Analyzing AIMSCAP's Participation In The World Trading Tournament (WTT)

Table of Contents

AIMSCAP's Pre-Tournament Preparation and Strategy

AIMSCAP's approach to the WTT was clearly one of meticulous planning and strategic preparation. Their pre-tournament training involved extensive simulations of various market conditions, encompassing both bull and bear markets. The team focused heavily on a blend of long-term investment strategies and short-term trading techniques, adapting their approach based on specific market sectors showing the most promise. Their strategy incorporated a sophisticated algorithmic trading system, built upon years of research and development.

- Team Composition and Expertise: AIMSCAP assembled a team of seasoned professionals, including quantitative analysts, experienced traders, and data scientists. This diverse skillset allowed for a multi-faceted approach to trading.

- Resource Allocation and Technological Advantages: Substantial resources were allocated to advanced technologies, including high-frequency trading platforms and proprietary analytical tools. This provided a significant technological advantage over some competitors.

- Risk Management Strategies: Robust risk management protocols were implemented to mitigate potential losses. This included stop-loss orders, position sizing techniques, and diversification across asset classes.

- Pre-Tournament Market Analysis: The team conducted extensive market analysis, identifying potential investment opportunities and forecasting market trends.

AIMSCAP's Performance During the WTT

AIMSCAP's performance throughout the WTT was characterized by periods of both significant gains and notable setbacks. Early in the tournament, they experienced strong growth, capitalizing on favorable market conditions in the tech sector. However, a sudden downturn in the energy market led to substantial losses. They showcased impressive adaptability, shifting their focus to other sectors and adjusting their trading strategies to minimize further losses.

- Specific Trading Decisions: Several key trading decisions significantly impacted their overall performance. For example, a well-timed investment in a rising cryptocurrency resulted in substantial profit. Conversely, a late exit from a falling stock market index resulted in a significant loss.

- Adaptation to Market Conditions: Their ability to adapt quickly to changing market conditions proved crucial. When volatility increased, AIMSCAP adjusted their portfolio to include more defensive assets, reducing their exposure to risk.

- Performance Compared to Competitors: While precise rankings are still pending official release, preliminary data suggests AIMSCAP's overall performance placed them within the top quartile of participating teams.

- Trading Tools and Techniques: The utilization of their proprietary algorithmic trading system and advanced analytical tools allowed them to react swiftly and efficiently to market fluctuations, a key factor in their success.

Strengths and Weaknesses of AIMSCAP's Approach

AIMSCAP’s participation in the WTT revealed both notable strengths and areas for improvement.

- Strengths: Strong risk management was a clear strength, limiting the impact of losses. Effective team collaboration and superior market analysis also played a vital role.

- Weaknesses: A potential weakness identified was a lack of diversification in their early strategy, making them vulnerable to market downturns in specific sectors. Their reliance on algorithmic trading, while generally successful, might have led to slow reactions in certain highly volatile situations.

Lessons Learned and Future Implications

The WTT provided invaluable experience for AIMSCAP.

- Potential Strategy Improvements: Diversifying investment strategies and incorporating more manual oversight in highly volatile situations are areas for potential improvement.

- Impact on Reputation: Their participation significantly enhanced AIMSCAP's brand image as a skilled and innovative player in the competitive trading arena.

- Future Market Predictions: The lessons learned from the WTT will inform AIMSCAP's future strategies, enhancing their predictive capabilities and risk mitigation strategies for future trading competitions.

Analyzing AIMSCAP's World Trading Tournament Journey: Conclusion

AIMSCAP's journey in the WTT was a testament to their capabilities, showcasing both impressive strengths and areas for refinement. Their performance highlights the importance of meticulous preparation, adaptable strategies, and robust risk management in the high-stakes world of competitive trading. While their reliance on a primarily algorithmic approach yielded successes, future participation might benefit from strategic adjustments to encompass greater diversification and a more dynamic response to sudden market shifts. We encourage you to share your thoughts on AIMSCAP’s trading strategies and continue following their progress in future World Trading Tournaments and other trading competitions. Analyzing AIMSCAP's performance and considering future AIMSCAP WTT participation offers valuable insights into the ever-evolving landscape of competitive trading.

Featured Posts

-

Abn Amro Analyse Van De Toename In Occasionverkoop

May 21, 2025

Abn Amro Analyse Van De Toename In Occasionverkoop

May 21, 2025 -

Paris Dans Le Viseur De Stephane Artiste Suisse

May 21, 2025

Paris Dans Le Viseur De Stephane Artiste Suisse

May 21, 2025 -

Trans Australia Run Record Breaking Attempt Underway

May 21, 2025

Trans Australia Run Record Breaking Attempt Underway

May 21, 2025 -

Vybz Kartel To Perform In New York A Historic Concert Event

May 21, 2025

Vybz Kartel To Perform In New York A Historic Concert Event

May 21, 2025 -

Legal Challenge To Racial Hatred Tweet Sentence By Ex Councillors Wife

May 21, 2025

Legal Challenge To Racial Hatred Tweet Sentence By Ex Councillors Wife

May 21, 2025

Latest Posts

-

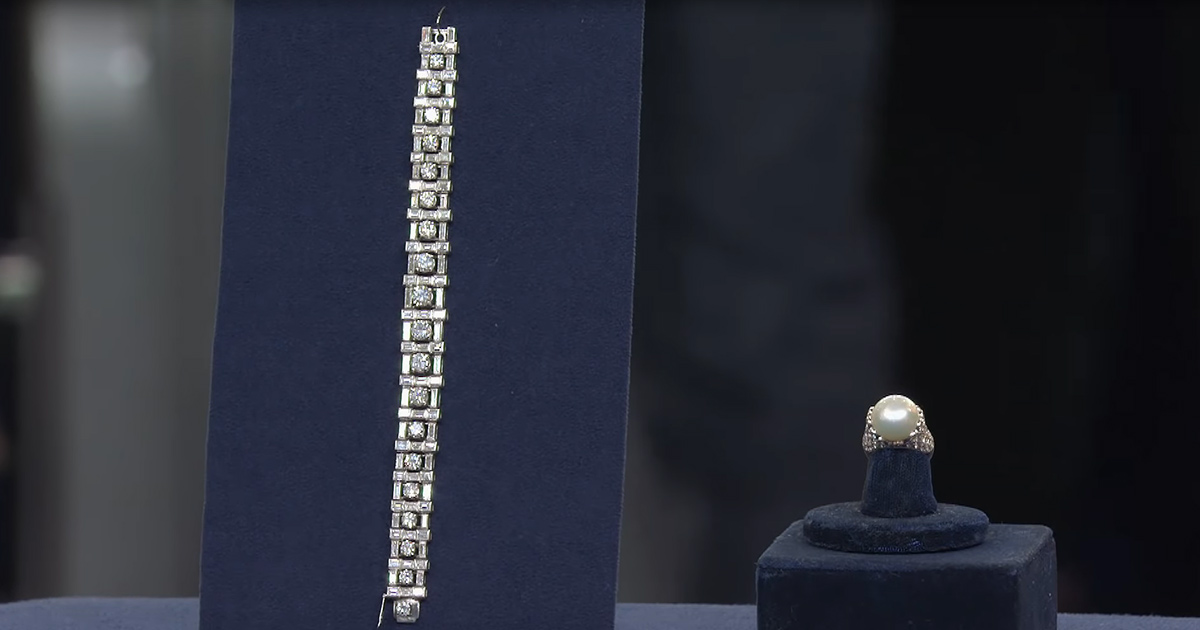

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025 -

Couple Sentenced After Antiques Roadshow Reveals Stolen Property

May 21, 2025

Couple Sentenced After Antiques Roadshow Reveals Stolen Property

May 21, 2025 -

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025 -

Antiques Roadshow Appraisal Exposes Stolen Items Leading To Imprisonment

May 21, 2025

Antiques Roadshow Appraisal Exposes Stolen Items Leading To Imprisonment

May 21, 2025 -

Jaw Dropping Antiques Roadshow Find Culminates In Trafficking Charges

May 21, 2025

Jaw Dropping Antiques Roadshow Find Culminates In Trafficking Charges

May 21, 2025