Amsterdam Exchange Plunges 7% At Opening Bell: Trade War Impact

Table of Contents

Understanding the Initial Market Reaction

The immediate consequence of the 7% drop in the Amsterdam Exchange was widespread panic. Panic selling ensued as investors reacted swiftly to the negative news, leading to a significant increase in market volatility. Trading volume surged during the opening hours as traders attempted to liquidate positions and limit further losses. The atmosphere was one of uncertainty and fear, reflecting the fragility of investor confidence.

- Specific examples of stocks significantly impacted: Shares in several export-oriented companies, particularly those in the agricultural and technology sectors, experienced double-digit percentage drops. For example, [Insert example of a specific company and its percentage drop].

- Percentage changes in key indices: The AEX index, a key benchmark for the Amsterdam Exchange, plummeted by 7%, while other related indices also experienced significant declines.

- Quotes from financial analysts regarding the initial market reaction: "[Insert quote from a financial analyst about the initial market reaction, emphasizing the severity of the drop and the uncertainty it caused]."

The Role of the Trade War in the Amsterdam Exchange Plunge

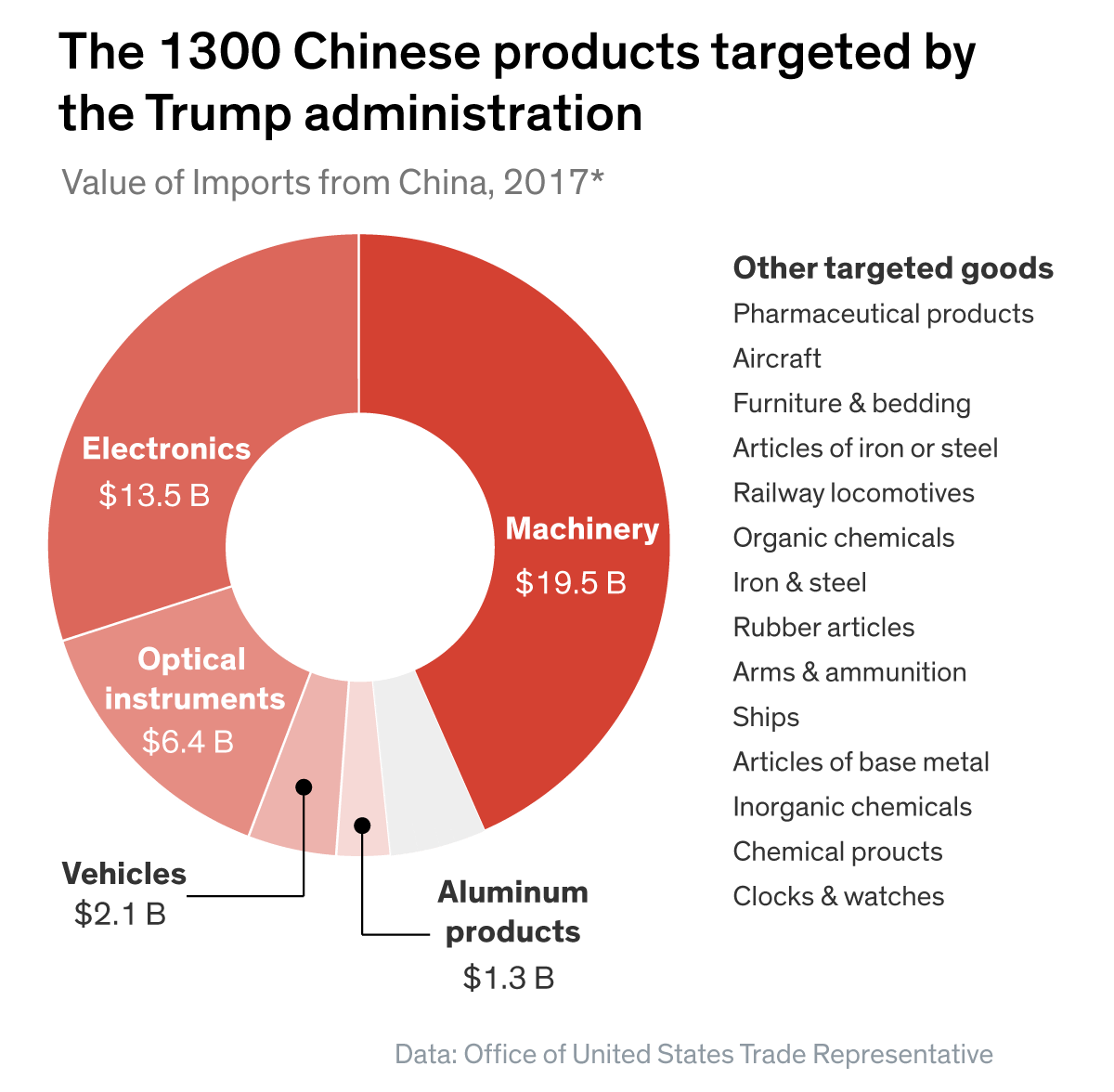

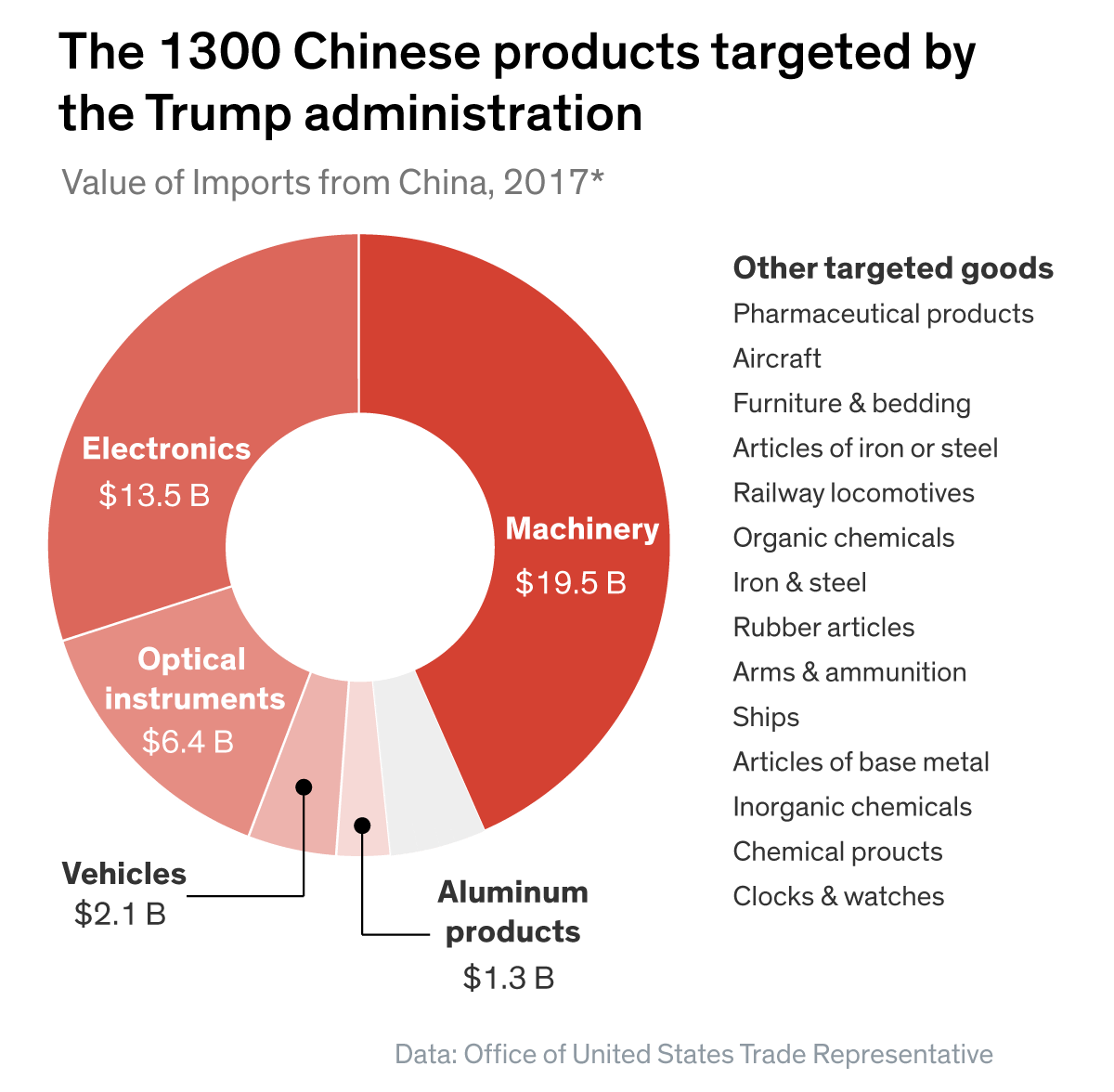

The current trade war, characterized by escalating tariffs and trade restrictions, is a primary driver of the Amsterdam Exchange plunge. The impact of these policies on Dutch businesses is severe, particularly those heavily reliant on international trade. Tariffs imposed by trading partners increase the cost of goods, reducing competitiveness and impacting profitability. Furthermore, trade restrictions disrupt global supply chains, leading to production delays and shortages. This uncertainty significantly erodes investor confidence, leading to capital flight and market declines.

- Examples of Dutch companies heavily reliant on international trade: [Insert examples of specific Dutch companies and their reliance on international trade].

- Specific sectors most affected (e.g., agriculture, technology): The agricultural sector, a major component of the Dutch economy, has been particularly hard-hit by tariffs imposed on agricultural exports. Similarly, technology companies face challenges due to supply chain disruptions and reduced demand.

- Analysis of the impact on export-oriented businesses: Export-oriented businesses in the Netherlands are experiencing reduced profits and decreased competitiveness due to increased costs and trade barriers.

Analyzing Wider European and Global Market Impacts

The Amsterdam Exchange plunge didn't occur in isolation. The ripple effects were felt across the European Union, impacting other major stock exchanges. While the extent of the impact varied, several European markets experienced significant declines, indicating a broader loss of confidence in the global economy. This event also had global ramifications, impacting investor sentiment and contributing to increased market volatility worldwide. The decline also impacted the Euro, leading to increased currency volatility.

- Comparison with other European market performance: [Compare the performance of the Amsterdam Exchange with other major European exchanges, such as the Frankfurt Stock Exchange or the London Stock Exchange].

- Impact on the Euro and other major currencies: The uncertainty caused by the Amsterdam Exchange plunge and the wider trade war contributed to fluctuations in the Euro and other major currencies.

- Predictions for future market trends based on the current situation: [Offer a cautious outlook on future market trends, highlighting the uncertainty and potential for further volatility].

Potential Strategies for Investors During Market Volatility

Navigating these turbulent market conditions requires careful consideration and strategic planning. Investors should prioritize diversification across asset classes to mitigate risk. A well-diversified portfolio can help cushion the impact of market downturns. Risk assessment is crucial, and investors should carefully evaluate their risk tolerance before making investment decisions. Long-term investment strategies, focused on sustainable growth, are more resilient to short-term market fluctuations.

- Recommendations for investors with different risk tolerances: [Offer tailored advice for investors with varying levels of risk tolerance, ranging from conservative to aggressive].

- Specific investment strategies to consider during a trade war: [Suggest strategies such as investing in defensive sectors, focusing on companies with strong domestic markets, or exploring alternative investment opportunities].

- Advice on seeking professional financial guidance: It is recommended to seek guidance from a qualified financial advisor to create a personalized investment plan aligned with individual needs and goals.

Conclusion: Navigating the Amsterdam Exchange's Uncertain Future Amidst Trade War Uncertainty

The 7% plunge in the Amsterdam Exchange at the opening bell serves as a stark reminder of the significant impact of the ongoing trade war on global markets. The combination of escalating tariffs, trade restrictions, and uncertainty profoundly impacted investor confidence, triggering a sharp market decline. The consequences extend beyond the Netherlands, impacting European markets and contributing to global market volatility. The future remains uncertain, and continued vigilance is crucial for investors and businesses alike. To stay informed about trade war developments and their potential impact on the Amsterdam Exchange and global markets, we recommend following reputable financial news sources and seeking professional financial advice. Regularly monitoring Amsterdam Exchange volatility and understanding trade war effects is essential for informed decision-making in this dynamic market environment. Conduct thorough market analysis to navigate these challenging times.

Featured Posts

-

Positief Beurssentiment Na Trump Uitstel Aex Analyse

May 25, 2025

Positief Beurssentiment Na Trump Uitstel Aex Analyse

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025 -

France Debates New Legislation On Underage Criminal Sentencing

May 25, 2025

France Debates New Legislation On Underage Criminal Sentencing

May 25, 2025 -

Pavel I I Trillery Interpretatsiya Fedora Lavrova O Chelovecheskoy Potrebnosti V Riske

May 25, 2025

Pavel I I Trillery Interpretatsiya Fedora Lavrova O Chelovecheskoy Potrebnosti V Riske

May 25, 2025 -

Leeds Contact Kyle Walker Peters Transfer Speculation Mounts

May 25, 2025

Leeds Contact Kyle Walker Peters Transfer Speculation Mounts

May 25, 2025

Latest Posts

-

Dc Love Story A Journey A Tragedy

May 25, 2025

Dc Love Story A Journey A Tragedy

May 25, 2025 -

Fujifilm X H2 Hands On Review Whimsical Refreshing And Fun

May 25, 2025

Fujifilm X H2 Hands On Review Whimsical Refreshing And Fun

May 25, 2025 -

Mans Front Lawn Unexpected Visitor A Runaway Container Ship

May 25, 2025

Mans Front Lawn Unexpected Visitor A Runaway Container Ship

May 25, 2025 -

Exploring The Audio Evidence The Titan Subs Fatal Implosion

May 25, 2025

Exploring The Audio Evidence The Titan Subs Fatal Implosion

May 25, 2025 -

The Sound Of Disaster Unlocking The Mystery Of The Titan Sub Implosion

May 25, 2025

The Sound Of Disaster Unlocking The Mystery Of The Titan Sub Implosion

May 25, 2025