Amundi MSCI World II UCITS ETF Dist: Daily NAV And Its Significance

Table of Contents

What is the Daily NAV and How is it Calculated?

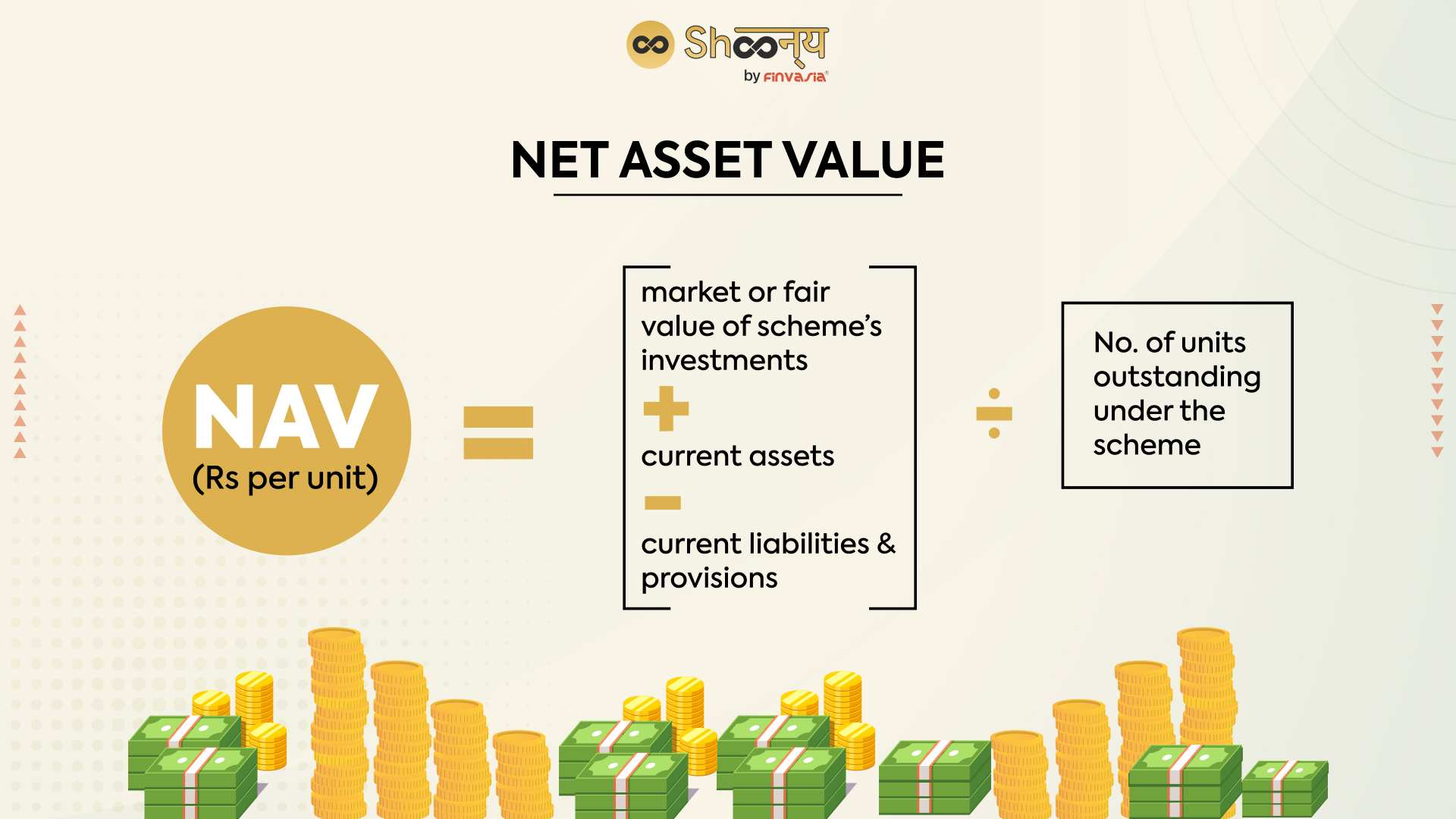

Defining Net Asset Value (NAV):

The Net Asset Value (NAV) represents the net value of an ETF's underlying assets. Think of it as the total value of everything the ETF owns (stocks, bonds, etc.) minus its liabilities, all divided by the number of outstanding shares. A simple analogy: imagine a pie. The NAV is the total value of the pie divided by the number of slices. Each slice represents a share of the ETF.

- Formula (simplified): NAV = (Total Asset Value - Liabilities) / Number of Outstanding Shares

- Market Fluctuations: The daily NAV fluctuates constantly, reflecting changes in the market prices of the ETF's underlying assets. If the market goes up, the NAV generally increases, and vice versa.

Specifics of Amundi MSCI World II UCITS ETF Dist NAV Calculation:

Calculating the NAV for the Amundi MSCI World II UCITS ETF Dist involves several factors:

- Underlying Asset Prices: The primary driver is the daily closing prices of the stocks comprising the MSCI World Index, which the ETF tracks.

- Dividend Distributions: Dividends received from the underlying companies are added to the ETF's assets, impacting the NAV. The Amundi MSCI World II UCITS ETF Dist is a distributing ETF, meaning dividends are paid out to shareholders.

- Currency Exchange Rates: Since the MSCI World Index includes companies from various countries, fluctuations in exchange rates affect the NAV, especially for investors holding the ETF in a currency different from the base currency of the underlying assets.

- Expenses: Management fees and other operational expenses reduce the NAV.

The NAV is typically calculated at the end of each trading day, using the closing prices of the underlying assets. Amundi then disseminates this information publicly.

Where to Find the Daily NAV:

You can find the daily NAV for the Amundi MSCI World II UCITS ETF Dist from several reliable sources:

- Amundi's Website: Check the official Amundi website for the most up-to-date information. [Insert link to Amundi's relevant page here if available]

- Financial News Portals: Major financial news websites and data providers (e.g., Bloomberg, Yahoo Finance) usually list the daily NAV for actively traded ETFs.

- Your Brokerage Account: Your brokerage platform will show the NAV of your holdings.

The Significance of Daily NAV for Investors

Monitoring Investment Performance:

Tracking the daily NAV allows you to accurately monitor your investment's performance. By comparing the current NAV to your purchase price, you can easily calculate your gains or losses.

Making Informed Investment Decisions:

Changes in the daily NAV, in conjunction with other market indicators, help inform your buy and sell decisions. A consistent upward trend might suggest continued investment, while a downward trend could warrant reassessment.

Understanding Dividend Distributions:

The daily NAV reflects the impact of dividend distributions. When dividends are paid out, the NAV typically decreases, reflecting the distribution of assets to shareholders. Reinvesting dividends increases your overall holdings and affects the subsequent NAV calculation.

Comparing to other ETFs:

Comparing the NAV of the Amundi MSCI World II UCITS ETF Dist with similar global equity ETFs can help you determine which investment option best aligns with your risk tolerance and investment goals.

Factors Affecting the Daily NAV of Amundi MSCI World II UCITS ETF Dist

Global Market Fluctuations:

Global economic events, political uncertainty, and market trends significantly influence the ETF's NAV. For example, a global recession could lead to a decrease in the NAV, while positive economic news could boost it.

Currency Exchange Rates:

Fluctuations in currency exchange rates directly impact the NAV if the underlying assets are denominated in a currency different from your base currency. A strengthening of the Euro against the US dollar, for example, could positively affect the NAV for US dollar-based investors.

Underlying Asset Performance:

The performance of the stocks within the MSCI World Index is the most significant factor. Strong performance by the underlying companies directly translates into an increase in the ETF's NAV, and vice versa.

Conclusion: Utilizing Daily NAV for Successful Amundi MSCI World II UCITS ETF Dist Investment

Understanding and regularly monitoring the daily NAV of the Amundi MSCI World II UCITS ETF Dist is paramount for successful ETF investing. The daily NAV provides a clear picture of your investment's performance and helps you make informed decisions. By analyzing NAV trends alongside market indicators and understanding the factors influencing it, you can optimize your investment strategy. Make it a habit to check the daily NAV of your Amundi MSCI World II UCITS ETF Dist holdings and use this crucial data to improve your portfolio performance. Regular monitoring of your Amundi MSCI World II UCITS ETF Dist's daily NAV is key to successful long-term investment.

Featured Posts

-

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist An In Depth Analysis

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist An In Depth Analysis

May 25, 2025 -

Explore The 2025 Porsche Cayenne Interior And Exterior Picture Gallery

May 25, 2025

Explore The 2025 Porsche Cayenne Interior And Exterior Picture Gallery

May 25, 2025 -

Mwshr Daks Alalmany Tjawz Dhrwt Mars Welamat Ela Astmrar Alnmw

May 25, 2025

Mwshr Daks Alalmany Tjawz Dhrwt Mars Welamat Ela Astmrar Alnmw

May 25, 2025 -

Net Asset Value Nav Of The Amundi Msci World Catholic Principles Ucits Etf Acc

May 25, 2025

Net Asset Value Nav Of The Amundi Msci World Catholic Principles Ucits Etf Acc

May 25, 2025 -

Glastonbury Festival Unofficial Us Band Announcement Creates Frenzy

May 25, 2025

Glastonbury Festival Unofficial Us Band Announcement Creates Frenzy

May 25, 2025

Latest Posts

-

The Phone Rings A Story Of Waiting

May 25, 2025

The Phone Rings A Story Of Waiting

May 25, 2025 -

Investigating Burys Missing M62 Link Road

May 25, 2025

Investigating Burys Missing M62 Link Road

May 25, 2025 -

Astonishing Footage Pair Refuels Car At 90mph During Police Chase

May 25, 2025

Astonishing Footage Pair Refuels Car At 90mph During Police Chase

May 25, 2025 -

Forgotten Highways The Bury M62 Relief Route

May 25, 2025

Forgotten Highways The Bury M62 Relief Route

May 25, 2025 -

Unbuilt Roads Investigating The Proposed M62 Bury Relief Route

May 25, 2025

Unbuilt Roads Investigating The Proposed M62 Bury Relief Route

May 25, 2025