Amundi MSCI All Country World UCITS ETF USD Acc: A Comprehensive Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated for the Amundi MSCI All Country World UCITS ETF USD Acc?

Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI All Country World UCITS ETF USD Acc, understanding the NAV is crucial because it reflects the intrinsic value of your investment. This value fluctuates daily, reflecting changes in the market prices of the stocks and other assets held within the ETF.

-

Definition of NAV: NAV is the per-share value of an ETF's assets, calculated by subtracting liabilities from the total asset value and dividing by the number of outstanding shares.

-

Formula for calculating NAV (simplified): (Total Asset Value - Liabilities) / Number of Outstanding Shares = NAV

-

Factors affecting NAV: Several factors influence the daily NAV calculation for the Amundi MSCI All Country World UCITS ETF USD Acc. These include:

- Market fluctuations of the underlying assets (stocks, bonds, etc.)

- Currency exchange rate movements (since the ETF is USD-denominated)

- Management fees and other expenses deducted from the asset value

- Dividend distributions to shareholders

-

Frequency of NAV calculation: The NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is typically calculated daily, at the close of the market.

Factors Influencing the Amundi MSCI All Country World UCITS ETF USD Acc NAV

The daily fluctuations in the Amundi MSCI All Country World UCITS ETF USD Acc's NAV are a direct result of various market forces. Understanding these influences allows for a more informed assessment of your investment.

-

Global market indices: The performance of major global market indices, such as the S&P 500, MSCI Emerging Markets, and others, significantly impact the NAV. Positive performance in these indices generally leads to a higher NAV.

-

Sector performance within the ETF's holdings: The ETF holds a diverse portfolio of global stocks across various sectors. Strong performance in specific sectors (e.g., technology, healthcare) will positively influence the NAV, while underperformance in others will have the opposite effect.

-

Currency risk and its impact on USD-denominated NAV: Because the Amundi MSCI All Country World UCITS ETF USD Acc is denominated in USD, fluctuations in exchange rates against other currencies can impact the NAV. A strengthening USD generally leads to a higher NAV (assuming other factors remain constant).

-

Geopolitical events and their effect on NAV: Unforeseen geopolitical events, such as wars, political instability, or major economic shifts, can cause significant volatility in the NAV.

Where to Find the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Accessing the real-time or historical NAV data for the Amundi MSCI All Country World UCITS ETF USD Acc is straightforward. Several reliable sources provide this information:

-

Amundi's official website: The Amundi website is the primary source for official NAV data. Look for fund fact sheets or dedicated pages for this ETF.

-

Reputable financial news sources: Major financial news websites, such as Bloomberg, Yahoo Finance, and Google Finance, typically provide real-time and historical NAV data for ETFs.

-

Brokerage account platforms: If you hold the ETF through a brokerage account, the platform will usually display the current NAV along with other relevant investment information.

-

ETF data providers: Specialized ETF data providers offer comprehensive information, including NAV data and historical performance charts.

Understanding the Difference Between NAV and Market Price

While the NAV is the intrinsic value of the ETF, the market price is the actual price at which the ETF shares are traded on the exchange. There can be minor discrepancies between the NAV and the market price, often due to supply and demand dynamics and trading volume.

-

Definition of market price: The market price reflects the price buyers and sellers agree upon for the ETF shares at a specific point in time.

-

Reasons for price discrepancies: Discrepancies can arise due to factors such as:

- High trading volume leading to price fluctuations

- Differences in supply and demand for the ETF shares

- Trading costs and commissions affecting the market price

-

Importance of understanding both NAV and market price: While the NAV is a key indicator of the ETF's underlying value, the market price is what you actually pay to buy or sell shares. Understanding both is essential for making informed investment decisions.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is critical for any investor. This guide outlined how NAV is calculated, the factors influencing it, and where to find reliable NAV data. Monitoring NAV fluctuations, alongside market trends and other relevant information, allows you to make more informed investment decisions and track the performance of your investment in the Amundi MSCI All Country World UCITS ETF USD Acc effectively. Stay informed about your Amundi MSCI All Country World UCITS ETF USD Acc NAV and utilize this data for successful investing.

Featured Posts

-

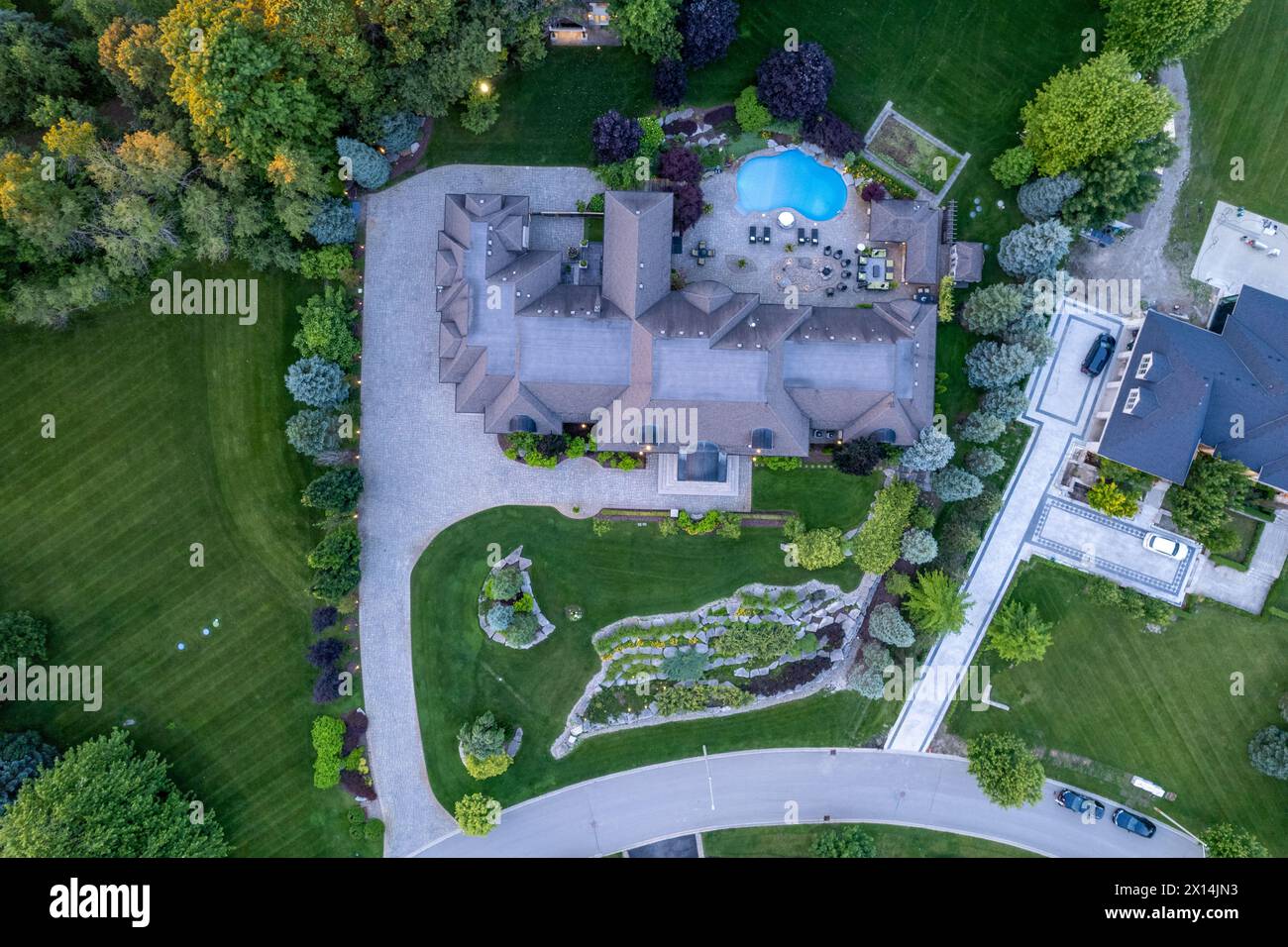

Escape To The Country Lifestyle Changes And Considerations

May 24, 2025

Escape To The Country Lifestyle Changes And Considerations

May 24, 2025 -

Escape To The Country Dream Homes Under 1 Million

May 24, 2025

Escape To The Country Dream Homes Under 1 Million

May 24, 2025 -

Kyle Walker Peters Crystal Palaces Free Transfer Pursuit

May 24, 2025

Kyle Walker Peters Crystal Palaces Free Transfer Pursuit

May 24, 2025 -

80

May 24, 2025

80

May 24, 2025 -

Is Glastonbury 2025 The Festival To Beat Analyzing The Lineup

May 24, 2025

Is Glastonbury 2025 The Festival To Beat Analyzing The Lineup

May 24, 2025

Latest Posts

-

Southamptons Kyle Walker Peters Leeds United Initiate Transfer Talks

May 24, 2025

Southamptons Kyle Walker Peters Leeds United Initiate Transfer Talks

May 24, 2025 -

Walker Peters To Leeds Contact Made Transfer Speculation Mounts

May 24, 2025

Walker Peters To Leeds Contact Made Transfer Speculation Mounts

May 24, 2025 -

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 24, 2025

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 24, 2025 -

Leeds Contact Kyle Walker Peters Is A Transfer On The Cards

May 24, 2025

Leeds Contact Kyle Walker Peters Is A Transfer On The Cards

May 24, 2025 -

The Kyle Walker Transfer And Lauryn Goodmans Move Connecting The Dots

May 24, 2025

The Kyle Walker Transfer And Lauryn Goodmans Move Connecting The Dots

May 24, 2025