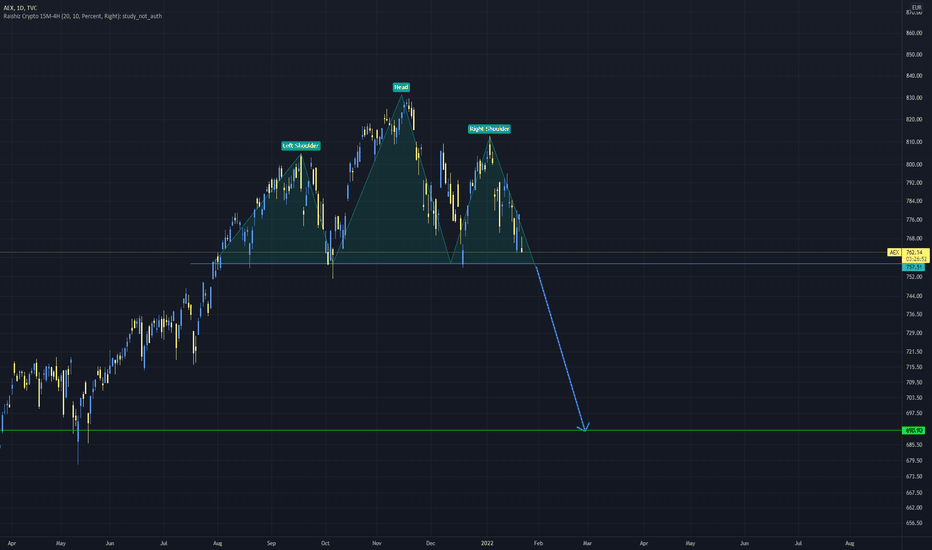

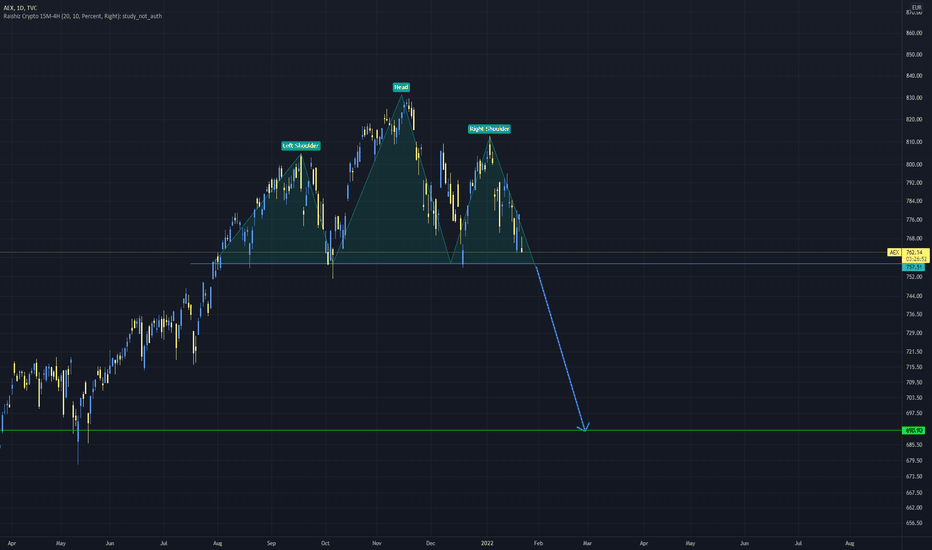

AEX Index Falls Below Key Support Level; Over 4% Drop

Table of Contents

Factors Contributing to the AEX Index Decline

Several interconnected factors contributed to the significant decline in the AEX Index. Understanding these elements is crucial for assessing the severity of the situation and predicting future market trends.

Impact of Global Market Volatility

The current global economic climate is characterized by considerable uncertainty. Geopolitical tensions, particularly the ongoing war in Ukraine and the complex US-China relationship, contribute to heightened investor anxiety. Rising inflation globally further fuels this volatility. Major global indices like the Dow Jones and S&P 500 have also shown signs of weakness, reflecting a broader trend of investor risk aversion. This negative sentiment is heavily impacting global equity markets, including the AEX.

- Increased investor risk aversion leads to sell-offs across various asset classes.

- Capital flight towards safer assets like government bonds is observed.

- Negative sentiment stemming from global uncertainties creates a domino effect on international stock markets.

Sector-Specific Performance within the AEX

The AEX decline isn't uniform across all sectors. A closer look reveals that certain sectors have been hit harder than others. For instance, the financial sector, often sensitive to interest rate changes, might have experienced a steeper drop compared to more resilient sectors like energy or consumer staples. Analyzing the performance of individual AEX component stocks is crucial for a complete understanding.

- Specific AEX component stocks heavily reliant on global trade are particularly vulnerable to geopolitical instability.

- Recent earnings reports and company-specific news might have negatively impacted investor confidence in particular sectors.

- Sectoral trends, such as a decline in consumer spending or a slump in the technology sector, can significantly influence AEX performance.

Influence of Interest Rate Hikes

The European Central Bank (ECB), along with other central banks globally, is actively combating inflation through interest rate hikes. Higher interest rates increase borrowing costs for businesses, potentially impacting corporate profitability and slowing economic growth. This makes fixed-income investments relatively more attractive, diverting capital away from the equity market. The relationship between interest rates and stock market performance is often inverse; rising rates typically put downward pressure on stock valuations.

- Increased borrowing costs make expansion and investment more expensive for businesses.

- Reduced corporate profitability directly translates into lower stock prices and decreased investor confidence.

- The higher yields on bonds make them a more appealing alternative to riskier equity investments.

Analyzing the Severity of the AEX Drop

Understanding the severity of the AEX drop requires a comparative analysis with historical market corrections. This helps contextualize the current situation and assess its potential long-term implications.

Comparison to Previous Market Corrections

The current AEX decline needs to be viewed against the backdrop of previous market corrections. By comparing the speed and depth of this drop to similar events in the past, we can better understand its significance. Examining historical data reveals the duration of past market corrections and the subsequent recovery periods. This historical context provides valuable insights into potential future trajectories.

- Analyzing historical data on AEX performance during similar events provides a benchmark for comparison.

- The duration of the current correction compared to previous ones offers clues about its potential length.

- The recovery time after past AEX drops helps to predict potential timelines for a return to stability.

Potential Short-Term and Long-Term Implications

The over 4% drop in the AEX has immediate consequences for investors and the Dutch economy. In the short term, we can anticipate decreased investor confidence and potential further market volatility. The long-term implications depend on various factors, including the effectiveness of central bank policies and the resolution of geopolitical uncertainties. A sustained period of low investor confidence could negatively impact economic growth and investment in the Netherlands.

- The impact on investor confidence could lead to further sell-offs and market instability.

- The potential for further decline or a swift recovery depends on the unfolding of various global and domestic factors.

- Long-term economic consequences could include slower growth, reduced investment, and potential job losses.

Conclusion: Understanding the AEX Index Fall and its Future Trajectory

The over 4% plunge in the AEX Index is a significant event driven by a confluence of factors: global market volatility, sector-specific underperformance, and the influence of rising interest rates. The severity of this decline and its potential implications for investors and the Dutch economy cannot be understated. While the short-term outlook remains uncertain, a careful monitoring of global events and the performance of individual AEX components is crucial. The long-term trajectory will depend on the resolution of global uncertainties and the effectiveness of policy responses.

Stay informed on the latest developments affecting the AEX Index and its component stocks to make informed investment decisions. Monitor the AEX Index closely for further updates and analysis.

Featured Posts

-

Escape To The Countryside Choosing The Right Property For Your Needs

May 25, 2025

Escape To The Countryside Choosing The Right Property For Your Needs

May 25, 2025 -

Will A Wall Street Rebound Undermine The Daxs Recent Success

May 25, 2025

Will A Wall Street Rebound Undermine The Daxs Recent Success

May 25, 2025 -

M56 Road Closure Current Traffic Conditions And Congestion

May 25, 2025

M56 Road Closure Current Traffic Conditions And Congestion

May 25, 2025 -

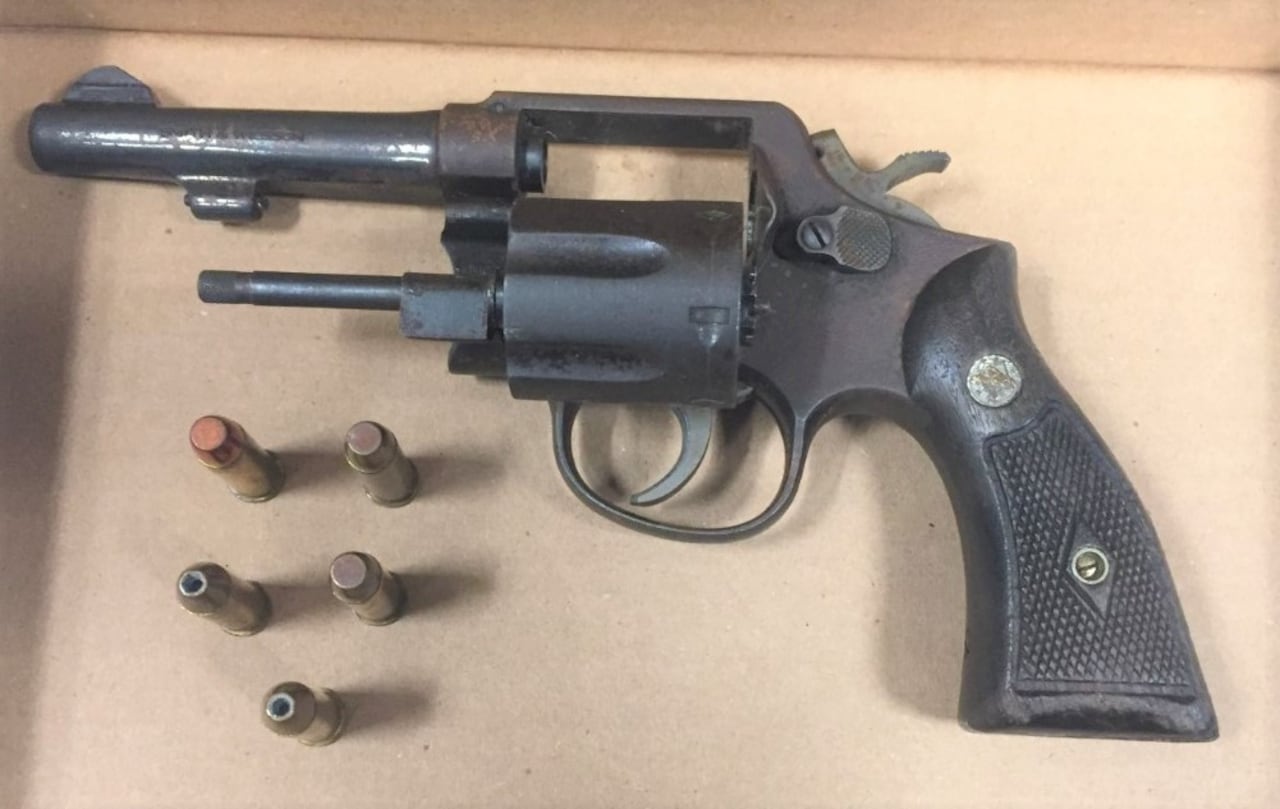

Massachusetts Authorities Seize Over 100 Firearms Arrest 18 In Gun Trafficking Case

May 25, 2025

Massachusetts Authorities Seize Over 100 Firearms Arrest 18 In Gun Trafficking Case

May 25, 2025 -

The Impact Of Elon Musks Actions On The Dogecoin Price

May 25, 2025

The Impact Of Elon Musks Actions On The Dogecoin Price

May 25, 2025

Latest Posts

-

From Scatological Documents To Engaging Podcasts An Ai Solution

May 25, 2025

From Scatological Documents To Engaging Podcasts An Ai Solution

May 25, 2025 -

Ai Powered Podcast Creation Analyzing And Transforming Scatological Data

May 25, 2025

Ai Powered Podcast Creation Analyzing And Transforming Scatological Data

May 25, 2025 -

Turning Poop Into Podcast Gold Ai Digest For Repetitive Documents

May 25, 2025

Turning Poop Into Podcast Gold Ai Digest For Repetitive Documents

May 25, 2025 -

Dogecoin Price Prediction Considering Elon Musks Role

May 25, 2025

Dogecoin Price Prediction Considering Elon Musks Role

May 25, 2025 -

The Impact Of Elon Musks Actions On The Dogecoin Price

May 25, 2025

The Impact Of Elon Musks Actions On The Dogecoin Price

May 25, 2025