Analysts Recommend Buying The Dip In This Entertainment Stock

Table of Contents

Why Analysts Are Bullish on [Entertainment Stock Name]

Several factors contribute to analysts' positive outlook on [Entertainment Stock Name]. Their bullish sentiment stems from a combination of strong financial performance, growth potential, and favorable market trends.

-

Positive Financial Performance: Recent financial reports for [Entertainment Stock Name] have shown [mention specific positive data, e.g., increased revenue, higher profits, strong earnings per share]. This suggests robust financial health and a capacity for continued growth.

-

Strong Competitive Advantage: [Entertainment Stock Name] enjoys a significant competitive advantage in the entertainment industry due to [explain the company's competitive edge, e.g., unique intellectual property, strong brand recognition, innovative technology, a first-mover advantage in a specific niche]. This positions them well for sustained success.

-

Upcoming Projects and Initiatives: The company's pipeline of upcoming projects, including [mention specific upcoming releases, projects, or initiatives, e.g., new movie releases, upcoming TV seasons, new game launches, expansion into new markets], promises further revenue growth and potential stock price appreciation. This positive momentum is a key driver for analysts' positive forecasts.

-

Favorable Market Valuation: While the recent dip has lowered the stock price, analysts believe the current market valuation is undervalued compared to [Entertainment Stock Name]'s historical performance and future growth prospects. Comparisons to similar companies in the entertainment sector further support this assessment.

-

Analyst Projections: Analysts' price targets for [Entertainment Stock Name] range from [mention range of price targets], indicating substantial upside potential if their projections materialize. These projections take into account the company's financial strength, market position, and future growth opportunities.

Understanding the Current Dip: What Caused It?

The recent dip in [Entertainment Stock Name]'s stock price can be attributed to a confluence of factors. Understanding these factors is crucial for assessing the risk associated with buying the dip.

-

Market-Wide Correction: A broader market correction, potentially triggered by [mention potential macro-economic factors, e.g., rising interest rates, inflation concerns, geopolitical uncertainties], often impacts even fundamentally sound companies like [Entertainment Stock Name].

-

Industry-Specific Challenges: The entertainment industry faces unique challenges, such as [mention specific challenges, e.g., competition from streaming services, changing consumer preferences, piracy]. These factors may have temporarily affected [Entertainment Stock Name]'s performance.

-

Temporary Setback: The dip could also be a result of a temporary setback, such as [mention specific temporary setback, e.g., a delay in a major project, a negative news cycle]. Such setbacks are often short-lived and should not overshadow the company's long-term potential.

It's crucial to note that these factors are largely temporary and don't necessarily reflect a fundamental flaw in [Entertainment Stock Name]'s business model. Analysts believe the company is well-positioned to overcome these challenges.

Assessing the Risk: Is Buying the Dip Right for You?

Investing in individual stocks always carries risk, and the entertainment industry is particularly volatile. Before buying the dip in [Entertainment Stock Name], careful consideration of the following points is essential:

-

Investment Risk: The stock market is inherently risky. The value of [Entertainment Stock Name] could continue to decline, resulting in potential financial losses.

-

Due Diligence: Conduct thorough due diligence before investing. This includes researching the company's financial statements, understanding its business model, and analyzing its competitive landscape.

-

Diversification: Diversification is a cornerstone of sound investment strategy. Don't put all your eggs in one basket. Spreading your investments across different asset classes reduces risk.

-

Financial Goals: Align your investment decisions with your broader financial goals and risk tolerance. Consult with a qualified financial advisor to determine if this investment aligns with your personal circumstances.

How to Buy the Dip in [Entertainment Stock Name]

Buying the dip in [Entertainment Stock Name] involves several straightforward steps.

-

Open a Brokerage Account: Choose a reputable online brokerage firm that suits your needs and preferences. Many offer user-friendly platforms and educational resources for beginners.

-

Fund Your Account: Deposit funds into your brokerage account to purchase the stock.

-

Place an Order: You can use a market order (to buy at the current market price) or a limit order (to buy only at a specific price or lower). Understanding the difference between these order types is crucial for managing risk.

Remember to always act responsibly and within your financial means.

Conclusion

Analysts' recommendation to buy the dip in [Entertainment Stock Name] is based on a combination of strong financial performance, a robust competitive advantage, and promising future projects. While the recent dip presents a buying opportunity, it's crucial to acknowledge the inherent risks associated with stock market investments. Thorough due diligence, diversification, and aligning investments with your financial goals are paramount. Don't miss out on the opportunity to buy the dip in this exciting entertainment stock. Start your research today and consider adding [Entertainment Stock Name] to your well-diversified investment strategy, but only after careful consideration and consultation with a financial advisor if needed.

Featured Posts

-

Dramatikk I Oslo Nyhetsvarsel Om Brann I Fire Bater

May 29, 2025

Dramatikk I Oslo Nyhetsvarsel Om Brann I Fire Bater

May 29, 2025 -

La Liga Mbappe Scores Twice As Real Madrid Defeats Celta Vigo Tightens Championship Battle

May 29, 2025

La Liga Mbappe Scores Twice As Real Madrid Defeats Celta Vigo Tightens Championship Battle

May 29, 2025 -

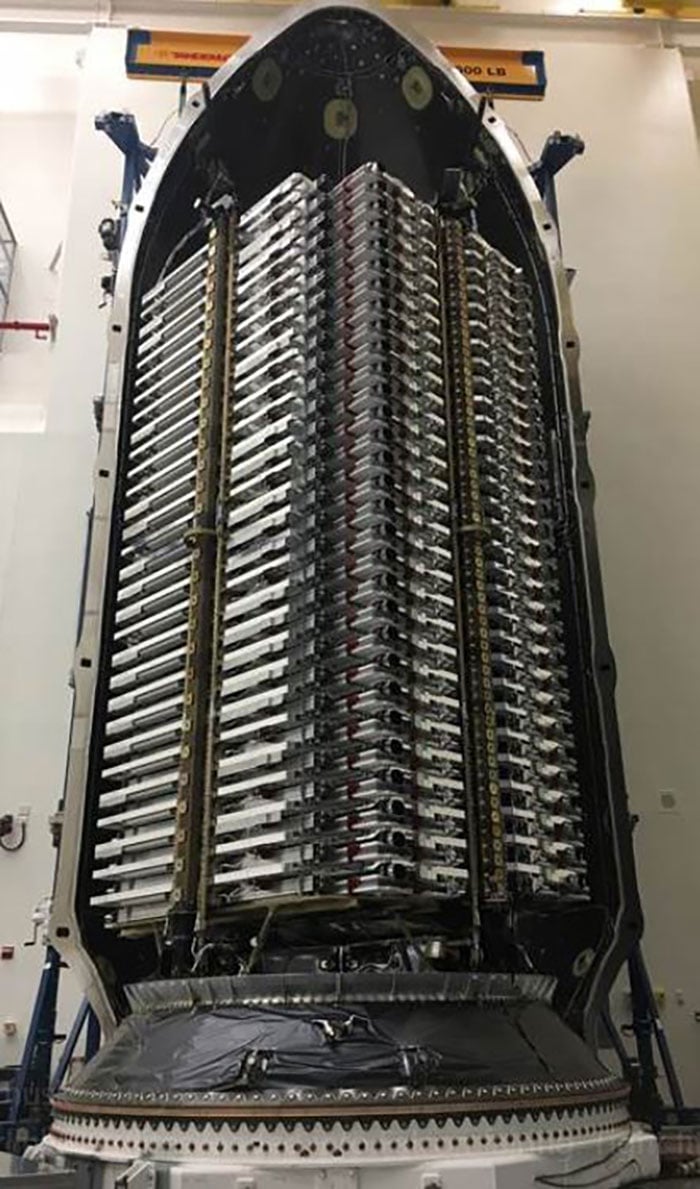

Falcon 9 Achieves New Milestone 28 Starlink Satellites Successfully Launched

May 29, 2025

Falcon 9 Achieves New Milestone 28 Starlink Satellites Successfully Launched

May 29, 2025 -

Identifying The Countrys Top New Business Areas

May 29, 2025

Identifying The Countrys Top New Business Areas

May 29, 2025 -

Draga Vatera Termekek Szazezres Aukcios Sikerek

May 29, 2025

Draga Vatera Termekek Szazezres Aukcios Sikerek

May 29, 2025

Latest Posts

-

Metallicas World Tour 2024 Hampden Park Glasgow Confirmed

May 30, 2025

Metallicas World Tour 2024 Hampden Park Glasgow Confirmed

May 30, 2025 -

Metallica Announces Hampden Park Gig In Glasgow World Tour Dates Revealed

May 30, 2025

Metallica Announces Hampden Park Gig In Glasgow World Tour Dates Revealed

May 30, 2025 -

Hoffenheim Vs Augsburg Kramarics Penalty Saves The Day

May 30, 2025

Hoffenheim Vs Augsburg Kramarics Penalty Saves The Day

May 30, 2025 -

Metallicas Glasgow Hampden Park Concert World Tour Stop Announced

May 30, 2025

Metallicas Glasgow Hampden Park Concert World Tour Stop Announced

May 30, 2025 -

Dublin 2026 Metallicas Two Night Aviva Stadium Concert

May 30, 2025

Dublin 2026 Metallicas Two Night Aviva Stadium Concert

May 30, 2025