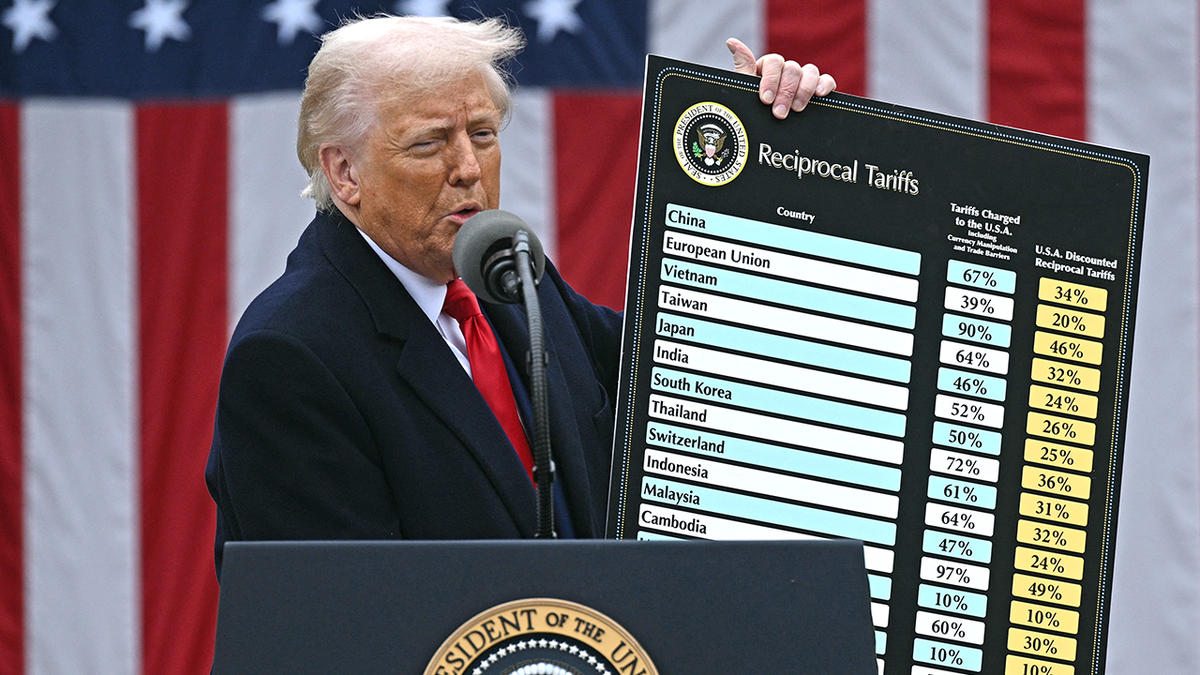

Amsterdam Stock Exchange Drops 2%: Trump's Tariffs Take Their Toll

Table of Contents

Impact of Trump's Tariffs on Dutch Businesses

Trump's tariffs, particularly those targeting steel and aluminum, have dealt a considerable blow to key Dutch industries. The Netherlands, a significant exporter, is feeling the pinch through decreased export opportunities and increased production costs. This translates directly into reduced competitiveness in global markets and, worryingly, potential job losses across various sectors.

-

Decreased export opportunities for Dutch manufacturers: Tariffs imposed on Dutch goods entering the US market reduce their price competitiveness, leading to a decline in demand and exports. This is particularly impacting sectors like machinery and equipment manufacturing.

-

Increased production costs due to higher raw material prices: The tariffs on steel and aluminum have driven up the cost of raw materials for Dutch manufacturers, increasing their production costs and squeezing profit margins. This cost increase is passed on to consumers, further diminishing competitiveness.

-

Reduced competitiveness in global markets: With higher production costs and reduced access to certain markets, Dutch businesses are losing their competitive edge against companies from countries not affected by the tariffs.

-

Potential job losses in affected sectors: The combination of reduced exports, higher costs, and decreased competitiveness inevitably leads to a threat of job losses within the manufacturing and related sectors, creating further economic uncertainty.

The ripple effect of these impacts on the Amsterdam Stock Exchange is substantial. Reduced profitability and the threat of job losses lead to decreased investor confidence and negatively impact stock valuations across the board.

Investor Sentiment and Market Volatility

The uncertainty surrounding the trade war has created a climate of negative investor sentiment, leading to increased market volatility and significant sell-offs on the Amsterdam Stock Exchange. Investors are reacting to the unpredictability of the situation and are looking for ways to protect their investments.

-

Fear of further tariff escalation: The ever-present threat of further tariff increases from the US administration fuels apprehension and encourages investors to take a cautious approach, often leading to selling off assets.

-

Concerns about global economic slowdown: The ongoing trade war threatens to stifle global economic growth, creating concerns about reduced future earnings and profits for companies listed on the Amsterdam Stock Exchange.

-

Uncertainty surrounding future trade agreements: The lack of clarity regarding the future of trade relations between the US and Europe contributes to investor uncertainty and hesitancy.

-

Capital flight to safer haven assets: In times of uncertainty, investors often move their capital to safer haven assets such as government bonds, which leads to a reduction in investment in riskier assets like stocks listed on the Amsterdam Stock Exchange.

This combination of factors has significantly contributed to the 2% drop in the Amsterdam Stock Exchange, demonstrating the crucial role of investor confidence in market performance.

Specific Companies Heavily Affected

Several prominent companies listed on the Amsterdam Stock Exchange have been significantly impacted by the tariffs. For example, ASML Holding (ASML), a leading producer of lithography systems used in semiconductor manufacturing, faces challenges from the broader global slowdown impacting the tech industry and the complexities of international supply chains. Unilever (ULVR), a multinational consumer goods company, is also experiencing increased costs due to tariffs on raw materials and the impact on consumer spending. These companies represent a microcosm of the broader challenges facing Dutch businesses.

-

Industry-specific tariff impacts: Companies heavily reliant on international trade, particularly with the US, are disproportionately affected by the tariffs.

-

Supply chain disruptions: Tariffs and trade restrictions can disrupt global supply chains, making it more expensive and difficult for companies to source raw materials and distribute finished goods.

-

Decreased consumer demand: As prices rise due to tariffs, consumer demand can decrease, impacting sales and profitability for companies.

AEX Index Performance and Analysis

The AEX index is the benchmark index of the Amsterdam Stock Exchange, reflecting the performance of its 25 largest companies. Its 2% drop reflects the overall negative sentiment and the significant impact of the trade war on the Dutch economy. The closing prices and trading volume on the day confirmed the substantial decline. For example, the AEX index closed at [Insert closing price] with a trading volume of [Insert trading volume], signifying significant investor activity influenced by the negative market sentiment. This 2% drop is in line with, or even slightly exceeding, the decline seen in other major European markets, indicating the pervasive impact of the trade war on the European Union as a whole.

Conclusion

The 2% drop in the Amsterdam Stock Exchange is a direct consequence of several interacting factors. Trump's tariffs have negatively impacted Dutch businesses, leading to decreased export opportunities, increased costs, and reduced competitiveness. This, in turn, has fuelled negative investor sentiment, heightened market volatility, and ultimately driven the decline. The AEX index decline further underscores the severity of the situation.

Call to Action: Stay informed about the ongoing developments in the trade war and its impact on the Amsterdam Stock Exchange. Regularly monitor the AEX index and the performance of individual companies listed on the Amsterdam Stock Exchange to make informed investment decisions. Continue researching the effects of tariffs on the Amsterdam Stock Exchange for a complete understanding of the market's future. Understanding the complexities of the Amsterdam Stock Exchange and the factors impacting it is crucial for navigating these turbulent times.

Featured Posts

-

Can Jordan Bardella Revitalize The French Right Wing

May 25, 2025

Can Jordan Bardella Revitalize The French Right Wing

May 25, 2025 -

Analyse Hogere Kapitaalmarktrentes En De Sterke Euro

May 25, 2025

Analyse Hogere Kapitaalmarktrentes En De Sterke Euro

May 25, 2025 -

Free Transfer Bid Crystal Palace Interested In Kyle Walker Peters

May 25, 2025

Free Transfer Bid Crystal Palace Interested In Kyle Walker Peters

May 25, 2025 -

Avrupa Borsalarinda Karisik Seyir Guenuen Oezeti

May 25, 2025

Avrupa Borsalarinda Karisik Seyir Guenuen Oezeti

May 25, 2025 -

Escape To The Country Financing Your Rural Dream

May 25, 2025

Escape To The Country Financing Your Rural Dream

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025 -

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025 -

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025