Amundi MSCI World II UCITS ETF USD Hedged Dist: NAV Calculation And Implications

Table of Contents

Deconstructing the NAV Calculation for Amundi MSCI World II UCITS ETF USD Hedged Dist

The Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist represents the value of its underlying assets minus its liabilities, divided by the number of outstanding shares. Understanding this calculation is fundamental to grasping the ETF's performance.

Several key components influence the NAV:

- Market Value of Underlying Assets: This is the primary driver of the NAV. The ETF holds a basket of global equities, and their market prices directly impact the overall value. Fluctuations in individual stock prices, driven by company performance and broader market trends, will directly affect the ETF's NAV.

- Currency Exchange Rates and their Influence on the USD Hedged NAV: The "USD Hedged" aspect is crucial. The ETF employs a hedging strategy to mitigate the risk of currency fluctuations between the underlying assets' various currencies and the US dollar. This hedging involves financial instruments designed to offset potential losses from currency movements. In contrast, an unhedged ETF would be directly exposed to these fluctuations, potentially leading to greater NAV volatility.

- Management Fees and Other Expenses: The ETF incurs expenses related to management, administration, and trading. These fees reduce the overall value available to investors and are deducted from the NAV calculation.

- Impact of Distributions (Dividends): When the underlying companies distribute dividends, this income is passed on to ETF shareholders. However, the NAV will typically decrease immediately after a distribution to reflect the payout, although the investor's overall return will increase.

The NAV is usually calculated daily, providing investors with a snapshot of the ETF's value at the end of each trading day. The frequency of this calculation is important because it affects the accuracy of pricing for trading purposes and allows investors to closely monitor performance. It's also critical to differentiate between the NAV and the bid-ask spread – the difference between the buying and selling price of the ETF shares on the exchange, which can deviate slightly from the calculated NAV.

Implications of NAV Fluctuations for Investors

Changes in the NAV directly impact investor returns. A rising NAV indicates an increase in the value of your investment, while a falling NAV signifies a loss.

For the Amundi MSCI World II UCITS ETF USD Hedged Dist, currency fluctuations, though mitigated by the hedging strategy, can still influence the NAV. While the hedge reduces exposure, unexpected shifts in exchange rates could still create minor variations.

- How NAV Movements Affect Potential Profits and Losses: Understanding the NAV's trajectory is paramount for assessing profit or loss. Consistent NAV growth signals positive performance, while persistent decline warrants close attention and potential adjustments to the investment strategy.

- Strategies for Mitigating Risk Associated with NAV Fluctuations: Strategies like dollar-cost averaging (investing a fixed amount at regular intervals) can help to reduce the risk associated with volatile NAVs. Diversifying your overall investment portfolio beyond just this single ETF is also recommended.

- The Significance of Regular Monitoring of NAV Performance: Tracking the NAV regularly allows you to monitor your investment's health and react to significant shifts. This can inform your decisions regarding when to buy more shares, hold, or consider selling.

Investors should use NAV data to make informed decisions about buying and selling. While not the sole factor in investment decisions, consistent monitoring can help investors make timely adjustments to their investment approach.

Accessing and Interpreting Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Data

Accurate and up-to-date NAV information is readily available from several sources:

- Reliable sources for NAV information: Check the official Amundi website, reputable financial news websites (such as those of major financial data providers), and your brokerage platform.

- Understanding different data presentation formats: NAV data is commonly presented in tables, charts, and graphs. Familiarize yourself with the different formats to interpret the information effectively.

- Interpreting NAV changes in the context of market trends: Always consider the broader market conditions when interpreting NAV changes. A slight dip in the NAV might simply reflect a general market correction rather than ETF-specific performance issues.

- Using data visualization tools to analyze NAV trends: Many financial platforms provide tools to visualize NAV data over time, making it easier to identify trends and patterns.

Potential discrepancies between sources are rare but possible due to slight reporting lags. If discrepancies occur, prioritize data from the official Amundi website or your brokerage platform.

Comparing Amundi MSCI World II UCITS ETF USD Hedged Dist to Alternatives

Several ETFs offer similar global market exposure but with different currency hedging strategies or asset compositions. Some may be unhedged, fully hedged, or utilize partial hedging. Others may focus on different market segments within the global landscape.

- Key differences between hedged and unhedged ETFs: Hedged ETFs offer currency risk mitigation, while unhedged ETFs provide greater exposure to currency movements. Consider your risk tolerance carefully.

- Comparison of expense ratios: Expense ratios (fees) vary across ETFs. Compare the expense ratio of the Amundi MSCI World II UCITS ETF USD Hedged Dist with competitors to identify the most cost-effective choice for your investment strategy.

- Comparison of tracking errors: Tracking error measures how closely an ETF tracks its benchmark index. Lower tracking errors indicate a more accurate representation of the underlying index.

When choosing between ETFs, consider factors such as expense ratios, tracking error, currency hedging strategy, and the specific market exposure offered by each fund.

Conclusion: Making Informed Decisions with Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Information

Understanding the NAV calculation and implications for the Amundi MSCI World II UCITS ETF USD Hedged Dist is crucial for making informed investment decisions. Regular monitoring of the NAV, coupled with awareness of its determinants, allows investors to track performance, manage risk, and adapt their investment strategies accordingly. By accessing NAV data from reputable sources and interpreting it within the context of market trends, investors can make confident and successful investment choices. Further research into the Amundi MSCI World II UCITS ETF USD Hedged Dist and its NAV is highly recommended to ensure your investment strategy aligns with your financial goals. Consider consulting a financial advisor for personalized guidance. You can find more information on the Amundi website [insert link here if available].

Featured Posts

-

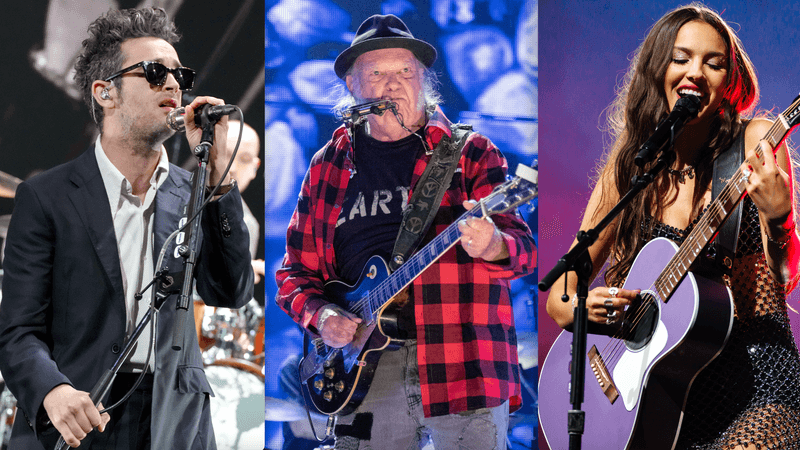

Glastonbury 2025 Lineup Confirmed Olivia Rodrigo The 1975 And More

May 24, 2025

Glastonbury 2025 Lineup Confirmed Olivia Rodrigo The 1975 And More

May 24, 2025 -

Nicki Chapmans Chiswick Retreat A Look At Her Stunning Garden Design

May 24, 2025

Nicki Chapmans Chiswick Retreat A Look At Her Stunning Garden Design

May 24, 2025 -

Your Escape To The Country Choosing The Right Rural Lifestyle

May 24, 2025

Your Escape To The Country Choosing The Right Rural Lifestyle

May 24, 2025 -

Escape To The Country Choosing The Right Property For Rural Living

May 24, 2025

Escape To The Country Choosing The Right Property For Rural Living

May 24, 2025 -

Learn From Nicki Chapman A 700 000 Escape To The Country Property Investment

May 24, 2025

Learn From Nicki Chapman A 700 000 Escape To The Country Property Investment

May 24, 2025

Latest Posts

-

Kyle Walker And Annie Kilner New Ring Sparks Engagement Speculation

May 24, 2025

Kyle Walker And Annie Kilner New Ring Sparks Engagement Speculation

May 24, 2025 -

Annie Kilner Shows Off Huge Diamond Ring After Walker Spotting

May 24, 2025

Annie Kilner Shows Off Huge Diamond Ring After Walker Spotting

May 24, 2025 -

Annie Kilners Diamond Ring Confirmation Of Kyle Walker Romance

May 24, 2025

Annie Kilners Diamond Ring Confirmation Of Kyle Walker Romance

May 24, 2025 -

Kyle Walker Party Pictures And Annie Kilners Return Home

May 24, 2025

Kyle Walker Party Pictures And Annie Kilners Return Home

May 24, 2025 -

The Kyle Walker Annie Kilner Situation A Detailed Explanation

May 24, 2025

The Kyle Walker Annie Kilner Situation A Detailed Explanation

May 24, 2025