Analysis: The Republican Divisions Threatening Trump's Tax Agenda

Table of Contents

Internal GOP Conflicts Hampering Tax Reform

The Republican party, despite holding a unified Congressional majority during the Trump administration, is far from monolithic on the issue of tax reform. Significant ideological clashes and competing priorities have created deep fissures, hindering the smooth passage of Trump's tax proposals. These internal conflicts represent a major challenge to the success of the agenda.

The Freedom Caucus's Resistance

The House Freedom Caucus, a conservative faction known for its uncompromising stance, has emerged as a significant roadblock to Trump's tax plan. Their opposition stems from several key concerns:

- Specific Policy Objections: Members have voiced concerns about specific provisions, particularly those involving increased spending or perceived loopholes benefiting large corporations. They advocate for a more fiscally conservative approach, prioritizing debt reduction over expansive tax cuts.

- Concerns about the National Debt: The Freedom Caucus has consistently raised concerns about the long-term impact of the proposed tax cuts on the national debt. They argue that the cuts are not fiscally responsible and could exacerbate existing economic problems.

- Ideological Disagreements: Underlying these specific objections are fundamental ideological disagreements about the role of government and the appropriate level of taxation. The Freedom Caucus champions a smaller government, lower taxes, and limited government intervention in the economy.

Moderate Republicans' Concerns

While the Freedom Caucus represents the conservative wing, moderate Republicans also harbor significant reservations. Their concerns often focus on the potential negative consequences of the proposed tax cuts:

- Specific Policy Concerns: Moderate Republicans worry that the tax cuts disproportionately benefit wealthy individuals and corporations at the expense of the middle class. They advocate for more targeted tax reforms aimed at boosting the middle class.

- Calls for Alternative Approaches: They have pushed for alternative approaches to tax reform, often emphasizing measures that would provide more direct benefits to middle- and lower-income families.

- Potential Compromises: While opposed to the most extreme elements of the Freedom Caucus's position, they're also unwilling to simply accept the administration's plan without meaningful changes addressing concerns about income inequality.

Impact of Intra-Party Disputes on Legislative Process

The internal disputes within the Republican party have significantly hampered the legislative process surrounding Trump's tax agenda. The infighting has created substantial delays, increased uncertainty, and raised the possibility of complete failure.

Challenges in Reaching Consensus

Negotiating a compromise that satisfies all factions within the Republican party has proven exceptionally difficult. The differing priorities and entrenched positions of the various groups have made finding common ground extremely challenging.

- Examples of Failed Compromises: Numerous attempts at compromise have failed due to the inability of the various factions to bridge their fundamental disagreements. These failed negotiations have further eroded trust and exacerbated the divisions.

- Stalled Negotiations: The legislative process has been repeatedly stalled by intra-party disagreements, leading to extended delays and creating uncertainty about the future of the tax agenda.

- Lack of Sufficient Support in Congress: Even if a compromise is eventually reached, securing sufficient support in Congress to pass the legislation remains a significant challenge given the ongoing divisions within the Republican party.

Increased Risk of Failure

The intense intra-party conflicts have significantly increased the risk that Trump's tax agenda will either fail to pass Congress or will be significantly watered down in the process.

- Alternative Scenarios: Several alternative scenarios are possible, ranging from a complete failure to pass any significant tax reform to the passage of a significantly weakened version that fails to deliver on its promised economic benefits.

- Potential Consequences of Failure: The failure to enact the proposed tax cuts could have profound political and economic ramifications, undermining Trump's legacy and potentially triggering economic instability.

- Impact on the Economy: The inability to pass meaningful tax reform could negatively impact economic growth, investor confidence, and job creation.

Potential Consequences of Failure to Pass Trump's Tax Agenda

The failure to enact Trump's tax agenda would carry substantial political and economic consequences, impacting both the near-term and long-term prospects of the United States.

Political Fallout for Trump and the GOP

The failure of Trump's tax plan would deal a significant blow to his presidency and the Republican party's prospects in future elections.

- Damage to Public Image: Failure to deliver on a key campaign promise could significantly damage Trump's public image and erode public trust in his ability to govern effectively.

- Loss of Support Among Voters: The inability to pass tax reforms could lead to a loss of support among key voter segments, impacting Republican performance in upcoming elections, particularly the midterms.

- Impact on Midterm Elections: The failure of the tax agenda could negatively impact Republican performance in the midterm elections, potentially leading to a shift in power in Congress.

Economic Implications of Tax Plan Failure

The absence of Trump's proposed tax reforms could have significant negative consequences for the U.S. economy.

- Impact on Economic Growth: The failure to pass the proposed tax cuts could stifle economic growth, potentially slowing job creation and reducing overall investment.

- Effects on the Stock Market: The uncertainty surrounding tax reform and the potential for policy failure could negatively impact the stock market, leading to volatility and decreased investor confidence.

- Implications for Jobs and Investment: The absence of stimulative tax policies could lead to reduced job creation and decreased levels of both domestic and foreign investment.

Conclusion

Republican divisions pose a significant threat to the success of Trump's tax agenda. Intra-party conflicts are hindering the legislative process, creating challenges in reaching consensus and increasing the risk of failure or significantly weakened legislation. The potential consequences of this failure are considerable, impacting both the political landscape and the U.S. economy. Stay informed about the ongoing developments concerning Trump's tax agenda and the evolving political landscape. Understanding the intricacies of this situation is crucial for every American citizen, as the outcome will significantly impact the economy and the political future. Continue following updates on the Republican divisions threatening Trump's tax agenda to better understand its trajectory and potential impact.

Featured Posts

-

Rosenberg Slams Bank Of Canadas Monetary Policy As Too Timid

Apr 29, 2025

Rosenberg Slams Bank Of Canadas Monetary Policy As Too Timid

Apr 29, 2025 -

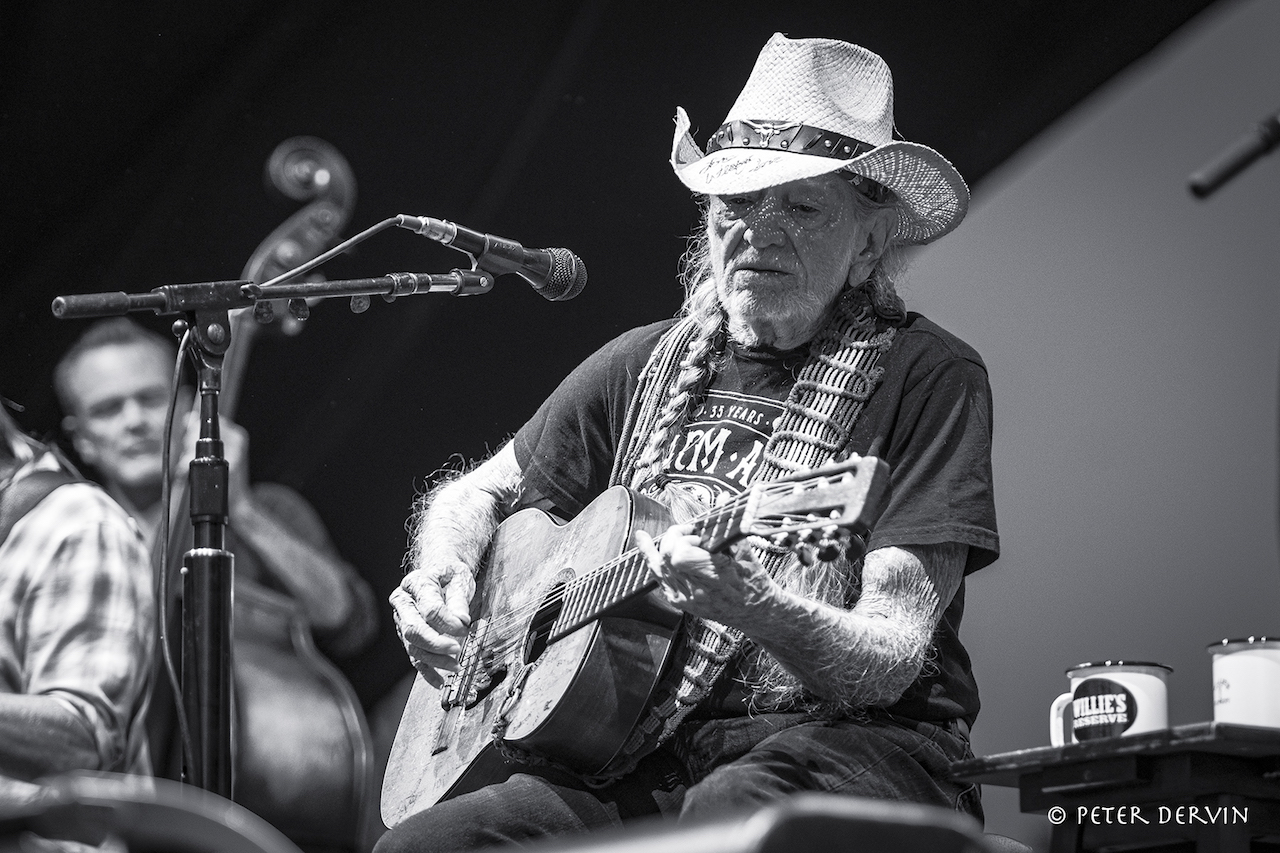

Willie Nelsons Life A Collection Of Fast Facts

Apr 29, 2025

Willie Nelsons Life A Collection Of Fast Facts

Apr 29, 2025 -

New York Times Spelling Bee April 1 2025 Complete Gameplay Guide

Apr 29, 2025

New York Times Spelling Bee April 1 2025 Complete Gameplay Guide

Apr 29, 2025 -

Ftc To Appeal Microsoft Activision Deal Ruling What Happens Next

Apr 29, 2025

Ftc To Appeal Microsoft Activision Deal Ruling What Happens Next

Apr 29, 2025 -

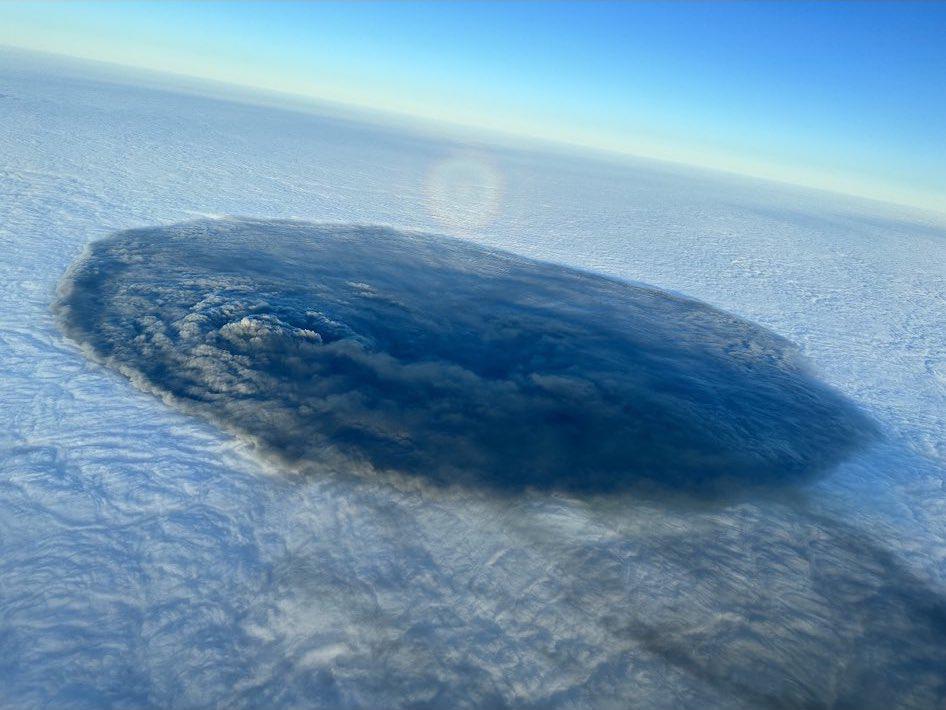

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Contamination Of Buildings

Apr 29, 2025

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Contamination Of Buildings

Apr 29, 2025

Latest Posts

-

Justin Herberts Chargers To Play In Brazil For 2025 Season Opener

Apr 29, 2025

Justin Herberts Chargers To Play In Brazil For 2025 Season Opener

Apr 29, 2025 -

Novak Djokovics Upset Loss To Alejandro Tabilo At Monte Carlo Masters 2025

Apr 29, 2025

Novak Djokovics Upset Loss To Alejandro Tabilo At Monte Carlo Masters 2025

Apr 29, 2025 -

Formacion Para La Garantia De Gol Con Alberto Ardila Olivares

Apr 29, 2025

Formacion Para La Garantia De Gol Con Alberto Ardila Olivares

Apr 29, 2025 -

2025 Nfl Season Justin Herbert Leads Chargers To Brazil

Apr 29, 2025

2025 Nfl Season Justin Herbert Leads Chargers To Brazil

Apr 29, 2025 -

Chargers To Kick Off 2025 Season In Brazil With Justin Herbert

Apr 29, 2025

Chargers To Kick Off 2025 Season In Brazil With Justin Herbert

Apr 29, 2025