Amundi MSCI World Catholic Principles UCITS ETF Acc: NAV Analysis And Tracking

Table of Contents

Understanding the Amundi MSCI World Catholic Principles UCITS ETF Acc

The Amundi MSCI World Catholic Principles UCITS ETF Acc (the ETF) aims to track the performance of the MSCI World Index while upholding a strict set of Catholic principles. This means the ETF invests in companies that align with these values, excluding those involved in activities considered morally objectionable. This rigorous screening process involves examining companies based on their involvement in sectors such as weapons manufacturing, pornography, abortion, and genetic engineering. Adherence to specific ethical guidelines, often incorporating social justice and environmental stewardship, is also a critical selection criterion.

The ETF's UCITS (Undertakings for Collective Investment in Transferable Securities) structure ensures compliance with the stringent regulations of the European Union, offering a level of investor protection and transparency. This makes the ETF accessible to a broader range of European investors.

- Key features of the ETF: Global diversification, ethical screening, UCITS compliance, competitive expense ratio.

- Target investor profile: Investors seeking ethical and responsible investments aligned with Catholic values; investors seeking global market exposure with ESG considerations.

- Expense ratio comparison to similar ETFs: The ETF's expense ratio should be compared to similar ethically-focused ETFs and broad market index ETFs to assess its cost-effectiveness. (Specific data would need to be inserted here.)

Analyzing the Net Asset Value (NAV)

The Net Asset Value (NAV) represents the net worth of the ETF's underlying assets per share. In simple terms, it reflects the current market value of all the securities held by the ETF minus any liabilities, divided by the total number of outstanding shares.

Several factors influence the ETF's NAV. The primary driver is the market performance of the underlying companies. Strong performance by the holdings will generally lead to a higher NAV, while poor performance will reduce it. Currency fluctuations can also have a significant impact, particularly for ETFs with international holdings.

(Insert chart or graph visualizing historical NAV performance here.)

- Historical NAV performance: (Include data here showing historical NAV trends. Clearly label axes and highlight significant periods.)

- Comparison of NAV to the benchmark index: (Show a comparison of the ETF's NAV against the MSCI World Index to demonstrate tracking performance.)

- Impact of dividend distributions on NAV: Dividend payments from the underlying companies will generally reduce the ETF's NAV, reflecting the distribution of funds to shareholders.

Tracking Performance Evaluation

Tracking error measures the difference between an ETF's performance and the performance of its benchmark index. A lower tracking error indicates the ETF is closely following its index. Analyzing the Amundi MSCI World Catholic Principles UCITS ETF Acc's tracking performance against the MSCI World Index over various timeframes (e.g., one year, three years, five years) is crucial for evaluating its effectiveness.

Discrepancies between the ETF's performance and the benchmark index can arise from several sources, including transaction costs associated with buying and selling securities, the impact of corporate actions (like mergers or stock splits), and the index reconstitution process.

- Tracking error metrics and analysis: (Provide specific data and analysis of tracking error.)

- Comparison to similar ethically-focused ETFs: (Compare tracking error against similar ETFs to gauge relative performance.)

- Factors affecting tracking performance: (Discuss specific factors, such as transaction costs, index reconstitution, and the impact of the ethical screening process.)

Risks and Considerations

Investing in ETFs, including the Amundi MSCI World Catholic Principles UCITS ETF Acc, carries inherent risks. Market risk, the possibility of losses due to overall market fluctuations, is always present. Specifically for this ETF, there is also the risk associated with ESG and ethical investing. Changes in societal values or regulatory frameworks could affect the eligibility of certain companies, potentially impacting the ETF's performance. Currency fluctuations can also represent a risk, especially for investors in currencies other than the ETF's base currency. Finally, remember that this ETF follows a specific ethical framework, and there's no guarantee this framework will always align with future investment opportunities.

- Market risk: The potential for loss due to general market downturns.

- ESG and ethical investing risk: The risk associated with changes in societal values and regulations affecting the ETF's screening criteria.

- Currency risk: Fluctuations in exchange rates impacting the value of the ETF for investors in different currencies.

Conclusion: Making Informed Decisions about the Amundi MSCI World Catholic Principles UCITS ETF Acc

This analysis of the Amundi MSCI World Catholic Principles UCITS ETF Acc's NAV and tracking performance highlights the ETF's potential as a vehicle for ethical and responsible investing aligned with Catholic principles. However, understanding its investment strategy and risk profile is crucial before investing. The ETF's suitability depends on an individual investor's risk tolerance, financial goals, and alignment with its ethical framework.

To make a fully informed decision, conduct thorough research, carefully considering the ETF's expense ratio, tracking error, and the potential risks associated with ethical investing. Consider the Amundi MSCI World Catholic Principles UCITS ETF Acc as part of a well-diversified investment strategy, but always remember to consult with a qualified financial advisor before making any investment decisions. This allows you to align your investments with your personal values and financial objectives effectively.

Featured Posts

-

Porsche Plecia Elektromobiliu Ikrovimo Tinkla Europoje

May 24, 2025

Porsche Plecia Elektromobiliu Ikrovimo Tinkla Europoje

May 24, 2025 -

Escape To The Countryside Properties Available For Under 1 000 000

May 24, 2025

Escape To The Countryside Properties Available For Under 1 000 000

May 24, 2025 -

Jejak Sejarah Porsche 356 Dari Zuffenhausen Jerman Menuju Legenda Otomotif

May 24, 2025

Jejak Sejarah Porsche 356 Dari Zuffenhausen Jerman Menuju Legenda Otomotif

May 24, 2025 -

Tracking The Net Asset Value Of The Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025

Tracking The Net Asset Value Of The Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025 -

Najvaecsie Nemecke Spolocnosti Vlna Prepustania Tisicok Zamestnancov

May 24, 2025

Najvaecsie Nemecke Spolocnosti Vlna Prepustania Tisicok Zamestnancov

May 24, 2025

Latest Posts

-

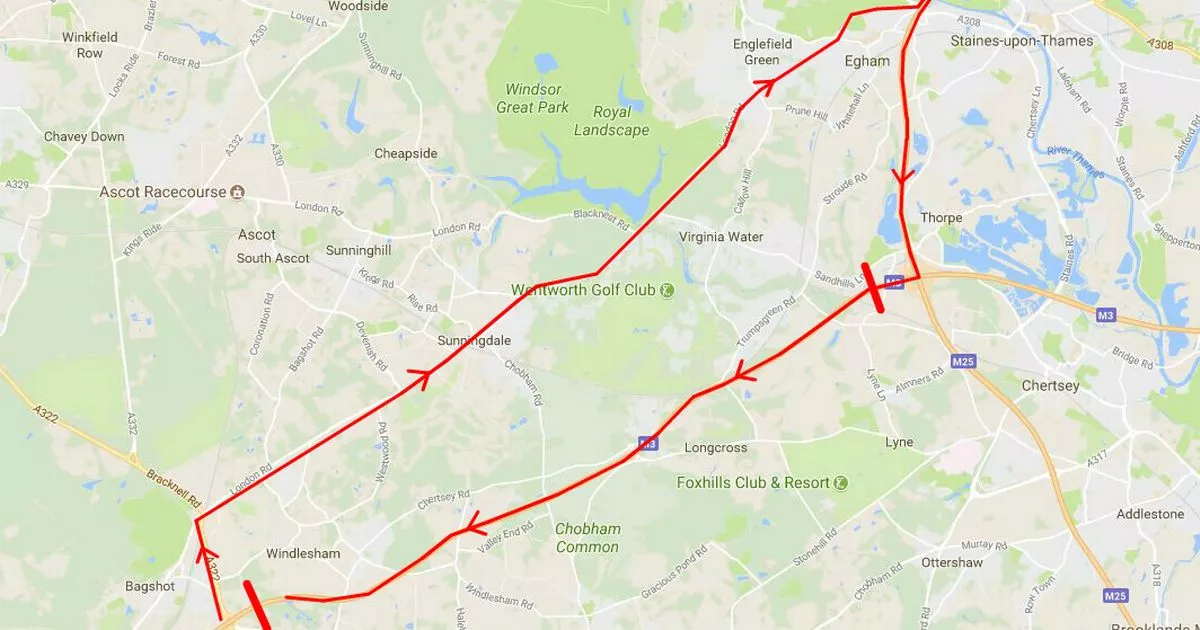

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025 -

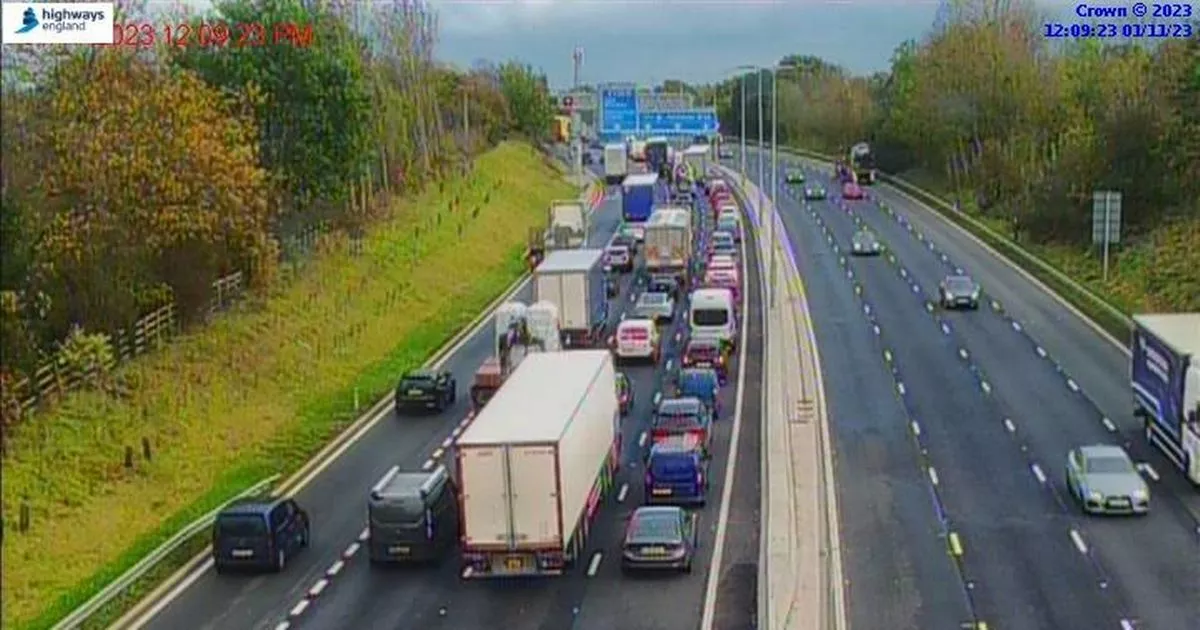

Long Queues On M56 Due To Crash Current Traffic Conditions

May 24, 2025

Long Queues On M56 Due To Crash Current Traffic Conditions

May 24, 2025 -

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025 -

Revealed Kyle Walkers Milan Party With Models Following Wifes Return To Uk

May 24, 2025

Revealed Kyle Walkers Milan Party With Models Following Wifes Return To Uk

May 24, 2025 -

Kyle Walker Partied In Milan With Serbian Models Following Wifes Uk Trip

May 24, 2025

Kyle Walker Partied In Milan With Serbian Models Following Wifes Uk Trip

May 24, 2025