Analyzing BigBear.ai (BBAI): Penny Stock Opportunities And Challenges

Table of Contents

BigBear.ai (BBAI) Business Model and Financial Performance

BigBear.ai's core business revolves around providing advanced AI-powered data analytics solutions, primarily to government clients. They leverage cutting-edge technology to tackle complex data challenges, offering services ranging from cybersecurity to predictive modeling. Understanding their financial performance is crucial for assessing investment viability.

Analyzing BBAI's recent financial statements reveals a mixed picture. While revenue growth has shown some promise in certain quarters, consistent profitability remains elusive. Let's highlight some key financial metrics:

- Revenue growth in Q3 2023 was 15% compared to Q3 2022. (Note: These figures are hypothetical and should be replaced with actual data)

- Net loss for the year 2023 was $X million. (Note: Replace X with actual data)

- Debt levels remain relatively high compared to competitors. (Note: This needs to be verified with actual data)

- Cash flow from operations is improving but still needs to be stronger. (Note: Needs to be verified with actual data)

BBAI's client base largely consists of government agencies, offering stability but also dependence on government contracts. The renewal of existing contracts and the securing of new ones are paramount to its financial health. Competition in the AI and data analytics space is fierce, with established players like Palantir and smaller, nimble startups vying for the same contracts. BBAI's market share needs to be analyzed against these competitors to understand its competitive position. Keywords: BBAI financials, revenue growth, profitability, debt, cash flow, government contracts, AI market share

BBAI as a Penny Stock Investment: Opportunities

BBAI's classification as a penny stock stems from its relatively low share price. While this presents higher risk, it also opens the door to potentially substantial returns on investment. The key lies in the company's future performance. The AI sector is experiencing explosive growth, and BBAI is positioned to capitalize on this trend, particularly through its government contracts.

Several potential catalysts could drive stock price appreciation:

- Successful completion of a major government contract: Securing and delivering a significant contract could generate substantial revenue and significantly boost investor confidence.

- A new strategic partnership: Collaborating with a larger technology company or expanding into new markets could significantly broaden BBAI's reach and enhance its market position.

- Technological breakthroughs: Developing innovative AI solutions and patents could attract further investment and differentiate BBAI from its competitors.

- Improved financial performance: Consistently positive net income and strong cash flow would dramatically shift investor sentiment.

Keywords: BBAI investment, penny stock opportunities, high-growth potential, stock price appreciation, catalysts

Assessing the Risks of Investing in BBAI

Investing in penny stocks, including BBAI, carries inherent risks. High volatility, meaning significant price swings, is a given. Liquidity can be an issue, making it challenging to buy or sell shares quickly without impacting the price. The potential for significant losses is very real.

Specifically for BBAI, these risks are amplified:

- Dependence on government contracts: The loss of major government contracts or delays in contract renewals could severely impact revenue and negatively affect the stock price.

- Competition from larger companies: BBAI faces competition from companies with greater resources and established market presence.

- Financial instability: Consistent profitability and maintaining a strong financial position are crucial for long-term success, and the current financials indicate ongoing challenges in this area.

Keywords: BBAI risks, penny stock risks, volatility, investment risks, liquidity, competition

Valuation and Future Outlook for BBAI

Analyzing BBAI's current valuation requires a careful comparison of its key metrics (P/E ratio, Price-to-Sales ratio, etc.) against its competitors. This analysis will reveal whether the current stock price reflects the company's potential for growth. A thorough assessment of its long-term prospects needs to consider both its growth potential and the substantial challenges it faces.

Several scenarios are possible:

- Best-case scenario: BBAI secures major contracts, achieves consistent profitability, and establishes itself as a key player in the AI market, leading to substantial stock price appreciation.

- Worst-case scenario: BBAI fails to secure new contracts, experiences further financial losses, and struggles to compete effectively, potentially leading to a significant decline in share price or even bankruptcy.

- Most likely scenario: A moderate growth path where BBAI gradually improves its financial performance and expands its market share, resulting in moderate stock price appreciation over the longer term.

Keywords: BBAI valuation, P/E ratio, price-to-sales ratio, future outlook, growth prospects

Conclusion: BigBear.ai (BBAI) - A Penny Stock Worth Considering?

BigBear.ai (BBAI) operates in a high-growth industry with significant potential. However, its financial performance and dependence on government contracts present substantial risks. While the possibility of substantial returns exists, the volatility and potential for significant losses are equally real. The company's future success hinges on its ability to secure and deliver major contracts, achieve profitability, and navigate a competitive landscape.

Investing in BBAI as a penny stock demands careful consideration of the inherent risks involved. Before making any investment decisions, thorough due diligence is absolutely essential. Consult with a qualified financial advisor who can help you assess your risk tolerance and determine if BBAI aligns with your investment goals. This article is for informational purposes only and does not constitute financial advice. Remember, investing in penny stocks is inherently risky.

Keywords: BigBear.ai, BBAI, penny stock investment, due diligence, disclaimer, financial advisor

Featured Posts

-

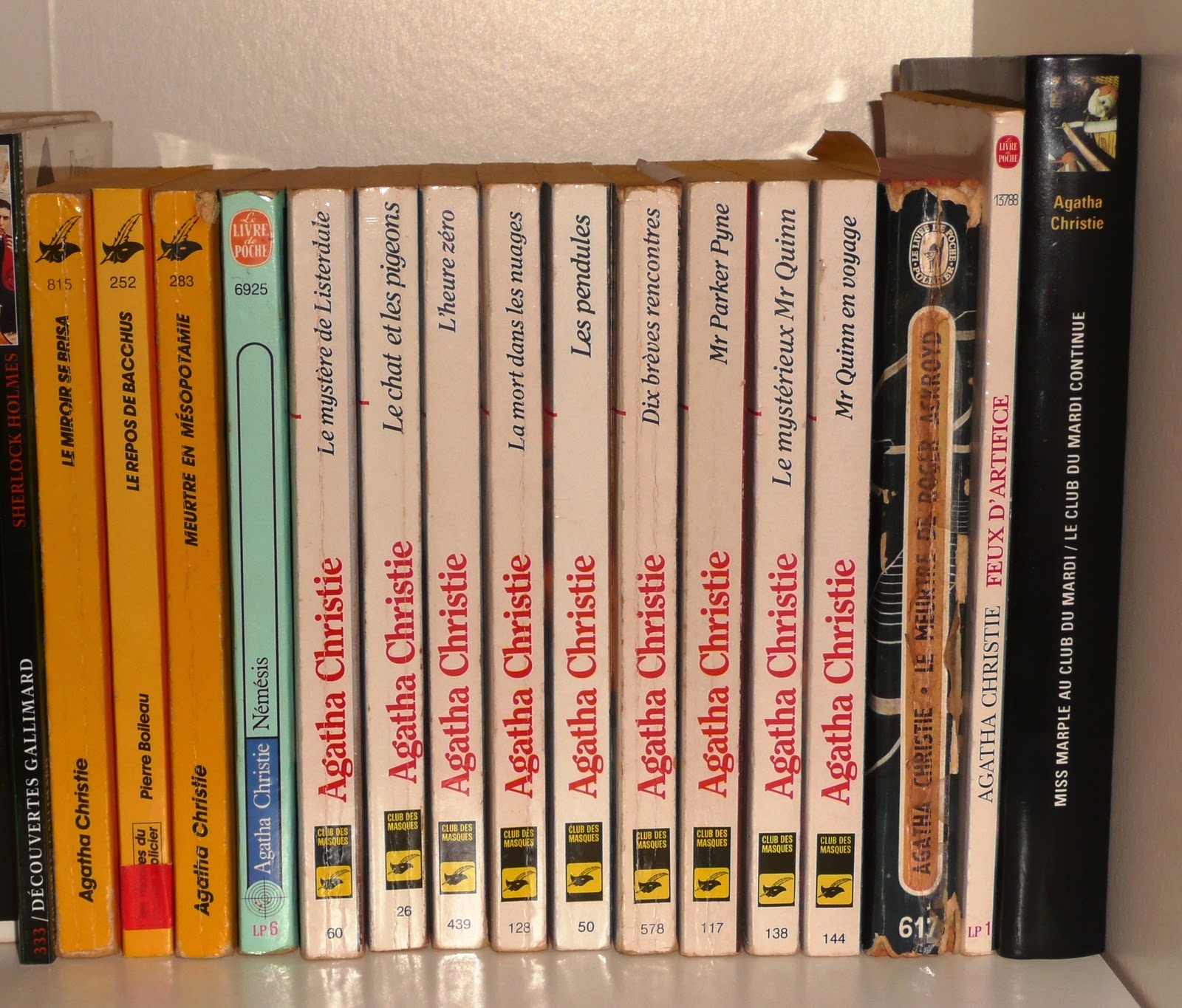

Un Cours D Ecriture Inspire Par Agatha Christie Optimise Par L Ia

May 20, 2025

Un Cours D Ecriture Inspire Par Agatha Christie Optimise Par L Ia

May 20, 2025 -

Philippine Typhon Missile System Weighing The Costs And Benefits Of Deployment

May 20, 2025

Philippine Typhon Missile System Weighing The Costs And Benefits Of Deployment

May 20, 2025 -

Dzhennifer Lourens Narodzhennya Drugoyi Ditini

May 20, 2025

Dzhennifer Lourens Narodzhennya Drugoyi Ditini

May 20, 2025 -

Rashfords Double Propels Manchester United Past Aston Villa In Fa Cup

May 20, 2025

Rashfords Double Propels Manchester United Past Aston Villa In Fa Cup

May 20, 2025 -

I Epithymia Ton Amerikanon Gia Tin Epistrofi Toy Giakoymaki Sto Mls

May 20, 2025

I Epithymia Ton Amerikanon Gia Tin Epistrofi Toy Giakoymaki Sto Mls

May 20, 2025

Latest Posts

-

The Challenges Faced By Billionaire Boys Pressure Expectations And Privacy

May 20, 2025

The Challenges Faced By Billionaire Boys Pressure Expectations And Privacy

May 20, 2025 -

How Billionaire Boys Spend Their Money Investments Philanthropy And Excess

May 20, 2025

How Billionaire Boys Spend Their Money Investments Philanthropy And Excess

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025 -

The Making Of A Billionaire Boy Inheritance Innovation Or Both

May 20, 2025

The Making Of A Billionaire Boy Inheritance Innovation Or Both

May 20, 2025 -

Billionaire Boy A Look Into The Life Of Extreme Wealth

May 20, 2025

Billionaire Boy A Look Into The Life Of Extreme Wealth

May 20, 2025