Analysis: G-7's Deliberations On De Minimis Tariffs For Chinese Products

Table of Contents

The Current State of De Minimis Tariffs on Chinese Imports into G7 Countries

De minimis tariffs, which exempt small shipments from customs duties, vary considerably across G7 nations. This inconsistency creates a complex and often unpredictable landscape for businesses, particularly small and medium-sized enterprises (SMEs) engaged in importing goods from China. These variations impact competitiveness and create administrative hurdles.

- Canada: Currently has a relatively low de minimis threshold for Chinese goods.

- United States: Maintains a de minimis threshold for low-value imports, but the application of this threshold to Chinese goods has been subject to recent changes and policy debates.

- United Kingdom: Post-Brexit, the UK has established its own de minimis threshold, which differs from its previous EU alignment.

- France, Germany, Italy, Japan: These countries each have their own unique de minimis levels, leading to inconsistencies in import costs and procedures.

The impact on SMEs is significant, as navigating different tariff structures adds administrative complexity and increases costs. A comparison with thresholds applied to imports from other major trading partners reveals a lack of uniformity in the G7's approach.

Arguments for Harmonization of De Minimis Tariffs within the G7

Harmonizing de minimis tariffs within the G7 offers several compelling economic advantages. Standardization would streamline import processes, boost trade efficiency, and foster fairer competition among importers.

- Reduced Administrative Burden: A uniform threshold simplifies customs procedures for businesses, reducing paperwork and processing times.

- Level Playing Field: A standardized system ensures equal treatment of importers, regardless of their country of origin or the G7 member they import into. This promotes fair competition and prevents discriminatory practices.

- Improved Predictability and Transparency: Consistent tariffs enhance predictability, allowing businesses to better plan their import strategies and reduce uncertainty related to costs.

Concerns and Challenges Related to Harmonizing De Minimis Tariffs on Chinese Products

Despite the potential benefits, harmonizing de minimis tariffs on Chinese products presents several challenges. The primary concern is the potential for increased Chinese market dominance in the G7 countries.

- Potential for Increased Chinese Market Dominance: Lowering tariffs across the board could significantly increase the influx of Chinese goods, potentially harming domestic industries in G7 countries.

- Concerns Regarding Intellectual Property Rights: Harmonization could inadvertently exacerbate concerns surrounding intellectual property theft and counterfeiting if not coupled with robust enforcement mechanisms.

- Different National Sensitivities and Political Pressures: Reaching a consensus among G7 members with diverse economic and political priorities will be difficult, with some countries likely prioritizing protectionist measures.

The Role of the WTO in the De Minimis Tariff Debate

The World Trade Organization (WTO) plays a crucial role in governing international trade practices, including customs valuation and tariff classifications. Any G7 agreement on de minimis tariffs must comply with WTO rules to avoid potential legal challenges.

- WTO Agreements on Customs Valuation and Tariff Classification: The G7's approach must align with existing WTO agreements to ensure its legitimacy and avoid trade disputes.

- Potential Legal Challenges to Any G7 Initiative: Disagreements over the harmonization process could lead to WTO dispute settlement proceedings.

- Impact on Developing Countries' Trade Relations: G7 decisions on de minimis tariffs have significant implications for developing countries, potentially affecting their access to G7 markets.

Potential Impacts of G7 Decisions on Global Trade

The G7's decisions on de minimis tariffs for Chinese products will have wide-ranging implications for global trade, impacting supply chains, consumer prices, and the overall structure of international commerce.

- Shift in Global Trade Flows: Harmonization could lead to significant shifts in global trade flows, with a potentially increased reliance on Chinese goods within the G7.

- Changes in Consumer Prices for Goods Imported from China: Changes in tariff structures could translate into changes in consumer prices, potentially impacting affordability and consumer choice.

- Impact on Manufacturing and Logistics Industries: Adjustments to tariff policies will influence manufacturing strategies and logistics networks, requiring adaptations within these industries.

Conclusion: Implications of G7's De Minimis Tariff Deliberations

Harmonizing de minimis tariffs for Chinese products presents a complex challenge for the G7, balancing the benefits of increased trade efficiency with concerns about market dominance and intellectual property protection. The G7's decisions will profoundly influence global trade dynamics and economic stability. The impact of de minimis tariffs extends far beyond the immediate economic effects; it touches upon geopolitical considerations and the overall fairness of the international trading system. Further research and informed public debate on the future of de minimis tariffs and their impact on Chinese product tariffs are crucial to navigating this complex issue and ensuring a stable and equitable future for international commerce. The long-term implications of these policy decisions require careful consideration to mitigate potential risks and maximize the benefits for all stakeholders involved.

Featured Posts

-

Paris Facing Economic Headwinds The Impact Of The Luxury Goods Market Slowdown March 7 2025

May 24, 2025

Paris Facing Economic Headwinds The Impact Of The Luxury Goods Market Slowdown March 7 2025

May 24, 2025 -

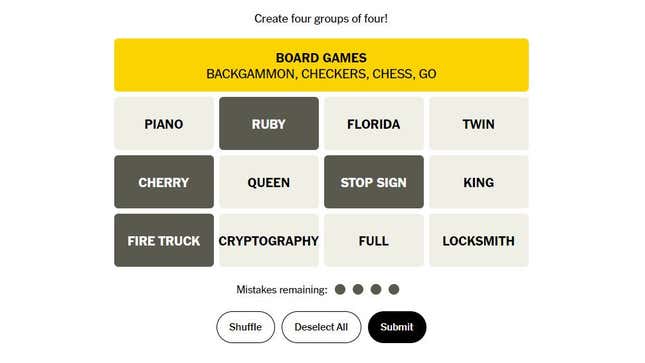

Solutions To New York Times Connections Puzzle 646 March 18 2025

May 24, 2025

Solutions To New York Times Connections Puzzle 646 March 18 2025

May 24, 2025 -

Glastonbury 2025 Lineup A Comprehensive Guide To The Top Performers

May 24, 2025

Glastonbury 2025 Lineup A Comprehensive Guide To The Top Performers

May 24, 2025 -

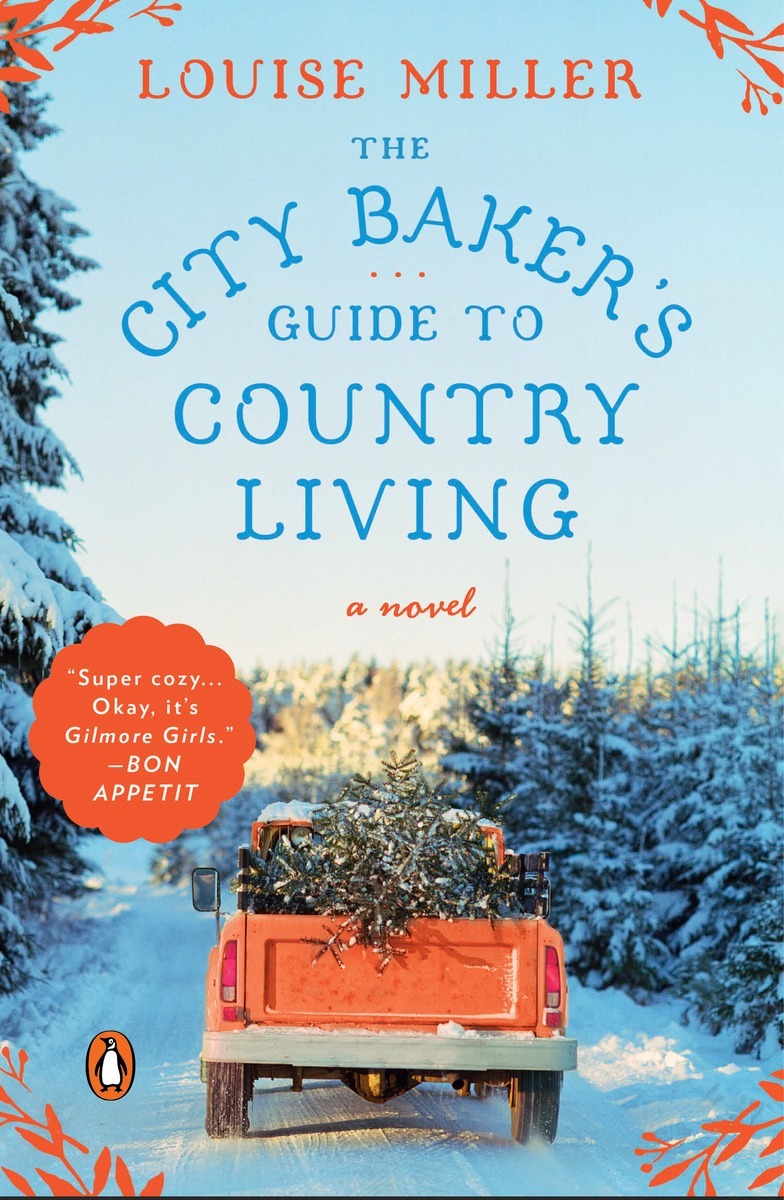

Planning Your Escape A Step By Step Guide To Country Living

May 24, 2025

Planning Your Escape A Step By Step Guide To Country Living

May 24, 2025 -

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025

Latest Posts

-

Indian Wells 2025 Swiatek And Rybakina Secure Fourth Round Berths

May 24, 2025

Indian Wells 2025 Swiatek And Rybakina Secure Fourth Round Berths

May 24, 2025 -

Rybakina Otkrovennoe Intervyu O Sostoyanii Formy

May 24, 2025

Rybakina Otkrovennoe Intervyu O Sostoyanii Formy

May 24, 2025 -

Elena Rybakina Otsenka Tekuschey Sportivnoy Formy

May 24, 2025

Elena Rybakina Otsenka Tekuschey Sportivnoy Formy

May 24, 2025 -

Sostoyanie Formy Eleny Rybakinoy Slova Samoy Tennisistki

May 24, 2025

Sostoyanie Formy Eleny Rybakinoy Slova Samoy Tennisistki

May 24, 2025 -

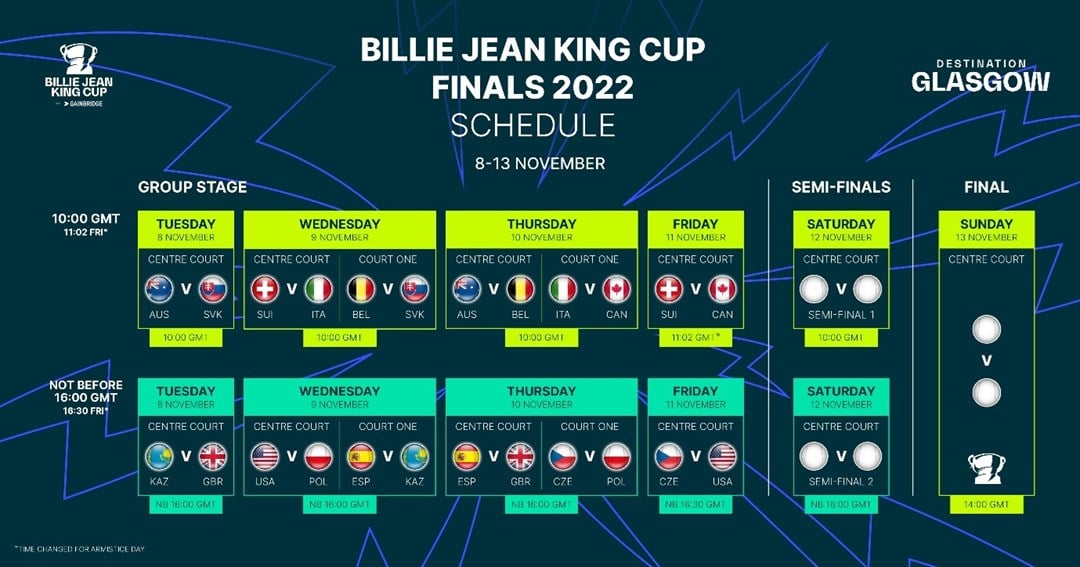

Rybakinas Victory Propels Kazakhstan To Billie Jean King Cup Finals

May 24, 2025

Rybakinas Victory Propels Kazakhstan To Billie Jean King Cup Finals

May 24, 2025