AIMSCAP At The World Trading Tournament (WTT): Strategies And Results

Table of Contents

AIMSCAP's Pre-Tournament Preparation and Strategy Development

Before even entering the World Trading Tournament, AIMSCAP engaged in extensive preparation, focusing on three key areas: market research and analysis, portfolio diversification, and algorithmic trading automation.

Market Research and Analysis

AIMSCAP’s approach to market research was comprehensive and multifaceted. Their team leveraged a variety of data sources and analytical tools to build a robust understanding of market trends and potential opportunities.

- Data Sources: Bloomberg Terminal, Refinitiv Eikon, proprietary data feeds.

- Analytical Tools: Advanced statistical modeling, machine learning algorithms, technical and fundamental analysis software.

- Risk Assessment: Monte Carlo simulations, stress testing, and Value at Risk (VaR) calculations were used to quantify and mitigate potential losses. They focused on identifying potential "black swan" events and developing contingency plans.

Portfolio Diversification and Asset Allocation

AIMSCAP implemented a carefully diversified portfolio, spreading investments across several asset classes to reduce overall risk. Their allocation strategy was based on a thorough assessment of market conditions and risk tolerance.

- Asset Allocation: 40% Equities (global diversification across various sectors), 30% Fixed Income (government and corporate bonds), 20% Commodities (gold, oil, agricultural products), 10% Alternative Investments (hedge funds, real estate).

- Rationale: This allocation aimed to balance potential returns with risk, capitalizing on growth opportunities while mitigating potential losses in any single asset class. The allocation was dynamically adjusted throughout the tournament based on market performance and opportunities.

Algorithmic Trading and Automation

A key component of AIMSCAP's success was their sophisticated use of algorithmic trading and automation. This allowed them to execute trades rapidly and efficiently, capitalizing on fleeting market opportunities.

- Algorithms Used: High-frequency trading (HFT) algorithms for exploiting short-term price discrepancies, mean reversion strategies for profiting from price corrections, and trend-following algorithms for riding market momentum.

- Advantages of Automation: Faster execution speeds, reduced emotional bias, and the ability to handle large volumes of trades simultaneously.

- Limitations: Vulnerability to unforeseen market events, the need for constant monitoring and adjustments, and potential for errors in code.

Key Trading Strategies Employed During the WTT

During the World Trading Tournament, AIMSCAP executed several key strategies that proved crucial to their victory. These included rigorous risk management, adaptability to market volatility, and a focus on identifying high-probability trading setups.

Risk Management and Position Sizing

AIMSCAP maintained strict risk management throughout the tournament. They employed several techniques to limit potential losses and protect their capital.

- Stop-Loss Orders: Used consistently to automatically exit positions when prices moved against them, limiting potential losses to a predetermined level.

- Position Sizing: Carefully calculated position sizes to ensure that no single trade exposed them to excessive risk. Their position sizing strategy was dynamic, adapting to market conditions and volatility.

- Diversification: Maintaining a well-diversified portfolio across multiple asset classes acted as a buffer against losses in any specific market segment.

Adaptability and Reaction to Market Volatility

The WTT presented numerous instances of unexpected market volatility. AIMSCAP demonstrated impressive adaptability, adjusting their strategies to navigate these challenges effectively.

- Example 1: During a sudden market downturn triggered by geopolitical uncertainty, AIMSCAP quickly shifted their allocation toward less volatile assets like government bonds and gold, mitigating potential losses.

- Example 2: When a specific sector experienced a rapid price surge, AIMSCAP capitalized on the opportunity by deploying their trend-following algorithms, generating significant profits. They were agile enough to adjust their strategies when opportunities presented themselves.

Successful Trades and Case Studies

AIMSCAP executed numerous successful trades throughout the WTT. A few examples illustrate their approach and the rationale behind their decisions.

- Trade 1: Identified an undervalued tech stock based on their fundamental analysis. They bought at $50, set a stop-loss at $45, and sold at $75, generating a 50% return.

- Trade 2: Used their HFT algorithms to capitalize on a temporary price discrepancy between two related futures contracts, generating a quick profit of 2%.

- Trade 3: Identified a weakening trend in a specific commodity market. They short-sold the commodity, profiting as the price declined by 10%.

Analysis of AIMSCAP's Results at the WTT

AIMSCAP's performance at the WTT was exceptional, marked by significant returns and a top ranking.

Overall Performance and Ranking

- Final Ranking: 1st place

- Percentage Return: 35%

- Sharpe Ratio: 2.5 (indicating strong risk-adjusted returns)

Key Factors Contributing to Success

Several factors contributed to AIMSCAP's remarkable success:

- Rigorous Pre-Tournament Preparation: Thorough market research, diversified portfolio, and sophisticated algorithms laid a strong foundation.

- Adaptive Trading Strategies: Ability to adjust strategies in response to market volatility.

- Effective Risk Management: Strict risk control procedures protected capital and ensured sustained profitability.

Lessons Learned and Future Implications

AIMSCAP's WTT experience provided valuable insights:

- The importance of continuous learning and adaptation in the dynamic trading environment.

- The critical role of technology and automation in enhancing trading efficiency and profitability.

- The need for a holistic approach that balances risk management with aggressive opportunity seeking.

Conclusion: Learning from AIMSCAP's WTT Success

AIMSCAP's victory at the World Trading Tournament demonstrates the power of a well-defined strategy, meticulous planning, and the ability to adapt to changing market conditions. Their success highlights the importance of comprehensive market research, rigorous risk management, and the effective utilization of algorithmic trading. By studying AIMSCAP's successful strategies at the World Trading Tournament, traders can gain valuable insights and improve their own performance. Explore AIMSCAP's resources and learn more about successful trading strategies today!

Featured Posts

-

Juergen Klopp Un Doenuesue Duenya Devi Nin Yeni Yoeneticisi Mi

May 21, 2025

Juergen Klopp Un Doenuesue Duenya Devi Nin Yeni Yoeneticisi Mi

May 21, 2025 -

Will This Attempt Break The Trans Australia Run Record

May 21, 2025

Will This Attempt Break The Trans Australia Run Record

May 21, 2025 -

Saskatchewans Costco Campaign A Political Panel Analysis

May 21, 2025

Saskatchewans Costco Campaign A Political Panel Analysis

May 21, 2025 -

Exploring The Versatility Of C Cassis Blackcurrant In Cocktails And Cuisine

May 21, 2025

Exploring The Versatility Of C Cassis Blackcurrant In Cocktails And Cuisine

May 21, 2025 -

El Superalimento Que Combate Enfermedades Cronicas Y Promueve La Longevidad

May 21, 2025

El Superalimento Que Combate Enfermedades Cronicas Y Promueve La Longevidad

May 21, 2025

Latest Posts

-

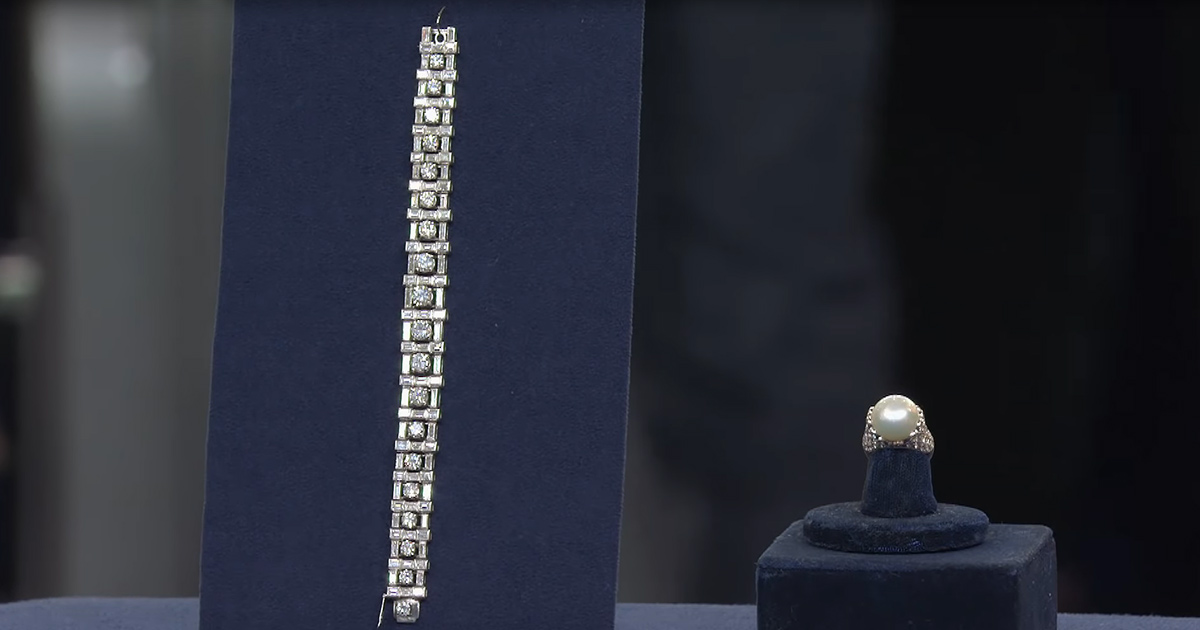

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025 -

Couple Sentenced After Antiques Roadshow Reveals Stolen Property

May 21, 2025

Couple Sentenced After Antiques Roadshow Reveals Stolen Property

May 21, 2025 -

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025 -

Antiques Roadshow Appraisal Exposes Stolen Items Leading To Imprisonment

May 21, 2025

Antiques Roadshow Appraisal Exposes Stolen Items Leading To Imprisonment

May 21, 2025 -

Jaw Dropping Antiques Roadshow Find Culminates In Trafficking Charges

May 21, 2025

Jaw Dropping Antiques Roadshow Find Culminates In Trafficking Charges

May 21, 2025