AIMSCAP's World Trading Tournament (WTT) Experience: Lessons Learned

Table of Contents

Pre-Tournament Preparation: Strategy and Research

Thorough pre-tournament preparation is paramount for success in the AIMSCAP World Trading Tournament (WTT). A robust trading strategy, coupled with extensive market research, forms the bedrock of a competitive approach. Neglecting this crucial stage can significantly hinder performance during the tournament. Our preparation focused on several key areas:

-

Extensive market analysis focusing on specific markets or asset classes. We dedicated significant time to analyzing historical data for various asset classes, including forex, indices, and commodities. This involved identifying trends, patterns, and potential trading opportunities. Specific focus was placed on understanding the volatility of each market to better inform our risk management strategy.

-

Development of a detailed trading plan encompassing risk tolerance, position sizing, and entry/exit strategies. We defined clear risk parameters, including stop-loss and take-profit levels, to mitigate potential losses. Position sizing was meticulously calculated to manage risk effectively across multiple trades. Entry and exit strategies were designed based on technical and fundamental analysis, aiming for optimal profit potential while minimizing risk. This trading plan was a living document, refined throughout the preparation phase.

-

Backtesting of trading strategies using historical data. We rigorously backtested our strategies using historical market data to assess their performance and identify potential weaknesses. This process allowed us to refine our approach and gain confidence in our chosen strategies before the actual competition. This iterative process was crucial in fine-tuning our methodology.

-

Thorough understanding of AIMSCAP's WTT rules and regulations. Familiarity with the competition rules is absolutely essential. Understanding the specifics of trading platforms, allowed position limits, and any restrictions on trading instruments was critical to avoid penalties or unforeseen complications during the tournament.

-

Preparation for various market scenarios, including volatile periods. We anticipated potential market volatility and developed contingency plans to adapt our strategies accordingly. This involved understanding how different market conditions might impact our trades and developing flexible responses to unexpected events.

The Tournament Experience: Challenges and Opportunities

Participating in the AIMSCAP WTT presented both significant challenges and exciting opportunities. The high-pressure environment, coupled with rapidly changing market conditions, tested our skills and resilience.

-

Navigating unexpected market volatility during the WTT. The WTT environment presented unpredictable market swings. Our pre-prepared strategies were challenged by these sudden shifts, necessitating quick adaptation and tactical adjustments.

-

The importance of emotional discipline in high-pressure situations. Maintaining emotional control was crucial. The pressure of competition, coupled with potential losses, can significantly impact decision-making. We found that disciplined adherence to our trading plan, despite emotional urges, was vital for consistent performance.

-

The effectiveness (or lack thereof) of pre-determined strategies in real-time scenarios. While pre-planning is essential, the WTT demonstrated the need for flexibility. Real-time market analysis and adaptation were key to success.

-

Utilization of real-time market data and analytics during the competition. Access to real-time market data and advanced analytical tools was critical. We leveraged these tools to track market movements, assess risk, and make informed trading decisions promptly.

-

Adaptability to changing market conditions and competitor strategies. The WTT is a dynamic environment. Observing competitor strategies and adapting our own approach based on market trends and competitor actions proved to be a significant learning experience.

Post-Tournament Analysis: Evaluating Performance and Identifying Areas for Improvement

Post-tournament analysis is as crucial as pre-tournament preparation. A thorough review of our performance, encompassing both successful and unsuccessful trades, was paramount for future improvement.

-

Detailed analysis of winning and losing trades. We meticulously reviewed each trade, identifying factors that contributed to success or failure. This involved analyzing market conditions, our trading decisions, and the effectiveness of our risk management strategies.

-

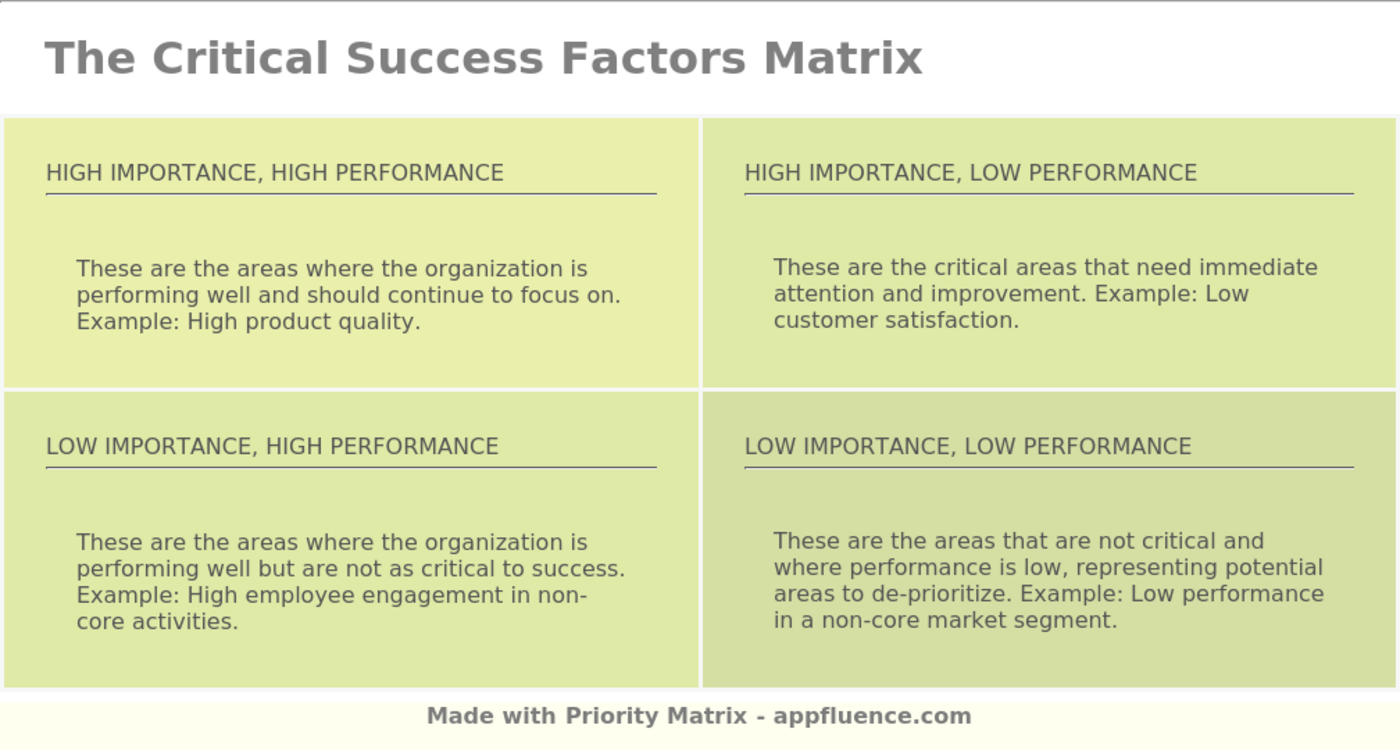

Identification of key strengths and weaknesses in our trading approach. This self-assessment pinpointed areas of excellence and those needing improvement. Strengths were reinforced, and weaknesses were addressed through targeted learning and practice.

-

Refinement of our risk management strategies based on lessons learned. Analyzing losses helped refine our risk management procedures. Adjustments were made to stop-loss and take-profit levels, position sizing, and overall risk tolerance to improve future performance.

-

Exploration of new trading indicators or techniques. Post-tournament analysis stimulated exploration of new analytical tools and techniques. This continuous learning process is vital for staying ahead in the competitive trading landscape.

-

Setting goals for future participation in the AIMSCAP World Trading Tournament. We established clear, achievable goals for future participation, focusing on specific areas for improvement identified during the post-tournament review.

Key Takeaways and Best Practices from the AIMSCAP WTT

Our AIMSCAP WTT experience highlighted several key best practices:

-

The critical role of consistent risk management. Maintaining disciplined risk management throughout the competition was paramount for mitigating losses and sustaining profitability.

-

The benefits of thorough pre-tournament research and preparation. Rigorous research and planning laid the foundation for our performance, ensuring we were well-equipped to face the challenges of the competition.

-

The importance of emotional control and disciplined trading execution. Emotional discipline and adherence to our trading plan, despite market fluctuations, were crucial for success.

-

The value of continuous learning and adaptation in the dynamic world of trading. The WTT highlighted the dynamic nature of trading and the importance of continuous learning and adaptation to maintain a competitive edge.

Conclusion

Our participation in the AIMSCAP World Trading Tournament (WTT) was an unparalleled learning experience. Through rigorous preparation, careful execution, and post-tournament analysis, we gained invaluable insights into effective trading strategies and risk management. By applying the lessons learned, we aim to improve our trading performance significantly. If you are considering participating in the AIMSCAP World Trading Tournament (WTT) or are looking to enhance your trading skills, we strongly encourage you to learn from our experience and dedicate yourself to rigorous preparation and continuous learning. Preparing for the AIMSCAP World Trading Tournament (WTT) requires dedication and strategic planning; we hope our insights help you excel in future competitions.

Featured Posts

-

Watch Peppa Pig Online A Complete Guide To Free And Paid Streaming

May 22, 2025

Watch Peppa Pig Online A Complete Guide To Free And Paid Streaming

May 22, 2025 -

Exploring The Success Of The Goldbergs A Critical Analysis

May 22, 2025

Exploring The Success Of The Goldbergs A Critical Analysis

May 22, 2025 -

La Haye Fouassiere Haute Goulaine Test D Une Navette Gratuite

May 22, 2025

La Haye Fouassiere Haute Goulaine Test D Une Navette Gratuite

May 22, 2025 -

Nederlandse Bankieren Vereenvoudigd Een Handleiding Voor Tikkie

May 22, 2025

Nederlandse Bankieren Vereenvoudigd Een Handleiding Voor Tikkie

May 22, 2025 -

Peppa Pigs Real Name A Surprise For Longtime Fans

May 22, 2025

Peppa Pigs Real Name A Surprise For Longtime Fans

May 22, 2025

Latest Posts

-

British Ultrarunners Bid For Australian Crossing Speed Record

May 22, 2025

British Ultrarunners Bid For Australian Crossing Speed Record

May 22, 2025 -

Bbc Breakfast Presenters Are You Still There Moment Guest Interruption Explained

May 22, 2025

Bbc Breakfast Presenters Are You Still There Moment Guest Interruption Explained

May 22, 2025 -

The Pursuit Of A New Trans Australia Run Record

May 22, 2025

The Pursuit Of A New Trans Australia Run Record

May 22, 2025 -

Across Australia On Foot New Speed Record Set

May 22, 2025

Across Australia On Foot New Speed Record Set

May 22, 2025 -

Australian Speed Record Challenge A British Ultrarunners Attempt

May 22, 2025

Australian Speed Record Challenge A British Ultrarunners Attempt

May 22, 2025