Analysis Of Trump's Oil Price Views: A Goldman Sachs Perspective

Table of Contents

Trump's Energy Policies and Their Initial Impact on Oil Prices

Trump's administration implemented several key energy policies that initially impacted oil prices. Goldman Sachs meticulously tracked these changes, offering insights into their predicted and actual effects.

Deregulation and Increased Domestic Production

A core tenet of Trump's energy platform was deregulation. This led to several key actions:

- Keystone XL Pipeline Approval: The approval of the Keystone XL pipeline, reversed under Obama, aimed to facilitate increased Canadian oil imports into the US, boosting overall supply.

- Easing of Environmental Regulations: Reduced environmental restrictions on drilling and extraction, particularly for shale oil, encouraged increased domestic production.

- Reduced Scrutiny on Fracking: Less stringent oversight on hydraulic fracturing (fracking) practices spurred further growth in US oil production.

Goldman Sachs, in numerous reports, predicted that these deregulatory measures would lead to a surge in US oil production and a subsequent impact on global supply and demand, ultimately influencing oil prices. While the exact figures varied across their publications, the overarching prediction consistently pointed towards a downward pressure on prices due to increased supply. These predictions were largely supported by observed increases in US oil production and, to a degree, lower global oil prices. Related keywords: US oil production, energy deregulation, Keystone XL pipeline, shale oil, fracking.

Withdrawal from the Paris Agreement

Trump's decision to withdraw the United States from the Paris Agreement on climate change had significant implications for the energy sector and, consequently, oil prices. Goldman Sachs analysts considered this move a significant factor influencing their forecasts.

- Reduced Commitment to Renewable Energy: The withdrawal signaled a lessened US commitment to renewable energy sources, potentially bolstering the continued reliance on fossil fuels.

- Impact on Global Climate Policy: The US withdrawal weakened the international commitment to reducing carbon emissions, potentially leading to higher global fossil fuel consumption.

Goldman Sachs likely factored in the potential for increased demand for oil as a result of this decision. Their analyses likely explored the interplay between reduced global climate action and the resulting effect on oil prices, acknowledging the complexity of forecasting in the face of such significant geopolitical shifts. Related keywords: Paris Agreement, climate change, global warming, carbon emissions.

Goldman Sachs' Forecasts and Analyses of Trump's Impact

Goldman Sachs, a leading financial institution, provided extensive commentary and forecasts regarding the impact of Trump's policies on oil prices. Analyzing their approach helps to understand the broader economic context.

Goldman Sachs' Predictions Before and During the Trump Presidency

Before Trump's election, Goldman Sachs likely offered baseline forecasts based on prevailing market conditions. During his presidency, their models needed to incorporate the changing policy landscape. Comparing these forecasts with the actual performance of the oil market offers insights into the accuracy of their models and the effectiveness of Trump's policies in influencing prices. Their reports likely detailed how various scenarios, factoring in different levels of deregulation and global cooperation, might play out in oil markets. Related keywords: Goldman Sachs forecast, oil price prediction, market analysis, economic modeling.

Key Factors Considered by Goldman Sachs

Goldman Sachs' analyses likely incorporated a multifaceted assessment of factors beyond just Trump's direct policies. These include:

- OPEC Decisions: The actions and production quotas of the Organization of the Petroleum Exporting Countries (OPEC) significantly influence global oil supply.

- Geopolitical Stability: Geopolitical instability in oil-producing regions (e.g., the Middle East) can disrupt supply and affect prices.

- Technological Advancements: Advances in oil extraction technologies (e.g., fracking) affect production costs and overall supply.

- Supply and Demand Dynamics: Basic economic principles of supply and demand remained central to Goldman Sachs' modeling.

Goldman Sachs’ sophisticated models likely integrated all these factors, weighting their relative importance to arrive at forecasts that attempted to capture the complex interplay between policy, geopolitics, and market forces. Related keywords: OPEC, geopolitical risk, energy technology, supply and demand.

Evaluating the Long-Term Effects of Trump's Oil Policies (Goldman Sachs Perspective)

Assessing the lasting impact of Trump's policies requires a long-term view, which Goldman Sachs likely considered in their post-presidency analyses.

Assessing the Lasting Impact of Trump's Deregulation on the US Energy Sector

The long-term effects of deregulation on the US energy sector remain a subject of ongoing debate. Goldman Sachs' analysis likely explored the potential for sustained growth in US oil production, the implications for energy independence, and the potential environmental consequences.

Analyzing the Long-Term Effects of the Withdrawal from the Paris Agreement on Global Oil Demand and Prices

The withdrawal's long-term impact on global oil demand is a complex issue, with Goldman Sachs likely considering both short-term gains in demand versus potential long-term shifts towards renewable energy sources driven by other global actors.

Goldman Sachs’ Predictions for Future Oil Price Trends in Light of Trump’s Legacy

Goldman Sachs' post-Trump analyses would likely include predictions for future oil price trends, considering the cumulative impact of his policies. These predictions would likely incorporate insights from their previous analyses, accounting for the lasting effects of deregulation and the US's reduced role in global climate agreements. Data and forecasts from these reports would provide crucial context to understand the long-term implications.

Conclusion: Recap and Call to Action

This analysis has explored the multifaceted impact of Donald Trump's energy policies on oil prices, as interpreted and forecasted by Goldman Sachs. We examined the immediate effects of deregulation and the withdrawal from the Paris Agreement, along with the key factors that Goldman Sachs considered in its analysis. While a full assessment of the lasting legacy requires further time and data, the initial impact was substantial. While Goldman Sachs' predictions might not have perfectly matched the actual market trajectory in all instances, their analysis offers a valuable framework for understanding the intricate relationship between political decision-making and global energy markets. To gain a deeper understanding of "Analysis of Trump's Oil Price Views: A Goldman Sachs Perspective," we strongly encourage readers to explore Goldman Sachs' official reports and publications directly. Further research into related publications on energy economics and geopolitical analysis will provide even more comprehensive insights.

Featured Posts

-

Seasoned Experts Aid Xis China In Securing Us Deal

May 15, 2025

Seasoned Experts Aid Xis China In Securing Us Deal

May 15, 2025 -

Why Middle Managers Matter Bridging The Gap Between Leadership And Teams

May 15, 2025

Why Middle Managers Matter Bridging The Gap Between Leadership And Teams

May 15, 2025 -

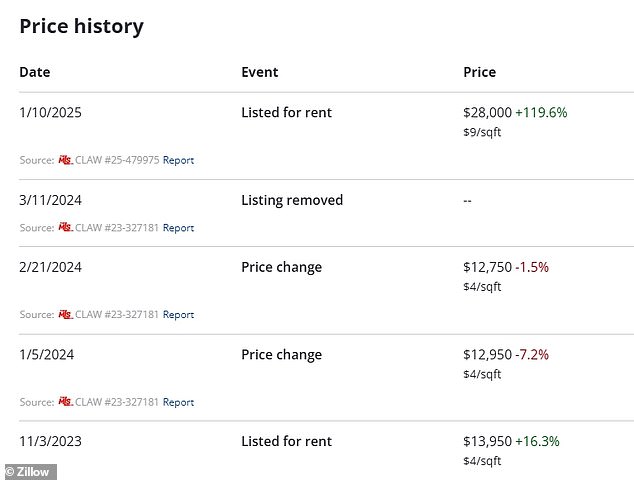

La Fires Landlords Accused Of Price Gouging Amidst Crisis

May 15, 2025

La Fires Landlords Accused Of Price Gouging Amidst Crisis

May 15, 2025 -

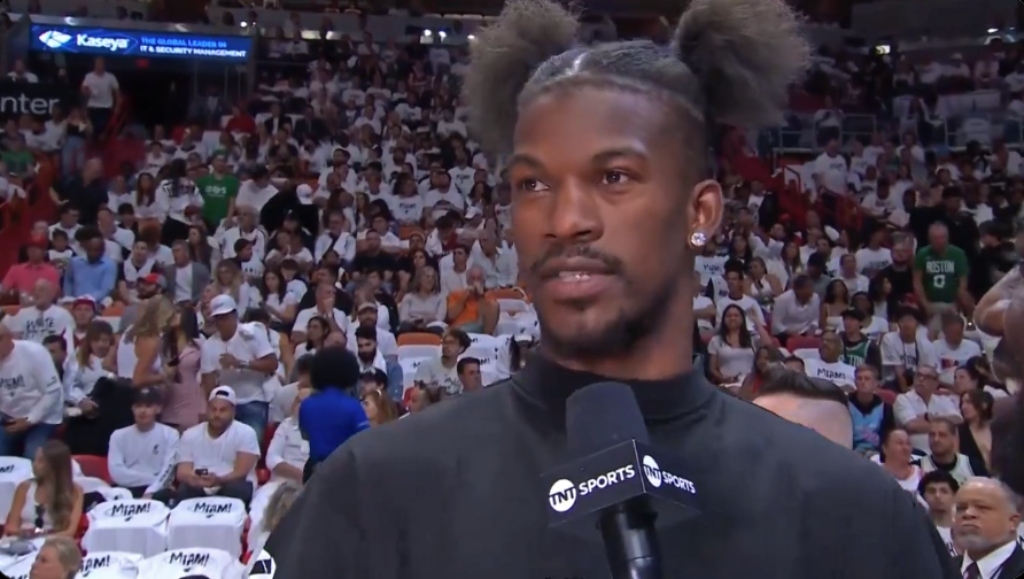

Heat Butler Jersey Number Rift A Hall Of Famers Perspective

May 15, 2025

Heat Butler Jersey Number Rift A Hall Of Famers Perspective

May 15, 2025 -

Jimmy Butler Leads Golden State Warriors To Win Over Houston Rockets

May 15, 2025

Jimmy Butler Leads Golden State Warriors To Win Over Houston Rockets

May 15, 2025

Latest Posts

-

Jimmy Butler Partners With Bigface To Offer Discount To Warriors Employees

May 15, 2025

Jimmy Butler Partners With Bigface To Offer Discount To Warriors Employees

May 15, 2025 -

Was Jimmy Butler Overwhelmed Evaluating His Need For Support In The Miami Heat Playoffs

May 15, 2025

Was Jimmy Butler Overwhelmed Evaluating His Need For Support In The Miami Heat Playoffs

May 15, 2025 -

Nba Fans React To Jimmy Butlers Injury Will He Play Against The Warriors

May 15, 2025

Nba Fans React To Jimmy Butlers Injury Will He Play Against The Warriors

May 15, 2025 -

Bigface Jimmy Butler Offers Employee Discount To Golden State Warriors Staff

May 15, 2025

Bigface Jimmy Butler Offers Employee Discount To Golden State Warriors Staff

May 15, 2025 -

Analyzing Jimmy Butlers Playoff Performance A Need For Help In Miami

May 15, 2025

Analyzing Jimmy Butlers Playoff Performance A Need For Help In Miami

May 15, 2025