Analysis: House Votes On Revised Trump Tax Legislation

Table of Contents

Key Provisions of the Revised Trump Tax Legislation

The revised Trump Tax Legislation introduces several key changes compared to the original proposal. Understanding these modifications is crucial to grasping the bill's overall impact.

-

Corporate Tax Rate Changes: The revised bill proposes a corporate tax rate of [Insert Percentage]%, a [Increase/Decrease] compared to the original proposal of [Original Percentage]%. This adjustment is expected to significantly influence corporate investment decisions and profitability. Further analysis is needed to determine the actual effect on competitiveness within the global market.

-

Individual Income Tax Bracket Adjustments: While the original bill included [Original Bracket Adjustments], the revised version incorporates [Revised Bracket Adjustments]. This means [Explain the effect of these changes on different income groups]. For example, individuals earning between [Income Range] could see their tax burden [Increase/Decrease] by approximately [Percentage/Dollar Amount].

-

Changes to Deductions: The revised legislation brings substantial changes to several crucial deductions. For example, the SALT (State and Local Taxes) deduction, a significant point of contention in the original bill, has been [Modified/Retained/Eliminated]. Additionally, the standard deduction has been [Adjusted], potentially impacting millions of taxpayers. This affects both high and low income earners, making a nuanced understanding of the changes essential.

-

Impact on Small Businesses: The impact on small businesses is a critical aspect of the revised Trump Tax Legislation. The changes to [Specific Tax Provisions relevant to small businesses] are anticipated to [Positively/Negatively] affect this sector, potentially influencing job creation and economic growth at a local level. Specific studies are now needed to fully assess this impact.

-

Changes to Estate or Gift Taxes: The revised bill includes [Specific Changes] to estate and gift taxes, potentially altering the tax implications for high-net-worth individuals and families. This aspect remains a subject of ongoing debate and further scrutiny is required for a comprehensive understanding.

House Voting Blocs and Their Positions

The House vote on the revised Trump Tax Legislation revealed clear partisan divides, although some surprising cross-party votes emerged.

-

Breakdown of Votes by Party Affiliation: [Insert data showing the breakdown of votes by Republican, Democrat, and Independent representatives]. This highlights the deeply partisan nature of the debate surrounding this legislation.

-

Notable Representatives Who Voted Against Party Lines: Several representatives voted against their party's stance, underscoring the complexity and nuance of the debate within each party. [Provide examples and their stated reasons]. This suggests that even within unified parties, there is internal dissension.

-

Significant Internal Disagreements Within Parties: [Discuss any notable internal disagreements and their impact on the voting outcome]. These fractures highlight a possible weakening of party unity on this crucial issue.

-

Key Political Figures Who Championed or Opposed the Bill: [Mention key figures who played crucial roles in advocating for or against the bill and their influence on the outcome]. Their public statements and actions influenced the final vote.

Economic Projections and Analysis

Experts offer varying perspectives on the economic implications of the revised Trump Tax Legislation.

-

Projected GDP Growth: The Congressional Budget Office (CBO) projects a [Percentage]% increase in GDP growth over [Time Period], while independent economists predict [Alternative Projections]. The divergence highlights the complexity of accurate economic forecasting.

-

Estimated Impact on Job Creation: Proponents of the bill argue it will lead to significant job creation, estimating [Number] new jobs over [Time Period]. Opponents, however, point to potential negative impacts on certain sectors and caution against over-optimistic projections.

-

Potential Effects on Inflation: The bill's potential effects on inflation are a subject of intense debate. Some economists predict a modest increase, while others foresee limited impact. Long-term inflation could be a considerable factor to consider.

-

Analysis of Potential Long-Term Economic Consequences: Long-term consequences remain largely uncertain, with a variety of potential scenarios depending on factors such as global economic conditions and implementation details.

-

Dissenting Economic Analyses and Rationale: Several economic analyses express concerns about the bill's potential for exacerbating income inequality and increasing the national debt. These counterarguments are important to consider for a balanced perspective.

Public Opinion and Reactions

Public reaction to the House vote on the revised Trump Tax Legislation has been mixed, reflecting the diverse viewpoints present within the population.

-

Results from Recent Polls on Public Opinion: Recent polls indicate [Summarize public opinion data, including percentages supporting or opposing the bill]. The range of responses showcases the differing impacts on various demographics.

-

Analysis of Media Coverage: Media coverage of the bill has been [Describe the dominant narratives and framing]. Different outlets have presented the bill and its consequences with varying degrees of support and opposition.

-

Statements from Advocacy Groups: Business groups have largely [Express their stance], while taxpayer advocacy groups express [their concerns]. These differing stances reflect the varied potential impacts on different segments of society.

-

Significant Public Protests or Demonstrations: [Mention any significant public demonstrations or protests related to the bill and their scale and impact]. These activities reflect the depth of feeling on both sides of the debate.

Conclusion: The Future of the Revised Trump Tax Legislation

The House vote on the revised Trump Tax Legislation marks a significant step in the legislative process, but the bill's ultimate fate remains uncertain. The key provisions, the partisan divides revealed in the voting patterns, and the conflicting economic projections all highlight the complexities surrounding this piece of legislation. The next steps include a Senate vote, followed by potential presidential action. The long-term consequences of this revised Trump Tax Legislation, impacting everything from corporate profits to individual tax burdens, require careful monitoring and ongoing analysis. Stay informed about further developments concerning the Trump Tax Legislation and its impact by following reputable news sources and engaging with relevant policy discussions. Understanding the implications of this legislation is crucial for every taxpayer.

Featured Posts

-

Predicciones Astrologicas Horoscopo Semanal 11 17 Marzo 2025

May 23, 2025

Predicciones Astrologicas Horoscopo Semanal 11 17 Marzo 2025

May 23, 2025 -

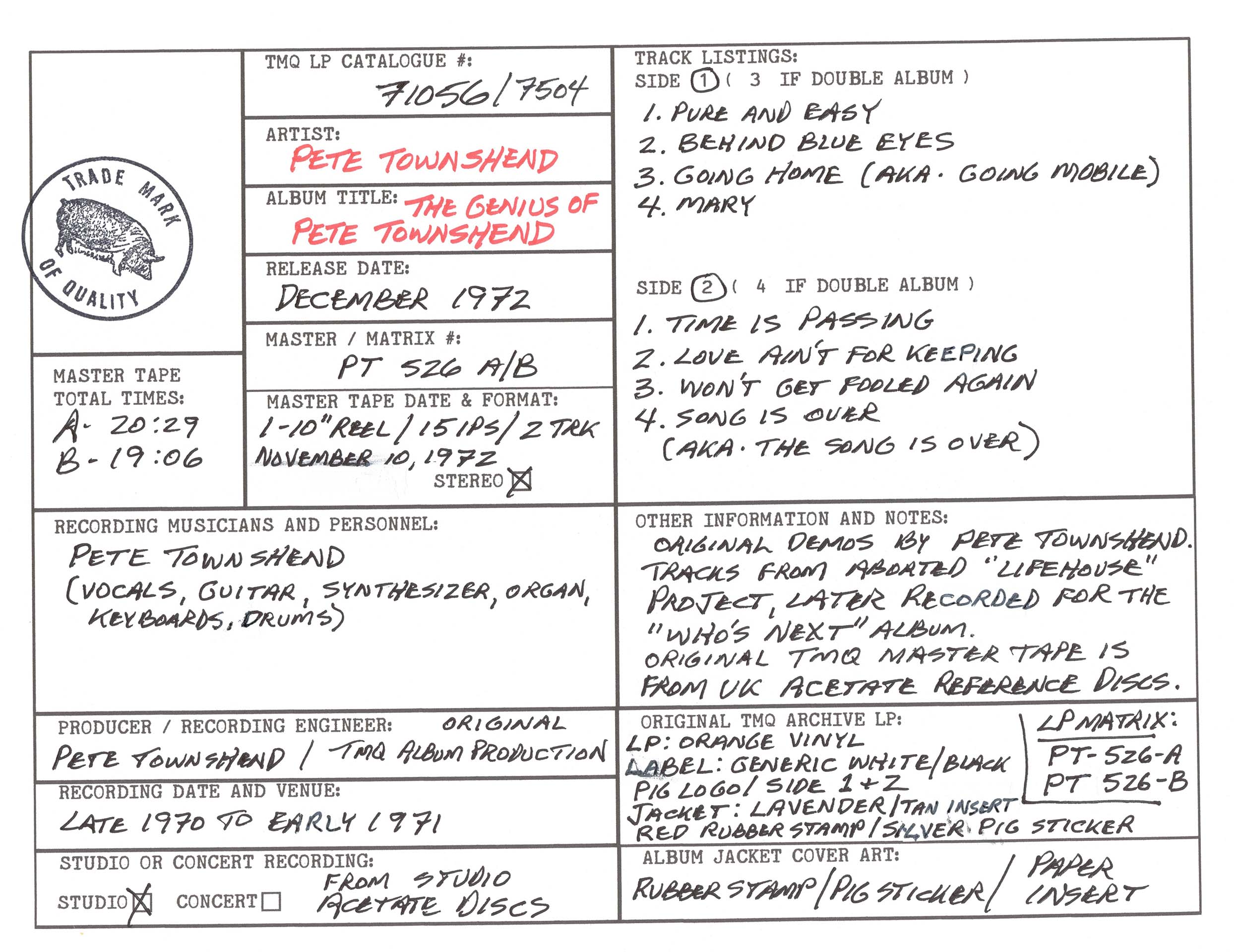

The Complete Guide To Ranking Pete Townshends Solo Discography

May 23, 2025

The Complete Guide To Ranking Pete Townshends Solo Discography

May 23, 2025 -

Who Is Elias Rodriguez Understanding The Suspect In The Israeli Embassy Attack

May 23, 2025

Who Is Elias Rodriguez Understanding The Suspect In The Israeli Embassy Attack

May 23, 2025 -

Man Uniteds Ten Hag Era Stams Harsh Verdict On Costly Transfers

May 23, 2025

Man Uniteds Ten Hag Era Stams Harsh Verdict On Costly Transfers

May 23, 2025 -

Oscar Piastri Claims First F1 Pole In Bahrain

May 23, 2025

Oscar Piastri Claims First F1 Pole In Bahrain

May 23, 2025

Latest Posts

-

Nyt Mini Crossword Puzzle Solutions March 6 2025

May 23, 2025

Nyt Mini Crossword Puzzle Solutions March 6 2025

May 23, 2025 -

Complete Guide To The Nyt Mini Crossword March 6 2025

May 23, 2025

Complete Guide To The Nyt Mini Crossword March 6 2025

May 23, 2025 -

March 6 2025 Nyt Mini Crossword Complete Answers And Clues

May 23, 2025

March 6 2025 Nyt Mini Crossword Complete Answers And Clues

May 23, 2025 -

Nyt Mini Crossword Answers March 13 2025 Full Solution Guide

May 23, 2025

Nyt Mini Crossword Answers March 13 2025 Full Solution Guide

May 23, 2025 -

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025