Analysis Of PwC's Pullout From Nine Sub-Saharan African Countries

Table of Contents

Reasons Behind PwC's Withdrawal

While PwC's official statement may cite overarching reasons, a deeper analysis reveals potential underlying factors contributing to their decision. Understanding these factors is crucial to grasping the full implications of this withdrawal.

-

Official Statement: [Insert and cite PwC's official statement here. Paraphrase and summarize the key points, avoiding direct plagiarism]. This statement likely highlights the challenges faced by the firm in the specific countries involved.

-

Underlying Factors: Several factors likely contributed to this decision:

-

Challenges in Regulatory Compliance: Navigating the diverse and sometimes complex regulatory landscapes across different Sub-Saharan African countries can be exceptionally challenging. Inconsistent standards, bureaucratic hurdles, and frequent changes in regulations create significant operational burdens and increase compliance costs for multinational firms like PwC.

-

Concerns Regarding Operational Risks and Security: Security concerns, including political instability, civil unrest, and even cybersecurity threats, present significant operational risks in certain Sub-Saharan African nations. These risks can affect staff safety, data security, and the overall feasibility of operations.

-

Financial Viability and Profitability: The profitability of PwC's operations in the affected countries might have fallen below expectations. Factors such as economic downturns, limited client base, and intense competition could have influenced this decision.

-

Impact of Global Economic Conditions and Reduced Demand: The global economic climate, including factors like inflation and recessionary pressures, likely played a role. Reduced demand for auditing and consulting services in these specific markets might have made continued operation unsustainable.

-

Competition from Other Accounting and Consulting Firms: Intense competition from other major accounting firms and local players vying for market share in Sub-Saharan Africa also played a part. This competitive pressure may have reduced PwC's profitability and prompted a strategic reassessment of its presence in the region.

-

Impact on the Affected Countries

PwC's withdrawal will likely have significant consequences for the nine affected countries. The ripple effects will be felt across multiple sectors and will hinder economic growth.

-

Consequences for Affected Nations:

-

Loss of Skilled Auditing and Consulting Expertise: The departure of PwC represents a substantial loss of skilled professionals in auditing, accounting, and consulting. This expertise gap will impact local businesses and government agencies alike.

-

Impact on Foreign Investment and Investor Confidence: The decision may negatively affect foreign investment and investor confidence. PwC's presence is often seen as a signal of stability and credibility, and its withdrawal may raise concerns about the business environment in the affected countries.

-

Potential Disruption to Local Businesses and Financial Markets: Local businesses that relied on PwC for auditing, taxation, and consulting services will face disruptions, potentially impacting their operations and financial stability. This could also lead to uncertainty and volatility in local financial markets.

-

Challenges for Government Agencies Reliant on PwC's Services: Government agencies that utilized PwC's services for auditing public finances, providing consulting advice, or undertaking other crucial projects will now need to find alternative providers, which may take considerable time and resources.

-

-

Ripple Effect on Related Industries: The impact extends beyond the immediate clients of PwC. Related industries, such as banking, finance, and legal services, will also experience repercussions, impacting the overall economic health of the affected nations.

Alternative Perspectives and Analyses

Various stakeholders offer different interpretations of PwC's decision. While PwC emphasizes strategic reasons, some analysts suggest broader economic and political factors are at play. Considering these alternative perspectives provides a more nuanced understanding of the situation.

- Diverse Viewpoints: Financial analysts may highlight the financial strain of operating in challenging markets, while business leaders might focus on the risks associated with security and regulatory compliance. Government officials may express concerns about the loss of crucial services and the implications for their economies.

The Future of PwC's Presence in Sub-Saharan Africa

PwC's future strategy in Sub-Saharan Africa remains uncertain. While they have withdrawn from nine countries, their presence in other parts of the continent remains significant.

- Future Strategy: The firm's long-term strategy might involve focusing resources on countries with more stable political and economic environments, stronger regulatory frameworks, and greater potential for growth. This could lead to further consolidation and selective expansion in the region.

Conclusion: Understanding PwC's Pullout from Sub-Saharan Africa

PwC's withdrawal from nine Sub-Saharan African countries marks a significant event with far-reaching consequences. The decision reflects a complex interplay of factors, including regulatory challenges, operational risks, financial viability concerns, and intense competition. The impact on the affected countries is potentially substantial, affecting foreign investment, local businesses, and government agencies. The long-term effects on PwC's Sub-Saharan African operations, the broader accounting industry, and the region's economic development remain to be seen. To better understand the ramifications of this decision, we encourage readers to continue following the unfolding situation, research further into the implications of this event for PwC's withdrawal from Africa, and consider the long-term effects on the business landscape in Sub-Saharan Africa and the broader global market.

Featured Posts

-

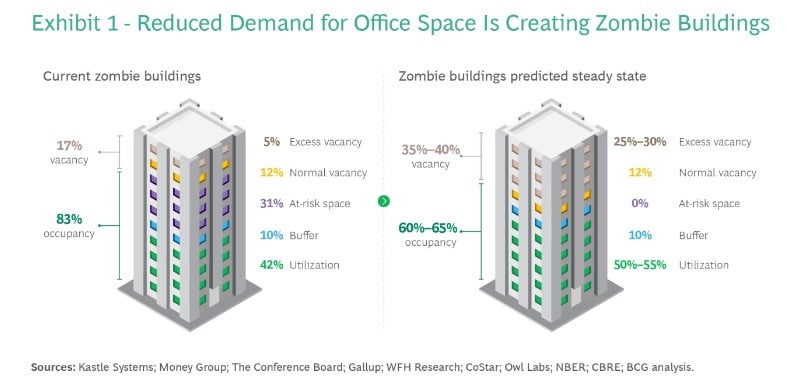

The Impact Of Zombie Office Buildings On Chicagos Real Estate Market

Apr 29, 2025

The Impact Of Zombie Office Buildings On Chicagos Real Estate Market

Apr 29, 2025 -

Investigation Launched After Georgian Man Allegedly Sets Wife On Fire In Germany

Apr 29, 2025

Investigation Launched After Georgian Man Allegedly Sets Wife On Fire In Germany

Apr 29, 2025 -

Brit Paralympian Missing At Wrestle Mania Found Safe

Apr 29, 2025

Brit Paralympian Missing At Wrestle Mania Found Safe

Apr 29, 2025 -

Solve The Nyt Spelling Bee April 27 2025 Clues And Strategies

Apr 29, 2025

Solve The Nyt Spelling Bee April 27 2025 Clues And Strategies

Apr 29, 2025 -

The Impact Of The 2012 Louisville Tornado A Retrospective

Apr 29, 2025

The Impact Of The 2012 Louisville Tornado A Retrospective

Apr 29, 2025

Latest Posts

-

Sveti Valentin Iva Ekimova I Kontsertt Na Dscherya Y

Apr 29, 2025

Sveti Valentin Iva Ekimova I Kontsertt Na Dscherya Y

Apr 29, 2025 -

Aktualno Prof Iva Khristova Za Gripnata Epidemiya

Apr 29, 2025

Aktualno Prof Iva Khristova Za Gripnata Epidemiya

Apr 29, 2025 -

Prof Iva Khristova Za Gripa Nyama Vtora Vlna

Apr 29, 2025

Prof Iva Khristova Za Gripa Nyama Vtora Vlna

Apr 29, 2025 -

Gripna Vlna Ofitsialno Sobschenie Ot Prof Iva Khristova

Apr 29, 2025

Gripna Vlna Ofitsialno Sobschenie Ot Prof Iva Khristova

Apr 29, 2025 -

Ekspertno Mnenie Prof Iva Khristova Za Gripnata Vlna

Apr 29, 2025

Ekspertno Mnenie Prof Iva Khristova Za Gripnata Vlna

Apr 29, 2025