Amundi MSCI World II UCITS ETF Dist: NAV Calculation And Implications

Table of Contents

Deconstructing the Amundi MSCI World II UCITS ETF Dist NAV Calculation

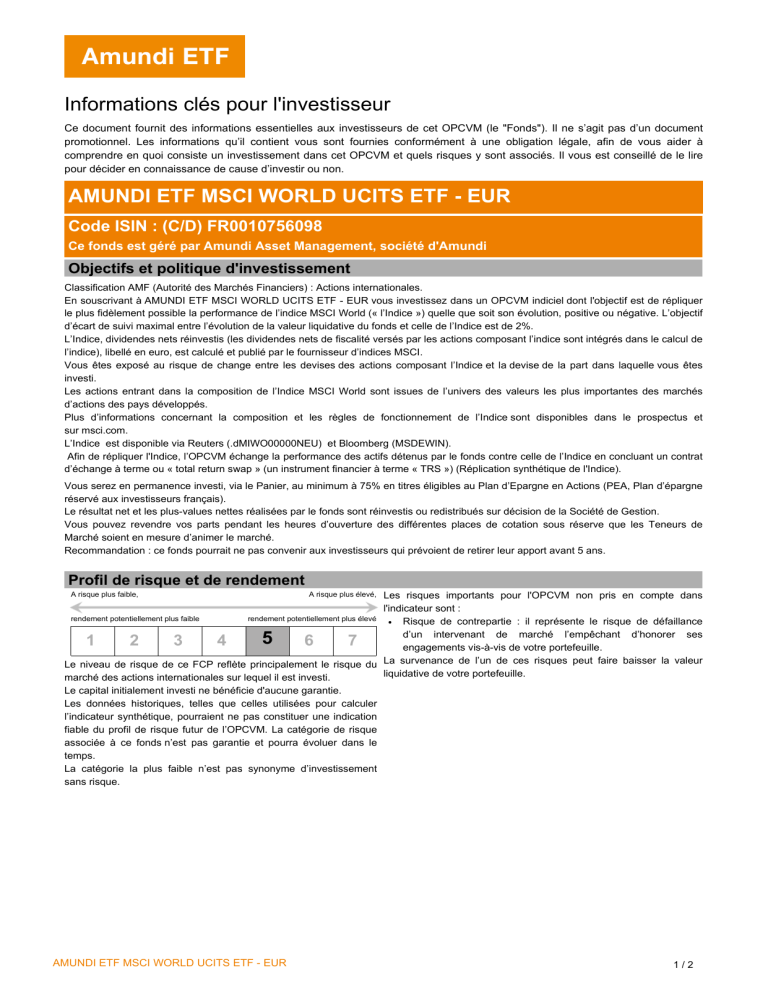

The Amundi MSCI World II UCITS ETF Dist NAV, like that of any ETF, reflects the total value of its underlying assets. Understanding how this value is calculated is essential for informed investment decisions.

Components of NAV

The NAV of the Amundi MSCI World II UCITS ETF Dist is calculated by considering several key components:

- Market Value of Assets: The ETF primarily invests in a diversified portfolio of global equities, mirroring the MSCI World Index. The market value of each holding is determined by its current price on the relevant stock exchange. This is the largest component of the NAV calculation.

- Currency Exchange Rates: As the ETF invests globally, currency fluctuations play a vital role. The value of assets held in foreign currencies is converted to the ETF's base currency (likely EUR) using prevailing exchange rates. Fluctuations in exchange rates can directly impact the daily NAV.

- Accrued Income: The ETF receives income from dividends paid by the underlying companies. This accrued income, until it's distributed, is added to the total asset value used in the NAV calculation.

- Expenses: The ETF incurs operational expenses, including management fees and administrative costs. These expenses are deducted from the total asset value before calculating the NAV. These are usually relatively small compared to other components.

The Calculation Process

The Amundi MSCI World II UCITS ETF Dist NAV calculation is typically a daily process. It involves the following steps:

- Asset Valuation: The custodian bank, responsible for holding the ETF's assets, determines the market value of each holding at the end of the trading day.

- Currency Conversion: The values of foreign assets are converted to the base currency using the closing exchange rates.

- Income and Expense Adjustment: Accrued income is added, and expenses are deducted.

- Total Value Calculation: The sum of all adjusted values constitutes the total net asset value.

- NAV per Share: This total value is then divided by the total number of outstanding ETF shares to determine the NAV per share.

Here's a simplified representation:

| Component | Hypothetical Value (EUR) |

|---|---|

| Market Value of Assets | 10,000,000 |

| Accrued Income | 10,000 |

| Expenses | 5,000 |

| Total Net Asset Value | 10,009,900 |

(Note: This is a simplified illustration and does not reflect the actual NAV calculation.)

Impact of Dividends on NAV

Dividend distributions from the underlying companies directly impact the NAV. On the ex-dividend date – the date on which the buyer of the share does not receive the dividend – the NAV is reduced by the amount of the dividend per share. However, if the dividends are reinvested, the NAV will eventually reflect this reinvestment, contributing to long-term growth.

Implications of Understanding Amundi MSCI World II UCITS ETF Dist NAV

Understanding the NAV of the Amundi MSCI World II UCITS ETF Dist has several key implications for investors:

Investment Decisions

- Performance Monitoring: Tracking NAV changes allows investors to monitor the ETF's performance over time.

- Benchmark Comparison: Comparing the ETF's NAV performance to its benchmark (MSCI World Index) helps assess its tracking efficiency.

- Buy/Sell Decisions: NAV can influence buy and sell decisions; investors might consider buying when the NAV is low relative to the market price and selling when it’s high.

- ETF Comparison: Comparing the NAV of this ETF to other similar ETFs helps identify potentially more efficient investments.

Risk Management

- Market Monitoring: Fluctuations in the NAV can indicate shifts in the market and the overall risk profile of the investment.

- NAV and Share Price: Understanding the relationship between NAV and the ETF's market price helps assess potential arbitrage opportunities or market inefficiencies.

Tax Implications

- Capital Gains Tax: Profits from selling the ETF at a price higher than its purchase price are subject to capital gains tax. The NAV at both purchase and sale is crucial in calculating the capital gain.

- Dividend Tax: Dividends received from the ETF are generally taxable income. The amount of dividend income is influenced by the NAV and distribution policy.

Conclusion: Mastering Amundi MSCI World II UCITS ETF Dist NAV for Informed Investing

Understanding the Amundi MSCI World II UCITS ETF Dist's NAV calculation is crucial for making well-informed investment decisions. This knowledge enables effective performance monitoring, risk management, and tax planning. By tracking the NAV, comparing it to the market price and benchmark, and understanding its components, investors can gain a better grasp of their investment's value and potential. To further your understanding of Amundi MSCI World II UCITS ETF Dist NAV and related investment strategies, review the ETF's official fact sheet or consult a qualified financial advisor for personalized advice tailored to your financial goals. Mastering Amundi MSCI World II UCITS ETF Dist's NAV is key to successful long-term investing.

Featured Posts

-

Ai I Phone

May 24, 2025

Ai I Phone

May 24, 2025 -

A Pandemic Haven A Seattle Womans Connection To Nature

May 24, 2025

A Pandemic Haven A Seattle Womans Connection To Nature

May 24, 2025 -

Europa Attende La Fed Impatto Sulle Borse Analisi Di Piazza Affari

May 24, 2025

Europa Attende La Fed Impatto Sulle Borse Analisi Di Piazza Affari

May 24, 2025 -

Apple Stock Key Levels Breached Before Q2 Results

May 24, 2025

Apple Stock Key Levels Breached Before Q2 Results

May 24, 2025 -

Crisi Moda Analisi Dell Impatto Dei Dazi Trump Del 20 Sull Ue

May 24, 2025

Crisi Moda Analisi Dell Impatto Dei Dazi Trump Del 20 Sull Ue

May 24, 2025

Latest Posts

-

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025 -

Past Florida Film Festival Guests Mia Farrow Christina Ricci And Other Notable Stars

May 24, 2025

Past Florida Film Festival Guests Mia Farrow Christina Ricci And Other Notable Stars

May 24, 2025 -

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025 -

Florida Film Festival Celebrity Sightings Mia Farrow Christina Ricci And More

May 24, 2025

Florida Film Festival Celebrity Sightings Mia Farrow Christina Ricci And More

May 24, 2025 -

Sadie Sink And Mia Farrow A Broadway Encounter Image 5162787

May 24, 2025

Sadie Sink And Mia Farrow A Broadway Encounter Image 5162787

May 24, 2025