Analysts Reset Palantir Stock Forecast: Understanding The Recent Rally

Table of Contents

The Recent Palantir Stock Rally: A Deep Dive

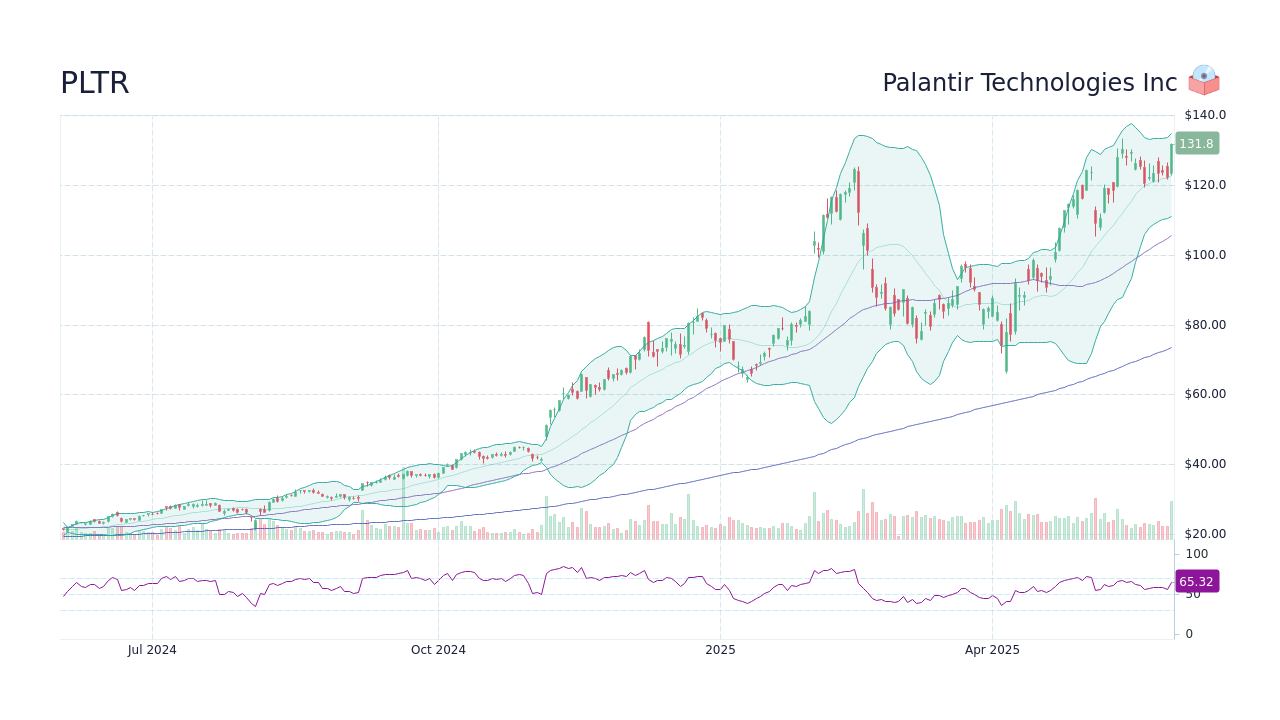

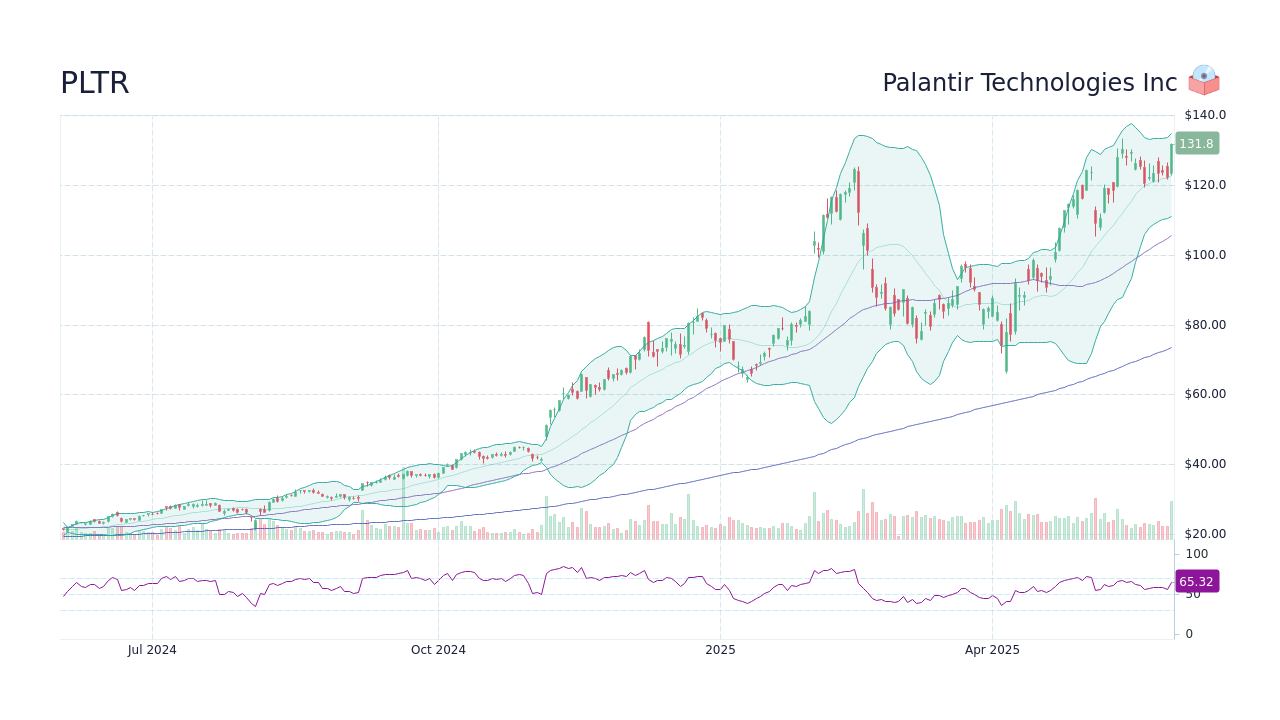

Palantir's stock price has shown a remarkable increase in recent weeks. For example, between October 26th and November 10th, the stock price jumped by approximately 25%, a significant move that surprised many market observers. This surge followed a period of relative stagnation, making the rally all the more noteworthy.

[Insert chart or graph visually representing Palantir's stock price movement between specified dates]

Several factors contributed to this increase in investor confidence:

- Increased Investor Confidence: Positive news and financial reports have boosted investor sentiment regarding Palantir's future prospects.

- Positive Financial Reports: Stronger-than-expected earnings reports, showcasing improved profitability and revenue growth, played a crucial role in driving the rally.

- New Strategic Partnerships: The formation of new partnerships with key players in various sectors has also contributed to the positive market reaction.

- Strong Government Contract Wins: Securing significant new government contracts further solidified investor confidence in Palantir's long-term growth potential.

Updated Palantir Stock Forecasts from Key Analysts

Following the recent rally, several prominent financial analysts have revised their Palantir stock forecast upwards. Goldman Sachs, for instance, increased its price target to $18, citing improved revenue projections and strong demand for Palantir's products. Morgan Stanley echoed this sentiment, raising its target price to $16, highlighting the company's growing commercial success.

| Analyst Firm | Previous Price Target | Updated Price Target | Rating |

|---|---|---|---|

| Goldman Sachs | $15 | $18 | Buy |

| Morgan Stanley | $14 | $16 | Overweight |

| JPMorgan Chase | $12 | $14 | Neutral |

| (Add more as needed) |

The upward revisions are primarily driven by:

- Reasons behind the upward revisions: Analysts point to improved revenue forecasts, increased profitability, and strong customer acquisition as key drivers.

- Analyst comments on Palantir's future growth prospects: Many analysts express optimism about Palantir's ability to capture a larger share of the growing data analytics market.

- Key factors influencing the forecasts: Revenue growth, margin expansion, and successful execution of the company's strategic initiatives are all cited as positive indicators.

Analyzing the Drivers of Palantir's Growth

Palantir's recent performance is a result of a combination of factors impacting both its government and commercial sectors.

- Strong performance in the government sector: Large, multi-year contracts with various government agencies, including those in defense and intelligence, continue to form a significant part of Palantir's revenue stream. Specific contract wins should be mentioned here if publicly available.

- Growing adoption of Palantir's commercial products: Palantir is experiencing increasing traction in the commercial sector, securing contracts with major companies across diverse industries. Highlighting key clients and their applications of Palantir's technology will strengthen this point.

- Technological advancements and innovations: Continuous innovation and improvement of Palantir's platform are key differentiators in a competitive market.

- Improved operational efficiency and profitability: Cost optimization and enhanced operational efficiency have positively impacted the company's profitability.

Government Contracts and their Impact on Palantir Stock

Government contracts are a cornerstone of Palantir's business model. These long-term agreements provide revenue stability and contribute significantly to the company's valuation. The relationships Palantir cultivates with various government agencies—defense, intelligence, and others—ensure a consistent stream of revenue, influencing investor confidence and directly impacting the Palantir stock forecast. The long-term nature of these contracts reduces the company's dependence on short-term fluctuations in commercial demand.

Commercial Growth and its Potential for Future Stock Performance

While government contracts are important, Palantir's expansion into the commercial sector holds immense potential for future stock performance. Analyzing the growth trajectory within various commercial sectors and comparing it to competitors helps understand its market positioning. The success of Palantir in the commercial market will directly influence future Palantir stock forecasts, offering diversification away from its reliance on government contracts.

Risks and Challenges Facing Palantir

Despite the recent positive momentum, several risks and challenges could affect Palantir's future stock performance:

- Competition from other data analytics companies: The data analytics market is highly competitive, with numerous established players and emerging startups.

- Data privacy and security concerns: Handling sensitive data requires robust security measures, and any data breach could severely impact Palantir's reputation and stock price.

- Dependence on large government contracts: While stable, over-reliance on government contracts could make Palantir vulnerable to changes in government spending.

- Economic uncertainty: A downturn in the global economy could negatively impact spending on data analytics solutions.

Conclusion: The Future of Palantir Stock: A Look Ahead

The recent rally in Palantir's stock price reflects a renewed confidence in the company's growth prospects. Updated Palantir stock forecasts from leading analysts point towards a positive outlook, driven by strong performance in both government and commercial sectors. However, it's crucial to acknowledge the existing risks and challenges. While the current trends are encouraging, staying informed about future developments, including new contract wins, commercial expansion, and competitive pressures, is essential. Conduct thorough research and consider consulting a financial advisor before making any investment decisions based on this or any Palantir stock forecast. Remember to regularly review your investment strategy and stay updated on the latest news and analysis concerning Palantir Technologies.

Featured Posts

-

Review Wynne And Joanna All At Sea A Nautical Adventure

May 09, 2025

Review Wynne And Joanna All At Sea A Nautical Adventure

May 09, 2025 -

Cheap Elizabeth Arden Skincare Walmart Alternatives

May 09, 2025

Cheap Elizabeth Arden Skincare Walmart Alternatives

May 09, 2025 -

Trumps Houthi Truce Shippers Remain Skeptical

May 09, 2025

Trumps Houthi Truce Shippers Remain Skeptical

May 09, 2025 -

Amy Walsh Defends Wynne Evans Following Sexual Slur Allegation

May 09, 2025

Amy Walsh Defends Wynne Evans Following Sexual Slur Allegation

May 09, 2025 -

Did The Fentanyl Crisis Open Doors For U S China Trade Talks

May 09, 2025

Did The Fentanyl Crisis Open Doors For U S China Trade Talks

May 09, 2025