Amsterdam Stock Exchange Opens Down 7%: Trade War Intensifies

Table of Contents

Impact of the Trade War on European Markets

The escalating trade war has far-reaching global implications, significantly affecting the Netherlands and the European Union. The interconnected nature of global markets means that events in one region quickly ripple outwards, impacting seemingly unrelated sectors and economies. The Netherlands, being a major trading nation, is particularly vulnerable to the effects of increased tariffs and trade restrictions.

- Global Supply Chains Disrupted: The trade war disrupts established supply chains, leading to increased production costs and delays. This impacts numerous sectors, from manufacturing to agriculture.

- Reduced Export Opportunities: Tariffs and sanctions imposed by trading partners significantly reduce export opportunities for Dutch businesses, leading to decreased revenue and potential job losses.

- Increased Import Costs: Higher tariffs on imported goods increase prices for consumers and businesses in the Netherlands, impacting purchasing power and overall economic growth.

The EU economy as a whole is facing similar challenges, with various sectors experiencing varying degrees of impact. The interconnectedness of the European and global economies means that the repercussions of this trade war will be felt far beyond the immediate players. Keywords: Global trade, EU economy, Netherlands economy, export, import, tariffs, sanctions.

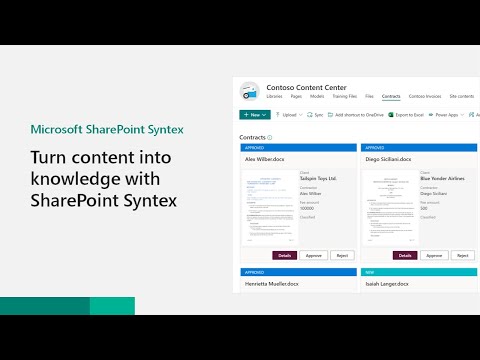

AEX Performance and Key Declining Sectors

The AEX index plummeted by 7%, marking its worst single-day performance in several months. This represents a significant downturn compared to the previous week’s relatively stable performance. Several key sectors were particularly hard hit:

- Technology: The technology sector, highly sensitive to global trade dynamics, experienced the most significant decline, with several major tech companies seeing double-digit percentage drops.

- Financials: The financial sector also suffered considerable losses, reflecting investor concerns about the broader economic outlook.

- Manufacturing: Manufacturing companies heavily reliant on international trade faced significant challenges due to increased import costs and reduced export demand.

Here are some of the top performers:

- ASML Holding (ASML): -12%

- ING Groep (INGA): -9%

- Unilever (UNA): -8%

[Insert Chart/Graph illustrating AEX performance here]

Keywords: AEX index, stock prices, sector performance, market volatility, top losers.

Investor Sentiment and Market Reactions

The market reacted negatively to the news, with investors exhibiting significant risk aversion. Investor confidence has plummeted, leading to widespread selling of assets as investors seek safer havens. This sell-off has been amplified by concerns about the unpredictable nature of the trade war and its potential long-term consequences.

Financial analysts are expressing cautious optimism, with many predicting short-term volatility but maintaining a generally positive long-term outlook for the AEX. However, the prevailing sentiment is one of uncertainty, reflecting the challenges in predicting the future trajectory of the trade war. Expert opinions vary, but the consensus points towards a period of market instability.

"The current situation is highly volatile," says leading financial analyst, Jan de Vries, "Investors should brace for more short-term fluctuations, but the underlying strength of the Dutch economy should eventually lead to recovery."

Keywords: Investor confidence, market sentiment, risk aversion, safe haven assets, market outlook.

Potential Mitigation Strategies and Future Outlook

Several strategies could potentially mitigate the impact of the trade war on the Amsterdam Stock Exchange:

- Government Intervention: Government intervention, such as fiscal stimulus packages or targeted support for affected industries, could help cushion the blow.

- Diversification: Businesses can diversify their supply chains and markets to reduce their dependence on specific trading partners.

- Technological Adaptation: Investing in new technologies and processes can help businesses improve efficiency and competitiveness in a changing global landscape.

The short-term outlook for the AEX remains uncertain, with continued volatility expected. However, the long-term prospects depend heavily on the resolution of the trade war and the ability of businesses and governments to adapt to the new reality. Positive factors such as a strong domestic economy and innovative industries could help offset some of the negative impacts.

Keywords: Economic policy, government intervention, market recovery, long-term growth, future outlook.

Conclusion: Navigating the Volatility of the Amsterdam Stock Exchange

The 7% drop in the Amsterdam Stock Exchange is a direct consequence of the escalating global trade war. This downturn has significantly impacted various sectors, from technology to financials, and has resulted in a negative shift in investor sentiment. While the short-term outlook remains uncertain, potential mitigation strategies exist, and the long-term prospects of the AEX are contingent on the resolution of the trade war and effective adaptation measures. Stay informed about developments in the Amsterdam Stock Exchange and the global trade war by subscribing to our newsletter [link to newsletter] or following us on social media [links to social media]. Understanding the volatility of the Amsterdam Stock Exchange and its relationship to global trade is crucial for effective investment strategies.

Featured Posts

-

How To Get Bbc 1 Big Weekend 2025 Sefton Park Tickets

May 24, 2025

How To Get Bbc 1 Big Weekend 2025 Sefton Park Tickets

May 24, 2025 -

The Tush Push Endures A Look At Nfls Evolving Celebration Policies

May 24, 2025

The Tush Push Endures A Look At Nfls Evolving Celebration Policies

May 24, 2025 -

European Leaders Trump Says Putin Isnt Ready To End The War Exclusive

May 24, 2025

European Leaders Trump Says Putin Isnt Ready To End The War Exclusive

May 24, 2025 -

La Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo

May 24, 2025

La Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo

May 24, 2025 -

Listen Now Joy Crookes Drops New Track Carmen

May 24, 2025

Listen Now Joy Crookes Drops New Track Carmen

May 24, 2025

Latest Posts

-

Repetitive Documents An Ai Solution For Creating A Poop Podcast

May 24, 2025

Repetitive Documents An Ai Solution For Creating A Poop Podcast

May 24, 2025 -

Ai Digest Transforming Repetitive Documents Into Informative Poop Podcasts

May 24, 2025

Ai Digest Transforming Repetitive Documents Into Informative Poop Podcasts

May 24, 2025 -

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

May 24, 2025

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

May 24, 2025 -

Utilizing Orbital Space Crystals For Superior Drug Production

May 24, 2025

Utilizing Orbital Space Crystals For Superior Drug Production

May 24, 2025 -

Space Crystals And Pharmaceutical Advancement Exploring New Frontiers In Drug Research

May 24, 2025

Space Crystals And Pharmaceutical Advancement Exploring New Frontiers In Drug Research

May 24, 2025