Addressing Investor Concerns: BofA On Stretched Stock Market Valuations

Table of Contents

BofA's Key Concerns Regarding High Stock Market Valuations

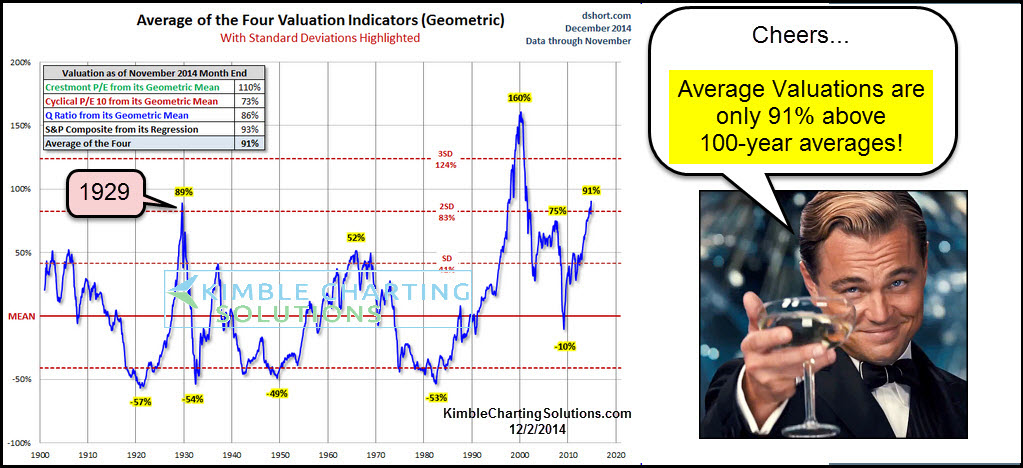

BofA's report doesn't mince words: current stock market valuations are stretched, presenting significant risks for investors. Several key factors contribute to this concern.

Elevated Price-to-Earnings Ratios (P/E):

BofA points to historically high Price-to-Earnings (P/E) ratios across various sectors as a major red flag. Understanding P/E ratios is crucial.

-

What are P/E Ratios? The P/E ratio is a valuation metric calculated by dividing a company's stock price by its earnings per share (EPS). A high P/E ratio suggests investors are paying a premium for each dollar of earnings, potentially indicating an overvalued stock.

-

Sectors with High P/E Ratios: BofA's report likely highlights specific sectors like technology or consumer discretionary, which have seen exceptionally high P/E ratios in recent years. These elevated valuations suggest that investor expectations for future growth are exceptionally high.

-

Implications for Future Returns: High P/E ratios generally suggest lower potential for future returns. While growth potential might exist, the current price already reflects a significant portion of those anticipated future gains, leaving less room for substantial appreciation.

Limited Margin of Safety:

The report further emphasizes a shrinking margin of safety for investors, leaving portfolios vulnerable to market corrections.

-

Margin of Safety Defined: The margin of safety is a key concept in value investing, referring to the difference between a security's intrinsic value (its true worth) and its market price. A large margin of safety provides a buffer against unforeseen events or inaccurate valuations.

-

Risk of Low Margins of Safety: Low or nonexistent margins of safety dramatically increase the risk of losses. If the market price falls, even slightly below the intrinsic value, investors with limited margins of safety face significant losses.

-

Impact of Rising Interest Rates: Rising interest rates directly impact margins of safety. Higher rates increase the discount rate used to calculate present value, reducing the perceived worth of future earnings and shrinking the margin of safety for many stocks.

Impact of Inflation and Interest Rate Hikes:

BofA emphasizes the significant influence of persistent inflation and rising interest rates on market valuations, factors that significantly influence investor behavior and market dynamics.

-

Inflation's Erosive Effect: Inflation erodes purchasing power, impacting corporate earnings and consumer spending. Higher prices for raw materials and labor can squeeze profit margins, negatively affecting stock valuations.

-

Higher Interest Rates and Borrowing Costs: Higher interest rates increase the cost of borrowing for companies, impacting their ability to invest and grow. Simultaneously, higher rates increase the opportunity cost of investing in stocks, making bonds a more attractive alternative for some investors.

-

Potential for Further Hikes: The continued threat of further interest rate hikes adds to the uncertainty, potentially further depressing stock valuations and increasing market volatility. This uncertainty makes accurate valuation even more challenging.

Strategies for Investors Facing Stretched Stock Market Valuations

Navigating stretched stock market valuations requires a proactive approach to risk management and portfolio construction. Several key strategies can help investors mitigate potential losses and position themselves for future growth.

Diversification:

A well-diversified portfolio is the cornerstone of effective risk management.

-

Diversifying Across Asset Classes: Diversify across different asset classes such as stocks, bonds, real estate, and alternative investments to reduce overall portfolio volatility. Don't put all your eggs in one basket.

-

International Diversification: Investing in international markets can reduce your dependence on any single economy and offer exposure to different growth opportunities. This diversification can help cushion against downturns in your home market.

-

Identifying Undervalued Asset Classes: Certain asset classes may offer better value than others in the current market. Thorough research is crucial to identifying those areas.

Value Investing:

Focusing on undervalued companies presents a more defensive approach.

-

Principles of Value Investing: Value investing focuses on identifying companies trading below their intrinsic value. The core idea is to buy low and sell high, profiting from the difference between the market price and the actual value.

-

Key Metrics for Identifying Undervalued Companies: Metrics like price-to-book ratio, dividend yield, and free cash flow can be used to identify potentially undervalued companies.

-

Importance of Fundamental Analysis: Thorough fundamental analysis is crucial to accurately assess a company's intrinsic value and identify undervalued opportunities.

Increased Risk Management:

In a potentially volatile market, robust risk management is paramount.

-

Stop-Loss Orders: Implementing stop-loss orders can limit potential losses by automatically selling a security when it falls to a predetermined price.

-

Hedging Strategies: Hedging strategies, such as options or futures contracts, can help protect against market downturns.

-

Regular Portfolio Rebalancing: Regularly rebalancing your portfolio helps maintain your desired asset allocation and prevent excessive exposure to any single asset class.

Conclusion

BofA's warnings about stretched stock market valuations underscore the need for proactive risk management and a well-defined investment strategy. Investors should critically assess their portfolios, focusing on diversification, value investing principles, and robust risk management techniques. Ignoring these concerns could lead to significant losses. Understanding and addressing these concerns regarding stretched stock market valuations is crucial for successful navigation of the current market landscape. By implementing the strategies discussed above and staying informed about market trends, investors can improve their chances of success. Remember to consult with a qualified financial advisor before making any significant investment decisions related to stretched stock market valuations.

Featured Posts

-

Stock Market Defies Recession Fears Investors See Continued Growth

May 06, 2025

Stock Market Defies Recession Fears Investors See Continued Growth

May 06, 2025 -

Watch Celtics Vs Trail Blazers Game Time Tv Broadcast And Live Stream Links For March 23rd

May 06, 2025

Watch Celtics Vs Trail Blazers Game Time Tv Broadcast And Live Stream Links For March 23rd

May 06, 2025 -

Massive Staffing Shortage Cripples Newark Airport A 7 Day Analysis

May 06, 2025

Massive Staffing Shortage Cripples Newark Airport A 7 Day Analysis

May 06, 2025 -

Auto Dealers Double Down On Opposition To Electric Vehicle Requirements

May 06, 2025

Auto Dealers Double Down On Opposition To Electric Vehicle Requirements

May 06, 2025 -

The Fallout From Us Tariffs Sheins London Ipo On Hold

May 06, 2025

The Fallout From Us Tariffs Sheins London Ipo On Hold

May 06, 2025

Latest Posts

-

Game 5 Celtics Vs Magic Date Time And Streaming Details

May 06, 2025

Game 5 Celtics Vs Magic Date Time And Streaming Details

May 06, 2025 -

Celtics Vs Heat Game Time Tv Schedule And Streaming Options April 2nd

May 06, 2025

Celtics Vs Heat Game Time Tv Schedule And Streaming Options April 2nd

May 06, 2025 -

Celtics Vs Magic Game 5 April 29th Complete Viewing Guide

May 06, 2025

Celtics Vs Magic Game 5 April 29th Complete Viewing Guide

May 06, 2025 -

Celtics Vs Magic Game 5 Date Time Tv Channel And Live Stream

May 06, 2025

Celtics Vs Magic Game 5 Date Time Tv Channel And Live Stream

May 06, 2025 -

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025