Amundi MSCI All Country World UCITS ETF USD Acc: Daily NAV Updates And Analysis

Table of Contents

Understanding Daily NAV Updates for Amundi MSCI All Country World UCITS ETF USD Acc

The NAV of an ETF like the Amundi MSCI All Country World UCITS ETF USD Acc represents the net value of its underlying assets per share. Understanding its daily fluctuations is vital for informed investment choices. The NAV is calculated daily by taking the total value of all the assets held in the ETF (stocks, bonds, etc.), subtracting any liabilities, and dividing by the total number of outstanding shares.

Several factors influence the daily NAV changes:

- Market Trends: Overall market movements, whether bullish or bearish, directly impact the value of the underlying assets. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV.

- Currency Exchange Rates: As this ETF is denominated in USD, fluctuations in exchange rates against other currencies can affect the NAV, especially given its global holdings.

- Individual Stock Performance: The performance of individual companies within the MSCI All Country World Index influences the overall ETF NAV. Strong performance by major holdings will positively impact the NAV.

Finding reliable NAV information is easy. Reputable financial websites, brokerage platforms, and the ETF provider's website (Amundi) will all provide up-to-date NAV data. Remember the difference between the bid price (what you can sell the ETF for) and the ask price (what you can buy it for).

- Definition of NAV: The net asset value represents the per-share value of the ETF's underlying assets.

- Factors Affecting Daily NAV: Market trends, currency fluctuations, and individual stock performance all play a role.

- Reliable NAV Sources: Check reputable financial websites, brokerage platforms, and Amundi's official website.

- Bid and Ask Prices: Understand that there's a difference between the price you can buy and sell the ETF at.

Analyzing Amundi MSCI All Country World UCITS ETF USD Acc Performance

Analyzing the Amundi MSCI All Country World UCITS ETF USD Acc's performance involves more than just looking at daily NAV changes. A holistic approach is crucial:

-

Long-Term Trends: Analyze historical NAV data to understand long-term growth patterns and identify potential trends. Consider charting the NAV over different time periods (e.g., 1 year, 5 years, 10 years).

-

Benchmark Comparison: Compare the ETF's performance against its benchmark, the MSCI All Country World Index. This reveals how well the ETF tracks the index and identifies any potential outperformance or underperformance.

-

Risk Assessment: Calculate the ETF's volatility (standard deviation) to understand its risk profile. Higher volatility indicates greater price fluctuations and higher risk.

-

Global Market Correlation: Analyze the ETF's correlation with major global market indices (e.g., S&P 500, FTSE 100) to understand its behavior during various market conditions.

-

Long-Term Performance Analysis: Use historical NAV data to identify trends and growth patterns.

-

Benchmark Comparison: Compare the ETF's performance against the MSCI All Country World Index.

-

Risk Assessment: Understand the ETF's volatility through standard deviation calculations.

-

Global Market Correlation: Analyze its relationship with major global indices.

Using the Amundi MSCI All Country World UCITS ETF USD Acc in Your Portfolio

The Amundi MSCI All Country World UCITS ETF USD Acc plays a vital role in portfolio diversification. Its broad global exposure effectively reduces overall portfolio risk by mitigating the impact of underperformance in any single region or sector.

-

Portfolio Integration: This ETF can be a cornerstone of a globally diversified portfolio, complementing other asset classes like bonds, real estate, or sector-specific ETFs.

-

Risk Management: Global diversification helps reduce unsystematic risk (risk specific to individual assets) and lowers overall portfolio volatility.

-

Asset Allocation Strategies: This ETF can be used in various asset allocation strategies, such as a globally diversified portfolio with a strategic asset allocation of 60% stocks and 40% bonds.

-

Global Diversification Advantages: Gain exposure to a wide range of global markets without the need for extensive individual stock selection.

-

Portfolio Integration: It complements other asset classes for a more diversified portfolio.

-

Risk Management: Global diversification reduces overall portfolio risk.

-

Asset Allocation Strategies: Integrate it into various strategic asset allocation models.

-

Global Diversification Advantages: Gain broad global exposure with ease.

Frequently Asked Questions (FAQs) about Amundi MSCI All Country World UCITS ETF USD Acc

- What is the expense ratio? The expense ratio is the annual fee charged to manage the ETF. Check the ETF's fact sheet for the most up-to-date information.

- What is the minimum investment? This varies depending on your brokerage. Check with your broker for their minimum investment requirements.

- What are the tax implications? Tax implications depend on your individual tax situation and jurisdiction. Consult a tax professional for personalized advice.

- What are the trading fees? Trading fees depend on your brokerage platform. Check their fee schedule for details.

Conclusion

Monitoring the daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is crucial for making informed investment decisions. Consistent performance analysis, coupled with an understanding of its role in portfolio diversification, empowers investors to make strategic choices. Regularly checking the daily NAV, conducting thorough performance analysis, and considering the integration of the Amundi MSCI All Country World UCITS ETF USD Acc into your investment strategy are vital steps towards achieving global market exposure and a well-diversified portfolio. Visit the Amundi website or your preferred financial data provider for up-to-date NAV and other relevant information.

Featured Posts

-

Get Tickets For Bbc Big Weekend 2025 In Sefton Park

May 24, 2025

Get Tickets For Bbc Big Weekend 2025 In Sefton Park

May 24, 2025 -

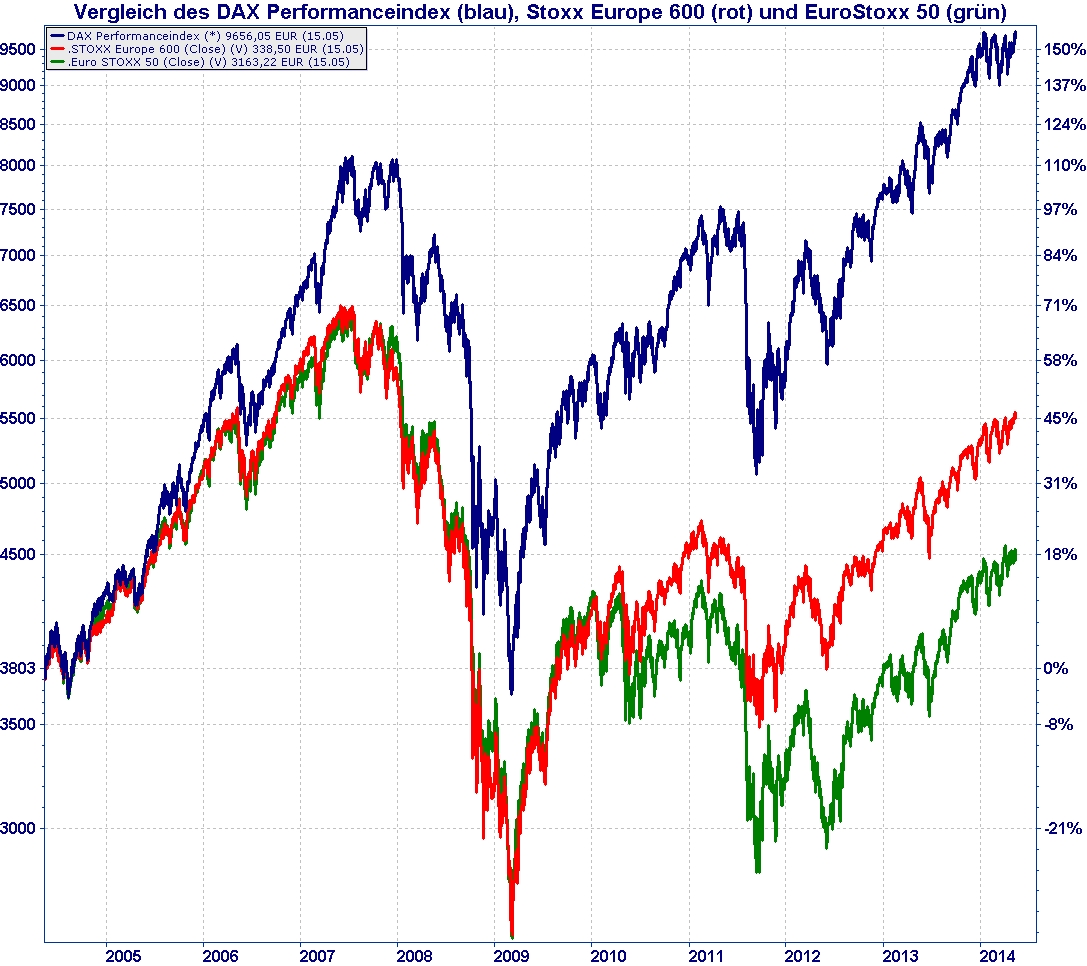

16 Nisan 2025 Avrupa Piyasa Raporu Stoxx 600 Ve Dax 40 In Duesuesue

May 24, 2025

16 Nisan 2025 Avrupa Piyasa Raporu Stoxx 600 Ve Dax 40 In Duesuesue

May 24, 2025 -

Porsche Classic Art Week 2025 Acara Seni Dan Otomotif Di Indonesia

May 24, 2025

Porsche Classic Art Week 2025 Acara Seni Dan Otomotif Di Indonesia

May 24, 2025 -

Is This Us Band Playing Glastonbury Unofficial Announcement Creates Buzz

May 24, 2025

Is This Us Band Playing Glastonbury Unofficial Announcement Creates Buzz

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc Explained

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc Explained

May 24, 2025

Latest Posts

-

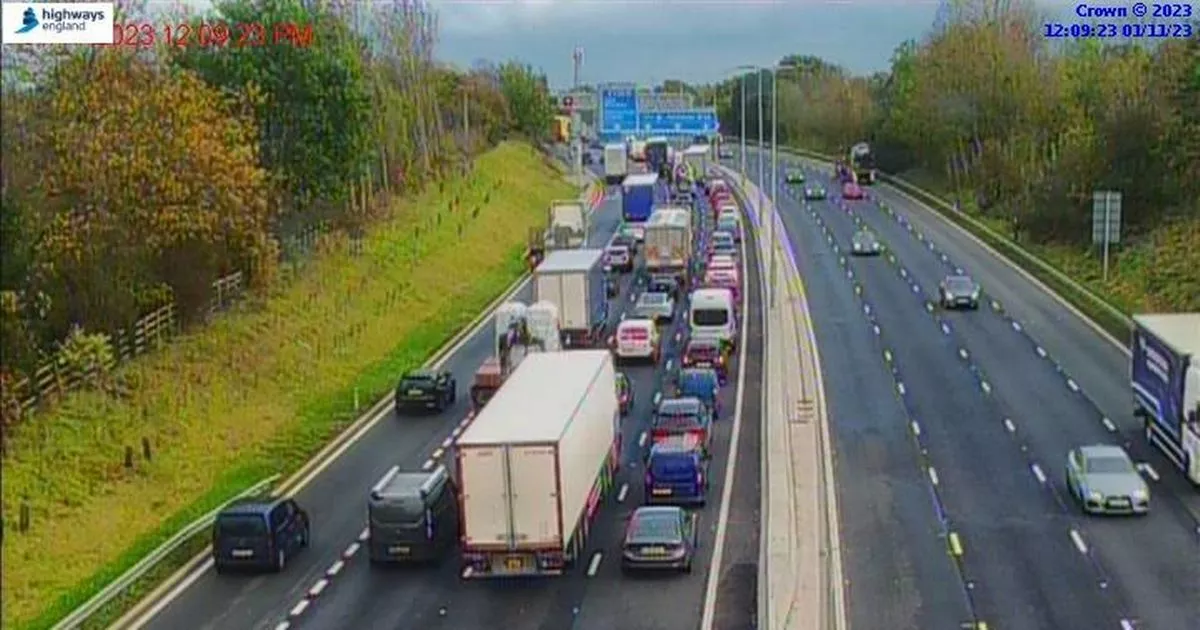

M56 Closed Serious Crash Causes Major Traffic Disruption Live M56 Traffic Updates

May 24, 2025

M56 Closed Serious Crash Causes Major Traffic Disruption Live M56 Traffic Updates

May 24, 2025 -

M56 Traffic Motorway Closure Due To Serious Crash Live Updates

May 24, 2025

M56 Traffic Motorway Closure Due To Serious Crash Live Updates

May 24, 2025 -

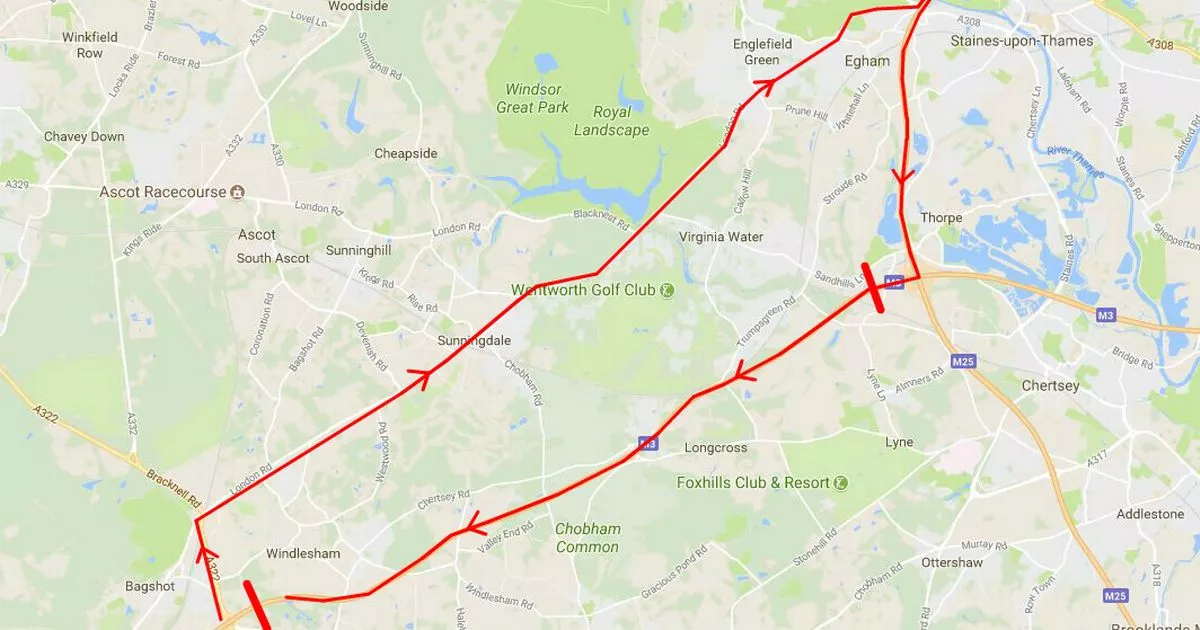

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025 -

Long Queues On M56 Due To Crash Current Traffic Conditions

May 24, 2025

Long Queues On M56 Due To Crash Current Traffic Conditions

May 24, 2025 -

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025