Amundi MSCI All Country World UCITS ETF USD Acc: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the value of a single share in an ETF. It's essentially the net worth of the fund, calculated by subtracting the fund's total liabilities from its total assets and then dividing by the number of outstanding shares. Understanding this seemingly simple calculation is fundamental to successful ETF investing.

The NAV is crucial for several reasons:

- Tracking Performance: Monitoring daily NAV changes allows you to track the ETF's growth or decline over time. This provides a clear picture of your investment's performance.

- Investment Decisions: The NAV is the price at which you buy or sell ETF shares. Understanding NAV fluctuations helps you make informed buying and selling decisions, potentially maximizing your returns.

- Understanding ETF Value: NAV provides a transparent view of the underlying assets' worth, giving you a clear understanding of the value of your investment in the fund. This is particularly important when assessing the value proposition against alternative investments.

Efficient NAV calculation is key to effective ETF valuation and the development of a sound investment strategy. Fluctuations in the share price relative to the NAV should be carefully monitored as part of your risk management strategy.

Calculating the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc

The NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is primarily influenced by the performance of its underlying assets, the MSCI All Country World Index. This index tracks a broad range of global equities, making the ETF's NAV sensitive to various market factors. Other significant influences include:

- MSCI All Country World Index Performance: The primary driver of the ETF's NAV is the overall performance of the index it tracks. Positive index performance generally leads to a higher NAV.

- Currency Fluctuations (USD): As the ETF is denominated in USD, fluctuations in exchange rates against other currencies can impact the NAV, particularly for holdings in non-USD denominated assets.

- Management Fees: The ETF's management fees are deducted from its assets, slightly reducing the NAV.

You can track the daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc from several sources:

- Amundi's Official Website: The ETF provider's website is the most reliable source for accurate, real-time NAV data.

- Financial News Platforms: Many financial news websites and data providers (like Bloomberg or Refinitiv) publish daily NAV updates for various ETFs.

- Brokerage Accounts: Your brokerage account will typically display the current NAV of any ETFs you hold in your portfolio.

Simplified NAV Calculation Example:

Let's assume (for illustrative purposes only) that the ETF has total assets of $100 million, total liabilities of $1 million, and 10 million outstanding shares. The NAV would be calculated as: ($100 million - $1 million) / 10 million shares = $9.90 per share. Note that this is a highly simplified example and does not reflect the complexity of a real-world NAV calculation for a global ETF.

How NAV Affects Your Investment in the Amundi MSCI All Country World UCITS ETF USD Acc

Changes in the NAV directly impact your investment returns. An increase in NAV translates to capital appreciation, while a decrease signifies a loss. Ideally, the ETF's share price should closely track its NAV. Minor discrepancies might exist due to market supply and demand, but significant deviations should be investigated.

- Investment Return: Your return on investment is directly tied to the change in NAV over the period you hold the ETF. Positive NAV changes result in gains; negative changes result in losses.

- Portfolio Diversification: This ETF offers broad global diversification, reducing overall portfolio risk. Understanding the NAV helps assess the performance of this diversified strategy.

- Benchmark Comparison: The NAV allows you to compare the ETF’s performance against its benchmark index (MSCI All Country World Index) to evaluate its effectiveness.

Regularly monitoring the NAV enables effective risk management and helps you adjust your investment strategy accordingly.

Where to Find the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Reliable sources for accessing the daily NAV of the Amundi MSCI All Country World UCITS ETF USD Acc include:

- Amundi's Official Website: Check the dedicated ETF page on Amundi's website for the most up-to-date information.

- Major Financial Data Providers: Reputable financial data providers like Bloomberg, Refinitiv, and others offer real-time NAV data.

- Your Brokerage Account: Your online brokerage account will usually provide the current NAV, along with historical NAV data.

Regularly checking the NAV is vital for making well-informed investment decisions. Understanding the daily NAV updates ensures you stay abreast of your investment's performance and allows for proactive portfolio adjustments.

Conclusion: Mastering the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is crucial for successful investment management. This article has explained what NAV is, how it’s calculated for this specific ETF, and why it's essential for making informed investment choices. By regularly monitoring the NAV and utilizing the resources outlined above, you can effectively track your investment's performance and adapt your strategy as needed. Remember to check the Amundi website for the latest information on the Amundi MSCI All Country World UCITS ETF USD Acc and its NAV. Mastering the NAV is key to mastering your Amundi MSCI All Country World UCITS ETF USD Acc investments. Make informed investment choices today! [Link to Amundi Website]

Featured Posts

-

The New Single From Joy Crookes Carmen

May 24, 2025

The New Single From Joy Crookes Carmen

May 24, 2025 -

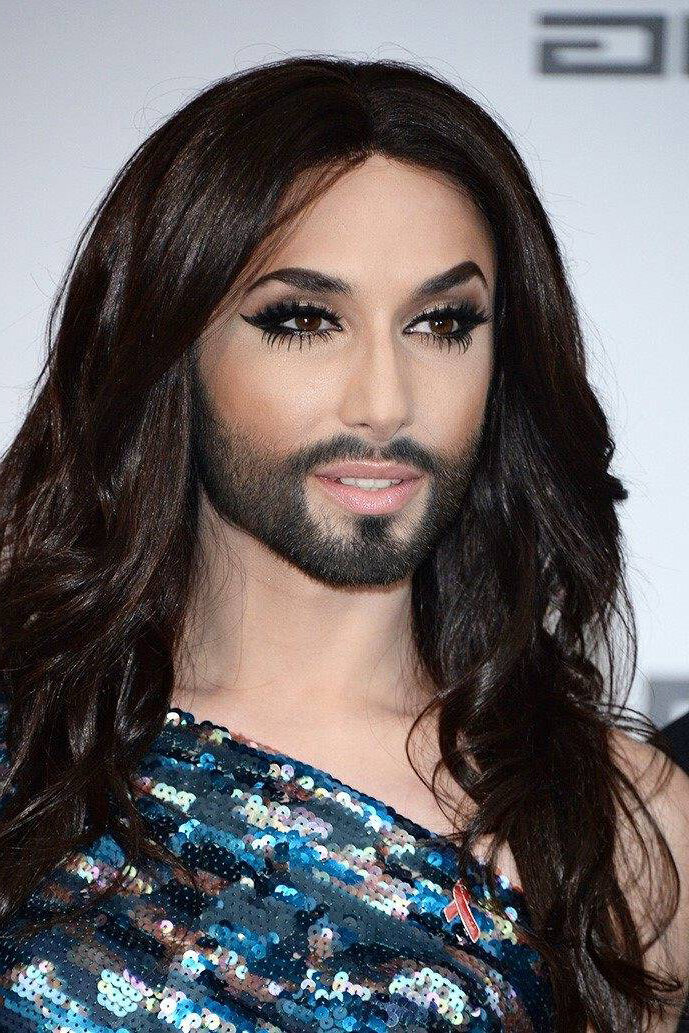

Kak Izglezhda Konchita Vurst Dnes Promeni Sled Evroviziya

May 24, 2025

Kak Izglezhda Konchita Vurst Dnes Promeni Sled Evroviziya

May 24, 2025 -

Prepustili Tisice Najvaecsie Nemecke Firmy A Dosledky Pre Ekonomiku

May 24, 2025

Prepustili Tisice Najvaecsie Nemecke Firmy A Dosledky Pre Ekonomiku

May 24, 2025 -

700 000 Property Profit Nicki Chapmans Escape To The Country Investment Strategy

May 24, 2025

700 000 Property Profit Nicki Chapmans Escape To The Country Investment Strategy

May 24, 2025 -

New York Times Connections Puzzle 646 Hints And Solutions March 18 2025

May 24, 2025

New York Times Connections Puzzle 646 Hints And Solutions March 18 2025

May 24, 2025

Latest Posts

-

Kyle Walker Party Pictures And Annie Kilners Return Home

May 24, 2025

Kyle Walker Party Pictures And Annie Kilners Return Home

May 24, 2025 -

The Kyle Walker Annie Kilner Situation A Detailed Explanation

May 24, 2025

The Kyle Walker Annie Kilner Situation A Detailed Explanation

May 24, 2025 -

The Annie Kilner Kyle Walker Situation A Breakdown Of Recent Events And Allegations

May 24, 2025

The Annie Kilner Kyle Walker Situation A Breakdown Of Recent Events And Allegations

May 24, 2025 -

Kyle Walkers Recent Activities Context And Annie Kilners Response

May 24, 2025

Kyle Walkers Recent Activities Context And Annie Kilners Response

May 24, 2025 -

Public Reaction To Annie Kilners Posts Following Kyle Walkers Night Out Incident

May 24, 2025

Public Reaction To Annie Kilners Posts Following Kyle Walkers Night Out Incident

May 24, 2025