Analysis: How Tariffs Are Stifling Initial Public Offerings

Table of Contents

Increased Uncertainty and Risk Assessment

Predictability is crucial for a successful IPO. Investors need confidence in a company's future profitability and growth potential before committing significant capital. Tariffs, however, introduce a significant element of unpredictability into the business environment, making accurate assessment extremely difficult. The ongoing trade wars and their associated tariffs are creating a volatile landscape for businesses, especially those with significant international operations.

Predictability is Key for IPO Success

Tariffs make it exceptionally challenging to forecast future revenue streams. Fluctuating import and export costs directly impact profit margins, making financial projections less reliable. This uncertainty makes investors wary.

- Difficulty in forecasting future revenue streams due to fluctuating import/export costs: A company reliant on imported materials faces unpredictable price increases, eroding profit margins and making it difficult to project future earnings accurately. This directly affects the valuation assigned by potential investors during the IPO process.

- Increased regulatory hurdles and compliance costs associated with navigating tariff complexities: Understanding and complying with constantly changing tariff regulations adds significant administrative burdens and costs, diverting resources away from core business activities. These added compliance costs further reduce profitability and increase the risk associated with the IPO.

- Investor hesitancy towards companies with significant international exposure: Investors are understandably more cautious about companies heavily involved in international trade, as their profitability is directly vulnerable to tariff changes and trade disputes. This reluctance leads to lower demand for IPOs in affected sectors.

Impact on Supply Chains and Production Costs

Tariffs disrupt global supply chains, forcing companies to reassess their sourcing strategies. This often leads to higher production costs and reduced profit margins, making IPOs less attractive.

- Increased reliance on more expensive domestic suppliers: Tariffs can make imported goods prohibitively expensive, forcing companies to switch to domestic suppliers, even if they are more costly or less efficient. This increases production costs and shrinks profit margins.

- Potential for delays and disruptions in the production process: Finding new suppliers and adjusting supply chains takes time and resources. This can lead to production delays and potential disruptions, negatively impacting a company's overall performance and its attractiveness to potential IPO investors.

- Pressure to increase prices to offset tariff-related costs: To maintain profitability in the face of increased production costs, companies are often forced to raise prices, potentially impacting consumer demand and market share. This price increase can also deter investors worried about reduced consumer purchasing power.

Negative Impact on Company Valuations

The uncertainty surrounding tariffs significantly impacts investor sentiment, leading to lower valuations for IPOs. This reduced valuation makes it less attractive for companies to go public.

Reduced Investor Confidence

The unpredictable nature of tariffs increases the perceived risk associated with investing in affected companies.

- Investors demanding higher risk premiums due to the increased uncertainty: Investors will demand a higher return on their investment to compensate for the added risk associated with tariff-related volatility. This higher required return directly reduces the valuation a company can achieve during its IPO.

- Reduced demand for IPOs in affected sectors: The combination of higher risk and lower projected returns leads to less demand for IPOs in industries heavily impacted by tariffs. This reduces the amount of capital a company can raise through its IPO.

- Potential for lower IPO pricing and decreased capital raised: To attract investors in a less favorable market, companies may be forced to lower their IPO pricing, resulting in less capital raised than initially anticipated. This can hinder their growth plans and long-term success.

The Impact of Trade Wars on Market Sentiment

Broader economic consequences of trade wars further exacerbate the negative impact on IPOs. Negative market sentiment discourages investment in general.

- Overall market volatility reducing investor appetite for new investments: Trade wars often create general market uncertainty, causing investors to become more risk-averse and less inclined to invest in new ventures through IPOs.

- Increased focus on defensive investments rather than growth stocks: In times of uncertainty, investors often shift their focus to more stable, defensive investments, reducing the attractiveness of growth-oriented companies seeking IPOs.

- Reduced IPO activity across multiple sectors: The negative impact of trade wars and tariffs extends beyond specific industries, leading to a decline in overall IPO activity across various sectors.

Alternative Strategies for Companies

Faced with unfavorable market conditions, many companies are exploring alternative strategies to going public.

Delayed IPOs and Private Funding

The increased uncertainty is prompting many companies to delay their IPO plans.

- Increased reliance on private equity and venture capital: Companies are increasingly turning to private funding sources to secure capital, postponing their IPO until the market conditions improve.

- Strategic acquisitions and mergers to consolidate market share: Rather than going public, companies might choose to consolidate their market position through strategic acquisitions or mergers to increase their competitiveness in a challenging environment.

- Focusing on domestic markets to reduce exposure to tariffs: Some companies are reducing their reliance on international trade by focusing on their domestic markets to mitigate the impact of tariffs.

Lobbying and Political Pressure

Companies are actively engaging with policymakers to influence trade policies.

- Increased engagement with government officials to advocate for tariff reductions: Companies are lobbying for tariff reductions or exemptions to reduce the impact on their business and make IPOs more attractive.

- Participation in trade negotiations and policy debates: Companies are participating in policy discussions to influence trade agreements and reduce the uncertainty created by tariffs.

- Collaboration with industry associations to address common concerns: Industry groups are working together to address the collective challenges posed by tariffs and advocate for policies that support business growth.

Conclusion

This analysis has demonstrated how tariffs are creating significant uncertainty, negatively impacting valuations, and ultimately discouraging companies from pursuing Initial Public Offerings. The unpredictable nature of tariffs increases risk, reduces investor confidence, and disrupts global supply chains, making it a challenging environment for companies seeking to go public. The implications are substantial for economic growth and capital formation. The decrease in IPO activity reflects a broader concern about the long-term consequences of trade wars and highlights the need for stable and predictable trade policies. Further research into the long-term effects of tariffs on IPOs is needed to inform policymakers and businesses alike. Understanding the impact of tariffs on Initial Public Offerings is crucial for investors, entrepreneurs, and policymakers. Continue to follow developments in the global trade landscape to gauge the future of IPOs in this dynamic environment.

Featured Posts

-

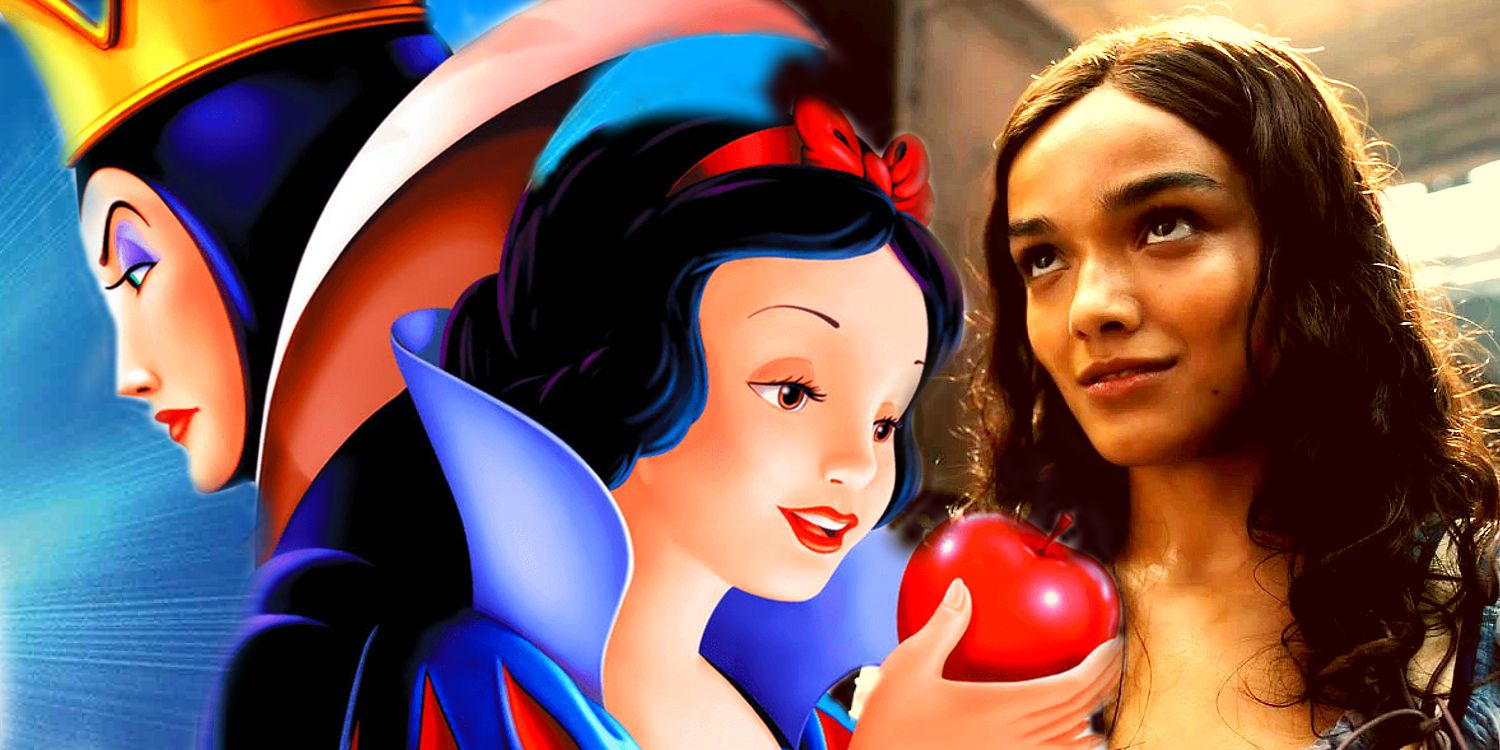

Addressing Concerns Disneys Updated Snow White Remake

May 14, 2025

Addressing Concerns Disneys Updated Snow White Remake

May 14, 2025 -

Celine Dion And Eurovision News And Updates Ahead Of The Final

May 14, 2025

Celine Dion And Eurovision News And Updates Ahead Of The Final

May 14, 2025 -

Saechsische Schweiz Umfangreiche Naturschutzbemuehungen Mit 190 000 Neu Gepflanzten Baeumen

May 14, 2025

Saechsische Schweiz Umfangreiche Naturschutzbemuehungen Mit 190 000 Neu Gepflanzten Baeumen

May 14, 2025 -

Eurojackpotin Potti Laehes 54 Miljoonaa Euroa Voitettavissa

May 14, 2025

Eurojackpotin Potti Laehes 54 Miljoonaa Euroa Voitettavissa

May 14, 2025 -

Nuit Des Musees 2025 Exposition Mode Au Petit Palais

May 14, 2025

Nuit Des Musees 2025 Exposition Mode Au Petit Palais

May 14, 2025