begins

Apr 24, 2025

Trumps Budget Cuts Increase Tornado Risk As Season Begins

Apr 24, 2025 -

Bold And The Beautiful Recap April 9 Steffy Finn Liam And A Crisis At The Icu

Apr 24, 2025

Bold And The Beautiful Recap April 9 Steffy Finn Liam And A Crisis At The Icu

Apr 24, 2025

Latest Posts

-

Stevensons Gaze Turns To Next Season Ipswich Town News

May 12, 2025

Stevensons Gaze Turns To Next Season Ipswich Town News

May 12, 2025 -

Loanees Bid For Celtic Success

May 12, 2025

Loanees Bid For Celtic Success

May 12, 2025 -

Celtic Loanees Push For League Victory

May 12, 2025

Celtic Loanees Push For League Victory

May 12, 2025 -

Post Match Analysis Sheehans Assessment Of Ipswich Towns Performance

May 12, 2025

Post Match Analysis Sheehans Assessment Of Ipswich Towns Performance

May 12, 2025 -

Gwalia Vs Ipswich Town Women A Battle For League Leadership

May 12, 2025

Gwalia Vs Ipswich Town Women A Battle For League Leadership

May 12, 2025