Analyzing Ethereum's Price Action: Could $2,700 Be Next? (Wyckoff Accumulation)

Table of Contents

Ethereum's price has always been a rollercoaster, captivating investors with its volatility and potential for massive returns. Recent market trends show intriguing patterns, prompting many to ask: could Ethereum reach $2700? This article delves into Ethereum's price action using the Wyckoff Accumulation method, a powerful tool for identifying potential price reversals. We'll analyze Ethereum charts, technical indicators, and market factors to assess the likelihood of a surge towards the $2700 mark. Our analysis will cover Ethereum price prediction, Ethereum price analysis, Wyckoff Accumulation, $2700 Ethereum, and Ethereum chart analysis.

Understanding Wyckoff Accumulation in the Context of Ethereum

What is Wyckoff Accumulation?

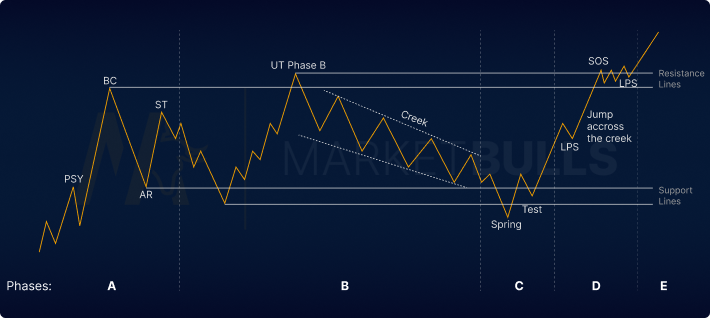

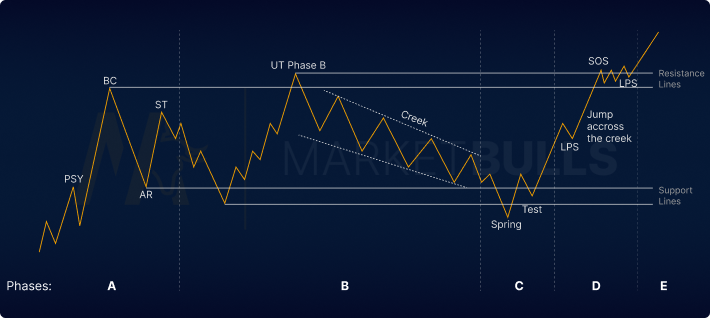

The Wyckoff method is a sophisticated technical analysis technique used to identify periods of market accumulation before significant price increases. It focuses on identifying the subtle shifts in price and volume that signal large players are quietly accumulating assets before a major price move. Instead of relying solely on simple indicators like moving averages, Wyckoff delves into the underlying market psychology and behavior.

Key phases of Wyckoff Accumulation include:

- Spring: A final shakeout designed to trap weak holders, often involving a sharp price drop followed by a quick rebound.

- Sign of Weakness (SOW): A lower low and lower volume than the preceding rally indicating weakening selling pressure.

- Test: The price tests the previous support level, which now serves as resistance. This tests the strength of the buyers.

- Markup: After successfully testing the resistance, the price begins a sustained upward trend as the accumulation phase ends and large players start to distribute their positions.

(Insert a chart here illustrating the Wyckoff phases with clear labels.)

Identifying Potential Wyckoff Accumulation in the Ethereum Market

Analyzing recent Ethereum price charts reveals potential signs consistent with Wyckoff Accumulation. We observe:

- Decreasing volume during price dips: This suggests that selling pressure is weakening, a classic sign of accumulation.

- Strong support levels holding: The price consistently bounces off certain support levels, demonstrating buyer interest.

- Higher lows and higher highs: This pattern is a clear indication of a potential upward trend forming.

(Insert an Ethereum price chart here, highlighting potential Wyckoff phases like Spring, SOW, Test, etc., with clear explanations and annotations.)

By observing these price actions and volume trends, we can identify potential Wyckoff phases within the recent Ethereum price movements and assess their validity in predicting the $2700 target. Keywords: Ethereum chart patterns, Ethereum support levels, Ethereum resistance levels, Ethereum trading volume, Ethereum price action.

Technical Indicators Supporting the $2700 Target

Moving Averages (MA):

The 50-day and 200-day moving averages are crucial indicators. A bullish crossover (50-day MA crossing above the 200-day MA) often signals a potential trend reversal. If this occurs alongside other Wyckoff signals, it strengthens the case for a price move to $2700. Additional indicators like the Moving Average Convergence Divergence (MACD) can confirm this trend.

Relative Strength Index (RSI):

The RSI measures momentum. An RSI below 30 often indicates an oversold condition, suggesting a potential price rebound. If the RSI shows oversold conditions during a potential Wyckoff accumulation phase, it adds further credence to a price increase toward $2700. Keywords: Moving average convergence divergence (MACD), Relative Strength Index (RSI), 50-day MA, 200-day MA, Ethereum technical indicators, RSI Ethereum, oversold, overbought, Ethereum RSI analysis.

Volume Analysis:

Increased volume during price increases confirms the strength of the upward trend. Conversely, decreasing volume during price dips, as discussed earlier, validates the accumulation phase. A significant surge in volume accompanying a breakout above resistance levels would provide strong confirmation of the target. Keywords: Ethereum trading volume analysis, volume confirmation, price volume analysis.

Potential Risks and Challenges

Market Sentiment:

Overall market sentiment plays a crucial role. A bearish market could hinder Ethereum's price regardless of technical indicators. Negative news events or broader economic downturns could impact the price target. Keywords: market sentiment, bearish market, bullish market, crypto market news.

Regulatory Uncertainty:

Regulatory changes can significantly impact cryptocurrency prices. Increased regulatory scrutiny or new regulations could negatively affect Ethereum's price, potentially hindering its progress toward $2700. Keywords: crypto regulation, SEC regulation, Ethereum regulation, regulatory uncertainty.

Competition from Other Cryptocurrencies:

The cryptocurrency market is highly competitive. New and improved projects could divert investment away from Ethereum, slowing its price appreciation. Keywords: crypto competition, altcoins, Ethereum rivals, blockchain technology.

Conclusion: Is $2700 Ethereum Realistic? Your Next Steps

Based on our analysis of Ethereum's price action through the lens of Wyckoff Accumulation and supporting technical indicators, reaching $2700 is a plausible scenario. The identified potential accumulation phase, coupled with supportive moving averages and RSI readings, suggests a bullish outlook. However, it's crucial to acknowledge the inherent risks associated with cryptocurrency investment. Market sentiment, regulatory uncertainty, and competition all pose potential challenges.

Therefore, while the $2700 Ethereum price target seems attainable based on our Wyckoff Accumulation strategy, it’s vital to conduct thorough independent research and monitor Ethereum's price action closely. Consider diversifying your portfolio and only invest what you can afford to lose. The potential for significant gains is balanced by substantial risks. Don't hesitate to continue your Ethereum price analysis and stay informed on market developments. Start your journey towards understanding Ethereum investment and Ethereum trading today, but always remember to proceed cautiously.

Featured Posts

-

Gta Vis Latest Trailer Exploring The Bonnie And Clyde Inspired Storyline

May 08, 2025

Gta Vis Latest Trailer Exploring The Bonnie And Clyde Inspired Storyline

May 08, 2025 -

Test Your Knowledge Nba Playoffs Triple Doubles Leader Quiz

May 08, 2025

Test Your Knowledge Nba Playoffs Triple Doubles Leader Quiz

May 08, 2025 -

El Nuevo Titulo De Filipe Luis

May 08, 2025

El Nuevo Titulo De Filipe Luis

May 08, 2025 -

Scathing Report On Angels Minor League Prospects

May 08, 2025

Scathing Report On Angels Minor League Prospects

May 08, 2025 -

Check The Daily Lotto Results For Thursday April 17 2025

May 08, 2025

Check The Daily Lotto Results For Thursday April 17 2025

May 08, 2025