Amundi Dow Jones Industrial Average UCITS ETF: NAV Analysis And Implications

Table of Contents

What is Net Asset Value (NAV) and Why is it Important for ETFs?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. For ETFs, the NAV is calculated by taking the total market value of all the securities held in the ETF's portfolio, subtracting any liabilities, and then dividing by the total number of outstanding shares. This calculation provides a snapshot of the ETF's intrinsic value at a specific point in time.

Monitoring the NAV is crucial for several reasons:

- Provides insight into the underlying asset performance: Changes in the NAV directly reflect the performance of the Dow Jones Industrial Average and its constituent companies. A rising NAV indicates positive performance, while a falling NAV suggests negative performance.

- Helps assess the ETF's pricing efficiency: By comparing the ETF's market price to its NAV, investors can assess whether the ETF is trading at a premium or discount. Significant deviations can signal opportunities or risks.

- Facilitates comparison with similar ETFs: Comparing the NAV performance of the Amundi Dow Jones Industrial Average UCITS ETF with similar ETFs tracking the Dow Jones Industrial Average allows investors to evaluate relative performance and identify better investment opportunities.

- Essential for determining potential gains or losses: Tracking NAV fluctuations is essential for calculating returns on investment and assessing the overall profitability of the ETF holding.

Analyzing the Amundi Dow Jones Industrial Average UCITS ETF's NAV Performance

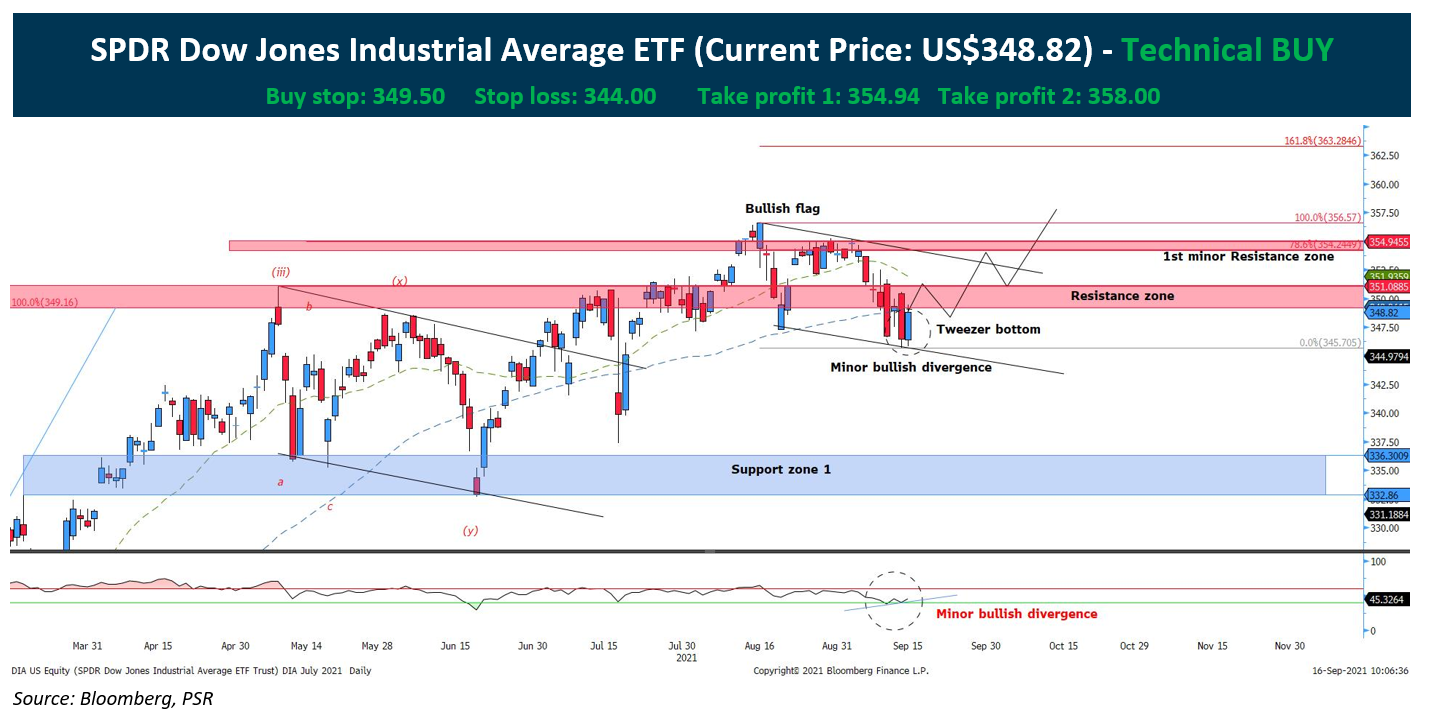

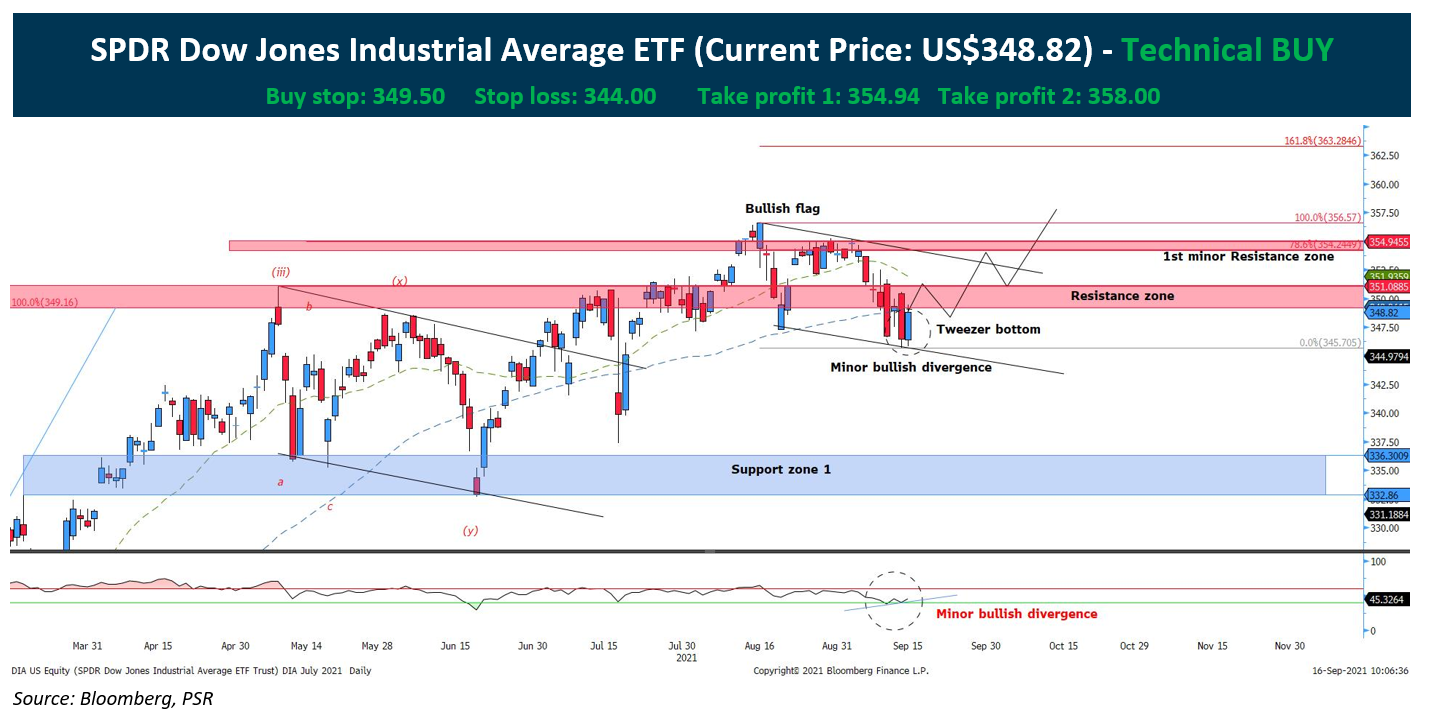

Analyzing the historical NAV performance of the Amundi Dow Jones Industrial Average UCITS ETF requires reviewing its price history and correlating it with market trends. (Include a chart or graph here showing historical NAV performance. Source should be cited.) Factors influencing NAV fluctuations include:

-

Market trends: Broad market movements, such as bull or bear markets, significantly impact the NAV. Positive market sentiment generally leads to NAV increases, while negative sentiment leads to decreases.

-

Constituent company performance: The performance of individual companies within the Dow Jones Industrial Average directly affects the ETF's NAV. Strong performance by major constituents typically boosts the NAV, while underperformance negatively impacts it.

-

Significant NAV increases/decreases: (Discuss specific periods of notable NAV movement and the factors contributing to them. For example, mention specific economic events or company-specific news.)

-

Correlation with the Dow Jones Industrial Average: The Amundi Dow Jones Industrial Average UCITS ETF's NAV should closely track the Dow Jones Industrial Average. Any significant divergence warrants investigation.

-

Key contributing factors to NAV movements: (Provide detailed explanations of various events influencing NAV such as interest rate changes, geopolitical events, and sector-specific performance)

-

Benchmark comparisons: (Compare the ETF’s NAV performance against other similar ETFs and relevant market benchmarks to analyze relative performance.)

Impact of Dividend Distributions on NAV

Dividend distributions from the underlying companies in the Dow Jones Industrial Average directly affect the ETF's NAV. When companies pay dividends, the ETF receives these payments, which are then typically distributed to ETF shareholders. This distribution reduces the NAV per share proportionally to the dividend amount.

The dividend reinvestment process further impacts NAV. If shareholders choose to reinvest dividends, the additional shares purchased increase the total number of outstanding shares, resulting in a slightly lower NAV per share.

- Examples of dividend impact on NAV: (Provide concrete examples illustrating how dividend payouts affect NAV calculations.)

- Tax implications of dividend distributions: (Discuss the tax consequences associated with receiving dividend distributions.)

- Benefits of dividend reinvestment for long-term growth: (Highlight the positive effect of dividend reinvestment on long-term investment growth.)

Implications for Investors: Strategies and Considerations

Analyzing the Amundi Dow Jones Industrial Average UCITS ETF's NAV can inform investment strategies. A "buy low, sell high" approach can be implemented by purchasing shares when the NAV is relatively low and selling when it's high, aiming to capitalize on market fluctuations. However, this requires precise timing and market forecasting skills.

Risk management is paramount. Investing in this ETF inherently carries risk associated with the overall performance of the Dow Jones Industrial Average. Market downturns can lead to significant NAV decreases and potential investment losses.

- Strategies for utilizing NAV data in investment decision-making: (Explain how to utilize NAV information to make informed investment decisions, like dollar-cost averaging, or tactical asset allocation strategies.)

- Risk assessment related to the Dow Jones Industrial Average and the ETF: (Detail the inherent risks of investing in this ETF, including market risk, interest rate risk, and sector-specific risks.)

- Comparison with alternative investment options: (Compare this ETF with other investment options, highlighting their respective advantages and disadvantages.)

- Long-term vs. short-term investment strategies: (Discuss the suitability of this ETF for different investment time horizons.)

Conclusion

Understanding the Net Asset Value of the Amundi Dow Jones Industrial Average UCITS ETF is vital for investors seeking exposure to the Dow Jones Industrial Average. This analysis highlights the importance of monitoring NAV fluctuations, considering the impact of dividends, and employing sound risk management strategies. By carefully analyzing NAV trends and correlating them with broader market conditions and the performance of individual companies within the index, investors can make more informed decisions.

Start monitoring the Amundi Dow Jones Industrial Average UCITS ETF's NAV today to optimize your investment strategy! Utilize online resources and financial tools to track NAV and analyze ETF performance effectively. Remember to conduct thorough research and consider seeking professional financial advice before making any investment decisions.

Featured Posts

-

Buffetts Apple Investment Impact Of Trump Tariffs

May 24, 2025

Buffetts Apple Investment Impact Of Trump Tariffs

May 24, 2025 -

Lewis Hamiltons Comments Draw Sharp Criticism From Ferrari

May 24, 2025

Lewis Hamiltons Comments Draw Sharp Criticism From Ferrari

May 24, 2025 -

New 2026 Porsche Cayenne Ev Spy Photos Offer Early Glimpse

May 24, 2025

New 2026 Porsche Cayenne Ev Spy Photos Offer Early Glimpse

May 24, 2025 -

Czy Porsche Cayenne Gts Coupe To Suv Marzen Moja Opinia

May 24, 2025

Czy Porsche Cayenne Gts Coupe To Suv Marzen Moja Opinia

May 24, 2025 -

Proverte Svoi Znaniya Roli Olega Basilashvili V Kino

May 24, 2025

Proverte Svoi Znaniya Roli Olega Basilashvili V Kino

May 24, 2025

Latest Posts

-

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025 -

Mia Farrow Demands Trumps Arrest For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Demands Trumps Arrest For Deporting Venezuelan Gang Members

May 24, 2025