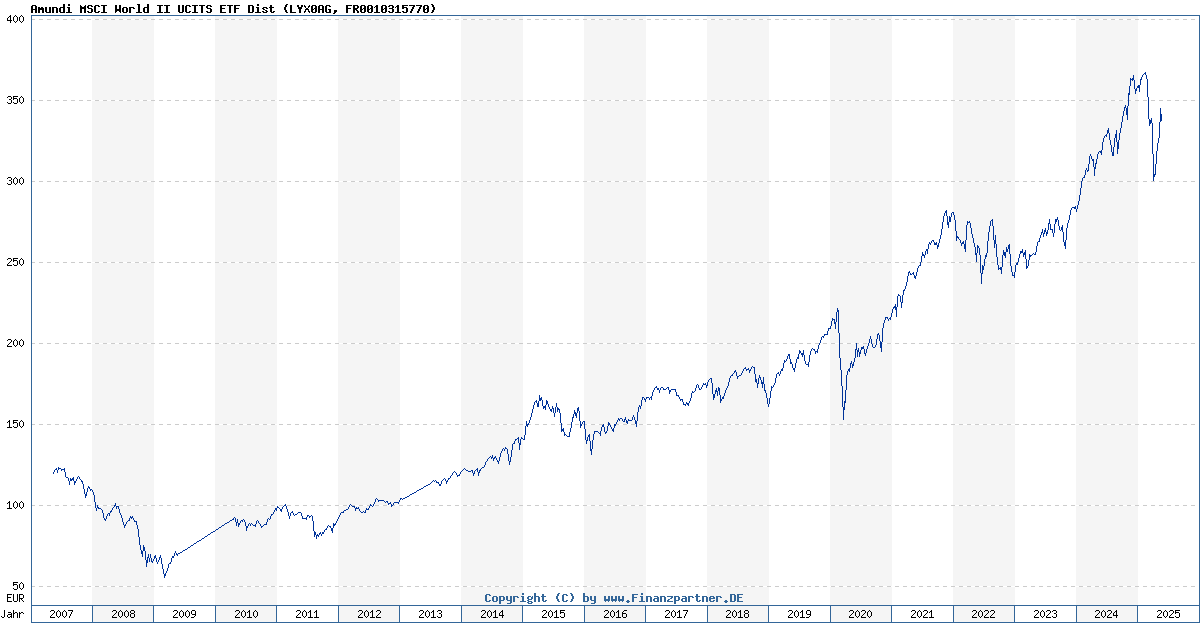

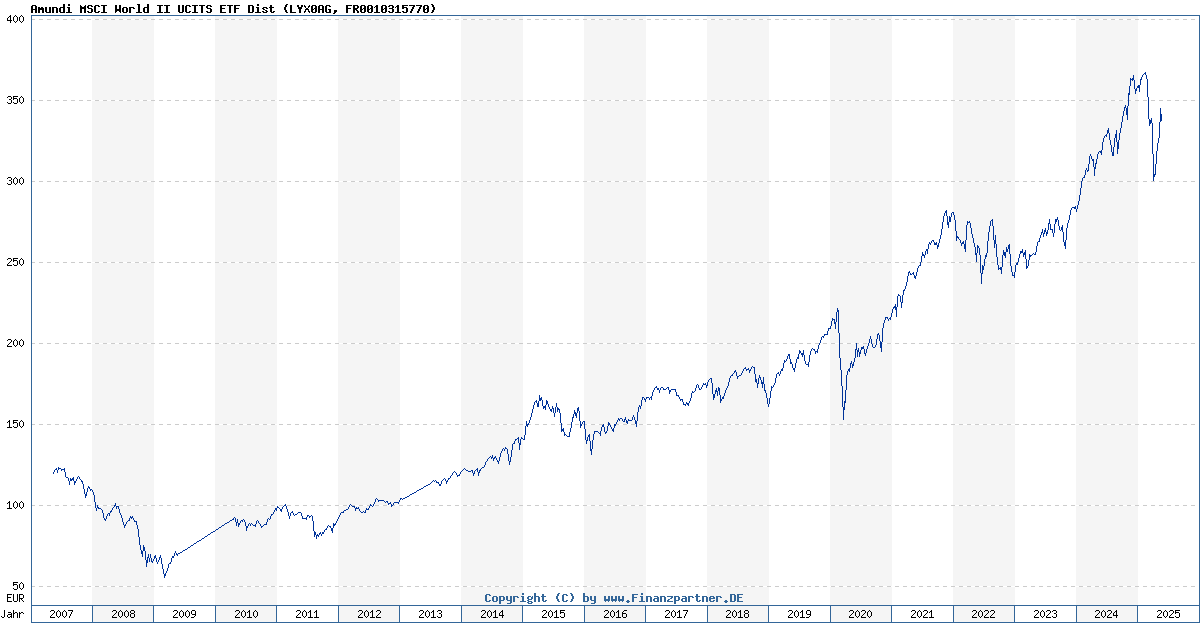

Amundi MSCI World II UCITS ETF USD Hedged Dist: NAV Explained

Table of Contents

What is Net Asset Value (NAV) and how does it relate to ETFs?

Net Asset Value (NAV) represents the true underlying value of an ETF's holdings. It's calculated by subtracting the fund's liabilities from its total assets. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, this means calculating the total value of all the underlying global equities held within the ETF, minus any expenses or liabilities. This NAV reflects the collective value of the stocks, bonds, or other assets within the fund, providing a snapshot of its net worth.

The NAV for the Amundi MSCI World II UCITS ETF USD Hedged Dist is calculated and published daily. This daily calculation ensures that the price reflects the current market value of its holdings. The difference between the market price of the ETF and its NAV is usually minimal due to efficient trading.

- NAV is the true underlying value of the ETF. It represents the actual worth of the assets the ETF holds.

- NAV fluctuates based on market movements of the underlying assets. If the underlying stocks perform well, the NAV increases; conversely, poor performance leads to a decrease.

- Understanding NAV helps in evaluating ETF performance. It allows you to track the actual growth of your investment, independent of market trading fluctuations.

- NAV is different from the market price of the ETF (though they should be close). While they are usually very similar, market forces can cause short-term discrepancies.

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist Structure

The Amundi MSCI World II UCITS ETF USD Hedged Dist aims to provide investors with broad global market diversification. It tracks the MSCI World Index, a widely recognized benchmark representing large and mid-cap equities across developed markets worldwide.

The "USD Hedged" aspect is crucial. This means the fund employs strategies to mitigate currency risk for investors holding USD. Fluctuations in exchange rates between the USD and other currencies are reduced, protecting the investment value in USD terms.

The "Distribution" signifies that the ETF distributes dividends to its shareholders regularly, derived from the dividends paid out by the underlying companies within the index.

- Broad diversification across global equities. This reduces risk compared to investing in individual stocks.

- Reduced currency risk for USD-based investors. This provides greater stability for US investors.

- Regular dividend distributions. This offers an additional stream of income.

- Suitable for long-term investors seeking global equity exposure. This ETF is a convenient and cost-effective way to access a diversified global portfolio.

Factors Affecting the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Several factors influence the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist. The most significant is the performance of the underlying assets – the global equities comprising the MSCI World Index. Market fluctuations, both positive and negative, directly impact the value of these assets and, consequently, the ETF's NAV.

Currency exchange rates, particularly the USD, also play a crucial role, especially considering the "USD Hedged" feature. While hedging mitigates risk, residual currency fluctuations can still have a minor effect.

Finally, dividend payouts from the underlying companies affect the NAV. When underlying companies distribute dividends, the ETF receives these dividends, increasing its assets and, therefore, its NAV. The expense ratio, though usually minimal, also has a slight impact.

- Global market performance. Positive global market trends generally lead to NAV increases.

- USD exchange rate movements. Despite hedging, exchange rate changes can marginally affect the NAV.

- Dividend payouts from underlying companies. Dividends increase the NAV.

- Expense ratio impact (though minimal). The fund's operating costs slightly reduce the NAV.

How to Use NAV Information When Investing in Amundi MSCI World II UCITS ETF USD Hedged Dist

Tracking the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist provides valuable insights into your investment's performance. By comparing the NAV over time (daily, weekly, or monthly), you can assess the growth or decline of your investment. This allows for performance evaluation against market benchmarks and helps inform investment decisions.

While the NAV shouldn't be the sole factor in your buy/sell decisions, it is a critical component. Combine NAV analysis with a broader understanding of market trends and your personal investment strategy.

You can typically find the daily NAV information on the Amundi website, your brokerage platform, or financial news websites that provide ETF data.

- Compare NAV to previous days/weeks to assess performance. This gives a clear picture of growth or loss.

- Use NAV to calculate returns. This helps you understand the actual return on your investment.

- Check fund fact sheets or broker platforms for NAV updates. This is the most reliable source of information.

- Don't solely rely on NAV for trading decisions; consider other factors. Market sentiment, economic indicators, and your individual financial goals are equally important.

Conclusion: Making Informed Decisions with Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Understanding the Net Asset Value (NAV) is paramount to making informed investment decisions with the Amundi MSCI World II UCITS ETF USD Hedged Dist. We've explored how NAV is calculated, the factors influencing it, and how to use this information to track performance and inform your investment strategy. Remember that while NAV is a key indicator, it shouldn't be the only factor considered. Thorough research and a well-defined investment plan are essential.

Learn more about the Amundi MSCI World II UCITS ETF USD Hedged Dist and its NAV to make informed investment decisions today! [Link to Amundi Fact Sheet] [Link to Brokerage Platform]

Featured Posts

-

Hawaii Keiki Showcase Artistic Talents Sew A Lei For Memorial Day Poster Contest

May 24, 2025

Hawaii Keiki Showcase Artistic Talents Sew A Lei For Memorial Day Poster Contest

May 24, 2025 -

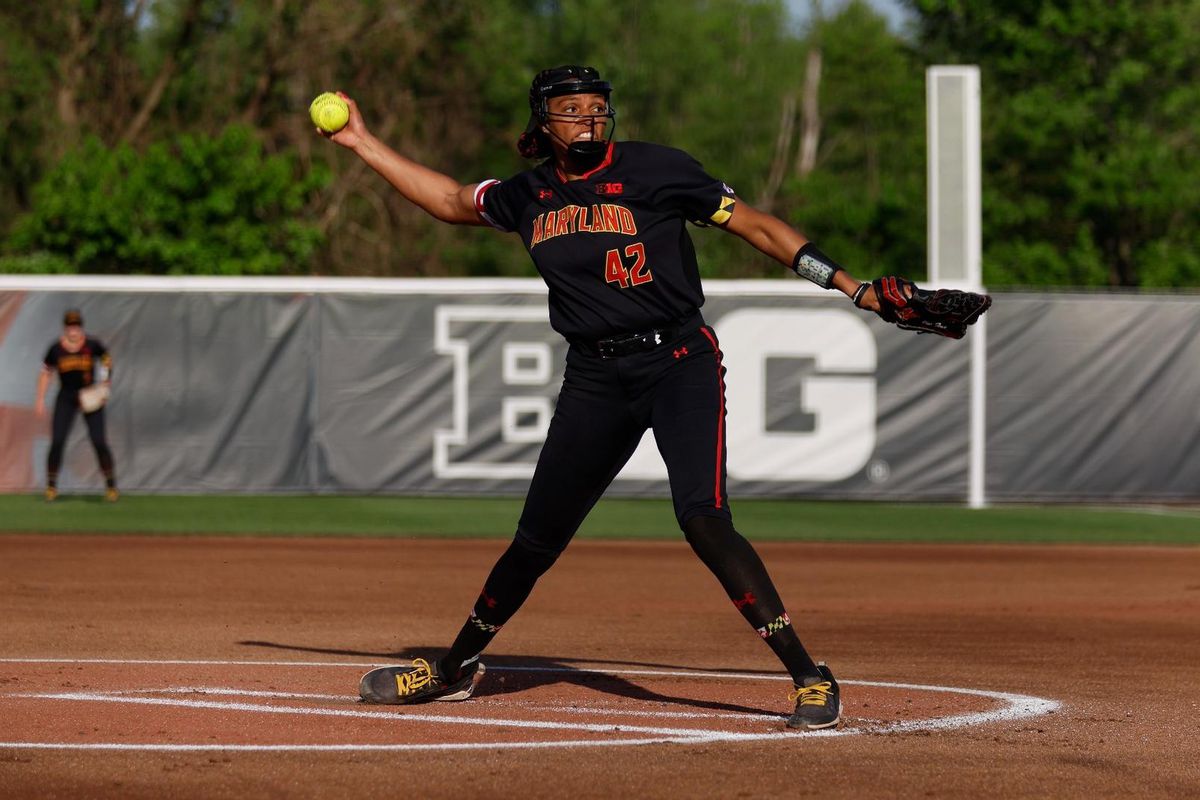

Maryland Softballs Aubrey Wurst Shines In 11 1 Win Against Delaware

May 24, 2025

Maryland Softballs Aubrey Wurst Shines In 11 1 Win Against Delaware

May 24, 2025 -

Kyle Walker Partied In Milan With Serbian Models Following Wifes Uk Trip

May 24, 2025

Kyle Walker Partied In Milan With Serbian Models Following Wifes Uk Trip

May 24, 2025 -

Escape To The Country Building Your Ideal Rural Lifestyle

May 24, 2025

Escape To The Country Building Your Ideal Rural Lifestyle

May 24, 2025 -

Glastonbury 2025 Olivia Rodrigo And The 1975 Join The Lineup

May 24, 2025

Glastonbury 2025 Olivia Rodrigo And The 1975 Join The Lineup

May 24, 2025

Latest Posts

-

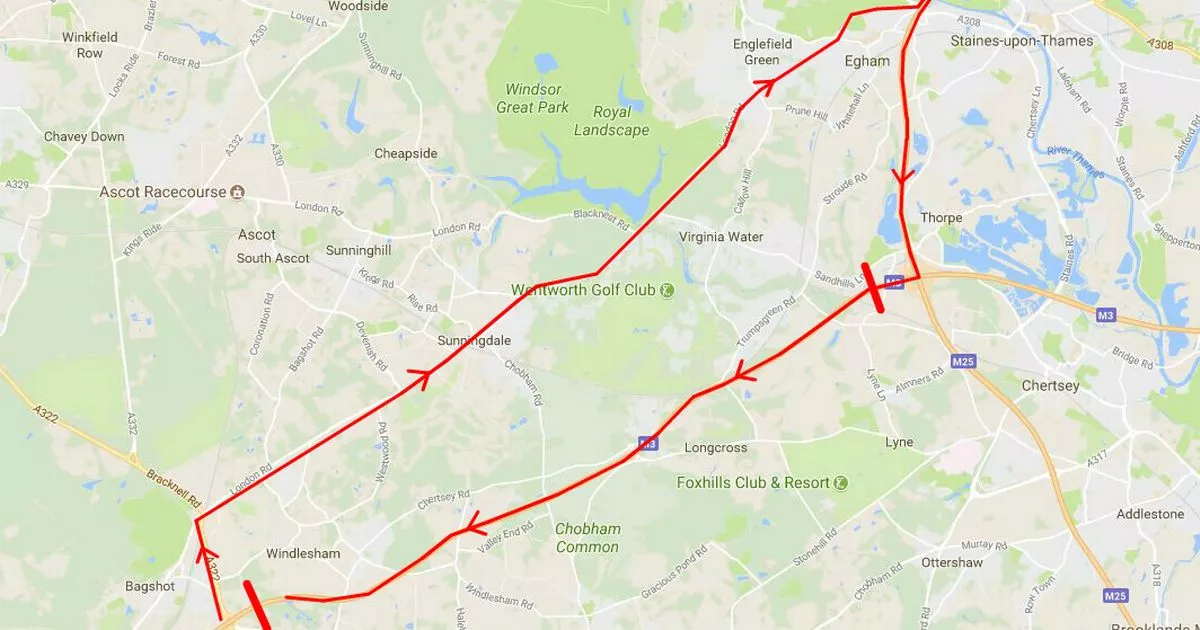

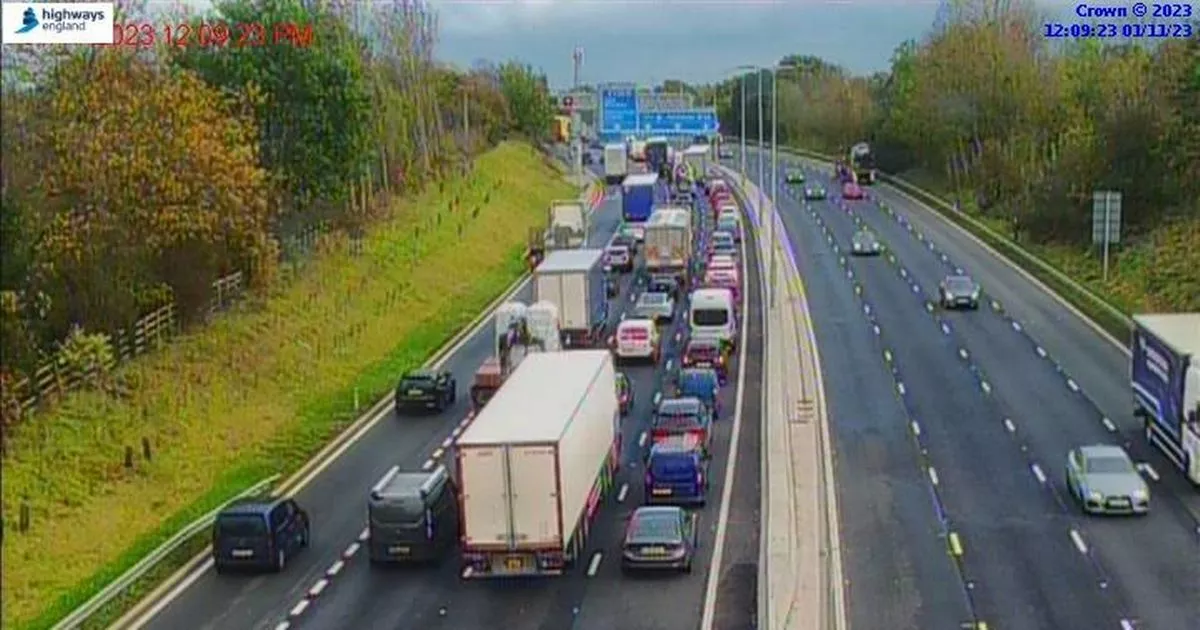

M56 Closed Serious Crash Causes Major Traffic Disruption Live M56 Traffic Updates

May 24, 2025

M56 Closed Serious Crash Causes Major Traffic Disruption Live M56 Traffic Updates

May 24, 2025 -

M56 Traffic Motorway Closure Due To Serious Crash Live Updates

May 24, 2025

M56 Traffic Motorway Closure Due To Serious Crash Live Updates

May 24, 2025 -

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025

M56 Road Closure Live Traffic Updates And Diversion Routes

May 24, 2025 -

Long Queues On M56 Due To Crash Current Traffic Conditions

May 24, 2025

Long Queues On M56 Due To Crash Current Traffic Conditions

May 24, 2025 -

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025