AIMSCAP's Wild Ride: A Deep Dive Into The World Trading Tournament (WTT)

Table of Contents

AIMSCAP's Preparation for the WTT

Team Selection and Training

AIMSCAP's preparation for the WTT was nothing short of rigorous. Team selection involved a multi-stage process, evaluating candidates on their trading expertise, risk management skills, and ability to work under pressure. Only the top performers, possessing a deep understanding of global markets and diverse trading strategies, made the cut. The training regimen was equally demanding:

- Intensive Simulation Exercises: The team participated in countless simulated trading scenarios, replicating the high-pressure environment of the WTT. These simulations incorporated various market conditions, including periods of high volatility and unexpected news events.

- Advanced Algorithmic Trading Training: The team honed its skills in algorithmic trading, utilizing AIMSCAP's proprietary software and advanced analytical tools. This ensured they could execute trades swiftly and efficiently, reacting to market changes in real-time.

- Expert Mentorship: The team benefited from mentorship from seasoned AIMSCAP traders and market analysts, receiving guidance on sophisticated trading strategies and risk management techniques. This expertise formed a significant part of their competitive advantage in the WTT.

- Focus on Specific Market Sectors: Training emphasized specific market sectors identified as key opportunities for profitable trades during the WTT. This targeted approach maximized the team's chances of success.

Keywords: AIMSCAP training, WTT preparation, trading strategies, competitive advantage, algorithmic trading, risk management.

Strategic Planning and Market Analysis

The development of AIMSCAP's trading strategy was a collaborative effort, involving meticulous market analysis and risk assessment. The team employed a multi-faceted approach:

- Fundamental Analysis: Thorough research into the financial health and future prospects of target companies formed the bedrock of their strategy.

- Technical Analysis: Sophisticated charting techniques and indicators were used to identify potential entry and exit points for trades, optimizing timing and maximizing returns.

- Quantitative Analysis: Statistical models and algorithms were deployed to predict market movements and assess risk, ensuring a data-driven approach to trading.

- Diversification and Risk Management: The team diversified their portfolio across different asset classes and implemented strict risk management protocols to limit potential losses.

Keywords: market analysis, risk management, trading strategies, WTT tactics, fundamental analysis, technical analysis, quantitative analysis, portfolio diversification.

The Tournament Experience: Navigating the Challenges of the WTT

The Competitive Landscape

The WTT presented a fiercely competitive environment. AIMSCAP faced some of the world's leading trading firms and individual experts. The pressure was intense, the atmosphere electric. Key challenges included:

- High Market Volatility: Unexpected geopolitical events and economic news created significant market fluctuations, testing the team's ability to react swiftly and decisively.

- Aggressive Competitors: Other teams employed aggressive trading strategies, creating a dynamic and challenging competitive landscape.

- Time Constraints: The rapid-fire nature of the WTT required the team to make quick, informed decisions under extreme pressure.

Keywords: WTT competition, global trading, market volatility, competitive pressure, trading firms.

Key Decisions and Outcomes

During the WTT, AIMSCAP's team demonstrated both remarkable successes and valuable learning experiences from setbacks. Some key decisions and their outcomes included:

- Successful Short Position in Tech Stocks: A timely short position in certain overvalued tech stocks generated significant profits, capitalizing on a market correction.

- Missed Opportunity in Emerging Markets: A cautious approach missed a potentially profitable opportunity in rapidly growing emerging markets, highlighting the need for greater risk tolerance in specific scenarios.

- Effective Risk Management During Volatility: Their robust risk management plan prevented substantial losses during periods of extreme market volatility.

Keywords: trading decisions, WTT results, market performance, successful trades, trading analysis, risk mitigation.

AIMSCAP's Performance and Final Results

Overall Standing and Achievements

AIMSCAP ultimately secured a respectable [Insert Rank] place in the WTT, a commendable achievement considering the intense competition. This demonstrates the team's skill and expertise in navigating a challenging market environment.

- Final Score: [Insert Score]

- Ranking: [Insert Rank] out of [Total Number of Teams]

- Awards: [Mention any awards received]

Keywords: WTT rankings, AIMSCAP achievements, tournament results, final score, trading performance.

Lessons Learned and Future Outlook

The WTT provided AIMSCAP with invaluable insights and lessons for future participation.

- Refining Algorithmic Trading Strategies: Data gathered during the tournament will be used to further refine their algorithmic trading strategies, improving their predictive models.

- Increased Risk Tolerance in Specific Sectors: Analysis of missed opportunities has led to a recalibration of their risk tolerance in specific sectors, aiming for better balance between risk and reward.

- Enhanced Team Collaboration: The experience solidified teamwork and communication within the team, enhancing their collaborative capabilities.

Keywords: future plans, WTT lessons, strategic improvements, future participation, algorithmic trading improvements.

Conclusion: Reflecting on AIMSCAP's WTT Journey

AIMSCAP's participation in the World Trading Tournament showcased their expertise in global trading, highlighting both their strengths and areas for improvement. The WTT provided a valuable platform for testing their trading strategies and algorithms in a high-stakes environment. While the final ranking reflects a successful performance, the valuable lessons learned will shape their approach to future World Trading Tournaments and similar high-stakes trading events. The experience underscores AIMSCAP's commitment to excellence in the dynamic world of global finance.

Stay tuned for AIMSCAP's next venture into the exciting world of the World Trading Tournament and witness their continued pursuit of excellence in global trading! Learn more about AIMSCAP and its innovative approaches to trading at [Insert AIMSCAP Website Link Here].

Featured Posts

-

Clisson Debat Sur Le Port De Symboles Religieux Au College

May 21, 2025

Clisson Debat Sur Le Port De Symboles Religieux Au College

May 21, 2025 -

Dexter Pops Funko Unveils Its First Ever Collection

May 21, 2025

Dexter Pops Funko Unveils Its First Ever Collection

May 21, 2025 -

Dexter New Blood Resurrection Trailer Release Date Speculation

May 21, 2025

Dexter New Blood Resurrection Trailer Release Date Speculation

May 21, 2025 -

Dexter Revival The Return Of Iconic Antagonists

May 21, 2025

Dexter Revival The Return Of Iconic Antagonists

May 21, 2025 -

The Goldbergs Exploring The Shows Popular Characters

May 21, 2025

The Goldbergs Exploring The Shows Popular Characters

May 21, 2025

Latest Posts

-

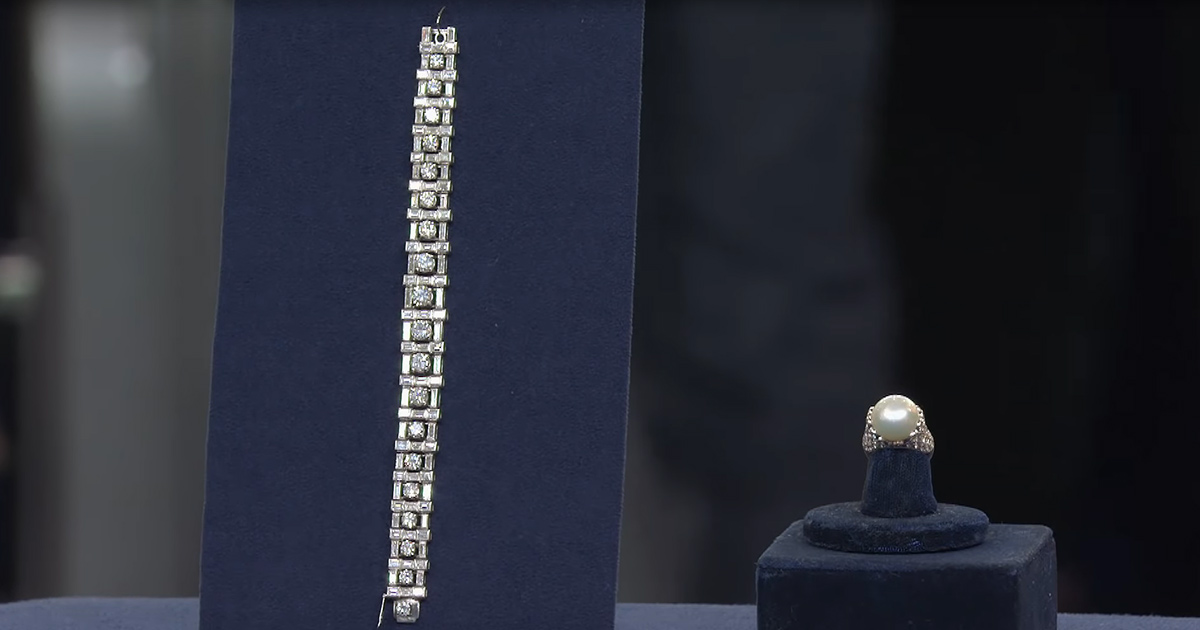

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025 -

Couple Sentenced After Antiques Roadshow Reveals Stolen Property

May 21, 2025

Couple Sentenced After Antiques Roadshow Reveals Stolen Property

May 21, 2025 -

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025 -

Antiques Roadshow Appraisal Exposes Stolen Items Leading To Imprisonment

May 21, 2025

Antiques Roadshow Appraisal Exposes Stolen Items Leading To Imprisonment

May 21, 2025 -

Jaw Dropping Antiques Roadshow Find Culminates In Trafficking Charges

May 21, 2025

Jaw Dropping Antiques Roadshow Find Culminates In Trafficking Charges

May 21, 2025