Analyzing CoreWeave (CRWV): Jim Cramer's Perspective And Market Implications

Table of Contents

CoreWeave (CRWV)'s Business Model and Market Position

CoreWeave's core business lies in providing GPU-accelerated cloud computing services, specifically tailored for the burgeoning artificial intelligence (AI) market. This specialization gives them a unique position in the competitive landscape dominated by giants like AWS, Google Cloud, and Microsoft Azure. While these established players offer similar services, CoreWeave distinguishes itself through several key advantages.

-

Focus on GPU-accelerated cloud computing: CoreWeave leverages the power of Graphics Processing Units (GPUs) to deliver significantly faster processing speeds, crucial for computationally intensive AI workloads. This focus allows them to target a niche market highly demanding of this specific type of infrastructure.

-

Specialization in AI workloads: CoreWeave isn't just offering general-purpose cloud computing; they're deeply focused on the unique needs of AI applications, providing optimized solutions for machine learning, deep learning, and other AI-related tasks. This targeted approach allows for greater efficiency and scalability for AI clients.

-

Target market segments: CoreWeave primarily targets AI startups and large enterprises with significant AI infrastructure requirements. These are high-value clients willing to pay a premium for specialized services and superior performance.

-

Scalability and infrastructure capacity: A critical factor in cloud computing is scalability. CoreWeave's infrastructure is designed for rapid scaling to meet fluctuating client demands, ensuring consistent performance even during peak usage periods.

-

Key partnerships and collaborations: Strategic partnerships with leading technology providers enhance CoreWeave's capabilities and reach, expanding its market access and strengthening its competitive position. These collaborations are vital for access to cutting-edge technologies and expanded client bases.

However, CoreWeave also faces challenges. The competition from established cloud providers with far greater resources and brand recognition is a significant hurdle. Maintaining a competitive edge in pricing and service offerings will be crucial for long-term success.

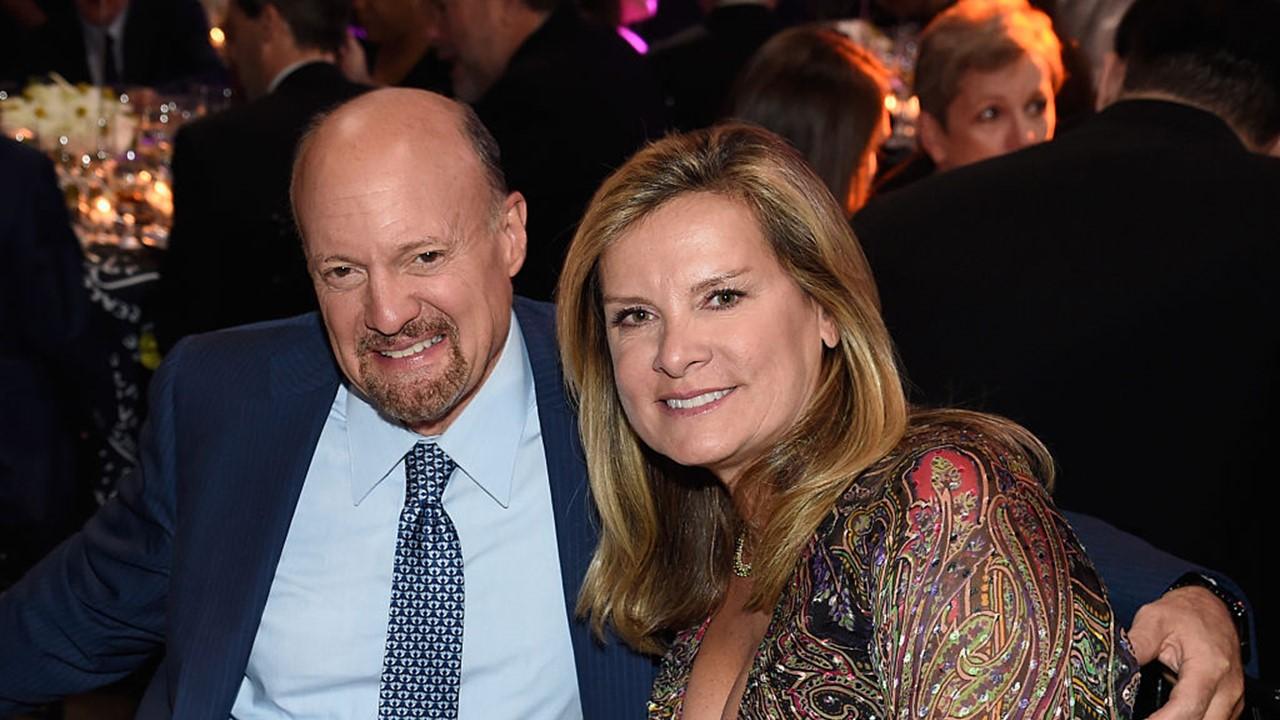

Jim Cramer's Stance on CoreWeave (CRWV)

Jim Cramer, the well-known host of CNBC's "Mad Money," has voiced his opinions on CoreWeave (CRWV) on several occasions. While a comprehensive compilation of all his statements is difficult, his general sentiment appears to be cautiously optimistic. He often highlights the growth potential of the AI sector and CoreWeave's specialized position within it. However, he also cautions investors about the risks associated with investing in a relatively young company in a volatile market.

-

Direct quotes from Jim Cramer (if available, cite sources): [Insert direct quotes from Jim Cramer's commentary on CoreWeave, if available, with proper citations].

-

Interpretation of his comments regarding CRWV's long-term prospects: [Analyze Cramer's comments to determine his overall assessment of CoreWeave's future].

-

Comparison of his viewpoint with other market analysts: [Compare Cramer's opinion with other analysts' assessments of CoreWeave's stock and prospects].

-

Consideration of any potential conflicts of interest: It's important to consider any potential conflicts of interest Cramer might have before taking his opinions at face value. [Discuss potential conflicts, if any].

CRWV Stock Performance and Valuation

Since its IPO, CoreWeave's stock price has experienced [Insert description of stock price performance – volatility, highs, lows, etc.]. Analyzing CRWV's valuation requires comparing it to its competitors. [Discuss valuation metrics like P/E ratio, market capitalization, etc., comparing CoreWeave to other cloud computing companies].

-

Stock price trends and volatility: [Describe the trends and volatility of the CRWV stock price].

-

Key financial indicators and their implications: [Analyze relevant financial indicators such as revenue growth, profitability, and debt levels].

-

Comparison with industry benchmarks: [Compare CRWV's performance to industry averages and competitor performance].

-

Potential for future price appreciation or depreciation: [Offer an informed opinion on the potential for future price movements, based on available data and market analysis].

-

Discussion of investor sentiment: [Describe the overall sentiment among investors regarding CRWV, noting bullish and bearish viewpoints].

Risks and Challenges Facing CoreWeave (CRWV)

Despite its potential, CoreWeave faces several significant risks:

-

Competition from established players: The intense competition from AWS, Google Cloud, and Microsoft Azure poses a major challenge to CoreWeave's growth. These giants possess vast resources and established customer bases.

-

Dependence on specific technologies or clients: Over-reliance on specific technologies or a limited number of major clients creates vulnerability to technological disruptions or shifts in client demand.

-

Regulatory hurdles and compliance issues: Navigating complex regulations in the data privacy and cybersecurity sectors presents operational and financial risks.

-

Potential for technological disruption: Rapid technological advancements could render CoreWeave's current technology obsolete, requiring significant investment in upgrades or potentially leading to obsolescence.

-

Operational risks and scalability challenges: Maintaining service reliability and scaling operations to meet growing demand requires significant investment and flawless execution.

Future Outlook and Investment Implications for CoreWeave (CRWV)

The future of CoreWeave (CRWV) depends heavily on its ability to navigate the competitive landscape and capitalize on the continued growth of the AI and cloud computing markets. The long-term outlook appears promising, given the increasing demand for GPU-accelerated computing. However, investors should proceed with caution, considering the substantial risks involved.

-

Long-term growth potential in the cloud computing and AI sectors: The long-term prospects for the cloud computing and AI markets are positive, creating a favorable environment for CoreWeave’s growth.

-

Impact of technological innovations and industry trends: Staying ahead of technological advancements and adapting to industry trends will be crucial for CoreWeave's continued success.

-

Potential for acquisitions or mergers: A potential acquisition by a larger tech company could be a significant catalyst for growth and value creation for investors.

-

Recommendations for investors (e.g., buy, hold, sell): [Provide a reasoned investment recommendation based on the analysis]. This should not be considered financial advice.

-

Considerations for risk-averse and aggressive investors: Risk-averse investors should proceed with caution, given the inherent volatility of the tech sector and the competitive pressure on CoreWeave. More aggressive investors might see the potential for significant returns despite the risks.

Conclusion

This analysis of CoreWeave (CRWV), incorporating Jim Cramer's perspective and broader market considerations, reveals a company operating within a high-growth, high-risk sector. While its innovative approach to GPU-accelerated cloud computing positions it for significant potential, investors must carefully weigh the risks and rewards before making any investment decisions in CRWV. Understanding the competitive landscape, the evolving technological landscape, and market sentiment is critical for navigating the complexities of investing in CoreWeave (CRWV). Conduct thorough due diligence and consult with a financial advisor before making any investment decisions related to CoreWeave (CRWV) or any other stock. Remember that this analysis is for informational purposes only and should not be considered financial advice. Further research into CoreWeave (CRWV) is essential before making any investment decisions.

Featured Posts

-

Shpani A Go Osvoi Tronot Vo Ln Tragichni Penali Za Khrvatska

May 22, 2025

Shpani A Go Osvoi Tronot Vo Ln Tragichni Penali Za Khrvatska

May 22, 2025 -

How To Buy Tickets For Metallica At Hampden Park Glasgow

May 22, 2025

How To Buy Tickets For Metallica At Hampden Park Glasgow

May 22, 2025 -

Abn Amro Analyse Van De Kwartaalcijfers En Impact Op De Aandelenkoers

May 22, 2025

Abn Amro Analyse Van De Kwartaalcijfers En Impact Op De Aandelenkoers

May 22, 2025 -

Music World Mourns Dropout Kings Adam Ramey Dead At 32

May 22, 2025

Music World Mourns Dropout Kings Adam Ramey Dead At 32

May 22, 2025 -

Analiz Peregovoriv Pozitsiya Yevrokomisiyi Schodo Chlenstva Ukrayini V Nato

May 22, 2025

Analiz Peregovoriv Pozitsiya Yevrokomisiyi Schodo Chlenstva Ukrayini V Nato

May 22, 2025

Latest Posts

-

Englands Unwavering Support For Zak Crawley Amid Poor Form

May 23, 2025

Englands Unwavering Support For Zak Crawley Amid Poor Form

May 23, 2025 -

England Backs Crawley Despite Recent Slump

May 23, 2025

England Backs Crawley Despite Recent Slump

May 23, 2025 -

Karate Kid Legend Of The Karate Kid Positive First Impressions For Cast And Film

May 23, 2025

Karate Kid Legend Of The Karate Kid Positive First Impressions For Cast And Film

May 23, 2025 -

Karate Kid Legend Of The Karate Kid Critics Praise Jackie Chan And Ralph Macchios Performances

May 23, 2025

Karate Kid Legend Of The Karate Kid Critics Praise Jackie Chan And Ralph Macchios Performances

May 23, 2025 -

Karate Kid Legend Of The Karate Kid First Reactions Rave About Jackie Chan And Ralph Macchio

May 23, 2025

Karate Kid Legend Of The Karate Kid First Reactions Rave About Jackie Chan And Ralph Macchio

May 23, 2025