Analysis: Gold's Unexpected Double Weekly Loss In 2025

Table of Contents

Macroeconomic Factors Driving the Gold Price Decline

Several macroeconomic headwinds converged to trigger the unexpected double weekly loss in gold prices during 2025. Understanding these factors is crucial to comprehending the market's reaction and predicting future gold price movements.

Rising Interest Rates and Their Impact on Gold

The inverse relationship between interest rates and gold prices is well-established. Higher interest rates generally make holding non-yielding assets like gold less attractive. Investors often shift their funds towards interest-bearing instruments like bonds and treasury bills when yields rise.

- Federal Reserve Policy: The aggressive interest rate hikes implemented by the Federal Reserve in 2025 significantly impacted gold prices. These actions aimed to combat inflation but inadvertently increased the opportunity cost of holding gold.

- Increased Bond Yields: The rise in interest rates led to higher yields on government bonds, making them a more competitive investment compared to gold, which offers no yield.

- Inflationary Pressures: While initially considered a hedge against inflation, gold's performance was dampened as inflation began to show signs of cooling down, reducing its appeal as a safe haven.

Keywords: interest rate hikes, Federal Reserve, inflation, gold investment, bond yields

Strengthening US Dollar and its Effect on Gold

The US dollar's strength also played a significant role in the gold price decline. Gold is typically priced in US dollars, so a stronger dollar makes gold more expensive for holders of other currencies, thereby reducing global demand.

- US Dollar Index Surge: The US dollar index (DXY) experienced a notable surge during the period of the gold price decline, reaching its highest level in several years.

- Currency Exchange Rates: This strengthening of the dollar led to unfavorable exchange rates for many international investors, making gold less affordable and thus decreasing demand.

- Impact on Global Demand: The combined effect of a stronger dollar and higher interest rates significantly dampened global demand for gold, further contributing to the price drop.

Keywords: US dollar index, currency exchange rates, dollar strength, gold in USD, gold price forecast

Geopolitical Stability and Reduced Safe-Haven Demand

While geopolitical uncertainty often fuels demand for gold as a safe-haven asset, a period of relative global stability in 2025 could have contributed to reduced investor appetite for gold.

- Decreased Geopolitical Risk: The absence of major geopolitical crises or escalating conflicts might have lessened the perceived need for safe-haven assets like gold.

- Improved Market Sentiment: Increased confidence in the global economy could have shifted investor focus away from gold towards riskier, higher-return assets.

- Shift in Investment Strategies: Investors might have reallocated their portfolios, reducing their holdings in gold and increasing their investments in other asset classes.

Keywords: geopolitical risk, safe haven asset, market sentiment, gold investment strategy, global economy

Technical Analysis of Gold's Double Weekly Loss

Analyzing the gold price chart reveals technical indicators that contributed to the double weekly loss.

Chart Patterns and Price Action

- Breakdown of Support Levels: The gold price decisively broke through key support levels, signaling a bearish trend.

- Technical Indicators: Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) may have shown bearish signals before the price drop, indicating weakening momentum.

- Head and Shoulders Pattern (Potential): A possible head and shoulders pattern, a bearish reversal pattern, might have been identified on the gold chart, foreshadowing the decline.

Keywords: technical analysis, chart patterns, support and resistance, RSI, MACD, trading signals, gold chart

Trading Volume and Market Sentiment

- Increased Selling Pressure: High trading volume during the decline suggests significant selling pressure from investors.

- Bearish Sentiment Shift: Market sentiment shifted from bullish to bearish, as evidenced by analyst reports and investor commentary.

- Liquidation of Positions: Investors might have liquidated their gold holdings to avoid further losses, exacerbating the price decline.

Keywords: trading volume, market sentiment, bearish trend, gold trading, investor behavior

Impact and Future Outlook for Gold Prices

The double weekly loss in gold prices had significant ramifications for investors and the future outlook remains uncertain.

Impact on Gold Investors

- Short-Term Losses: Short-term gold investors experienced significant losses during this period.

- Long-Term Strategy: Long-term investors might have adopted a "buy the dip" strategy, seeing the decline as a buying opportunity.

- Portfolio Diversification: The event underscored the importance of portfolio diversification to mitigate risk.

Keywords: gold investment risk, portfolio diversification, risk management, gold ETF, gold futures

Predictions and Future Price Movement

Predicting future gold prices with certainty is impossible. However, several factors could influence future price movements:

- Interest Rate Trajectory: The path of future interest rate adjustments will significantly impact gold prices.

- US Dollar Strength: The dollar's strength will continue to be a critical factor affecting gold's price.

- Geopolitical Developments: Unforeseen geopolitical events can quickly impact investor sentiment and gold prices.

Keywords: gold price prediction, gold market outlook, gold forecast 2026, future of gold

Conclusion: Navigating the Volatility: Understanding Gold's Unexpected Double Weekly Loss in 2025

The unexpected double weekly loss in gold prices during 2025 was a complex event driven by a confluence of macroeconomic factors and technical indicators. Understanding the interplay between rising interest rates, a strengthening US dollar, and shifts in geopolitical stability is critical for navigating the volatile gold market. Furthermore, incorporating technical analysis into your investment strategy can help identify potential turning points and mitigate risk. The volatility of gold highlights the need for careful investment strategies, including diversification and risk management. To avoid similar unexpected losses in the future, continue learning about gold price movements and stay informed about market trends. Develop robust gold price analysis and gold market insights to craft effective gold investment strategies and understand gold price movements.

Featured Posts

-

Watch Celtics Vs Trail Blazers Game Time Tv Broadcast And Live Stream Links For March 23rd

May 06, 2025

Watch Celtics Vs Trail Blazers Game Time Tv Broadcast And Live Stream Links For March 23rd

May 06, 2025 -

Celtics Vs Suns Game Information Time Tv Coverage And Streaming Options For April 4th

May 06, 2025

Celtics Vs Suns Game Information Time Tv Coverage And Streaming Options For April 4th

May 06, 2025 -

House Democrats Public Battle The Issue Of Senior Leadership

May 06, 2025

House Democrats Public Battle The Issue Of Senior Leadership

May 06, 2025 -

Celtics Vs 76ers Game Prediction Odds Stats And Winning Picks February 20 2025

May 06, 2025

Celtics Vs 76ers Game Prediction Odds Stats And Winning Picks February 20 2025

May 06, 2025 -

Razdevanie Patrika Shvartseneggera I Ebbi Chempion Pravda O Syemkakh Dlya Kim Kardashyan

May 06, 2025

Razdevanie Patrika Shvartseneggera I Ebbi Chempion Pravda O Syemkakh Dlya Kim Kardashyan

May 06, 2025

Latest Posts

-

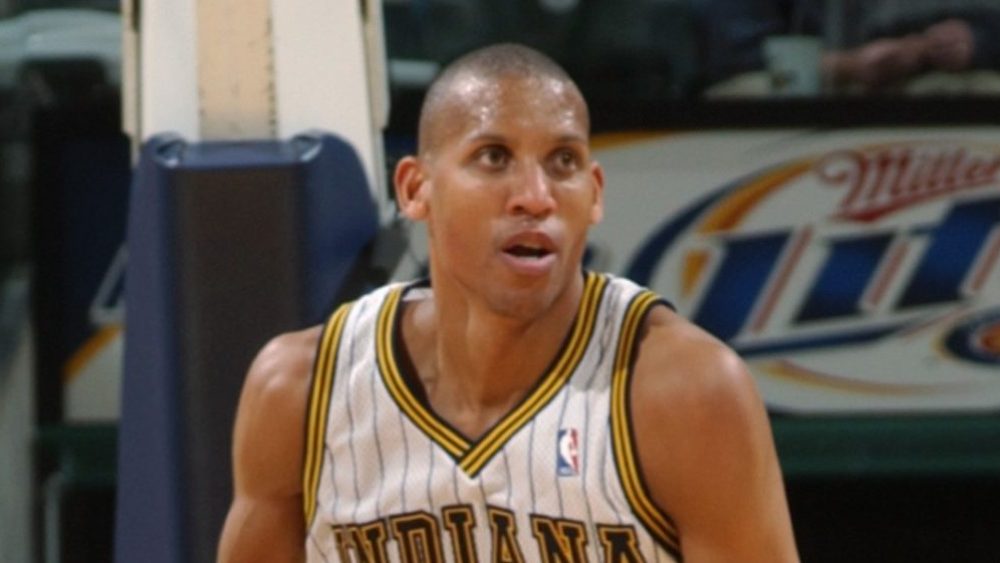

The Future Of Nba Broadcasting Reggie Millers Move To Nbc And What It Means

May 06, 2025

The Future Of Nba Broadcasting Reggie Millers Move To Nbc And What It Means

May 06, 2025 -

Nbcs Nba Coverage Gets A Boost Reggie Miller Takes On Lead Analyst Role

May 06, 2025

Nbcs Nba Coverage Gets A Boost Reggie Miller Takes On Lead Analyst Role

May 06, 2025 -

Nba Broadcast Shakeup Reggie Miller Confirmed As Nbcs Lead Analyst

May 06, 2025

Nba Broadcast Shakeup Reggie Miller Confirmed As Nbcs Lead Analyst

May 06, 2025 -

Reggie Millers New Role Nbc Sports Lead Nba Analyst A Deep Dive Into The Nba Broadcast Shuffle

May 06, 2025

Reggie Millers New Role Nbc Sports Lead Nba Analyst A Deep Dive Into The Nba Broadcast Shuffle

May 06, 2025 -

The Librarians The Next Chapter Tnt Announces Premiere Date With New Trailer And Poster

May 06, 2025

The Librarians The Next Chapter Tnt Announces Premiere Date With New Trailer And Poster

May 06, 2025