Analysis: Dangote Refinery's Influence On NNPC's Petrol Pricing Strategy

Table of Contents

Nigeria's fuel market is on the cusp of a significant transformation. The completion of the Dangote refinery, Africa's largest, marks a pivotal moment, potentially reshaping the landscape of petrol pricing and challenging the established dominance of the Nigerian National Petroleum Company (NNPC). For years, Nigerians have grappled with volatile petrol prices, largely driven by import dependency and fluctuating global crude oil markets. The NNPC, traditionally the primary player, has navigated a complex system of subsidies and price controls to manage this volatility. This article analyzes the profound implications of Dangote Refinery's Influence on NNPC's Petrol Pricing Strategy, exploring how this new player will impact the market dynamics, government policies, and ultimately, the price Nigerians pay at the pump.

Increased Domestic Refining Capacity and its Implications

Nigeria's current reliance on imported refined petroleum products has long been a major source of economic instability. The cost of importing fuel, coupled with fluctuations in the foreign exchange market and international crude oil prices, has directly translated into unpredictable and often high petrol prices for consumers. The Dangote refinery's massive refining capacity—capable of producing over 650,000 barrels per day—represents a dramatic shift towards self-sufficiency. This increased domestic refining capacity promises several key advantages:

- Reduced import costs: By significantly reducing the nation's reliance on imported fuel, the Dangote refinery can dramatically lower the cost of petrol. This eliminates the exposure to international price volatility and shipping costs.

- Improved forex stability: Less demand for foreign currency to import fuel will positively impact Nigeria's foreign exchange reserves and overall economic stability.

- Increased fuel availability: The refinery’s high capacity can address persistent fuel shortages, ensuring a more consistent supply across the country.

- Potential for price competition: The presence of a major private player will introduce competition, potentially forcing NNPC to adjust its pricing strategies to remain competitive.

Competitive Dynamics and Market Liberalization

The entry of the Dangote refinery marks a significant move away from the previously monopolistic nature of Nigeria's petroleum market. The NNPC, for years the dominant player, will now face competition from a significant private sector rival. This shift towards a more liberalized market introduces several critical dynamics:

- Market share competition: Both NNPC and Dangote will compete to capture market share, potentially leading to price adjustments to attract customers.

- Price adjustments by NNPC: In response to Dangote’s entry, NNPC may adjust its pricing strategy, potentially lowering prices to maintain competitiveness or employing other strategies to retain its market share.

- Impact on consumer prices: The ultimate beneficiary of this competition should be the Nigerian consumer, who can potentially expect lower petrol prices.

- Potential for government regulation: The government will play a crucial role in ensuring fair competition and preventing anti-competitive practices.

Government Policy and Regulatory Framework

The Nigerian government has historically played a significant role in regulating fuel pricing, often employing subsidies to keep prices artificially low. This has placed a considerable burden on the national budget. The Dangote refinery's influence on government policy will be substantial:

- Subsidy removal implications: The increased domestic supply could make the removal of fuel subsidies more politically feasible, freeing up government resources for other priorities.

- Government price controls: The government may need to adapt its price control mechanisms to accommodate the new competitive environment.

- Regulatory adjustments: New regulations may be required to ensure fair competition and prevent market manipulation.

- Impact on national budget: Reduced reliance on fuel imports and potential subsidy removal could significantly impact the national budget.

Economic Impacts and Social Consequences

The economic and social implications of the Dangote refinery are far-reaching:

- Lower transportation costs: Reduced fuel costs will benefit businesses and consumers, lowering transportation costs for goods and services.

- Reduced inflation: Lower petrol prices can have a significant dampening effect on inflation, benefiting the overall economy.

- Increased economic activity: Cheaper fuel can stimulate economic activity across various sectors, boosting overall growth.

- Job creation: The refinery itself, and related downstream industries, will create numerous jobs, contributing to employment in the country.

Conclusion: The Future of Petrol Pricing in Nigeria: The Dangote Refinery's Enduring Impact

The Dangote refinery's impact on NNPC's petrol pricing strategy is undeniable. Its increased refining capacity promises to significantly reduce Nigeria's reliance on imported fuel, introduce competition, and potentially lead to lower prices for consumers. While uncertainties remain regarding the exact extent of price reductions and the government's regulatory response, the long-term implications are promising. Analyzing Dangote Refinery's impact on the Nigerian economy and understanding NNPC's response to this new competitive landscape will be crucial in shaping the future of petrol pricing in Nigeria. We encourage further research into this evolving dynamic and staying informed about the ongoing influence of the Dangote refinery on NNPC's petrol pricing strategy.

Featured Posts

-

Ghettoisation Fears Rise As Caravans Flood Uk City

May 10, 2025

Ghettoisation Fears Rise As Caravans Flood Uk City

May 10, 2025 -

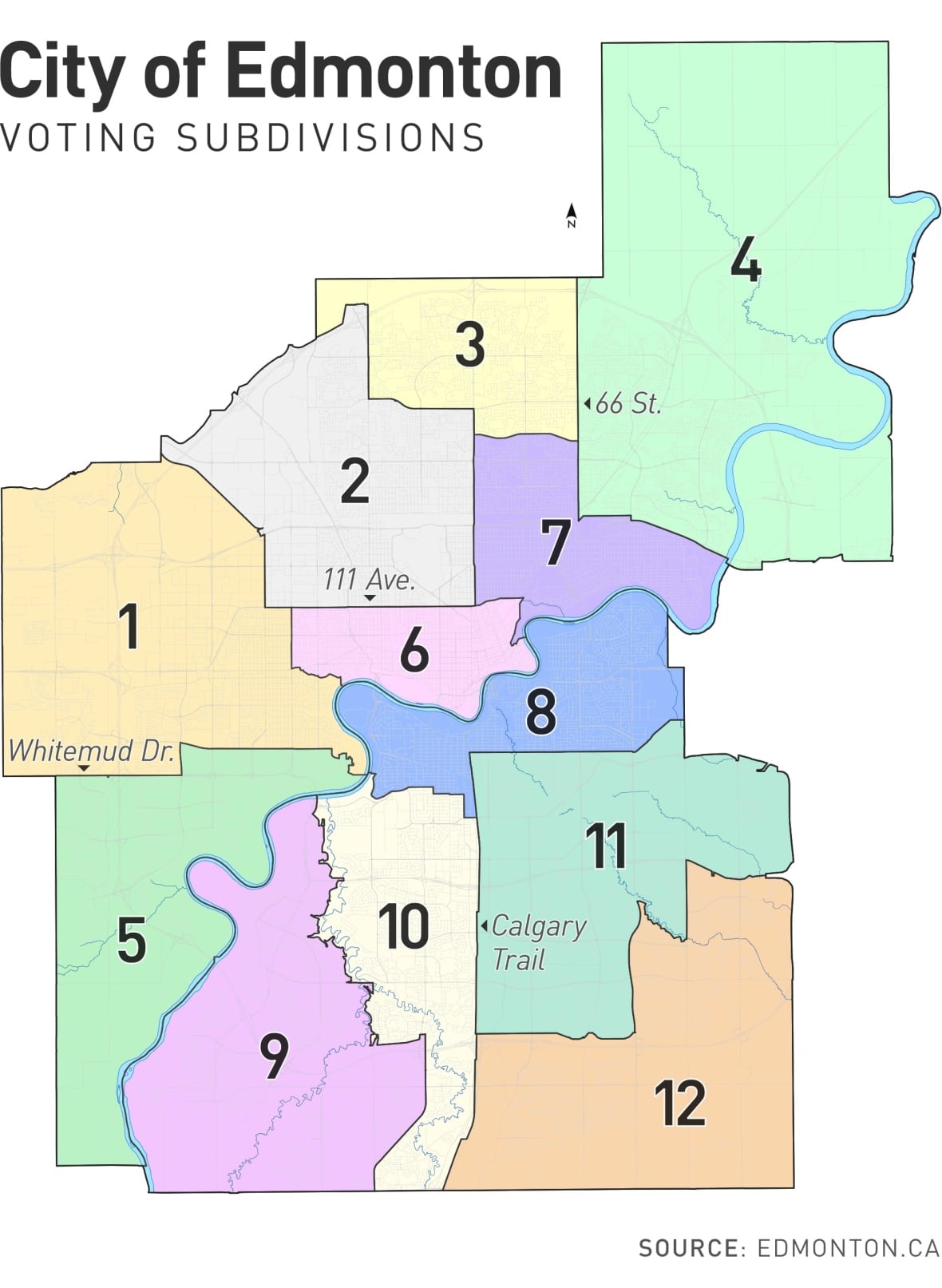

Edmonton Federal Riding Changes What Voters Need To Know

May 10, 2025

Edmonton Federal Riding Changes What Voters Need To Know

May 10, 2025 -

Red Wings Playoff Bid Takes A Blow Following Vegas Loss

May 10, 2025

Red Wings Playoff Bid Takes A Blow Following Vegas Loss

May 10, 2025 -

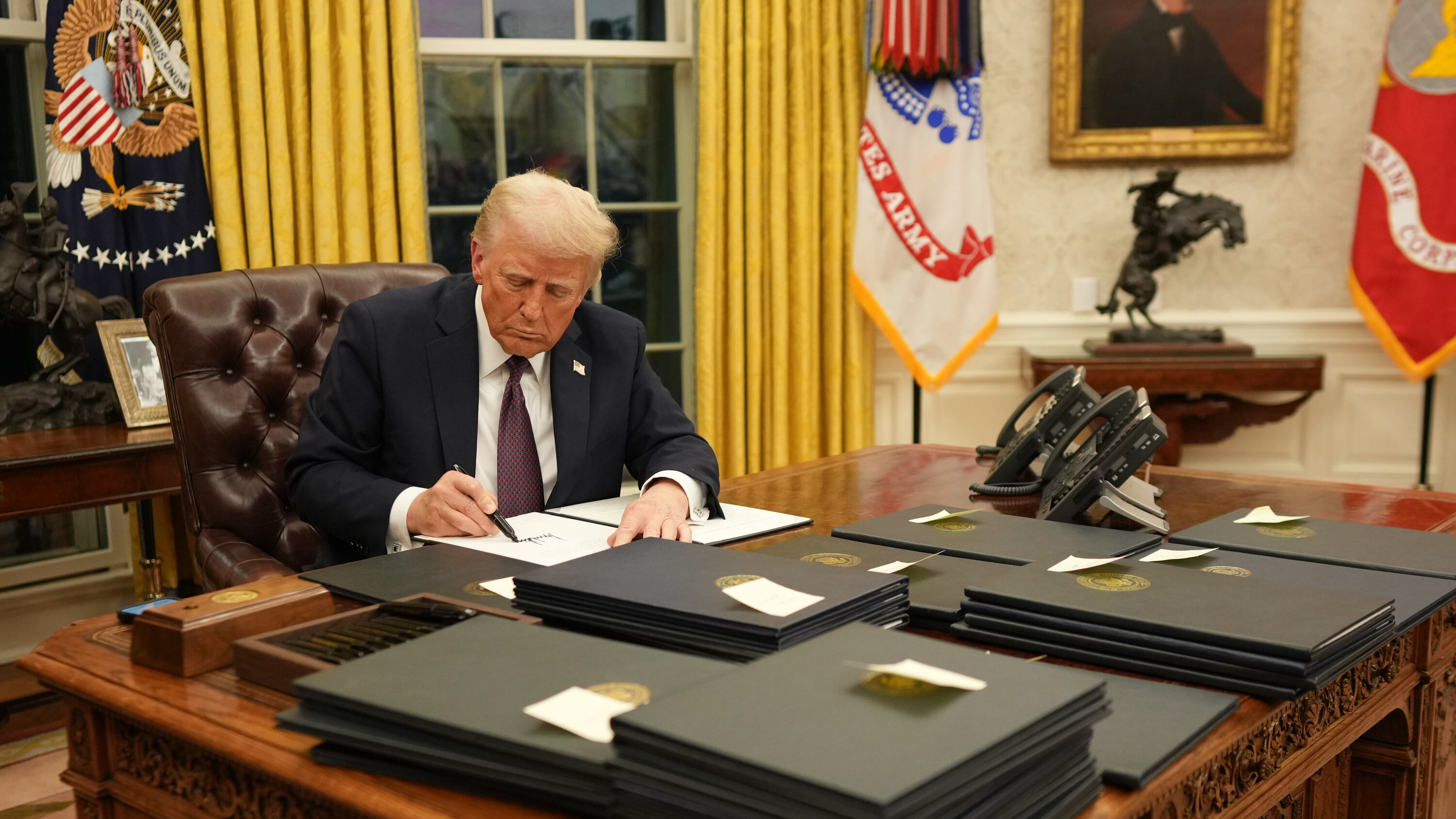

Increased Danish Involvement In Greenland Understanding Trumps Role

May 10, 2025

Increased Danish Involvement In Greenland Understanding Trumps Role

May 10, 2025 -

Stock Market Highlights Sensex And Nifty Daily Performance Review

May 10, 2025

Stock Market Highlights Sensex And Nifty Daily Performance Review

May 10, 2025