Analysis Of The Trump Tax Cut Bill Proposed By House Republicans

Table of Contents

The US economy's trajectory is deeply intertwined with its tax policies. Proposed tax cuts, while potentially stimulating growth, often carry risks of increased national debt and income inequality. This article delves into the specifics of the "Trump Tax Cut Bill Proposed by House Republicans," analyzing its key features, potential economic consequences, and political implications. Our goal is to provide a comprehensive overview, allowing readers to form their own informed opinions on this significant piece of proposed legislation.

Individual Income Tax Changes

Changes to Tax Brackets

The proposed Trump Tax Cut Bill aims to significantly alter individual income tax brackets. These "tax bracket adjustments" will impact "marginal tax rates" and, consequently, overall "individual tax liability" for different income groups.

- Example 1: The proposed bill might reduce the highest tax bracket from 37% to 35%, potentially benefiting high-income earners.

- Example 2: Conversely, lower tax brackets might see minimal changes or even slight increases, raising concerns about the bill's impact on lower and middle-income families.

- Standard Deduction and Exemptions: The bill might also include adjustments to standard deductions and personal exemptions, further influencing individual tax liabilities. Details on these changes are crucial to fully understanding the bill's effect. For example, an increased standard deduction could offset some of the impact of higher marginal rates for lower earners. The elimination of personal exemptions, however, could offset this benefit.

Impact on High-Income Earners vs. Low-Income Earners

Analyzing the "distributional effects" of the proposed tax changes reveals a potentially widening "income inequality." The proposed cuts are likely to disproportionately benefit high-income earners, leading to a decrease in their "tax burden."

- Statistical Evidence: Independent analyses are needed to provide concrete statistical evidence comparing the tax burden before and after implementation of the proposed changes across different income strata. This data would quantify the differences and highlight potential winners and losers.

- Political Implications: The differing impacts across income groups have major political implications. Critics argue that such disparities exacerbate existing inequalities, while proponents maintain that the economic growth spurred by the tax cuts will ultimately benefit everyone.

Corporate Tax Rate Reductions

Proposed Corporate Tax Rate

A central component of the proposed bill involves substantial "corporate tax cuts." The plan suggests lowering the corporate tax rate from its current level (e.g., 21%) to a significantly lower percentage (e.g., a hypothetical 15%). This reduction is intended to stimulate "business investment" and fuel "economic growth."

- Incentivizing Investment: Lower corporate taxes could encourage businesses to invest more in expansion, research and development, and job creation. This could lead to increased employment opportunities.

- Potential Drawbacks: However, lower rates could also lead to a decrease in government revenue, potentially increasing the "national debt" and impacting the government's ability to fund essential social programs.

International Implications

The proposed corporate tax rate changes hold significant "international implications," impacting "global competitiveness" and the flow of foreign investment.

- Comparison to Other Nations: Analyzing the proposed US rate in comparison to corporate tax rates in other developed nations is critical. A lower US rate might attract foreign investment but could also trigger accusations of creating a "tax haven" and unfair competition.

- Effect on Multinational Corporations: The changes would likely significantly impact multinational corporations, potentially altering their investment strategies and affecting the US trade balance. Companies might shift profits to take advantage of lower tax jurisdictions.

Economic Forecasts and Projections

Projected GDP Growth

Economic models predict varying levels of "GDP growth" following the implementation of the proposed tax cuts. These "economic stimulus" effects are a key justification for the bill, but projections vary widely.

- Data from Economic Models: Several independent economic organizations will publish forecasts. It's vital to critically examine the methodologies and assumptions underpinning these predictions.

- Positive and Negative Projections: Some models predict significant GDP growth, while others suggest the impact will be minimal or even negative. Understanding the range of possible outcomes is crucial.

Impact on the National Debt

A key area of concern is the "budgetary impact" and the potential long-term "sustainability" of the proposed tax cuts on the "national debt."

- Projected Changes in Revenue and Spending: An analysis of projected changes in government revenue and spending is essential to assess the potential increase in the fiscal deficit.

- Long-Term Consequences: The accumulation of debt could lead to higher interest rates, reduced government spending in other areas, and a diminished capacity to respond to future economic challenges.

Political and Policy Implications

Partisan Debate and Public Opinion

The "Trump Tax Cut Bill Proposed by House Republicans" has sparked intense "political debate," with Republicans generally supporting it and Democrats largely opposing it.

- Arguments For and Against: The debate centers on the distributional effects, the impact on the national debt, and the effectiveness of tax cuts as an economic stimulus. Public opinion is likely to be highly polarized.

- Likelihood of Passage: Analyzing the current political climate and the legislative process in Congress is crucial to predicting the bill's chances of becoming law.

Comparison to Previous Tax Legislation

Understanding the proposed bill requires comparing it with previous major US "tax reform" efforts.

- Similarities and Differences: Highlighting the similarities and differences between the proposed bill and past tax legislation can provide valuable insights into potential outcomes and policy precedents.

- Lessons Learned: Examining the successes and failures of previous tax reforms can help evaluate the potential long-term impact of the proposed bill.

Conclusion: Understanding the Trump Tax Cut Bill – A Call to Action

This analysis of the "Trump Tax Cut Bill Proposed by House Republicans" highlights significant potential impacts on individual tax liabilities, corporate profitability, economic growth, and the national debt. The proposed changes to tax brackets suggest a disproportionate benefit for high-income earners, while corporate tax cuts aim to incentivize investment. Economic forecasts show a range of possible outcomes, with some predicting substantial GDP growth and others forecasting a significant increase in the national debt. The political debate surrounding the bill is intensely partisan, and its ultimate success hinges on navigating the complexities of the legislative process.

Key Takeaways: The proposed bill presents a complex interplay of potential benefits and substantial risks. Careful consideration of its distributional effects, long-term fiscal implications, and international consequences is essential.

Call to Action: Learn more about the Trump Tax Cut Bill by researching independent analyses, contacting your representatives to voice your concerns, and engaging in informed public discussions about the proposed tax cuts. Staying informed is crucial for shaping the future of tax policy in the United States.

Featured Posts

-

Earth Series 1 Inferno A Comprehensive Guide

May 13, 2025

Earth Series 1 Inferno A Comprehensive Guide

May 13, 2025 -

Australia And Britain Hypocrisy In The Face Of Myanmars Crisis

May 13, 2025

Australia And Britain Hypocrisy In The Face Of Myanmars Crisis

May 13, 2025 -

Paso Robles Heat Advisory Temperature Forecasts And Safety Tips

May 13, 2025

Paso Robles Heat Advisory Temperature Forecasts And Safety Tips

May 13, 2025 -

Erneuter Einsatz An Braunschweiger Grundschule Entwarnung Nach Bombendrohung

May 13, 2025

Erneuter Einsatz An Braunschweiger Grundschule Entwarnung Nach Bombendrohung

May 13, 2025 -

Gov Abbotts Intervention Texas Rangers Probe Plano Islamic Center Project

May 13, 2025

Gov Abbotts Intervention Texas Rangers Probe Plano Islamic Center Project

May 13, 2025

Latest Posts

-

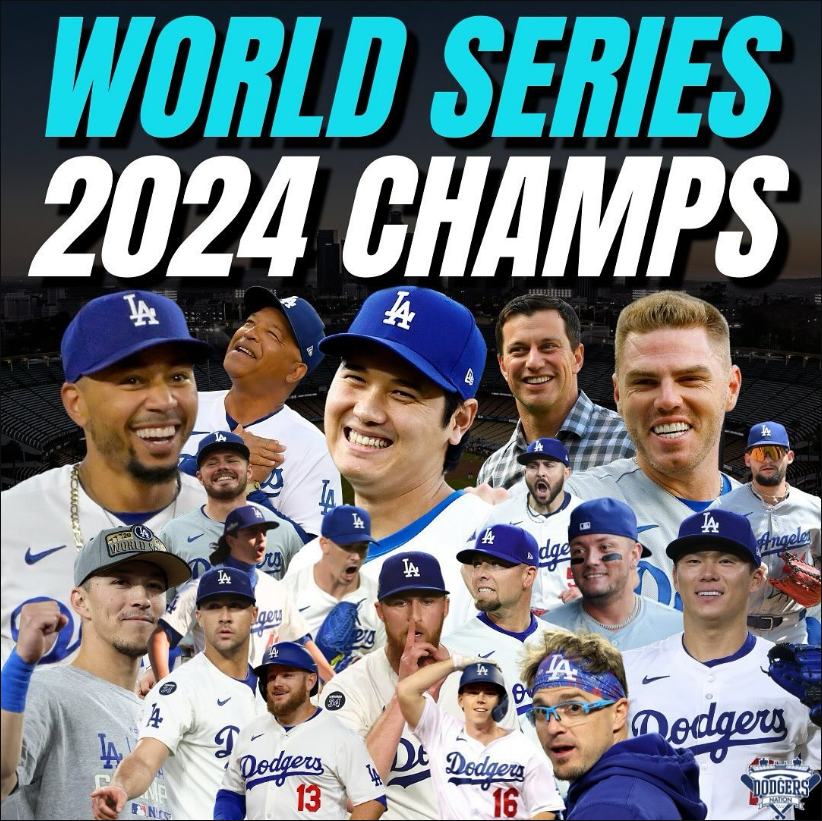

Dodgers Defeat Diamondbacks 14 11 Ohtanis Crucial Home Run

May 14, 2025

Dodgers Defeat Diamondbacks 14 11 Ohtanis Crucial Home Run

May 14, 2025 -

Dodgers Ohtani 3 Run Homer Fuels Comeback Win Against Diamondbacks

May 14, 2025

Dodgers Ohtani 3 Run Homer Fuels Comeback Win Against Diamondbacks

May 14, 2025 -

Ohtanis Late Game Heroics Power Dodgers To 14 11 Victory

May 14, 2025

Ohtanis Late Game Heroics Power Dodgers To 14 11 Victory

May 14, 2025 -

Ohtanis Power Surge 6 Run 9th Fuels Dodgers Comeback

May 14, 2025

Ohtanis Power Surge 6 Run 9th Fuels Dodgers Comeback

May 14, 2025 -

Dramatic Dodgers Win Ohtanis 6 Run 9th Seals Victory

May 14, 2025

Dramatic Dodgers Win Ohtanis 6 Run 9th Seals Victory

May 14, 2025