Amundi Dow Jones Industrial Average UCITS ETF: A Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the underlying value of an ETF's holdings per share. It's essentially the market value of all the assets the ETF owns, minus its liabilities, divided by the number of outstanding shares. Think of it as the true worth of your investment in the ETF, independent of its trading price on the exchange.

For example, imagine an ETF holding $10 million in assets and having $100,000 in liabilities. If there are 1 million shares outstanding, the NAV per share would be ($10,000,000 - $100,000) / 1,000,000 = $9.90. This means each share theoretically holds $9.90 worth of assets.

- NAV is calculated daily.

- It reflects the market value of all assets held by the ETF, including stocks, bonds, and other securities.

- Liabilities, such as management fees and expenses, are subtracted from the total asset value to arrive at the net asset value.

- NAV per share is calculated by dividing the total NAV by the number of outstanding shares. This provides a clear picture of the value of each individual share.

How is the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Calculated?

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is calculated daily, reflecting the value of its underlying assets which aim to track the Dow Jones Industrial Average. The calculation process involves several steps:

- Daily pricing of the underlying Dow Jones Industrial Average components: The value of each of the 30 constituent stocks in the Dow Jones Industrial Average is determined at market close.

- Consideration of currency exchange rates: If the ETF holds assets in multiple currencies, the current exchange rates are applied to convert those values into the ETF's base currency (usually Euros, in this case).

- Inclusion of any dividends received: Any dividends received by the ETF from its holdings are added to the total asset value.

- Deduction of management fees and other operational expenses: The ETF's management fees and other operational costs are deducted from the total asset value to arrive at the final NAV. This ensures the NAV accurately represents the net value available to investors.

Why is NAV Important for Amundi Dow Jones Industrial Average UCITS ETF Investors?

Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for several reasons:

- Monitoring ETF performance over time: Tracking the NAV allows investors to see how their investment is performing over the long term. Consistent increases in NAV generally indicate a healthy investment.

- Comparing the ETF's performance to the Dow Jones Industrial Average: By comparing the NAV changes to the movements of the Dow Jones Industrial Average, investors can assess how effectively the ETF is tracking its benchmark index.

- Evaluating the success of investment strategy: The NAV helps investors evaluate the effectiveness of their investment strategy. A rising NAV often indicates successful investment decisions, while a consistently falling NAV may warrant a review of the strategy.

- Determining the appropriate buy or sell points: While not the sole determinant, NAV can provide valuable insights when considering buying or selling shares, allowing for more informed investment decisions. Analyzing NAV alongside market price can signal potential undervalued or overvalued situations.

Accessing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Investors can find the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF through several reliable sources:

- The Amundi ETF website: The official website of Amundi is the most reliable source for the NAV data.

- Financial news websites: Many reputable financial news websites publish real-time or end-of-day NAV data for ETFs.

- Brokerage accounts: Most brokerage platforms display the current NAV for ETFs held in investor accounts.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is paramount for any investor seeking to track performance and make well-informed decisions. By regularly monitoring the NAV, comparing it to the benchmark index, and utilizing the information available through various sources, investors can gain a clearer picture of their investment’s health and adjust their strategy as needed. Stay informed about your Amundi Dow Jones Industrial Average UCITS ETF NAV and remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

From Deficit To Victory Maryland Softballs Thrilling 5 4 Win

May 24, 2025

From Deficit To Victory Maryland Softballs Thrilling 5 4 Win

May 24, 2025 -

Yubileyniy Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 24, 2025

Yubileyniy Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 24, 2025 -

France L Influence Chinoise Et La Censure Des Voix Discordantes

May 24, 2025

France L Influence Chinoise Et La Censure Des Voix Discordantes

May 24, 2025 -

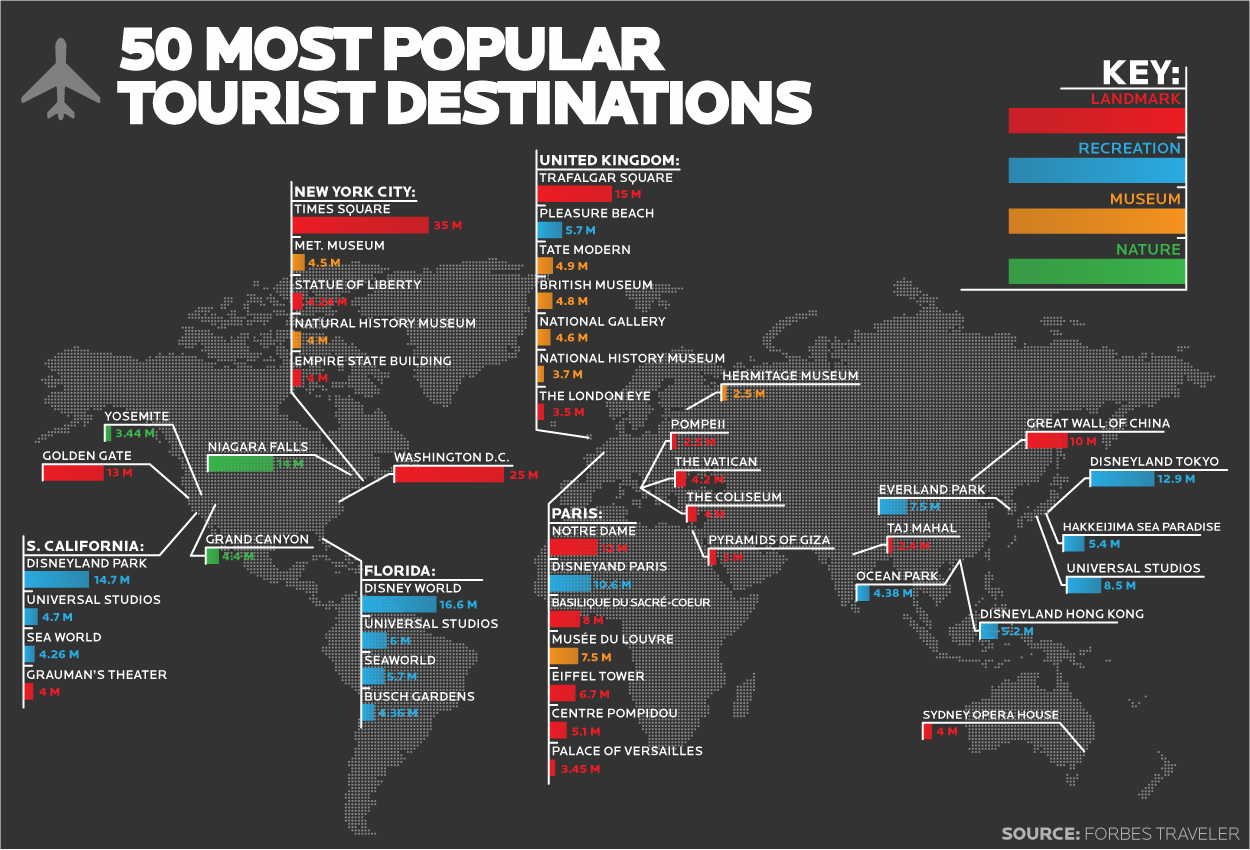

Escape To The Country Top Destinations For A Tranquil Lifestyle

May 24, 2025

Escape To The Country Top Destinations For A Tranquil Lifestyle

May 24, 2025 -

New Era Of Cooperation Bangladesh And Europes Commitment To Growth

May 24, 2025

New Era Of Cooperation Bangladesh And Europes Commitment To Growth

May 24, 2025

Latest Posts

-

Florida Film Festival Celebrity Sightings Mia Farrow Christina Ricci And More

May 24, 2025

Florida Film Festival Celebrity Sightings Mia Farrow Christina Ricci And More

May 24, 2025 -

Sadie Sink And Mia Farrow A Broadway Encounter Image 5162787

May 24, 2025

Sadie Sink And Mia Farrow A Broadway Encounter Image 5162787

May 24, 2025 -

Mia Farrow And Christina Ricci At The Florida Film Festival

May 24, 2025

Mia Farrow And Christina Ricci At The Florida Film Festival

May 24, 2025 -

Broadways Photo 5162787 Mia Farrow Supports Fellow Nominee Sadie Sink

May 24, 2025

Broadways Photo 5162787 Mia Farrow Supports Fellow Nominee Sadie Sink

May 24, 2025 -

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025