Analysis: BP Chief Executive's 31% Pay Reduction

Table of Contents

Reasons Behind the 31% Pay Cut

Financial Performance of BP

The BP Chief Executive's 31% pay reduction is likely intertwined with BP's recent financial performance. While a detailed breakdown requires access to BP's financial statements, analyzing key performance indicators (KPIs) is crucial. Let's consider some potential factors:

- Lower than expected profits: A comparison of BP's profits in the year preceding the pay cut with previous years will reveal whether underperformance played a role. Did profits fall short of targets or expectations, leading to this salary adjustment?

- Impact of fluctuating oil prices: The volatile nature of oil prices significantly affects energy company profitability. Did a period of low oil prices contribute to the need for cost-cutting measures, including executive compensation adjustments?

- Significant financial decisions: Major investments, divestments, or write-downs can impact a company's overall financial health. Did any such significant financial decisions influence the decision regarding the BP CEO pay cut?

Pressure from Shareholders and Activists

Shareholder activism and pressure from environmental groups significantly influence executive compensation in publicly traded companies. The BP CEO pay cut might be a direct response to such pressure:

- Activist shareholder resolutions: Were there shareholder resolutions filed expressing concerns about executive compensation levels compared to company performance or ESG targets?

- Public campaigns: Did environmental or social justice groups publicly campaign for reduced executive pay at BP, citing concerns about corporate responsibility and fair compensation practices?

- Successful campaigns influencing the decision: Did any of these campaigns directly influence the board's decision to reduce the BP CEO's salary?

BP's Commitment to ESG (Environmental, Social, and Governance) Goals

The pay cut could also reflect BP's commitment to its publicly stated ESG goals. This aligns with a growing trend of companies linking executive compensation to sustainability performance:

- Alignment with ESG targets: Does the pay reduction demonstrate a commitment to reducing the carbon footprint or improving social responsibility initiatives as part of a broader ESG strategy?

- Public statements on responsible business practices: Have BP's public statements highlighted a commitment to responsible business practices, including fair and sustainable executive compensation?

- Linking executive pay to ESG performance: Does BP have a compensation structure that directly links executive pay to the achievement of ESG goals, making the pay cut a natural consequence of performance against these targets?

Implications of the Reduced Compensation

Impact on Employee Morale and Motivation

A significant reduction in the CEO's pay could impact employee morale and motivation in several ways:

- Potential for increased pay disparity concerns: A large difference between executive pay and employee compensation could lead to increased discontent and dissatisfaction among employees.

- Impact on employee retention and recruitment: The perceived fairness of compensation practices can influence employee retention and attract top talent. A visible pay cut might signal a shift towards fairer compensation policies, potentially benefiting employee morale.

Signal to Other Energy Companies

BP's decision could influence compensation practices across the energy sector:

- Setting a new precedent: Could this significant pay cut set a precedent for other energy companies to re-evaluate their executive compensation strategies, potentially leading to more moderate pay levels?

- Impact on industry standards of executive pay: Will this decision contribute to a broader industry movement towards linking executive pay more closely to company performance and ESG goals?

Long-Term Strategic Considerations

The pay reduction has several long-term strategic implications:

- Influence on investor perception: Investors might view this as a positive signal of responsible governance and commitment to long-term value creation.

- Impact on long-term planning and business decisions: The decision might indirectly signal a shift towards a more sustainable and socially responsible business model influencing long-term investment choices.

Comparing BP's CEO Pay to Competitors

Benchmarking Against Peers

A comparative analysis of BP's CEO compensation (before and after the reduction) against competitors in the energy sector provides context:

- Table of comparisons: A table showing the CEO compensation of BP and its main competitors (e.g., Shell, ExxonMobil) before and after the BP CEO pay cut, highlighting significant differences.

Industry Trends in Executive Pay

Analyzing current trends in executive compensation within the energy sector helps understand BP's decision:

- Broader industry movements: Are there broader industry movements towards reducing or limiting executive pay, reflecting increased scrutiny of corporate governance and social responsibility?

Conclusion: Analyzing the Significance of BP Chief Executive's 31% Pay Reduction

The 31% reduction in BP's Chief Executive's pay is a significant event with multiple contributing factors. Financial performance, shareholder pressure, and a commitment to ESG goals all appear to have played a role. The implications are far-reaching, potentially impacting employee morale, influencing industry practices, and shaping BP's long-term strategic direction. The decision may set a precedent for other energy companies, highlighting the growing importance of responsible executive compensation practices.

Key Takeaways: The BP CEO pay cut reflects a complex interplay of financial performance, shareholder activism, and ESG considerations. The decision's long-term effects on employee morale, industry standards, and BP's strategic direction remain to be seen, but it undoubtedly marks a significant shift in the landscape of executive compensation within the energy sector.

Call to Action: Stay informed about the evolving landscape of executive compensation in the energy sector by following future updates on BP's financial performance and the impact of this significant pay reduction. Further analysis of BP Chief Executive's 31% pay reduction is crucial for understanding corporate governance trends.

Featured Posts

-

College De Clisson Le Port De La Croix Catholique Questionne

May 21, 2025

College De Clisson Le Port De La Croix Catholique Questionne

May 21, 2025 -

Abn Amro De Impact Van Toegenomen Autobezit Op De Occasionmarkt

May 21, 2025

Abn Amro De Impact Van Toegenomen Autobezit Op De Occasionmarkt

May 21, 2025 -

Gbr Highlights Best Grocery Deals Lucky Quarter And Doge Poll Update

May 21, 2025

Gbr Highlights Best Grocery Deals Lucky Quarter And Doge Poll Update

May 21, 2025 -

Trade Friction Switzerland And China Prioritize Dialogue On Tariffs

May 21, 2025

Trade Friction Switzerland And China Prioritize Dialogue On Tariffs

May 21, 2025 -

Manhattan Forgotten Foods Festival A Celebration Of Rare Ingredients

May 21, 2025

Manhattan Forgotten Foods Festival A Celebration Of Rare Ingredients

May 21, 2025

Latest Posts

-

Abn Amro Financiert Transferz Een Innovatief Digitaal Platform

May 21, 2025

Abn Amro Financiert Transferz Een Innovatief Digitaal Platform

May 21, 2025 -

Karin Polman Nieuwe Directeur Hypotheken Intermediair Bij Abn Amro Florius En Moneyou

May 21, 2025

Karin Polman Nieuwe Directeur Hypotheken Intermediair Bij Abn Amro Florius En Moneyou

May 21, 2025 -

Occasionverkoop Abn Amro Impact Van De Toename In Autobezit

May 21, 2025

Occasionverkoop Abn Amro Impact Van De Toename In Autobezit

May 21, 2025 -

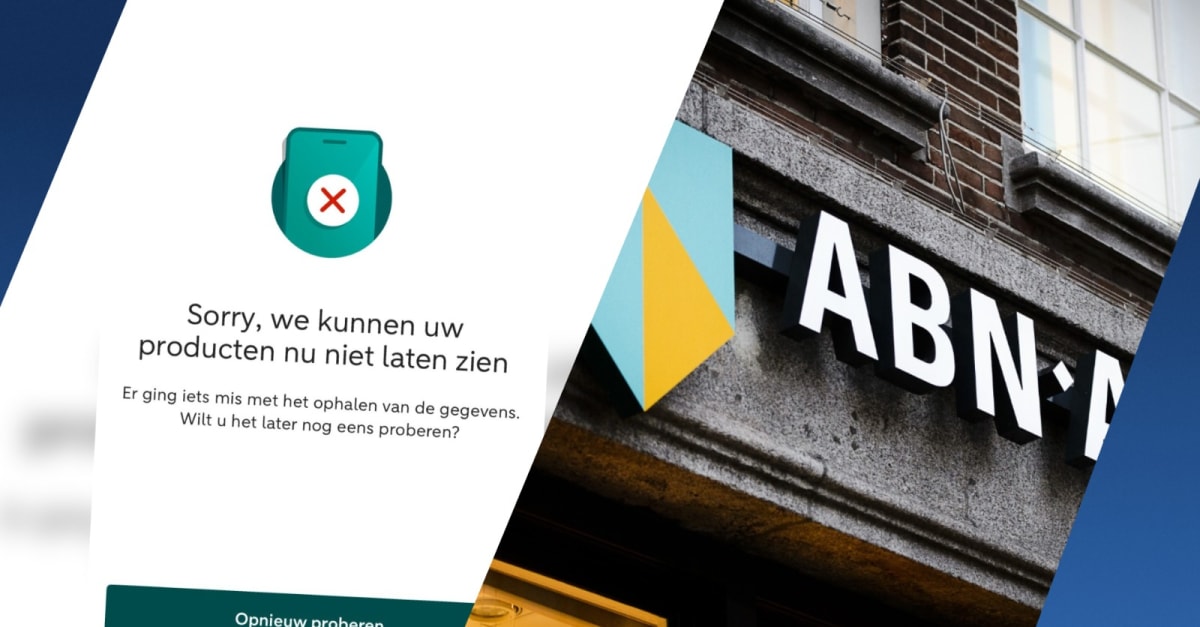

Online Betalingen Abn Amro Opslag Troubleshooting En Oplossingen

May 21, 2025

Online Betalingen Abn Amro Opslag Troubleshooting En Oplossingen

May 21, 2025 -

Abn Amro Analyse Van De Toename In Occasionverkoop

May 21, 2025

Abn Amro Analyse Van De Toename In Occasionverkoop

May 21, 2025