Amsterdam AEX Index Suffers Sharpest Decline In Over A Year

Table of Contents

Factors Contributing to the AEX Index's Sharp Decline

Several intertwined macroeconomic factors contributed to the sharp decline in the Amsterdam AEX Index. The confluence of these issues created a perfect storm that negatively impacted investor sentiment and triggered widespread selling.

-

Global Economic Slowdown/Recession Fears: Growing concerns about a potential global recession significantly dampened investor confidence. Slowing growth in major economies like the US and China fueled anxieties about decreased demand for Dutch exports and a subsequent slowdown in domestic economic activity. This uncertainty directly translates to decreased investment in the AEX.

-

Rising Interest Rates and Their Impact on Investor Sentiment: The European Central Bank's (ECB) aggressive interest rate hikes, aimed at combating inflation, have increased borrowing costs for businesses and dampened investor enthusiasm. Higher interest rates make borrowing more expensive, impacting business investments and potentially slowing economic growth. This makes bonds a more attractive investment compared to stocks, leading to capital flight from the stock market, including the AEX.

-

Inflation and Its Effect on Consumer Spending and Business Confidence: Persistent high inflation continues to erode consumer purchasing power and dampen business confidence. Rising prices for essential goods and services reduce consumer spending, leading to lower corporate profits and impacting stock valuations. The AEX, reflecting the performance of major Dutch companies, is highly sensitive to these consumer and business trends.

-

Geopolitical Instability (e.g., War in Ukraine, Energy Crisis): The ongoing war in Ukraine and the resulting energy crisis in Europe continue to exert significant pressure on global markets. The uncertainty surrounding energy supplies and escalating geopolitical tensions contribute to market volatility and negatively impact investor confidence, influencing the AEX's performance.

-

Specific Company Performance Affecting the Index: [Mention specific companies and sectors that experienced significant declines and their reasons. For example: "The underperformance of [Company Name] in the [Sector] sector, due to [Reason], contributed significantly to the overall AEX decline."]

-

Weakening Euro Impacting Export-Oriented Businesses: A weakening Euro negatively impacts export-oriented Dutch businesses, as their products become more expensive for international buyers. This decreased competitiveness directly affects profitability and stock prices, leading to a further decline in the AEX Index.

Impact on Key Sectors within the Amsterdam AEX Index

The AEX decline disproportionately impacted certain sectors within the Dutch economy.

-

Energy Sector Performance and Volatility: The energy sector experienced significant volatility due to the ongoing energy crisis and the price fluctuations of natural gas and oil. Companies heavily reliant on energy production and distribution were particularly vulnerable.

-

Financial Sector Response to Interest Rate Hikes: The financial sector, sensitive to interest rate changes, felt the impact of the ECB's rate hikes. Higher rates can squeeze profit margins and impact lending activities.

-

Technology Sector Vulnerability to Market Shifts: The technology sector, often considered a bellwether of economic health, demonstrated vulnerability to the overall market downturn. Growth stocks, typically found in the tech sector, tend to suffer more during periods of increased risk aversion.

-

Consumer Goods Sector Sensitivity to Inflation: The consumer goods sector, directly impacted by consumer spending habits, felt the pinch of inflation. Decreased consumer spending led to reduced sales and profitability for companies in this sector.

Investor Sentiment and Market Reaction to the AEX Decline

The AEX decline triggered a strong market reaction, significantly influencing investor sentiment and investment strategies.

-

Increased Market Volatility and Trading Volume: The sharp drop increased market volatility and trading volume as investors reacted to the unexpected downturn. This heightened volatility reflects the uncertainty surrounding the future direction of the market.

-

Shift in Investor Strategies (Risk Aversion, Hedging): Many investors shifted towards risk-averse strategies, moving away from equities and towards safer assets like government bonds. Hedging strategies became more prevalent as investors sought to protect their portfolios from further losses.

-

Potential for Further Declines or Market Corrections: The sharp drop raises concerns about the potential for further declines or a broader market correction. The ongoing macroeconomic headwinds suggest a period of heightened uncertainty.

-

Analysis of Expert Opinions and Market Forecasts: Market analysts offer varying opinions on the future trajectory of the AEX. Some predict a further decline, while others anticipate a rebound based on [mention specific factors supporting these different forecasts].

Potential Long-Term Consequences of the Amsterdam AEX Decline

The sharp AEX decline has significant potential long-term consequences for the Dutch economy.

-

Impact on Economic Growth and Job Creation: A prolonged period of low AEX performance could negatively impact economic growth and job creation, particularly in sectors closely tied to the stock market.

-

Effect on Foreign Investment in the Netherlands: A sustained downturn could discourage foreign investment in the Netherlands, reducing capital inflows and hindering economic development.

-

Government Response and Potential Policy Changes: The Dutch government may respond to the AEX decline with fiscal or monetary policies aimed at stimulating economic growth and boosting investor confidence.

-

Long-Term Investor Confidence and Recovery Prospects: The speed and extent of the AEX's recovery will depend on the resolution of the underlying macroeconomic factors and the restoration of investor confidence.

Conclusion: Navigating the Volatility of the Amsterdam AEX Index

The recent sharp decline in the Amsterdam AEX Index represents a significant event with potentially long-lasting implications for the Dutch economy. The confluence of global economic slowdown, rising interest rates, inflation, geopolitical instability, and specific company performance contributed to this substantial drop. The impact extends across key sectors, influencing investor sentiment and strategies. The potential for further declines and long-term economic consequences necessitates careful monitoring of the market and adaptable investment strategies. Understanding the Amsterdam AEX Index is crucial for navigating current market uncertainty. Stay updated on the latest AEX Index news and analysis to make informed investment decisions.

Featured Posts

-

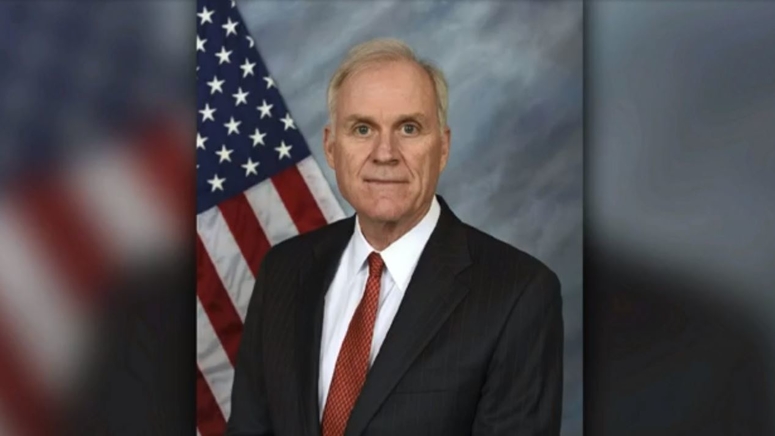

Presidential Seal Controversy Expensive Watches And Exclusive Events Under Scrutiny

May 25, 2025

Presidential Seal Controversy Expensive Watches And Exclusive Events Under Scrutiny

May 25, 2025 -

Is Elon Musks Anger Fueling Teslas Success

May 25, 2025

Is Elon Musks Anger Fueling Teslas Success

May 25, 2025 -

Glastonbury 2024 Us Bands Unsanctioned Reveal Ignites Festival Frenzy

May 25, 2025

Glastonbury 2024 Us Bands Unsanctioned Reveal Ignites Festival Frenzy

May 25, 2025 -

The La Wildfires And The Growing Market For Disaster Related Wagers

May 25, 2025

The La Wildfires And The Growing Market For Disaster Related Wagers

May 25, 2025 -

Us Tariff Pause Sends Euronext Amsterdam Stocks Soaring 8

May 25, 2025

Us Tariff Pause Sends Euronext Amsterdam Stocks Soaring 8

May 25, 2025

Latest Posts

-

From Scatological Documents To Engaging Podcasts An Ai Solution

May 25, 2025

From Scatological Documents To Engaging Podcasts An Ai Solution

May 25, 2025 -

Ai Powered Podcast Creation Analyzing And Transforming Scatological Data

May 25, 2025

Ai Powered Podcast Creation Analyzing And Transforming Scatological Data

May 25, 2025 -

Turning Poop Into Podcast Gold Ai Digest For Repetitive Documents

May 25, 2025

Turning Poop Into Podcast Gold Ai Digest For Repetitive Documents

May 25, 2025 -

Dogecoin Price Prediction Considering Elon Musks Role

May 25, 2025

Dogecoin Price Prediction Considering Elon Musks Role

May 25, 2025 -

The Impact Of Elon Musks Actions On The Dogecoin Price

May 25, 2025

The Impact Of Elon Musks Actions On The Dogecoin Price

May 25, 2025