Airbus Confirms US Airlines Responsible For Tariff Payments

Table of Contents

The Dispute and the Ruling

The long-standing trade dispute between the US and the EU centers around allegations of illegal subsidies provided to both Airbus and Boeing, leading to unfair competition. This protracted battle culminated in rulings by the World Trade Organization (WTO). The WTO found both sides guilty of providing illegal subsidies, leading to the authorization of retaliatory tariffs. Specifically, the WTO authorized the US to impose tariffs on Airbus aircraft imported into the US, citing illegal subsidies provided by European governments to Airbus. Airbus has officially stated that US airlines are ultimately responsible for the payment of these tariffs on imported aircraft.

- Timeline of key events:

- 2004: The initial WTO complaint is filed.

- 2011-2019: Series of WTO rulings and appeals.

- October 2019: The US begins imposing tariffs on Airbus aircraft.

- Specific amounts of tariffs imposed: Tariffs range from 10% to 25% of the value of the aircraft, depending on the model. The exact figures are complex and subject to change based on the specific aircraft and the ongoing dispute.

- Relevant WTO case numbers and references: (Insert relevant WTO case numbers and links here if available – this would require research to provide accurate details).

Financial Impact on US Airlines

These tariffs represent a significant financial burden for US airlines that purchase Airbus aircraft. The added cost directly impacts profitability and could affect investment strategies. Airlines face a difficult choice: absorb the increased costs, impacting their bottom line, or pass the cost onto consumers through higher airfares.

- Examples of specific airlines affected: Major US airlines such as American Airlines, United Airlines, and Delta Air Lines, which operate significant numbers of Airbus aircraft, are directly affected. The extent of the impact varies based on the number of Airbus planes in each airline's fleet.

- Estimates of the total cost of tariffs: Precise figures are difficult to obtain publicly but estimates put the total cost to the US airline industry in the hundreds of millions, possibly even billions of dollars, depending on the duration of the tariffs.

- Potential strategies airlines may use to mitigate these costs: Airlines may explore options such as renegotiating contracts with Airbus, seeking government assistance, or adjusting their fleet acquisition strategies to favor Boeing aircraft (although this too presents complexities).

Potential Consequences for the Aviation Industry

The implications of the Airbus US Airline Tariffs extend far beyond the financial impact on individual airlines. The decision could trigger retaliatory measures from the EU, further escalating the trade war and disrupting the delicate balance of international trade within the aviation sector. This will have an impact on international trade relations and competition within the aircraft manufacturing industry.

- Impacts on aircraft pricing and availability: The tariffs may lead to increased aircraft prices for US airlines, potentially limiting their fleet expansion or modernization plans. This could also influence the availability of certain aircraft models in the US market.

- Potential for disruptions to air travel routes: While not a direct consequence, long-term effects could see adjustments to air travel routes based on operational costs and aircraft availability.

- Long-term effects on industry growth and development: The ongoing trade dispute and related tariffs create an uncertain environment, potentially hindering investment and innovation within the aviation sector as airlines face financial uncertainty.

Consumer Impact – Higher Airfares?

The crucial question is whether passengers will see higher airfares. Airlines will likely consider passing on at least some of these costs to consumers. However, the extent of the price increase will depend on several factors including fuel prices, competitive pressure, and overall economic conditions.

- Market analysis of the airline industry's pricing strategies: Airline pricing is complex and influenced by various factors. Airlines often aim for profit maximization but face pressures to remain competitive.

- Economic models predicting the impact of increased airfares: Economic models can help predict consumer behavior in response to increased airfares. However, the complexity of the airline industry and unpredictable external factors make precise predictions difficult.

- Comparison to other instances of increased costs impacting airfares: Historically, increased fuel prices and other operational costs have frequently resulted in higher airfares, demonstrating a precedent for cost pass-through.

Conclusion

Airbus's confirmation that US airlines bear the responsibility for tariff payments on imported aircraft has significant implications. The financial burden on US airlines is substantial, potentially affecting profitability, investment, and ultimately, consumer airfares. The broader consequences for the aviation industry include the possibility of retaliatory measures and disruptions to international trade. Further research into the impact of these Airbus US Airline Tariffs is crucial for understanding the future of the aviation industry. Stay informed about ongoing developments; continue to monitor news and updates concerning this important trade dispute and its impact on air travel.

Featured Posts

-

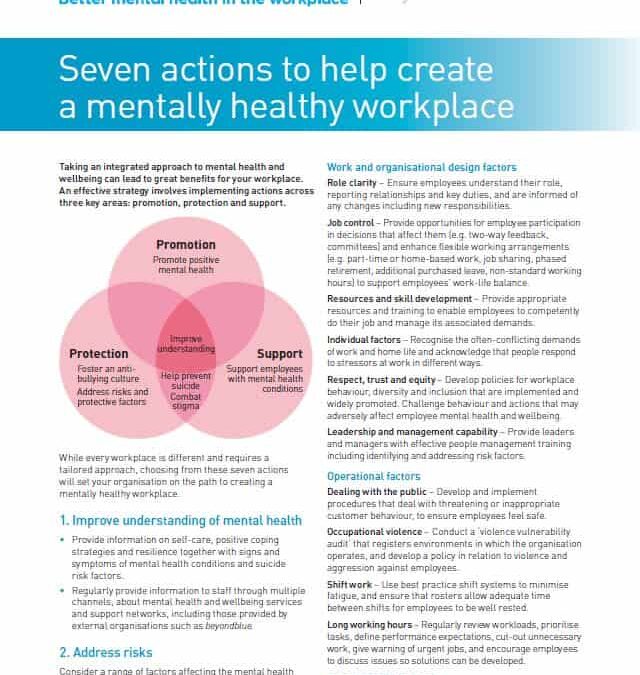

Improving Workplace Productivity Through Effective Mental Health Policies

May 02, 2025

Improving Workplace Productivity Through Effective Mental Health Policies

May 02, 2025 -

This Country A Travelers Handbook

May 02, 2025

This Country A Travelers Handbook

May 02, 2025 -

Bbc Faces Unprecedented Crisis After 1bn Funding Loss

May 02, 2025

Bbc Faces Unprecedented Crisis After 1bn Funding Loss

May 02, 2025 -

Daily Lotto Wednesday 16th April 2025 Winning Numbers

May 02, 2025

Daily Lotto Wednesday 16th April 2025 Winning Numbers

May 02, 2025 -

New Harry Potter Store Opens In Chicago Must See For Fans

May 02, 2025

New Harry Potter Store Opens In Chicago Must See For Fans

May 02, 2025