Analyst Insight: Should You Buy This Entertainment Stock Now?

Table of Contents

Current Market Conditions and Their Impact on Entertainment Stocks

Market volatility significantly impacts entertainment stock prices. Understanding current market trends, including the influence of inflation, interest rates, and changing consumer behavior, is crucial before investing in entertainment industry stocks.

- Market Fluctuations: Recent market downturns have generally led to decreased valuations for entertainment stocks, presenting both opportunities and risks. However, a robust entertainment company with a strong content library and diversified revenue streams may weather these storms better than its less established competitors.

- Inflation and Interest Rates: High inflation and rising interest rates can impact consumer spending, potentially reducing demand for entertainment products and services. This, in turn, can affect the revenue and profitability of entertainment companies, leading to lower stock prices. Careful analysis of a company's ability to manage costs and maintain profitability during inflationary periods is essential.

- Changing Consumer Behavior: The shift towards streaming services and cord-cutting continues to reshape the entertainment landscape. Companies that adapt effectively to these changes, offering compelling streaming content and digital distribution channels, are likely to perform better than those that lag behind. Analyzing media consumption patterns is vital to predict future performance.

- Major Players' Performance: The performance of key players like Netflix, Disney, and Warner Bros. Discovery reflects broader market trends. Monitoring their financial results and strategic moves provides valuable insights into the overall health of the entertainment sector. For example, Netflix's subscriber growth and Disney's integration of streaming services into their broader business strategy are important indicators of market health. Analyzing these players’ stock market performance alongside their individual business strategies helps paint a clearer picture of the overall industry.

- Data-Driven Insights: Analyzing historical data, including box office revenue, subscription numbers, and stock price movements, helps identify trends and potential future performance. Charts illustrating these trends can offer visual representations of market dynamics and assist in making informed decisions about buying entertainment stock.

Analyzing the Specific Entertainment Stock Under Consideration

Let's assume we are analyzing Company X, a significant player in the animation industry. A thorough analysis of Company X requires a deep dive into its financial health, revenue streams, and growth potential.

- Financial Health: Reviewing Company X's balance sheets, income statements, and cash flow statements is essential to assess its financial stability. We will focus on key ratios like the debt-to-equity ratio, which indicates the company's financial leverage. A lower ratio suggests better financial health and reduced risk for investors.

- Revenue Streams and Growth Potential: Company X's revenue is derived from theatrical releases, streaming deals, and merchandising. Analyzing the growth trajectory of each revenue stream is crucial. A diversified revenue model is often less susceptible to market fluctuations than one reliant on a single source.

- Profitability: We will examine Company X's profit margins and return on equity (ROE) to assess its profitability and efficiency. High profit margins indicate strong pricing power and efficient cost management. A healthy ROE signals effective utilization of shareholder investments.

- Debt Levels and Financial Stability: Company X’s debt level is an important factor in assessing its long-term viability. High debt levels can pose significant risk, especially during economic downturns. We'll analyze the company's ability to service its debt and maintain financial stability.

- Stock Valuation: We'll evaluate Company X's stock valuation using metrics like the Price-to-Earnings (P/E) ratio and Price-to-Earnings-Growth (PEG) ratio. These metrics help determine if the stock is currently undervalued or overvalued compared to its peers and growth prospects. A thorough stock valuation is a critical aspect of determining whether or not a stock is a sound investment.

- Future Projections and Growth Forecasts: Analyst predictions and internal company projections provide a glimpse into the company's future performance. These forecasts should be considered cautiously, as they are not guaranteed.

Competitive Landscape and Market Share

Company X operates in a competitive market with established players and emerging competitors.

- Competitive Position: We need to evaluate Company X's competitive advantages and disadvantages compared to its rivals. Its unique strengths, such as its animation style, brand recognition, and distribution network, will be carefully examined.

- Competitive Advantages & Disadvantages: Does Company X have a strong IP portfolio? What is its brand recognition compared to its competitors? How does its distribution reach compare? These considerations help to establish its competitive position.

- Market Share and Growth Potential: Assessing Company X's market share within the animation industry is crucial. A larger market share indicates a stronger position and potentially higher growth potential. Analyzing market share trends over time reveals the company's ability to compete and gain market dominance.

- Strategic Partnerships and Collaborations: Company X's partnerships and collaborations can significantly impact its market reach and revenue streams. Strategic alliances can expand the company's distribution channels and provide access to new technologies or content.

Risk Assessment and Potential Returns

Investing in entertainment stocks involves inherent risks. A thorough risk assessment is crucial.

- Key Risks: Risks associated with Company X might include competition, changing consumer preferences, production delays, and economic downturns. Identifying and understanding these risks is the first step in mitigating them.

- Potential Returns and Capital Appreciation: While there are risks, the potential for high returns and capital appreciation is significant, particularly with a well-managed and growing entertainment company. We'll look at historical performance and compare it to industry benchmarks to establish potential returns.

- Risk Tolerance: Investing in Company X may require a moderate to high-risk tolerance depending on your overall investment portfolio. It's important to only invest what you can afford to lose.

- Diversification Strategies: Diversifying your investment portfolio across different asset classes and sectors is crucial to mitigate risk. Investing only a portion of your portfolio in Company X is a recommended strategy.

- Return on Investment (ROI): Comparing the potential ROI of Company X with other investment options helps to determine if it aligns with your overall investment goals and risk tolerance.

Conclusion

This analysis of the entertainment stock market and Company X provides a framework for making an informed investment decision. Weighing the current market conditions, Company X's financial health, competitive landscape, and risk-return profile is crucial. Remember that this is not financial advice.

Ultimately, the decision of whether to buy this entertainment stock now is yours. However, by conducting thorough research and considering the factors outlined in this analyst insight, you can make a more confident and informed decision about your investment in the entertainment stock market. Remember to conduct your own due diligence before investing in any entertainment stock.

Featured Posts

-

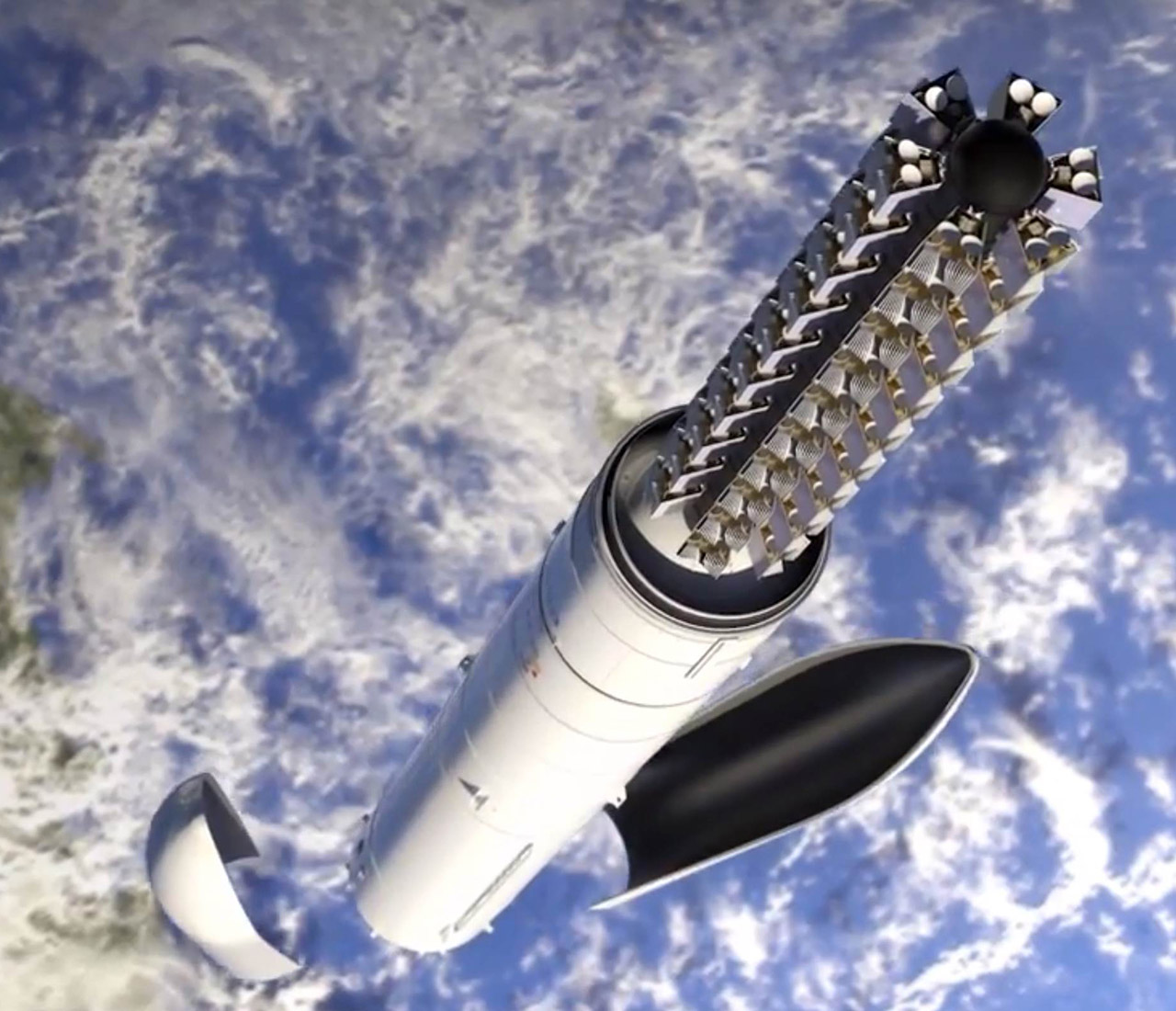

Space X Falcon 9 28 Starlink Satellites Successfully Deployed Video

May 29, 2025

Space X Falcon 9 28 Starlink Satellites Successfully Deployed Video

May 29, 2025 -

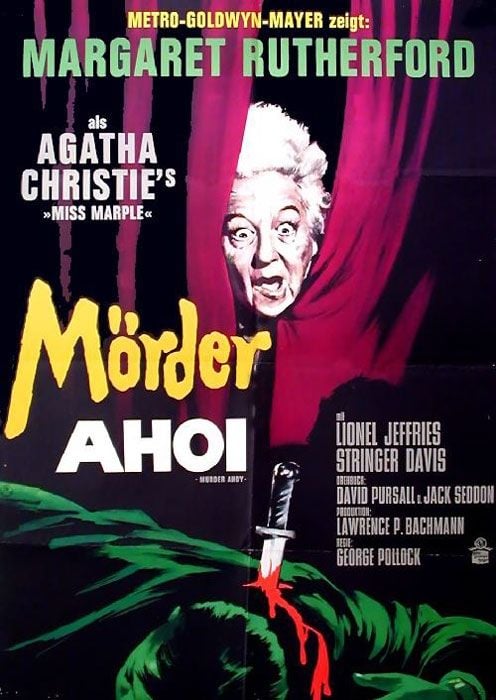

Legdragabb Aukcios Tetelek A Vateran

May 29, 2025

Legdragabb Aukcios Tetelek A Vateran

May 29, 2025 -

Latest Developments In Beacon Hill Shooting Investigation

May 29, 2025

Latest Developments In Beacon Hill Shooting Investigation

May 29, 2025 -

Your Guide To The Air Jordan May 2025 Lineup

May 29, 2025

Your Guide To The Air Jordan May 2025 Lineup

May 29, 2025 -

Late Run Lifts Jefferson Softball To Victory Against Musselman

May 29, 2025

Late Run Lifts Jefferson Softball To Victory Against Musselman

May 29, 2025

Latest Posts

-

Bayern Augsburg Verpflichtet Garteig Ingolstadt Torwart Wechselt Den Verein

May 30, 2025

Bayern Augsburg Verpflichtet Garteig Ingolstadt Torwart Wechselt Den Verein

May 30, 2025 -

Automatenkiosk In Bayern Verdacht Des Marihuana Verkaufs

May 30, 2025

Automatenkiosk In Bayern Verdacht Des Marihuana Verkaufs

May 30, 2025 -

Marihuana Handel In Bayern Automatenkiosk Im Fokus Der Polizei

May 30, 2025

Marihuana Handel In Bayern Automatenkiosk Im Fokus Der Polizei

May 30, 2025 -

Sport Und Identitaet Die Geschichte Juedischer Sportler In Augsburg

May 30, 2025

Sport Und Identitaet Die Geschichte Juedischer Sportler In Augsburg

May 30, 2025 -

Frau In Bayern Soll Marihuana In Automatenkiosk Verkauft Haben Ermittlungen Laufen

May 30, 2025

Frau In Bayern Soll Marihuana In Automatenkiosk Verkauft Haben Ermittlungen Laufen

May 30, 2025