Analysis: Elon Musk's SpaceX Holdings Now Exceed Tesla Investment By $43 Billion

Table of Contents

The Meteoric Rise of SpaceX Valuation

SpaceX's remarkable valuation surge isn't accidental; it's the culmination of several key factors.

Factors Contributing to SpaceX's Growth

SpaceX's phenomenal growth can be attributed to a confluence of strategic successes:

- Successful Launches: The consistent success of its Falcon 9 and Falcon Heavy rockets, boasting impressive reliability and cost-effectiveness, has solidified SpaceX's position as a leading launch provider.

- Government Contracts: Securing lucrative contracts with NASA, the US Department of Defense, and other international space agencies has provided a steady stream of revenue and boosted SpaceX's profile.

- Starlink's Explosive Growth: The deployment of Starlink, SpaceX's ambitious satellite internet constellation, is generating substantial revenue and creating a new market for high-speed, global internet access. This represents a massive expansion beyond traditional space launch services.

- Increasing Demand for Space-Based Services: The growing demand for satellite imagery, communication services, and Earth observation data from governments and private companies fuels SpaceX's expansion.

- Strategic Partnerships: Collaborations with other aerospace companies and technology firms have enhanced SpaceX's capabilities and expanded its market reach.

Key Milestones and Financial Achievements:

- 2023: Successfully launched numerous Falcon 9 missions, expanding Starlink coverage significantly. Secured major contracts for lunar missions.

- 2022: Continued Starlink expansion, surpassing a million subscribers. Successful Starship prototype tests.

- 2021: Achieved orbital flight of Starship prototype. Continued expansion of Starlink.

SpaceX's Future Prospects and Potential for Further Growth

SpaceX's future looks incredibly bright, fueled by several ambitious projects:

- Mars Colonization: The long-term goal of Mars colonization through the Starship program represents a potentially massive market for future expansion and represents a bold, long-term vision.

- Starlink Global Dominance: The potential for Starlink to become the dominant global internet provider remains a significant driver of SpaceX's valuation. Expansion into underserved regions offers substantial growth opportunities.

- Space Tourism and Asteroid Mining: Ventures into space tourism and the exploration of asteroid mining could unlock entirely new revenue streams, further boosting SpaceX's financial prospects. These are high-risk, high-reward endeavors.

- Business Model Sustainability: The long-term sustainability of SpaceX's business model hinges on the continued success of Starlink, securing government contracts, and the development of new revenue streams. The diversification of its business model mitigates risk.

Tesla's Continued Success Despite Relative Value Shift

Despite SpaceX surpassing its valuation, Tesla remains a dominant force in the electric vehicle market.

Tesla's Strengths and Market Position

Tesla's success is built upon several key factors:

- EV Market Leadership: Tesla holds a strong lead in the global electric vehicle market, establishing a strong brand identity and a loyal customer base.

- Battery Technology and Infrastructure: Tesla's innovative battery technology and extensive Supercharger network provide a competitive edge in the electric vehicle market.

- Production Capacity and Sales Growth: Tesla’s continually expanding production capacity and strong sales figures demonstrate its market dominance and potential for further growth.

- Energy Storage and Solar: Expansion into energy storage (Powerwall) and solar power (Solar Roof) diversify Tesla's revenue streams and enhance its overall market position.

- Brand Recognition and Loyalty: Tesla's strong brand recognition and loyal customer base provide a significant competitive advantage.

Challenges Faced by Tesla

Tesla isn't without its challenges:

- Increased Competition: Increased competition from established and emerging automakers is putting pressure on Tesla’s market share and profit margins.

- Supply Chain Disruptions: Global supply chain disruptions can impact production and sales.

- Price Wars and Profit Margins: Intense price competition in the EV market can negatively impact profit margins.

- Regulatory Hurdles and Geopolitical Risks: Navigating complex regulatory environments and geopolitical uncertainties pose significant challenges.

Implications of the SpaceX-Tesla Valuation Shift

The shift in valuations between SpaceX and Tesla has profound implications.

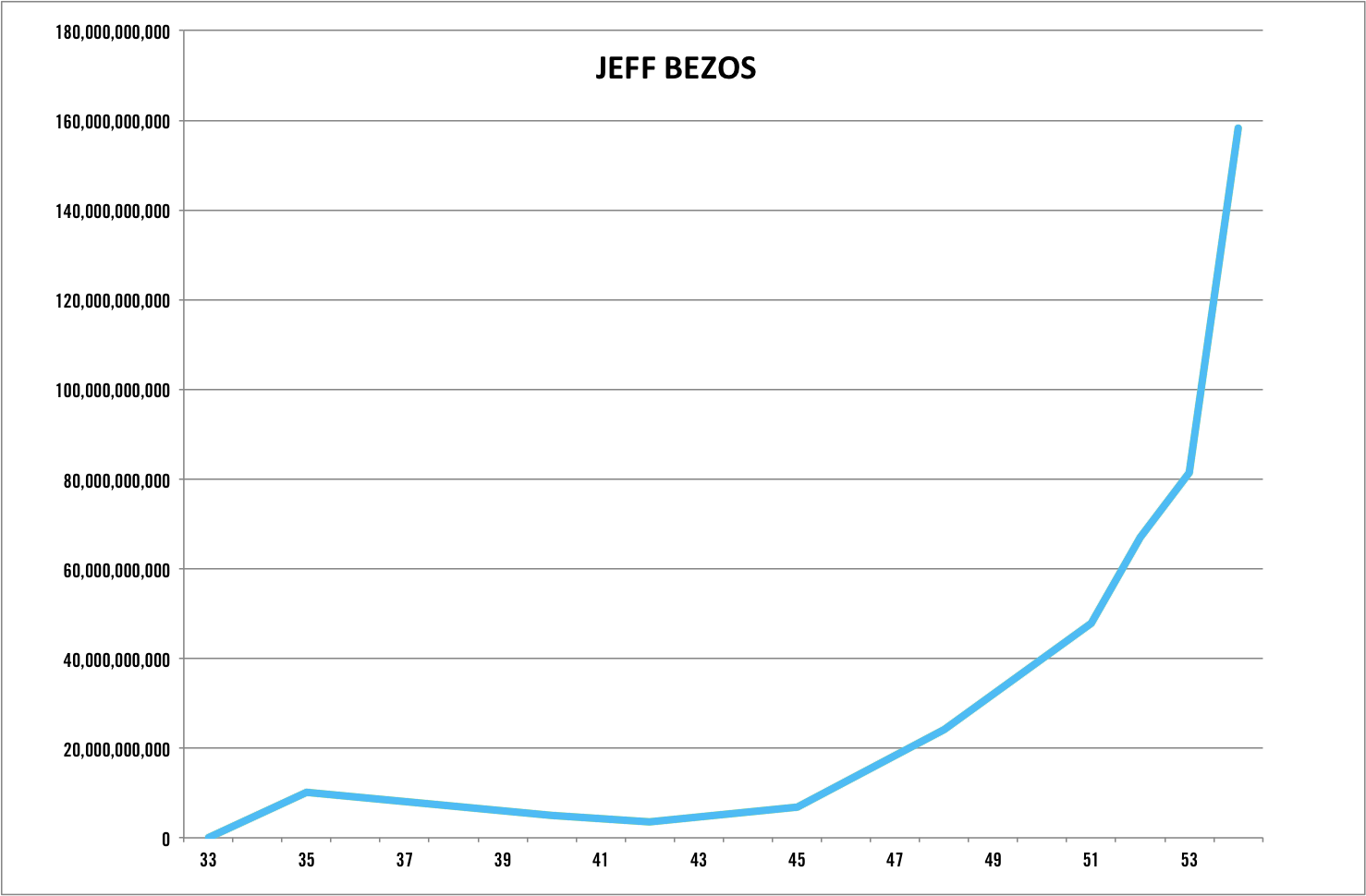

Impact on Elon Musk's Net Worth and Influence

The valuation change significantly impacts Elon Musk's net worth, solidifying his position as one of the world's wealthiest individuals. His influence across technology and space exploration remains unparalleled. This shift emphasizes the growth potential in space exploration relative to the electric vehicle sector.

Broader Market Implications and Investment Strategies

This valuation shift signals a potential shift in investor sentiment towards space exploration and its potential for massive returns. It encourages investors to reassess their portfolios and consider allocating resources to space-related ventures. The risk-reward profile of both SpaceX and Tesla require careful consideration before investment.

Conclusion

The fact that SpaceX's valuation now exceeds Tesla's by $43 billion underscores the incredible growth and potential of the space exploration industry. While Tesla continues its dominance in the electric vehicle market, SpaceX's achievements in rocketry, satellite internet, and its ambitious future plans have propelled it to the forefront of investor interest. This valuation shift represents a significant development, urging investors to carefully evaluate the investment potential of both SpaceX and Tesla, and to follow the SpaceX and Tesla story as it unfolds. Stay updated on the latest developments in SpaceX valuation and the ongoing competition and innovations within both sectors. Analyze the investment potential of both SpaceX and Tesla carefully.

Featured Posts

-

Visa Crackdown Uk Considers Restricting Applications From Pakistan Nigeria And Sri Lanka

May 10, 2025

Visa Crackdown Uk Considers Restricting Applications From Pakistan Nigeria And Sri Lanka

May 10, 2025 -

A Comprehensive Review Of Aocs Fact Check Of Jeanine Pirro

May 10, 2025

A Comprehensive Review Of Aocs Fact Check Of Jeanine Pirro

May 10, 2025 -

The 10 Best Film Noir Movies For A Perfect Night In

May 10, 2025

The 10 Best Film Noir Movies For A Perfect Night In

May 10, 2025 -

Elon Musks Net Worth Fluctuations During Trumps Initial 100 Days In Office

May 10, 2025

Elon Musks Net Worth Fluctuations During Trumps Initial 100 Days In Office

May 10, 2025 -

Exploring The Business Empire Of Samuel Dickson A Canadian Industrialist

May 10, 2025

Exploring The Business Empire Of Samuel Dickson A Canadian Industrialist

May 10, 2025