Analyzing CoreWeave Inc. (CRWV) Stock Performance: Thursday's Decline Explained

Table of Contents

Broader Market Influences on CRWV Stock Performance

Thursday's downturn in CRWV stock wasn't an isolated incident. The broader market experienced some volatility, impacting many tech stocks, including CoreWeave. Understanding the overall market conditions is crucial for assessing the extent to which external factors contributed to CRWV's decline.

- Market Indices: The Nasdaq Composite and the S&P 500, both key indicators of overall market health, experienced moderate declines on Thursday. This general negative sentiment likely contributed to the downward pressure on CRWV stock.

- Macroeconomic Factors: Rising interest rates and persistent inflation concerns continue to cast a shadow over the tech sector. Investors often become more risk-averse during periods of economic uncertainty, leading to sell-offs in growth stocks like CRWV.

- Tech Sector News: Negative news concerning other cloud computing companies or broader technology trends could also have influenced investor sentiment towards CRWV. Any significant regulatory changes or competitive pressures within the sector could impact investor confidence. For example, negative news about a competitor could lead to a sell-off across the entire sector. Staying updated on industry news is crucial for understanding market movements.

Company-Specific Factors Affecting CRWV Stock Price

While broader market trends played a role, it's equally important to analyze any company-specific news or events that might have influenced CRWV's stock price.

- Company Announcements: Review CoreWeave's press releases and SEC filings from Thursday and the preceding days for any announcements that could have spooked investors. Any unexpected news concerning financial performance, partnerships, or strategic decisions could have triggered the sell-off.

- Financial Performance: Examination of CoreWeave's recent financial performance—including revenue growth, profitability margins, and customer acquisition costs—is crucial. A disappointing earnings report or a less-than-optimistic financial outlook could trigger a stock decline.

- Leadership and Strategy: Any changes in the company's leadership or a shift in its strategic direction could also impact investor confidence. Significant management changes or a sudden alteration in the company's core business strategy might unsettle investors.

Sentiment Analysis and Investor Behavior

Investor sentiment plays a significant role in shaping stock prices. Understanding the prevailing mood surrounding CRWV is essential to interpreting Thursday's drop.

- Analyst Ratings: A sudden downgrade in analyst ratings or a lowering of price targets for CRWV could have triggered a wave of selling. Analyst opinions often influence investor decisions.

- Trading Volume: Analyzing the trading volume of CRWV shares on Thursday can reveal the extent of investor activity. High trading volume during a price drop suggests significant selling pressure.

- Social Media Sentiment: Monitoring social media conversations about CRWV can provide insights into investor sentiment. Negative sentiment on platforms like Twitter or StockTwits could indicate a growing concern among investors. Using sentiment analysis tools can help quantify these qualitative observations.

Technical Analysis of CRWV Stock Chart

Technical analysis provides another layer to understanding the CRWV stock decline. Examining the chart patterns might reveal clues about the sell-off.

- Chart Patterns: Identifying candlestick patterns (e.g., bearish engulfing patterns, hammer) or other chart formations could help explain the price movement. A clear bearish signal on the chart might have triggered stop-loss orders, exacerbating the decline.

- Support and Resistance: Breaching key support levels can accelerate a downward trend. If the stock price broke through a significant support level, it would have signaled to investors that further declines were possible.

- Technical Indicators: Studying indicators such as RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) might reveal overbought or oversold conditions or other signals that contributed to the drop. A bearish divergence, for instance, could point towards a weakening trend. (Insert image of CRWV stock chart here)

Conclusion: Understanding and Navigating CRWV Stock Fluctuations

Thursday's drop in CoreWeave Inc. (CRWV) stock stemmed from a confluence of factors. Broader market volatility, company-specific news (or lack thereof if no negative announcements were made), shifting investor sentiment, and technical indicators all contributed to the decline. It's vital to remember that evaluating stock performance requires considering both macro and micro factors. While the short-term outlook may be uncertain, CRWV operates in a high-growth sector with significant long-term potential.

Conduct thorough research, including reviewing CoreWeave's financial reports and staying abreast of market analyses, before making any investment decisions concerning CRWV stock. Setting up price alerts can help you monitor CRWV stock price changes and react to market fluctuations accordingly. Remember, informed decision-making is key to navigating the volatile world of stock investment.

Featured Posts

-

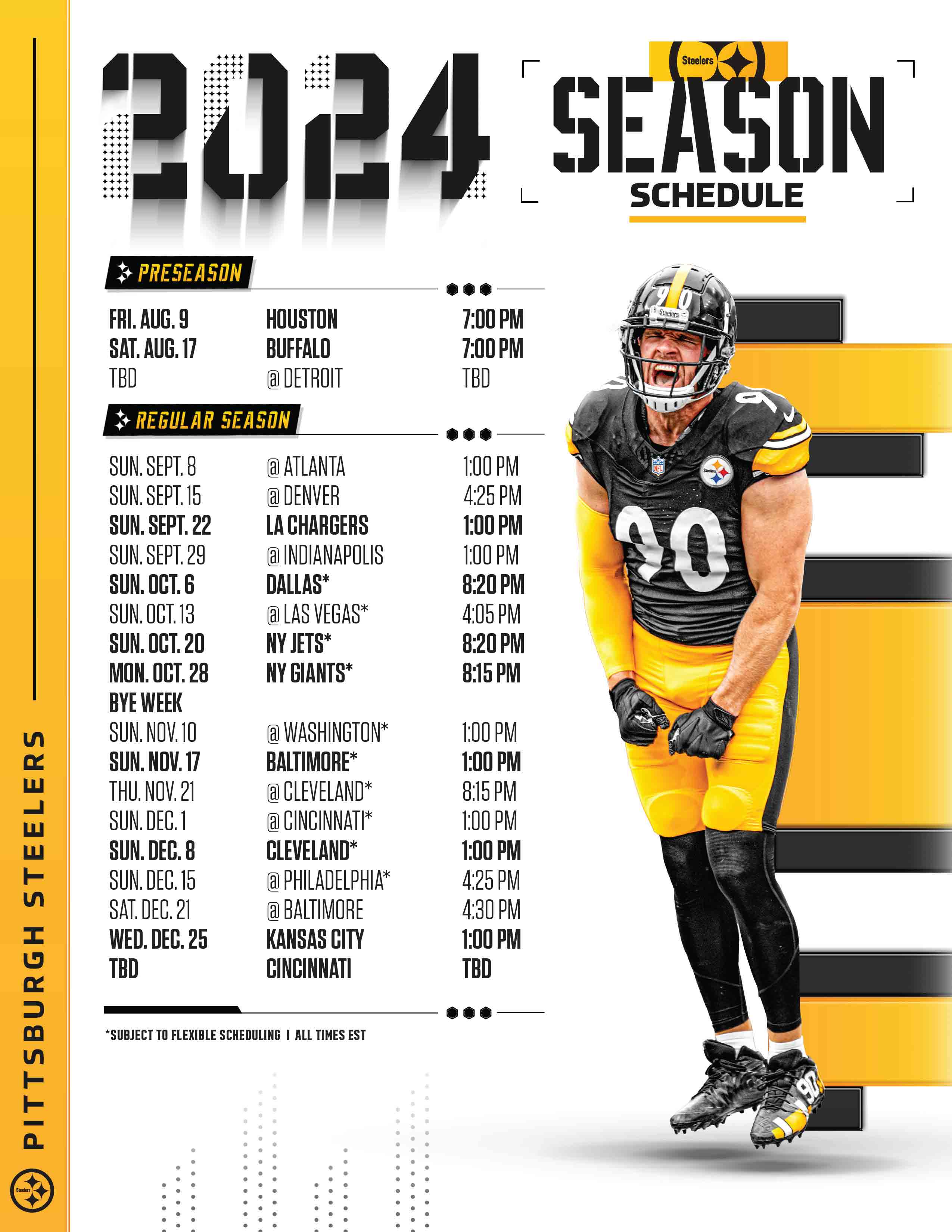

Pittsburgh Steelers And The 2024 Nfl Draft Quarterback Focus

May 22, 2025

Pittsburgh Steelers And The 2024 Nfl Draft Quarterback Focus

May 22, 2025 -

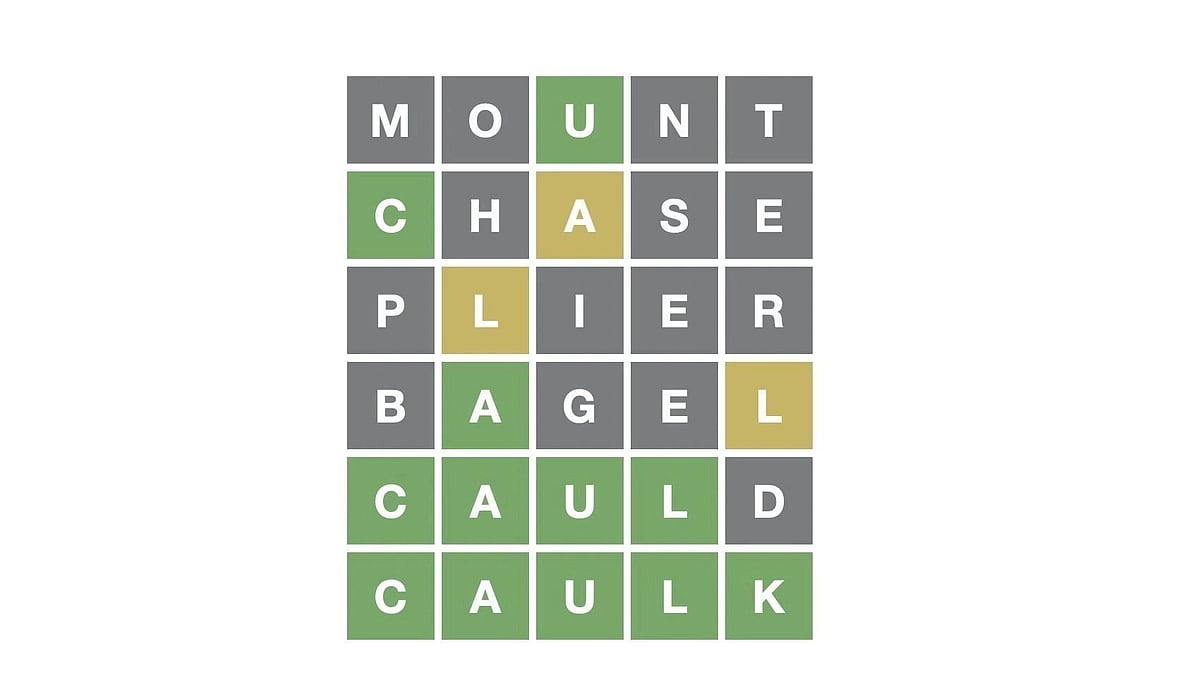

Wordle 1352 March 2nd Hints Clues And Solution

May 22, 2025

Wordle 1352 March 2nd Hints Clues And Solution

May 22, 2025 -

Alles Over Het Verkoopprogramma Voor Abn Amro Kamerbrief Certificaten

May 22, 2025

Alles Over Het Verkoopprogramma Voor Abn Amro Kamerbrief Certificaten

May 22, 2025 -

Cau Ma Da Noi Dong Nai Binh Phuoc Du Kien Khoi Cong Thang 6

May 22, 2025

Cau Ma Da Noi Dong Nai Binh Phuoc Du Kien Khoi Cong Thang 6

May 22, 2025 -

The Blake Lively Taylor Swift Gigi Hadid Drama Familys Response

May 22, 2025

The Blake Lively Taylor Swift Gigi Hadid Drama Familys Response

May 22, 2025

Latest Posts

-

Lindsi Grem Ta Posilennya Sanktsiy Proti Rf Detali Zakonoproektu

May 22, 2025

Lindsi Grem Ta Posilennya Sanktsiy Proti Rf Detali Zakonoproektu

May 22, 2025 -

S Sh A Gotovyat Novye Sanktsii Protiv Rossii Reaktsiya Senata

May 22, 2025

S Sh A Gotovyat Novye Sanktsii Protiv Rossii Reaktsiya Senata

May 22, 2025 -

Senat S Sh A Ugrozhaet Uzhestochit Sanktsii Protiv Rossii Novye Detali

May 22, 2025

Senat S Sh A Ugrozhaet Uzhestochit Sanktsii Protiv Rossii Novye Detali

May 22, 2025 -

Sanktsiyi Proti Rosiyi Lindsi Grem Napolyagaye Na Yikh Posilenni

May 22, 2025

Sanktsiyi Proti Rosiyi Lindsi Grem Napolyagaye Na Yikh Posilenni

May 22, 2025 -

Dodatkovi Sanktsiyi Proti Rf Lindsi Grem Ta Noviy Zakonoproekt

May 22, 2025

Dodatkovi Sanktsiyi Proti Rf Lindsi Grem Ta Noviy Zakonoproekt

May 22, 2025