Analysis: Recent XRP Whale Activity And Its Market Implications

Table of Contents

Identifying Significant XRP Whale Transactions

Tracking the actions of large XRP holders requires sophisticated methods. Understanding how these whales operate is key to analyzing market movements.

Tracking Large XRP Transfers

Several methodologies exist for tracking large XRP transactions. Blockchain analysis tools, such as those offered by various cryptocurrency analytics firms, provide valuable insights by monitoring on-chain data. Public databases and explorers, like those maintained by the XRP Ledger, offer a degree of transparency. However, accessing and interpreting this data requires technical expertise.

- Challenges in Identification: Pinpointing whales definitively is challenging due to the inherent privacy afforded by blockchain technology. Many large holders utilize multiple wallets and mixing services to obscure their activity.

- Specific Transaction Examples: For instance, a recent transfer of 100 million XRP (adjust with actual example if available) to an unknown wallet triggered a brief price dip. Analyzing the timing of such transactions relative to market price movements is crucial for identifying potential causal links, although correlation doesn't equal causation.

- Limitations of Blockchain Explorers: While blockchain explorers provide invaluable data, their limitations lie in the inability to definitively identify the individuals or entities behind the wallets. Further, interpreting the purpose of each transaction can be subjective.

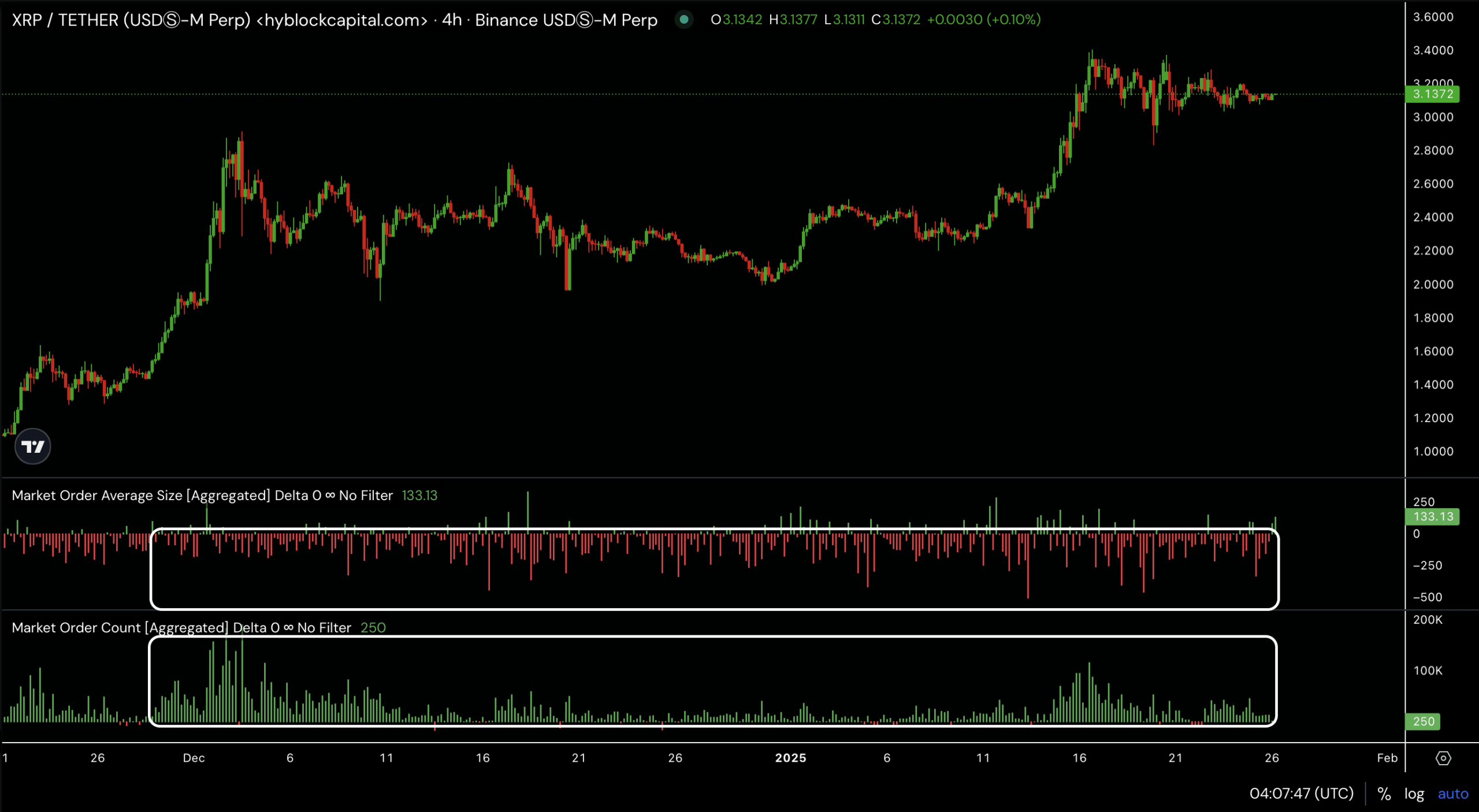

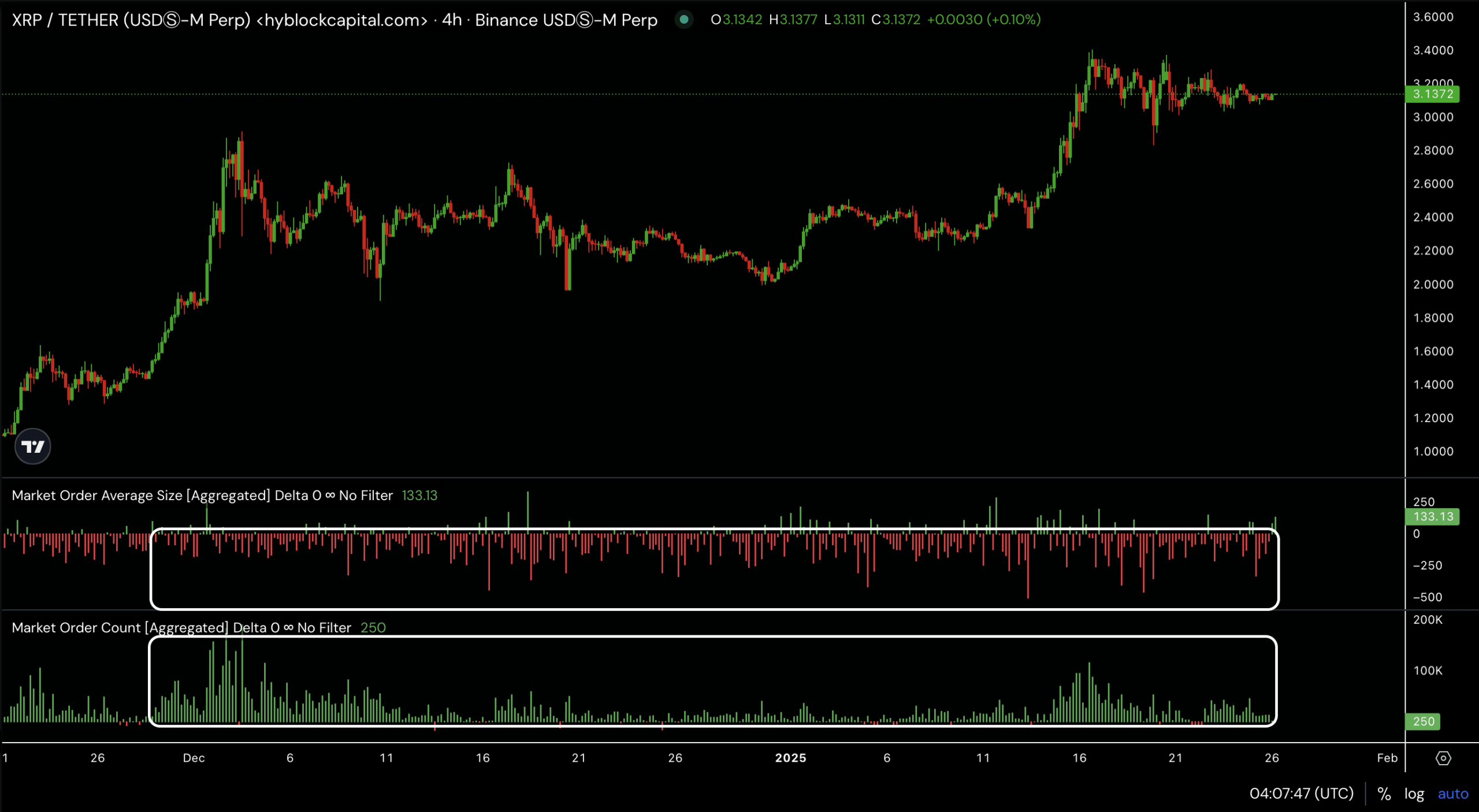

Analyzing the Volume and Frequency of Whale Activity

Analyzing the volume and frequency of XRP whale transactions provides a clearer picture of overall market dynamics.

- Volume Trends: Monitoring the volume of XRP transferred in large blocks over time reveals trends and patterns. For instance, a sudden increase in large transactions might suggest anticipation of significant market events or news.

- Comparison to Historical Patterns: Comparing current XRP whale activity with historical data allows for identifying anomalies and potential outliers. Understanding historical patterns provides a baseline for assessing the significance of recent activity.

- High or Low Activity: Determining whether current whale activity is unusually high or low compared to historical averages allows investors to better gauge the potential impact on the market.

Potential Market Implications of XRP Whale Activity

The actions of XRP whales can significantly impact both the price and the sentiment surrounding the cryptocurrency.

Impact on XRP Price Volatility

Large buy and sell orders by whales can drastically influence XRP price volatility.

- Influence of Buy/Sell Orders: When a whale makes a significant purchase, it can create buying pressure, driving up the price. Conversely, large sell-offs can trigger price drops, potentially leading to sell-offs by smaller investors.

- Market Depth and Manipulation: The depth of the XRP market plays a critical role. In shallow markets, whale activity can have a disproportionately large effect, raising concerns about potential price manipulation.

- Correlation Analysis: While a correlation between whale activity and subsequent price movements is often observed, establishing a definitive cause-and-effect relationship requires considering other market factors.

Influence on Market Sentiment and Investor Confidence

Whale activity significantly influences investor psychology.

- Signaling Market Trends: Large purchases can be interpreted as bullish signals, triggering fear of missing out (FOMO) among other investors. Conversely, large sell-offs can trigger fear and uncertainty.

- Psychological Impact: The sheer size of whale transactions can significantly impact investor confidence, sometimes leading to herd behavior and amplified price movements.

- Trading Volume and Liquidity: Whale activity often correlates with increased trading volume and potentially improved liquidity, but this isn't always the case, especially during periods of significant uncertainty.

Regulatory Scrutiny and its Influence on Whale Behavior

The regulatory landscape significantly impacts whale behavior and investment strategies.

The Role of Regulatory Uncertainty

The ongoing legal battle between Ripple and the SEC casts a long shadow over XRP and influences whale behavior.

- Impact of the Ripple/SEC Lawsuit: The uncertainty surrounding the regulatory status of XRP directly impacts investor confidence and influences whale decisions regarding holding or selling their XRP holdings.

- Regulatory Clarity and Investment Strategies: Greater regulatory clarity could lead to increased institutional investment in XRP, potentially reducing the influence of individual whales. Conversely, stricter regulations could curtail their ability to manipulate the market.

- Potential for Limiting Whale Influence: Increased regulatory oversight could introduce mechanisms to limit the disproportionate influence of whales on XRP's price, potentially promoting a more balanced and stable market.

Conclusion

This analysis of recent XRP whale activity highlights the significant influence these large holders can exert on the market. While pinpointing definitive cause-and-effect relationships remains challenging due to market complexities and the inherent difficulty of tracking all whale transactions, the analysis suggests a strong correlation between substantial XRP movements and subsequent price volatility and shifts in market sentiment. Understanding these patterns is crucial for navigating the XRP market.

Call to Action: Stay informed on future XRP whale activity and market trends to make well-informed investment decisions. Further research into XRP whale activity and its long-term market implications is essential for investors and market analysts alike. Continue monitoring the latest updates on XRP and whale movements to understand its ongoing impact. Keep a close eye on XRP whale transactions for valuable insights into market dynamics.

Featured Posts

-

Nba Star Jayson Tatum Welcomes Son With Singer Ella Mai

May 08, 2025

Nba Star Jayson Tatum Welcomes Son With Singer Ella Mai

May 08, 2025 -

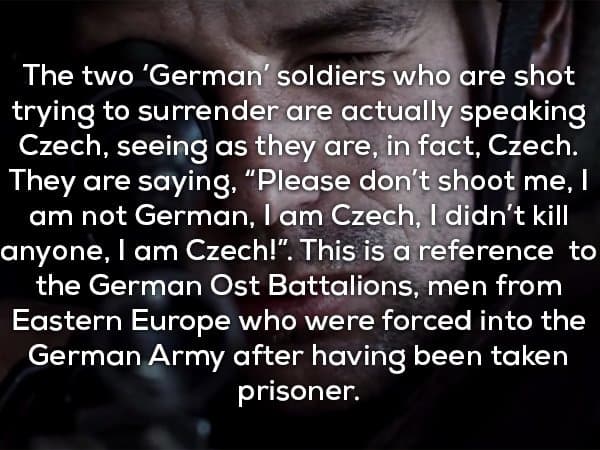

Do You Know These 20 Facts About Saving Private Ryan

May 08, 2025

Do You Know These 20 Facts About Saving Private Ryan

May 08, 2025 -

Understanding The Recent Xrp Rally The Trump Factor

May 08, 2025

Understanding The Recent Xrp Rally The Trump Factor

May 08, 2025 -

Lahwr Py Ays Ayl Ke Dwran Askwlwn Ke Awqat Kar Myn Tbdyly Ka Nwtyfkyshn Jary

May 08, 2025

Lahwr Py Ays Ayl Ke Dwran Askwlwn Ke Awqat Kar Myn Tbdyly Ka Nwtyfkyshn Jary

May 08, 2025 -

Rogue 2 Preview Ka Zars Fight For Survival In The Savage Land

May 08, 2025

Rogue 2 Preview Ka Zars Fight For Survival In The Savage Land

May 08, 2025