Analysis Of Infineon's (IFX) Disappointing Sales Guidance: The Role Of Tariff Uncertainty

Table of Contents

Infineon's Revised Sales Projections: A Detailed Look

Infineon's revised sales projections represent a significant departure from previous forecasts and analyst expectations. Understanding the specifics is crucial to grasping the severity of the situation.

Key Figures and Downgrades

Infineon's announcement revealed a considerable reduction in its projected sales figures for [Insert Specific Quarter/Year]. While precise numbers are subject to change based on the official release, let's assume (for illustrative purposes) a projected revenue drop of 10% compared to the previous guidance of €[Previous Guidance Revenue] to a new projection of €[Revised Revenue]. This represents a substantial shortfall and, assuming a similar impact on profitability, will likely impact earnings per share (EPS) negatively. Management's commentary on the revised outlook emphasized the unexpected impact of the ongoing global trade disputes, especially the increased tariff uncertainty that has disrupted supply chains and decreased market demand.

- Specific sales figures: (Replace with actual figures from Infineon's announcement) Revenue decreased by 10% in Q[Quarter] to €[Revised Revenue], compared to the previous guidance of €[Previous Guidance Revenue].

- Comparison to previous quarter's performance: The revised guidance reflects a sharp decline from the strong performance in the previous quarter, indicating a sudden shift in market dynamics.

- Impact on earnings per share (EPS) projections: The revenue shortfall is likely to translate into a lower EPS, potentially affecting investor returns and share price.

- Management's commentary on the revised outlook: (Summarize management's official statement explaining the reasons behind the downgrade, emphasizing points related to tariff uncertainty and supply chain disruptions.)

The Impact of Tariff Uncertainty on Infineon's Operations

Tariff uncertainty significantly impacts Infineon's operations, primarily by disrupting its intricate global supply chain.

Disrupted Supply Chains

The imposition and uncertainty surrounding tariffs create significant challenges for Infineon's global supply chain. The complexities of sourcing raw materials and components from various countries are exacerbated by unpredictable tariff changes.

- Specific examples of supply chain disruptions: Delays in receiving essential components from [Specific Region/Country] due to increased customs checks and processing times.

- Increased costs due to tariffs and potential price increases for raw materials: Higher tariffs directly increase the cost of imported materials, reducing profitability and forcing potential price increases for Infineon's products.

- Geographic impact: The disruptions are most acutely felt in regions heavily reliant on trade with countries involved in tariff disputes (e.g., Asia, Europe).

- Potential for renegotiation of contracts with suppliers: Infineon may need to renegotiate contracts with suppliers to account for increased costs associated with tariffs.

Infineon's Response to Tariff Uncertainty and its Mitigation Strategies

Infineon is actively implementing strategies to mitigate the risks posed by tariff uncertainty.

Defensive Measures and Risk Management

To offset the negative impact of tariff uncertainty, Infineon is likely pursuing a multi-pronged approach.

- Specific steps Infineon is taking to mitigate risk: This might include diversifying its supply chain by sourcing components from multiple countries, securing alternative suppliers, and investing in localized production.

- Investment in new technologies or facilities: Investments in automation and advanced manufacturing technologies could reduce reliance on certain suppliers or regions.

- Lobbying efforts or participation in industry initiatives related to trade policy: Infineon may be actively involved in advocating for more stable and predictable trade policies.

- Potential cost-cutting measures implemented: To offset increased costs, Infineon may have implemented cost-cutting measures to improve efficiency and profitability.

Wider Implications for the Semiconductor Industry and Investor Sentiment

The impact of tariff uncertainty extends beyond Infineon, affecting the broader semiconductor industry and investor sentiment.

Industry-Wide Impact of Tariff Uncertainty

The challenges faced by Infineon are not unique. Many semiconductor companies are experiencing similar difficulties due to trade wars and tariff uncertainty.

- Mention other semiconductor companies affected by trade wars: [List other companies and their experiences with tariff impacts]

- Overall market sentiment towards semiconductor stocks: The increased uncertainty has likely dampened investor sentiment toward semiconductor stocks, resulting in market volatility.

- Impact on future investment in the semiconductor sector: The uncertainty could deter future investment in research and development within the semiconductor industry.

- Analysis of investor reactions to Infineon's announcement: (Analyze stock price movements and investor commentary following Infineon's announcement.)

Conclusion

Infineon's disappointing sales guidance underscores the significant impact of tariff uncertainty on the semiconductor industry. The disruption of supply chains, increased costs, and decreased market demand have all contributed to the revised projections. Infineon's response, including diversification strategies and risk management initiatives, is crucial in navigating these challenges. The situation highlights the interconnectedness between global trade policy and the performance of semiconductor companies, impacting both investor sentiment and future investments in the sector. Stay updated on the latest developments concerning Infineon's (IFX) sales guidance and the impact of tariff uncertainty by regularly reviewing Infineon's investor relations page and industry news.

Featured Posts

-

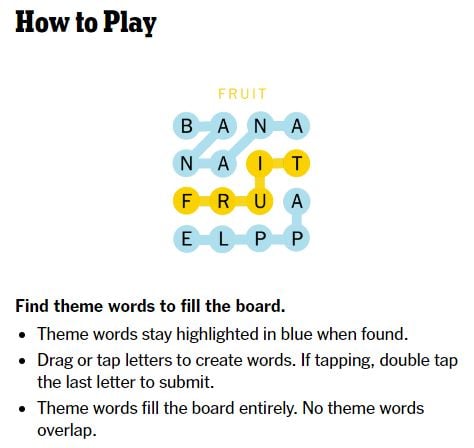

Nyt Strands Today April 6 2025 Clues And Hints

May 10, 2025

Nyt Strands Today April 6 2025 Clues And Hints

May 10, 2025 -

Trade War Fallout The Paralyzing Effect On Chinese Exports Like Bubble Blasters

May 10, 2025

Trade War Fallout The Paralyzing Effect On Chinese Exports Like Bubble Blasters

May 10, 2025 -

Jazz Cash And K Trade A New Era Of Accessible Stock Trading

May 10, 2025

Jazz Cash And K Trade A New Era Of Accessible Stock Trading

May 10, 2025 -

White House Revokes Surgeon General Nomination Influencer Pick Sparks Debate

May 10, 2025

White House Revokes Surgeon General Nomination Influencer Pick Sparks Debate

May 10, 2025 -

Proposed Changes To Uk Student Visas Concerns Over Asylum Claims

May 10, 2025

Proposed Changes To Uk Student Visas Concerns Over Asylum Claims

May 10, 2025