Amundi MSCI World II UCITS ETF USD Hedged Dist: A Guide To NAV Calculation And Analysis

Table of Contents

Deconstructing the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Calculation

Understanding the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is crucial for assessing its performance and value. The NAV represents the net asset value per share, calculated daily, reflecting the market value of the ETF's underlying assets.

Understanding the Components of NAV

The NAV calculation involves several key components:

- Market Value of Underlying Assets: This is the primary component, representing the total market value of all the stocks and securities held within the ETF, mirroring the MSCI World Index. Fluctuations in the global market directly impact this value.

- Currency Exchange Rates: The "USD Hedged Dist" designation signifies that the ETF employs a currency hedging strategy to mitigate the risk of fluctuations between the base currency (likely EUR) and the US dollar. This hedging involves complex calculations that adjust the NAV based on exchange rate movements.

- Accrued Income (Dividends): Dividends received from the underlying holdings are added to the NAV calculation before expenses are deducted. This contributes to the overall return for investors.

- Expenses: Management fees, administrative costs, and other expenses are deducted from the total asset value to arrive at the net asset value.

The fund's custodian plays a vital role in maintaining accurate records of asset holdings. An independent valuation process ensures the integrity and accuracy of the NAV calculation, adding transparency and trust.

The Impact of Currency Hedging on NAV

The USD hedging strategy in the Amundi MSCI World II UCITS ETF USD Hedged Dist significantly influences the NAV. Unlike an unhedged version, where currency fluctuations directly impact the NAV expressed in USD, the hedged version aims to minimize this exposure.

- Benefits: Hedging reduces the volatility of the NAV in USD terms, making it potentially more predictable for US-based investors. This can be especially beneficial during periods of significant currency fluctuations.

- Drawbacks: While hedging reduces downside risk from currency movements, it can also limit potential upside gains if the base currency appreciates significantly against the USD. The hedging strategy itself involves costs which can slightly reduce the overall return.

For example, if the Euro weakens against the dollar, an unhedged ETF would show a lower NAV in USD, while the hedged version would experience a less dramatic decrease (or even remain relatively stable), thanks to the hedging mechanism.

Analyzing Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Trends

Analyzing NAV trends provides valuable insights into the ETF's performance.

Interpreting NAV Charts and Graphs

NAV charts visually represent the ETF's value over time. Analyzing these charts requires understanding:

- Timeframes: Daily charts show short-term fluctuations; weekly, monthly, and yearly charts reveal longer-term trends.

- Trends: Identify upward trends (indicating growth) and downward trends (indicating decline). Look for significant changes and potential turning points.

By examining these patterns, investors can assess the ETF's growth trajectory and potential risk levels.

Comparing NAV to Other Similar ETFs

Benchmarking the Amundi MSCI World II UCITS ETF USD Hedged Dist against similar globally diversified ETFs is essential. This comparative analysis allows you to assess its relative performance:

- Competitive Analysis: Compare its NAV growth with ETFs tracking similar indices (e.g., other MSCI World ETFs or broad global market index ETFs). Consider expense ratios for a fair comparison.

- Informed Decisions: By understanding how the Amundi ETF compares to its competitors in terms of NAV performance, you can make a more informed decision regarding its suitability for your investment portfolio.

Factors Affecting NAV Fluctuations

Several factors influence the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist:

- Market Movements: Performance of the underlying global equity markets (MSCI World Index) is the primary driver. Positive global market sentiment generally leads to NAV increases, while negative sentiment leads to decreases. Sector-specific performance also plays a role.

- Currency Fluctuations (Indirect): Even with hedging, residual currency impacts are possible. Significant shifts in exchange rates can still indirectly affect the NAV.

- Expense Ratios: Higher expense ratios can slightly reduce the NAV growth compared to lower-cost ETFs, impacting long-term returns.

Resources for Tracking Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Reliable NAV data is essential for informed decision-making. You can access this data from several sources:

- Amundi Website: The official Amundi website is the most reliable source for real-time and historical NAV data.

- Financial News Websites: Major financial news providers (e.g., Yahoo Finance, Google Finance) often display ETF NAV data.

- Brokerage Platforms: Your brokerage account will display the current NAV of your holdings.

Remember to always verify information from multiple reliable sources to ensure accuracy. Discrepancies may arise due to time delays or data processing differences.

Conclusion: Mastering Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Analysis

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV calculation and analyzing its trends are critical for assessing the ETF's performance and making informed investment decisions. By carefully examining the components of the NAV, considering the impact of currency hedging, comparing it to similar ETFs, and tracking its performance through reliable sources, you can gain a comprehensive understanding of its value and potential. Become a savvy investor by mastering Amundi MSCI World II UCITS ETF USD Hedged Dist NAV analysis today! Regularly monitor your investments and use the insights gained to optimize your portfolio strategy.

Featured Posts

-

Nicki Chapmans 700 000 Country Home Investment Escape To The Country Success Story

May 24, 2025

Nicki Chapmans 700 000 Country Home Investment Escape To The Country Success Story

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist A Guide To Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist A Guide To Net Asset Value Nav

May 24, 2025 -

Porsche 911 Luxus Extrak Es Az Aruk

May 24, 2025

Porsche 911 Luxus Extrak Es Az Aruk

May 24, 2025 -

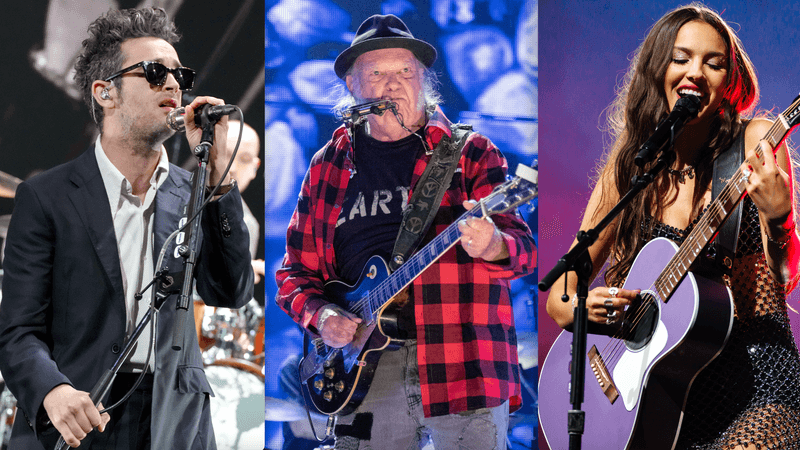

Glastonbury 2025 Lineup Confirmed Olivia Rodrigo The 1975 And More

May 24, 2025

Glastonbury 2025 Lineup Confirmed Olivia Rodrigo The 1975 And More

May 24, 2025 -

Matt Malteses Sixth Album Her In Deep Exploring Intimacy And Personal Growth

May 24, 2025

Matt Malteses Sixth Album Her In Deep Exploring Intimacy And Personal Growth

May 24, 2025

Latest Posts

-

Southamptons Kyle Walker Peters Leeds United Initiate Transfer Talks

May 24, 2025

Southamptons Kyle Walker Peters Leeds United Initiate Transfer Talks

May 24, 2025 -

Walker Peters To Leeds Contact Made Transfer Speculation Mounts

May 24, 2025

Walker Peters To Leeds Contact Made Transfer Speculation Mounts

May 24, 2025 -

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 24, 2025

Free Transfer Target Crystal Palace And Kyle Walker Peters

May 24, 2025 -

Leeds Contact Kyle Walker Peters Is A Transfer On The Cards

May 24, 2025

Leeds Contact Kyle Walker Peters Is A Transfer On The Cards

May 24, 2025 -

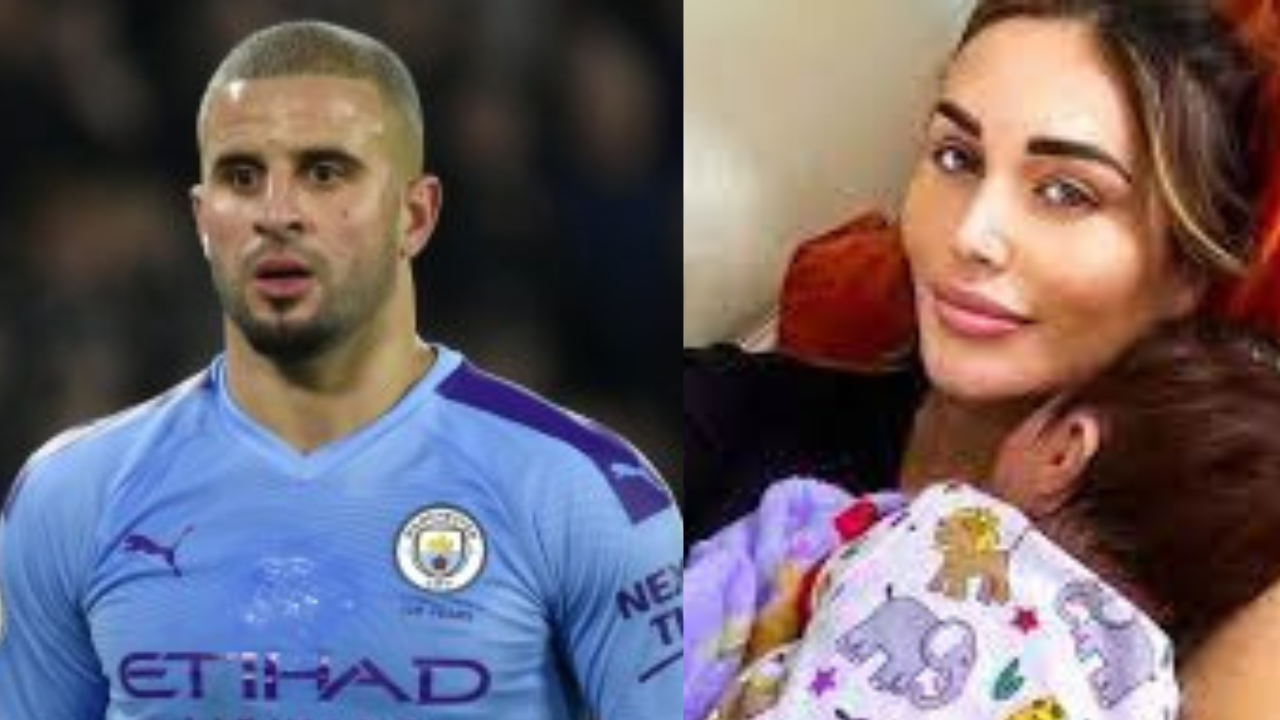

The Kyle Walker Transfer And Lauryn Goodmans Move Connecting The Dots

May 24, 2025

The Kyle Walker Transfer And Lauryn Goodmans Move Connecting The Dots

May 24, 2025