Amundi Dow Jones Industrial Average UCITS ETF Dist: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Defining NAV

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. It's essentially the per-share value of the ETF's holdings. Think of it as the underlying value of what you own in the fund.

- Assets: These include the market value of all the stocks, bonds, or other securities held within the ETF, mirroring the Dow Jones Industrial Average constituents in this case.

- Liabilities: These encompass expenses such as management fees, operational costs, and any outstanding debts.

- Outstanding Shares: This is the total number of ETF shares currently in circulation.

Example: If an ETF has total assets of $10 million, liabilities of $100,000, and 1 million outstanding shares, its NAV would be ($10,000,000 - $100,000) / 1,000,000 = $9.90 per share.

The bid price (what you can sell your shares for) and ask price (what you pay to buy shares) fluctuate around the NAV, reflecting market supply and demand. The NAV, however, remains a constant measure of the ETF's intrinsic value.

NAV Calculation for Amundi Dow Jones Industrial Average UCITS ETF Dist

The NAV calculation for the Amundi Dow Jones Industrial Average UCITS ETF Dist follows the same principles, but with a focus on the specific assets within the ETF, which are designed to track the Dow Jones Industrial Average. The fund's holdings are rebalanced periodically to maintain this alignment. Dividends received from the underlying stocks are usually reinvested or distributed to shareholders, impacting the NAV accordingly. The fund manager calculates and publishes the NAV daily, typically at the end of the trading day.

Factors Affecting NAV

Several external factors influence the Amundi Dow Jones Industrial Average UCITS ETF Dist's NAV:

- Market Fluctuations: The primary driver of NAV changes is the performance of the Dow Jones Industrial Average itself. Increases or decreases in the value of the underlying stocks directly impact the ETF's NAV.

- Currency Exchange Rates: If the ETF holds international assets (even indirectly), fluctuations in currency exchange rates can affect the NAV, particularly important for a globally diversified investor.

- Underlying Asset Performance: The individual performance of each company within the Dow Jones Industrial Average influences the overall NAV. A strong performance by a major component boosts the NAV, while poor performance lowers it.

The relationship between the Dow Jones Industrial Average and the ETF's NAV is very close; the ETF aims to mirror the index's performance as closely as possible.

Why is Understanding NAV Important for Investors?

Tracking Performance

Monitoring the NAV allows investors to track the Amundi Dow Jones Industrial Average UCITS ETF Dist's performance over time. By comparing the NAV at different points, investors can easily identify growth or losses. This provides a clear picture of investment returns, useful when comparing the ETF to other investments.

Making Informed Investment Decisions

NAV plays a pivotal role in investment decisions. A comparison between the NAV and the market price helps determine whether the ETF is undervalued or overvalued. If the market price is significantly higher than the NAV, it might indicate an overbought situation. Conversely, if the market price is lower, it could suggest a potential buying opportunity. The NAV helps evaluate the ETF's value proposition relative to its market price and other investment alternatives.

Calculating Returns on Investment

Calculating your return on investment (ROI) using the NAV is straightforward. A simple formula is: ((Current NAV - Initial NAV) / Initial NAV) * 100%. This calculation, however, doesn't account for reinvested dividends, which significantly impact overall returns. Adding the dividends received to the final NAV calculation provides a more complete picture of your investment's performance.

Where to Find the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Dist?

Official Sources

Several sources provide the daily NAV:

- Amundi Website: The official Amundi website is the most reliable source for the NAV of their ETFs.

- Financial News Websites: Reputable financial news sources such as Bloomberg, Yahoo Finance, and Google Finance typically list ETF NAVs.

- Brokerage Platforms: Most brokerage platforms display the NAV of ETFs held in your portfolio.

Understanding Data Presentation

NAV data is commonly presented in tables and charts showing the NAV's historical performance. Understanding how to read these presentations is essential for effective monitoring.

Potential Delays in NAV Reporting

There might be slight delays in reporting the NAV, often due to the time needed to process the end-of-day market data for all the underlying assets. This delay is usually minimal and shouldn't significantly impact investment decisions.

Conclusion: Mastering Net Asset Value for Successful Amundi Dow Jones Industrial Average UCITS ETF Dist Investing

Understanding the Net Asset Value is fundamental for successful investing in the Amundi Dow Jones Industrial Average UCITS ETF Dist. By monitoring your Amundi Dow Jones Industrial Average UCITS ETF Dist NAV, you gain crucial insights into your investment's performance, enabling informed buying and selling decisions. Remember to regularly check the NAV from reliable sources. While this guide helps you understand your Amundi Dow Jones Industrial Average UCITS ETF Dist's Net Asset Value, always consult with a financial advisor for personalized investment advice tailored to your financial goals and risk tolerance. Optimize your Amundi Dow Jones Industrial Average UCITS ETF Dist investment by tracking its NAV consistently.

Featured Posts

-

90 Let So Dnya Rozhdeniya Sergeya Yurskogo Geniy Paradoksov Ostroumie I Intellekt

May 24, 2025

90 Let So Dnya Rozhdeniya Sergeya Yurskogo Geniy Paradoksov Ostroumie I Intellekt

May 24, 2025 -

Krijgt De Snelle Marktbeweging Van Europese Aandelen Een Vervolg

May 24, 2025

Krijgt De Snelle Marktbeweging Van Europese Aandelen Een Vervolg

May 24, 2025 -

The Ultimate Guide To An Escape To The Country

May 24, 2025

The Ultimate Guide To An Escape To The Country

May 24, 2025 -

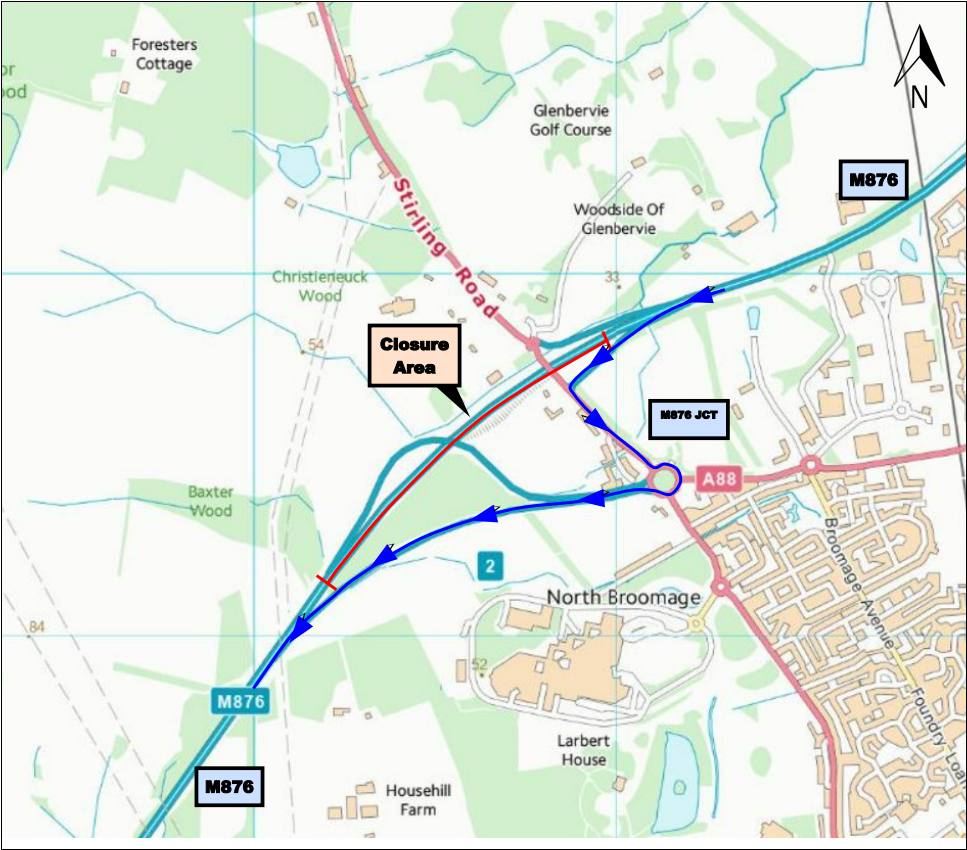

Planned M62 Westbound Closure For Resurfacing Manchester Warrington

May 24, 2025

Planned M62 Westbound Closure For Resurfacing Manchester Warrington

May 24, 2025 -

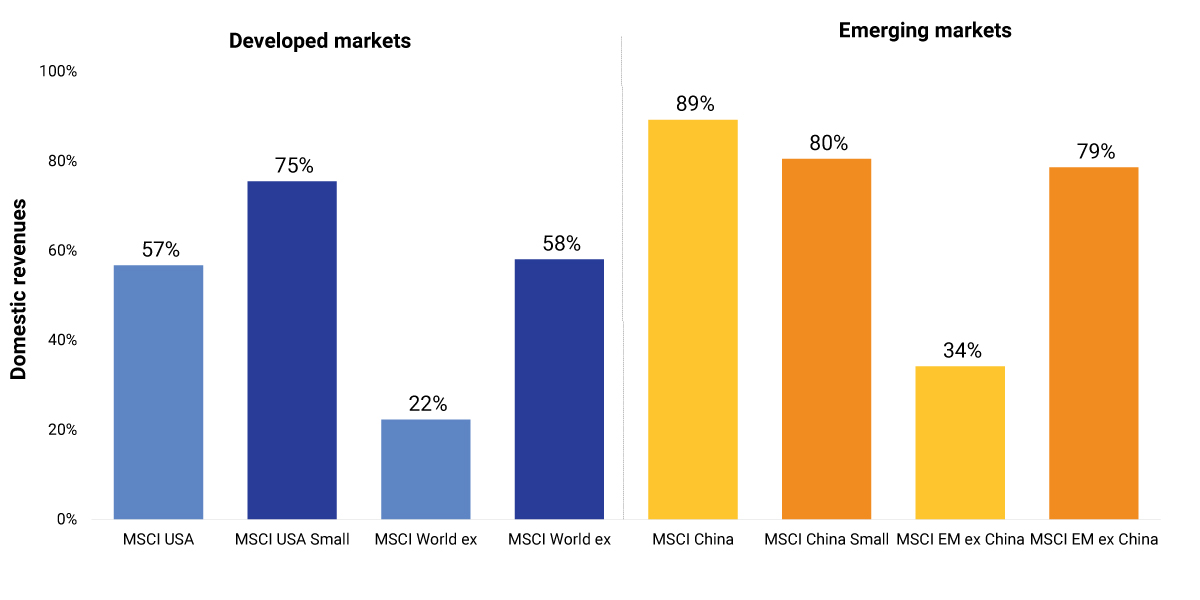

Apakah Mtel And Mbma Layak Dibeli Setelah Masuk Msci Small Cap Index

May 24, 2025

Apakah Mtel And Mbma Layak Dibeli Setelah Masuk Msci Small Cap Index

May 24, 2025

Latest Posts

-

Mia Farrow And Christina Ricci At The Florida Film Festival

May 24, 2025

Mia Farrow And Christina Ricci At The Florida Film Festival

May 24, 2025 -

Broadways Photo 5162787 Mia Farrow Supports Fellow Nominee Sadie Sink

May 24, 2025

Broadways Photo 5162787 Mia Farrow Supports Fellow Nominee Sadie Sink

May 24, 2025 -

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025 -

Florida Film Festival Spotting Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival Spotting Mia Farrow And Christina Ricci

May 24, 2025 -

Mia Farrow And Sadie Sink Broadway Reunion Captured In Photo 5162787

May 24, 2025

Mia Farrow And Sadie Sink Broadway Reunion Captured In Photo 5162787

May 24, 2025