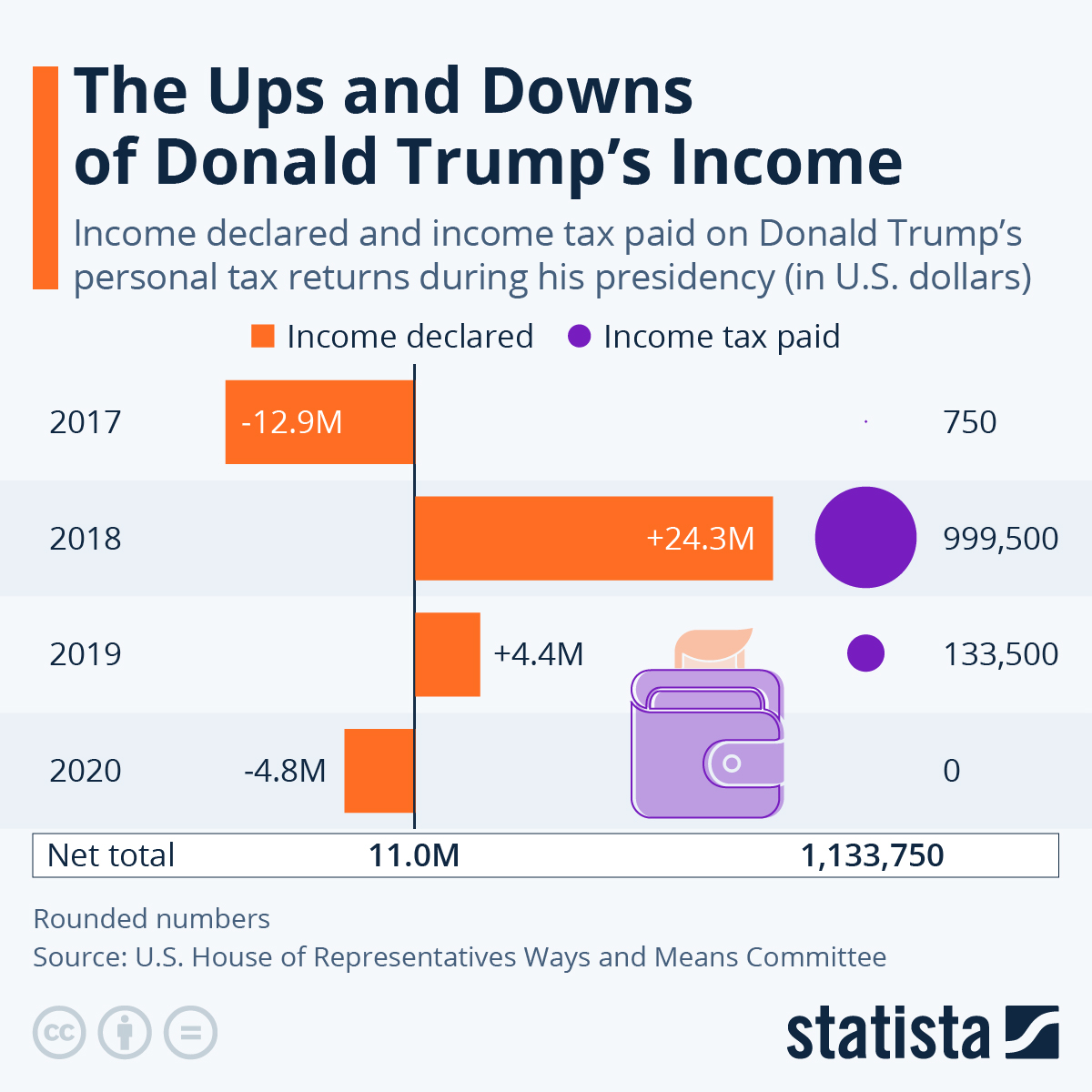

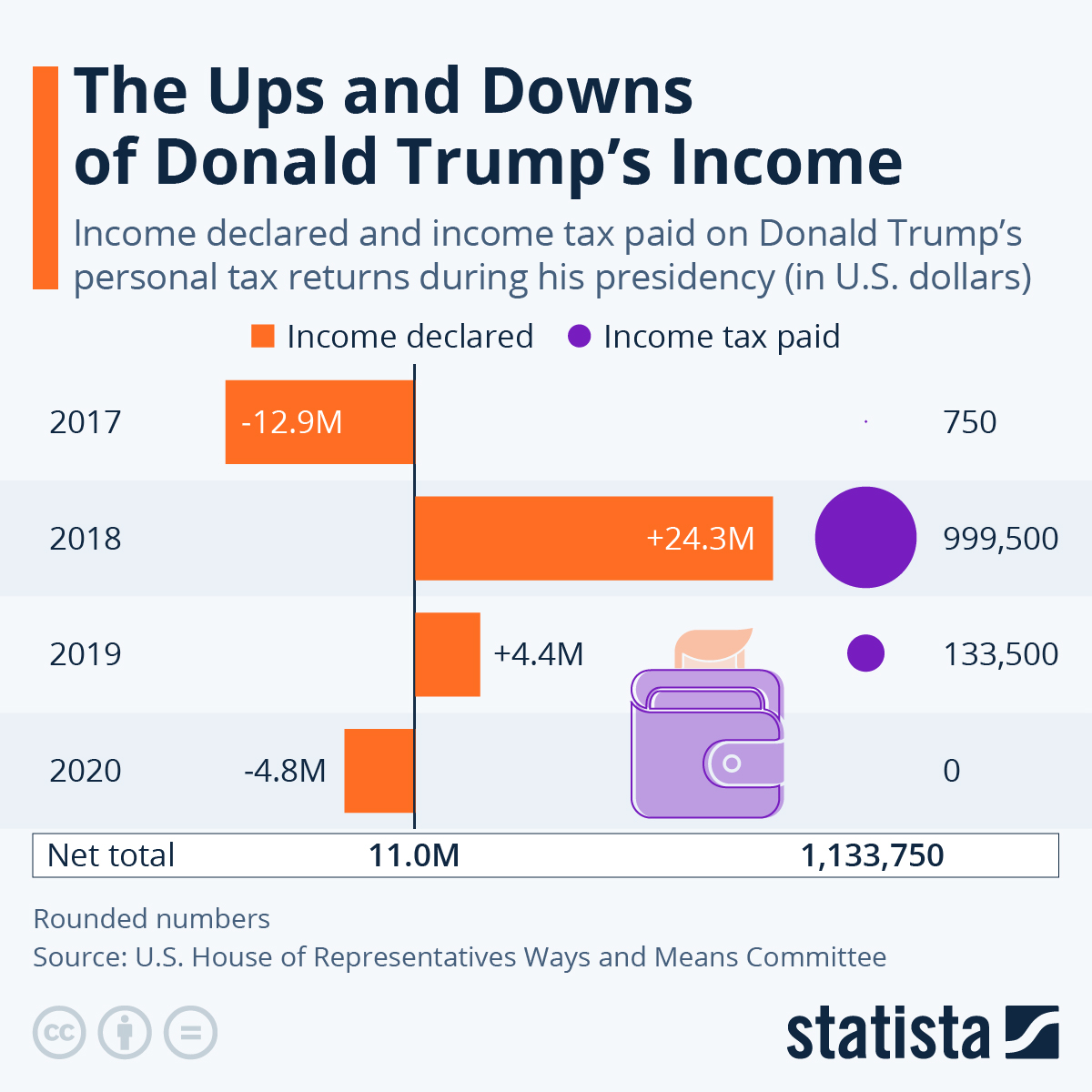

Analysis: The House GOP's Plan To Revise Trump's Tax Policies

Table of Contents

Key Proposals for Revising Trump's Tax Cuts

The House GOP's plan to revise Trump's tax policies involves a multifaceted approach, targeting individual income tax rates, corporate tax structures, and estate and gift taxes. These changes aim to address perceived shortcomings in the previous legislation and align the tax code with the party's current economic priorities.

Changes to Individual Income Tax Rates

The proposed revisions to individual income tax rates include adjustments to existing tax brackets, standard deductions, and other key provisions. Specifics remain fluid, but initial proposals suggest:

- Increased Tax Brackets: A potential increase in the number of tax brackets, potentially impacting higher-income earners.

- Adjusted Tax Rates: Changes to the percentage rates within each tax bracket, possibly leading to both tax increases and decreases depending on income level.

- Modified Standard Deduction: Potential alterations to the standard deduction amount, affecting the number of individuals who itemize their deductions. For example, a reduction in the standard deduction might incentivize more taxpayers to itemize.

- Limitations on Certain Deductions: Potential restrictions on itemized deductions, such as those for state and local taxes (SALT), further impacting individual tax liabilities.

These changes could significantly impact different income groups. Higher-income individuals might face increased tax burdens, while lower-income individuals may see minimal changes or even slight tax reductions depending on the specific details of the plan. Arguments for these changes center on increased revenue generation for government programs and a fairer distribution of the tax burden. Opponents argue they could stifle economic growth and disproportionately affect middle-class families.

Reforms to Corporate Tax Rates

The plan also proposes reforms to corporate tax rates and deductions, aiming to stimulate economic growth and attract investment. Potential changes include:

- Slight Increase in Corporate Tax Rate: A modest increase in the corporate tax rate compared to the rates under Trump's tax cuts.

- Modified Deductions for Businesses: Changes to deductions for research and development, capital expenditures, or other business expenses.

- Incentives for Domestic Investment: Potential tax incentives aimed at encouraging businesses to invest within the United States rather than overseas.

The projected impact on corporate profits and investment remains a subject of ongoing debate. Supporters believe a slight increase in the corporate tax rate will provide additional revenue without significantly hindering business growth. Critics argue it could discourage investment and lead to job losses. The ultimate impact hinges on the interplay between the adjusted tax rate and the specific nature of accompanying deductions and incentives.

Modifications to Estate and Gift Taxes

The proposed modifications to estate and gift taxes could significantly alter wealth transfer dynamics. The House GOP may propose:

- Lowering Estate and Gift Tax Exemptions: Reducing the amount of wealth that can be passed on tax-free to heirs.

- Increasing Estate and Gift Tax Rates: Raising the percentage rate applied to amounts exceeding the exemption.

These changes will have substantial distributional effects. Reducing exemptions and increasing rates would mainly impact high-net-worth individuals and families, potentially generating significant revenue for the government. Arguments for these changes often center on reducing income inequality and ensuring a fairer tax system. Opponents argue they could harm family businesses and discourage charitable giving.

Projected Economic Impacts of the Revised Tax Plan

The potential economic consequences of the House GOP's revised tax plan are complex and multifaceted. Analyzing the plan's potential impacts requires careful consideration of several key factors.

Impact on the National Debt

A crucial concern is the plan's potential effect on the national debt and budget deficit. The specific impact will depend on the magnitude of tax increases and the effectiveness of spending cuts (if any). Initial estimates suggest the plan could increase the national debt in the short term, though some analysts argue long-term economic growth could offset this in the future. However, concerns persist about fiscal responsibility and the long-term sustainability of the national debt.

Effects on Economic Growth

The impact on economic growth depends on how businesses and consumers respond to the changes. Proponents argue that targeted tax incentives could boost investment and job creation. Conversely, opponents worry that tax increases could dampen consumer spending and hinder overall economic growth. Economists will use various models, including macroeconomic simulations and econometric analysis, to predict the impact, but the uncertainty is considerable.

Distributional Effects (Impact on different income groups)

Understanding the distributional effects is critical. While some higher-income individuals might experience higher tax burdens, others could benefit from specific provisions. Lower-income individuals may see minimal change. Analyzing the overall impact on income inequality requires detailed modeling to assess the combined effects of all proposed changes. This analysis will reveal whether the plan exacerbates or alleviates existing income disparities.

Political Considerations and Potential for Passage

The political landscape will heavily influence the plan's passage. The House GOP's control of the House provides a clear path towards advancement, but reaching bipartisan agreement in the Senate remains a significant hurdle. Potential compromises and concessions might be necessary to secure the necessary votes for passage. Powerful lobbying groups and special interests will undoubtedly play a significant role, influencing the details of the legislation and its eventual fate.

Conclusion: Analysis: The House GOP's Plan to Revise Trump's Tax Policies

The House GOP's plan to revise Trump's tax policies presents a complex mix of potential economic and political consequences. While aiming to address perceived flaws in the existing system, the plan’s impact on the national debt, economic growth, and income inequality remains uncertain. The final shape of the legislation, and its ultimate success, will depend heavily on the ongoing political negotiations and the interplay of various economic factors. Understanding the implications of revising Trump's tax policies is crucial for the future of the US economy. Stay informed about Trump's tax policies, follow the debate on tax reform, and contact your representatives to voice your opinions on these crucial matters.

Featured Posts

-

Oakland Athletics Muncys Addition And Starting Role At Second Base

May 15, 2025

Oakland Athletics Muncys Addition And Starting Role At Second Base

May 15, 2025 -

Ohtani Delivers Walk Off Blow Dodgers Suffer 8 0 Defeat

May 15, 2025

Ohtani Delivers Walk Off Blow Dodgers Suffer 8 0 Defeat

May 15, 2025 -

Kritiek Op Frederieke Leeflang Actie Bij De Npo

May 15, 2025

Kritiek Op Frederieke Leeflang Actie Bij De Npo

May 15, 2025 -

8

May 15, 2025

8

May 15, 2025 -

Aanhoudende Klachten Over Angstcultuur Bij De Npo Onder Leiding Van Leeflang

May 15, 2025

Aanhoudende Klachten Over Angstcultuur Bij De Npo Onder Leiding Van Leeflang

May 15, 2025

Latest Posts

-

My Vont Weekend A Photo Journal April 4 6 2025

May 15, 2025

My Vont Weekend A Photo Journal April 4 6 2025

May 15, 2025 -

Relive Vont Weekend 2025 Photos From 107 1 Kiss Fm

May 15, 2025

Relive Vont Weekend 2025 Photos From 107 1 Kiss Fm

May 15, 2025 -

1 Kiss Fms Vont Weekend Photo Highlights April 4 6 2025

May 15, 2025

1 Kiss Fms Vont Weekend Photo Highlights April 4 6 2025

May 15, 2025 -

Vont Weekend 2025 Four Days In Pictures 107 1 Kiss Fm

May 15, 2025

Vont Weekend 2025 Four Days In Pictures 107 1 Kiss Fm

May 15, 2025 -

Five Photos Vont Weekend Recap 104 5 The Cat April 4 6 2025

May 15, 2025

Five Photos Vont Weekend Recap 104 5 The Cat April 4 6 2025

May 15, 2025