Analysis Of CoreWeave (CRWV) Stock's Sharp Rise Last Week

Table of Contents

The Role of Artificial Intelligence (AI) in CRWV's Surge

The burgeoning field of artificial intelligence is a primary catalyst for CoreWeave's recent success. The explosive growth of AI, particularly in machine learning and deep learning applications, demands immense computing power. This demand fuels the need for robust cloud computing infrastructure, a space where CoreWeave excels. CoreWeave's data centers, heavily reliant on Graphics Processing Units (GPUs), are perfectly positioned to capitalize on this surge in AI-driven workloads. Their high-performance computing capabilities are particularly attractive to companies developing and deploying sophisticated AI models.

- CoreWeave's infrastructure is uniquely suited to the demands of AI: Their GPU-optimized cloud platform provides the processing power required for training complex AI models, significantly reducing development time and costs for clients.

- Competitive advantage in the AI cloud computing market: CoreWeave distinguishes itself through its specialized infrastructure, focusing on the specific needs of AI development and deployment, setting it apart from general-purpose cloud providers.

- Strategic partnerships and contracts: While specific details might be limited at this stage, the company's strategic focus on the AI sector suggests it is securing key partnerships and contracts that contribute to revenue growth and investor confidence. Future announcements in this area will likely further boost CRWV's stock price.

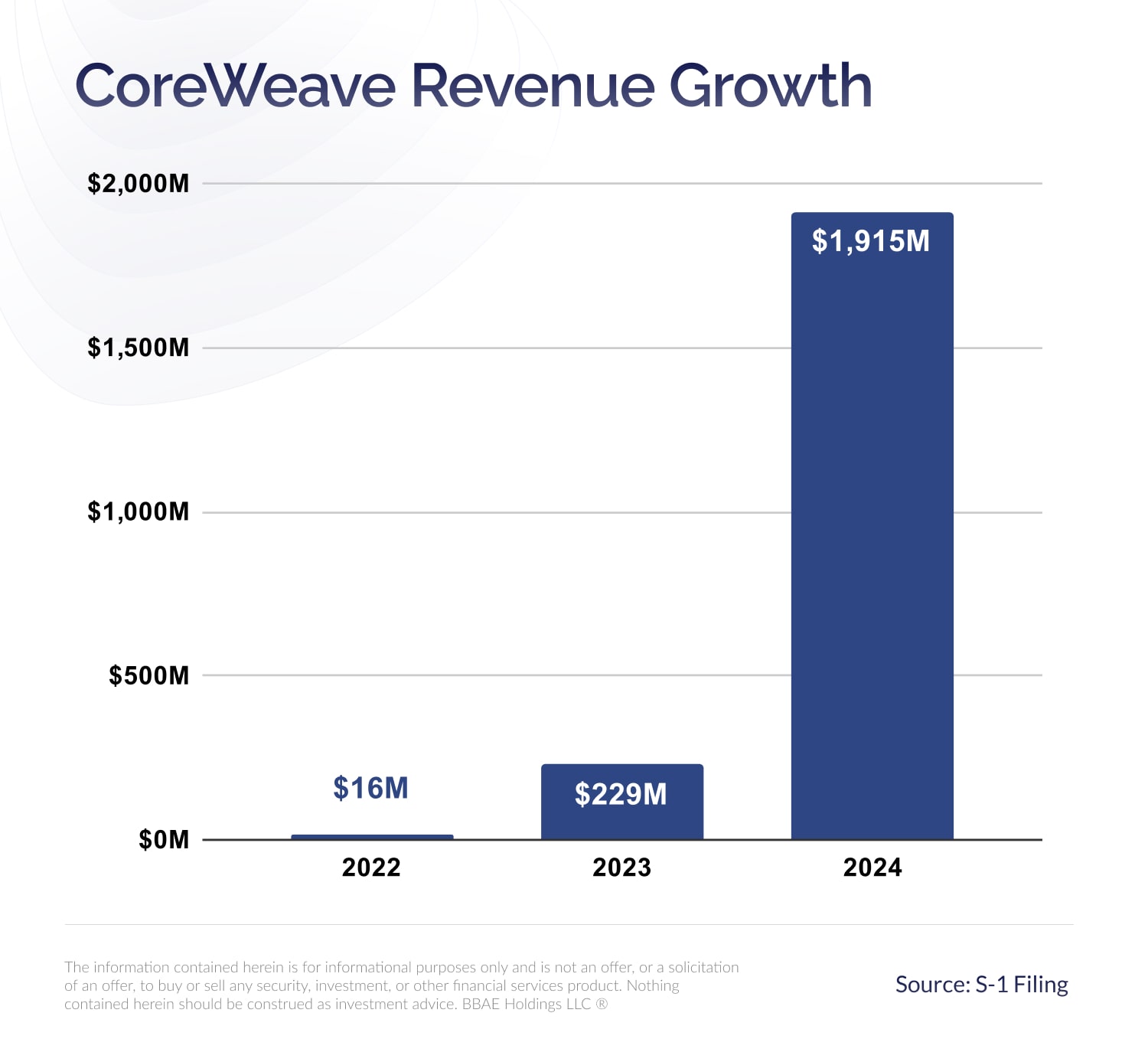

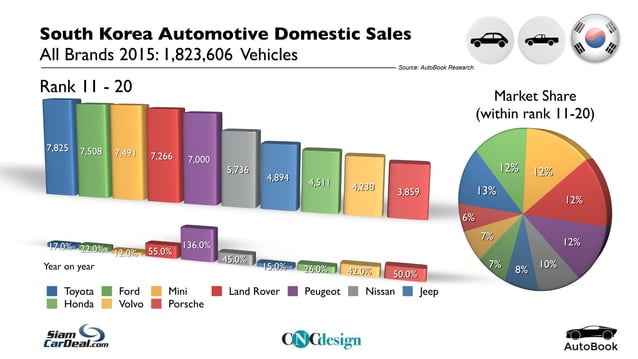

Analyzing CoreWeave's (CRWV) Recent Financial Performance

While specific financial details may require referencing CoreWeave's official reports, the recent stock surge suggests positive financial performance. Strong revenue growth, fueled by the increasing demand for its AI-focused cloud services, is likely a major contributor. Increased profitability, exceeding market expectations, would further bolster investor sentiment and drive the stock price upward.

- Revenue growth: Analyzing quarter-over-quarter and year-over-year revenue growth will reveal the extent of CoreWeave's success in capturing market share within the expanding AI cloud computing sector.

- Earnings surprises: Positive earnings surprises – exceeding analyst predictions – are a powerful driver of stock price increases, signaling strong financial health and future potential.

- Impact on investor confidence: Strong financial performance directly translates into increased investor confidence, leading to higher demand for CRWV stock and subsequently driving up its price.

Market Sentiment and Speculation Surrounding CRWV

The sharp rise in CRWV's stock price is also influenced by broader market sentiment and speculation. Positive news coverage highlighting CoreWeave's technological advancements and market position likely contributed to the increased investor interest. Analyst upgrades and upward revisions of price targets further fueled the positive momentum. The overall positive sentiment towards the tech sector, particularly companies involved in AI and cloud computing, also played a significant role.

- Media impact: Positive media coverage amplifies the narrative surrounding CoreWeave’s success, attracting new investors and reinforcing confidence among existing stakeholders.

- Analyst ratings: Upward revisions in analyst ratings and increased price targets signal a positive outlook on the company’s future prospects, boosting investor confidence and increasing demand.

- Broader market trends: Positive sentiment within the tech sector, particularly AI and cloud computing, creates a favorable environment for companies like CoreWeave to thrive and see their stock prices appreciate.

Potential Risks and Future Outlook for CoreWeave (CRWV)

While the outlook for CoreWeave appears promising, investors should acknowledge potential risks. Intense competition exists within the cloud computing market, with established players and new entrants vying for market share. Market volatility, inherent in the technology sector, could impact CRWV's stock price. Furthermore, as a relatively new public company, CoreWeave faces the inherent risks associated with growth and expansion.

- Competition: Analyzing the competitive landscape, including the strengths and weaknesses of major competitors like AWS, Azure, and Google Cloud, is crucial for understanding CoreWeave's long-term prospects.

- Future growth potential: While the AI market offers immense potential, CoreWeave's ability to consistently innovate and meet evolving market demands will determine its future growth trajectory.

- Market volatility and risk: Investors should understand that the technology sector is susceptible to significant price fluctuations, requiring a long-term perspective and careful risk management.

Conclusion

CoreWeave's (CRWV) remarkable stock price surge last week can be attributed to a confluence of factors. The increasing demand for AI computing power, strong (presumed) financial performance, and positive market sentiment all played significant roles. However, potential risks associated with competition, market volatility, and the inherent uncertainties of a relatively new public company should be considered. Before making any investment decisions, thorough due diligence is paramount. Learn more about CoreWeave (CRWV) and analyze its potential within the rapidly expanding AI market. Remember to conduct your own research and consider CoreWeave as part of a diversified investment strategy.

Featured Posts

-

The Love Monster Within How To Cultivate Self Love And Acceptance

May 22, 2025

The Love Monster Within How To Cultivate Self Love And Acceptance

May 22, 2025 -

Understanding The Allegations The Blake Lively Case

May 22, 2025

Understanding The Allegations The Blake Lively Case

May 22, 2025 -

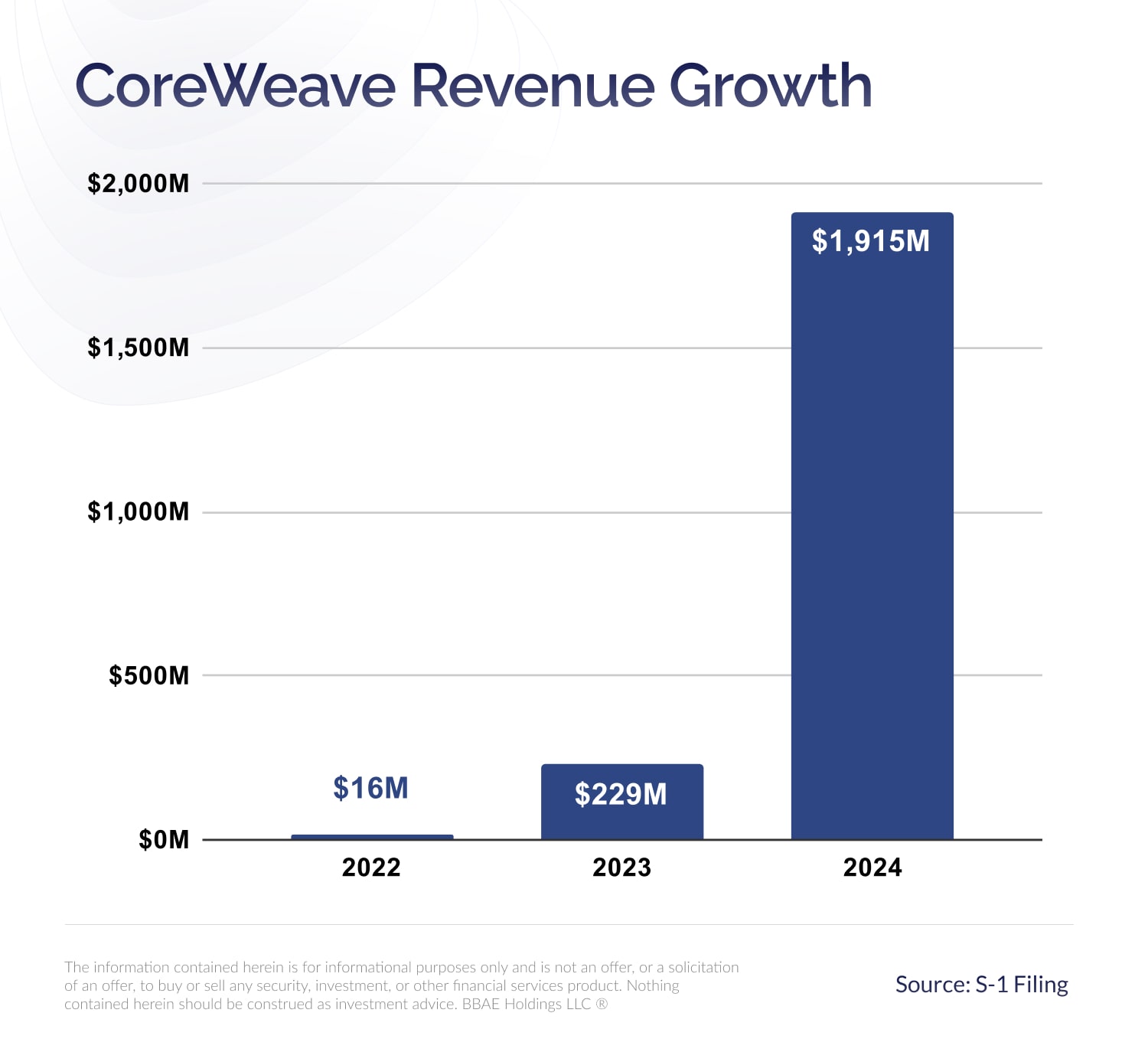

Chinas Impact On Bmw And Porsche Market Share And Future Outlook

May 22, 2025

Chinas Impact On Bmw And Porsche Market Share And Future Outlook

May 22, 2025 -

New Netflix Drama White Lotus And Oscar Winning Star Headline Darkly Funny Series

May 22, 2025

New Netflix Drama White Lotus And Oscar Winning Star Headline Darkly Funny Series

May 22, 2025 -

Switzerlands Official Statement On Prc Military Activities

May 22, 2025

Switzerlands Official Statement On Prc Military Activities

May 22, 2025

Latest Posts

-

Washington D C Terror Attack Remembering Yaron And Sara

May 22, 2025

Washington D C Terror Attack Remembering Yaron And Sara

May 22, 2025 -

Suspect Arrested In Killing Of Embassy Employees Lischinsky And Milgram

May 22, 2025

Suspect Arrested In Killing Of Embassy Employees Lischinsky And Milgram

May 22, 2025 -

Rossiyskaya Agressiya Senat S Sh A Rassmatrivaet Usilenie Sanktsiy

May 22, 2025

Rossiyskaya Agressiya Senat S Sh A Rassmatrivaet Usilenie Sanktsiy

May 22, 2025 -

London Israeli Embassy Staff Fear Repeat Of Us Terrorist Attack

May 22, 2025

London Israeli Embassy Staff Fear Repeat Of Us Terrorist Attack

May 22, 2025 -

Zakonoproekt Grem Posilennya Sanktsiynogo Tisku Na Rosiyu

May 22, 2025

Zakonoproekt Grem Posilennya Sanktsiynogo Tisku Na Rosiyu

May 22, 2025