Analyzing Live Nation Entertainment (LYV): Potential Returns And Risks

Table of Contents

Introduction: Live Nation Entertainment (LYV) is a behemoth in the global live entertainment industry, presenting significant potential returns for savvy investors. However, like any investment in the volatile world of entertainment stocks, LYV stock carries inherent risks. This comprehensive analysis will dissect the potential rewards and challenges associated with investing in Live Nation Entertainment, empowering you to make an informed decision about whether it aligns with your unique investment strategy.

Understanding Live Nation Entertainment's Business Model and Revenue Streams

Keywords: Live Nation revenue, Ticketmaster, concert promotion, venue ownership, sponsorship revenue, artist management.

Live Nation Entertainment's business model rests on several key pillars, creating a diversified revenue stream that contributes to its overall financial strength. Its dominance stems from its control over multiple aspects of the live music experience.

-

Ticketmaster's Unrivaled Market Share: Live Nation's ownership of Ticketmaster, the world's leading ticketing platform, provides a significant revenue stream and considerable market power. This control allows them to capture a large percentage of ticket sales for countless concerts and events worldwide.

-

Venue Ownership and Operation: Live Nation owns and operates a vast portfolio of amphitheaters, arenas, and other venues globally. This vertical integration provides substantial revenue from ticket sales, concessions, and sponsorships within their own venues. This aspect minimizes reliance on external venues and provides greater control over the event experience.

-

Diversified Revenue Streams: Beyond ticketing and venue operation, Live Nation generates revenue from sponsorship deals with major brands, artist management contracts, and even through its own festivals. This diversification helps cushion the company against potential downturns in any one specific area.

-

Global Reach and Market Diversification: Live Nation's global footprint exposes it to various music genres and artist demographics, mitigating the risk of over-reliance on specific artists or musical trends. This broad exposure to international markets also offers significant growth potential.

-

Historical Revenue Trends and Growth Projections: Analysis of historical data reveals consistent revenue growth for Live Nation, although this growth has been impacted by factors such as global pandemics. Future projections often rely on factors like the resurgence of live music attendance and continued expansion into new markets.

Assessing the Potential Returns of Investing in LYV Stock

Keywords: LYV stock price, stock performance, dividend yield, capital appreciation, future growth potential, market valuation.

Investing in LYV stock presents the opportunity for substantial returns, but understanding the potential avenues of return is crucial.

-

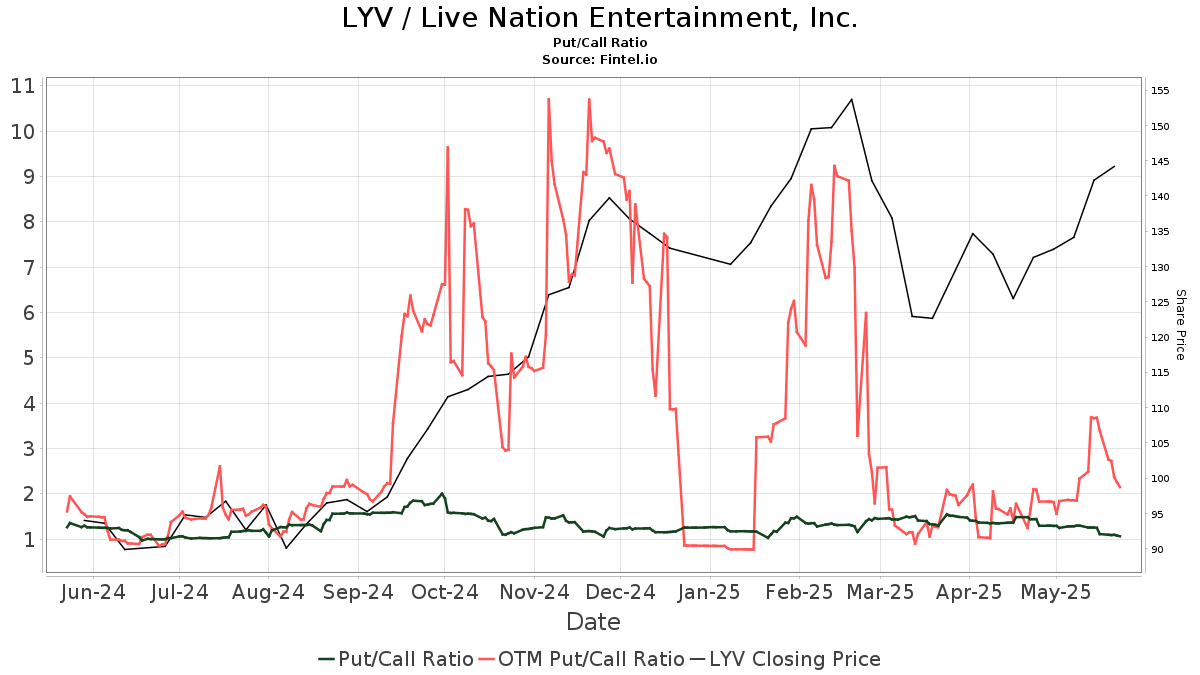

Historical Stock Performance and Volatility: A review of LYV's historical stock performance reveals periods of strong growth interspersed with periods of volatility, reflecting the cyclical nature of the entertainment industry. Understanding this volatility is key to managing investment risk.

-

Potential for Capital Appreciation: Industry analysts frequently forecast continued growth for Live Nation, fueled by factors such as increased concert attendance, international expansion, and the continued evolution of the live music experience. This potential for capital appreciation makes LYV an attractive prospect for long-term investors.

-

Dividend Payouts and Potential Growth: While not a primary focus, LYV's dividend payouts can provide a supplementary income stream for investors. The potential for dividend growth depends on the company's financial performance and overall strategy.

-

Valuation Metrics Compared to Competitors: A key component of any stock analysis is a comparative valuation analysis with competitors in the entertainment industry. This involves comparing key metrics such as Price-to-Earnings (P/E) ratio, to determine if LYV is fairly valued or presents an opportunity.

-

Long-Term Growth Opportunities: Live Nation's long-term growth is tied to several factors, including successful festival expansion, international market penetration, and the adaptation to evolving technological trends within the entertainment industry.

Identifying and Evaluating the Risks Associated with Live Nation Entertainment

Keywords: LYV stock risks, economic downturn, competition, pandemic impact, regulatory risks, artist cancellations.

While the potential returns are enticing, investing in LYV stock isn't without its risks. A comprehensive understanding of these risks is vital for informed investment decisions.

-

Economic Downturn Vulnerability: As discretionary spending is often the first to be cut during an economic downturn, Live Nation's revenue is inherently vulnerable to economic fluctuations. Concert attendance can significantly decrease during economic hardship.

-

Competition from Other Entertainment Companies and Streaming Services: The entertainment landscape is fiercely competitive. Live Nation faces competition from other concert promoters, streaming services offering alternative forms of entertainment, and other leisure activities vying for consumer spending.

-

Pandemic Impact and Unforeseen Events: The COVID-19 pandemic highlighted the vulnerability of the live events industry to unforeseen circumstances. Future pandemics, or other major unforeseen events, could significantly impact Live Nation's revenue.

-

Regulatory Risks and Antitrust Concerns: Ticketmaster's market dominance has resulted in ongoing regulatory scrutiny and antitrust concerns. Adverse regulatory decisions could significantly impact Live Nation's operations and profitability.

-

Risk of Artist Cancellations: The cancellation of major artists due to illness, unforeseen circumstances, or other factors can cause significant revenue loss for Live Nation, impacting its financial performance.

Specific Risk Mitigation Strategies

Keywords: risk management, diversification, investment strategy, portfolio allocation.

To mitigate the risks associated with investing in LYV stock, investors should employ several strategic approaches.

-

Diversification: Diversifying your investment portfolio across different asset classes is essential to reduce the overall risk exposure. Don't put all your eggs in one basket!

-

Thorough Due Diligence: Before investing in LYV stock, conduct comprehensive research and analysis of the company's financial statements, industry trends, and competitive landscape.

-

Regular Monitoring: Regularly monitor LYV's financial performance, news, and industry trends to stay informed about any significant changes that might impact your investment.

-

Alternative Investment Options: Consider diversifying your investment portfolio to include alternative investment options within the broader entertainment or financial markets.

Conclusion

Investing in Live Nation Entertainment (LYV) presents the potential for substantial returns, fueled by its market leadership and diversified revenue streams. However, it's imperative to acknowledge the inherent risks, including economic susceptibility, competition, and the impact of unforeseen events. A thorough risk assessment and a well-diversified investment strategy are crucial for mitigating potential losses. Before making any investment decisions regarding Live Nation Entertainment (LYV), conduct exhaustive research and consider seeking advice from a qualified financial advisor to ensure it aligns with your personal risk tolerance and long-term financial aspirations. Begin your analysis of Live Nation Entertainment (LYV) today!

Featured Posts

-

Aftenpostens Arets Redaktor En Fortjent Utmerkelse

May 29, 2025

Aftenpostens Arets Redaktor En Fortjent Utmerkelse

May 29, 2025 -

Rsalt Thnyt Mn Alshykh Fysl Alhmwd Bmnasbt Eyd Astqlal Alardn

May 29, 2025

Rsalt Thnyt Mn Alshykh Fysl Alhmwd Bmnasbt Eyd Astqlal Alardn

May 29, 2025 -

Mein Schiff Relax Christening Robbie Williams Star Performance

May 29, 2025

Mein Schiff Relax Christening Robbie Williams Star Performance

May 29, 2025 -

Doj Lawsuit Against Live Nation Fuels Criticism Of Board Appointment

May 29, 2025

Doj Lawsuit Against Live Nation Fuels Criticism Of Board Appointment

May 29, 2025 -

Analyzing Arcane Changes To League Of Legends Lore And Their Effect On 2 Xko Strategies

May 29, 2025

Analyzing Arcane Changes To League Of Legends Lore And Their Effect On 2 Xko Strategies

May 29, 2025

Latest Posts

-

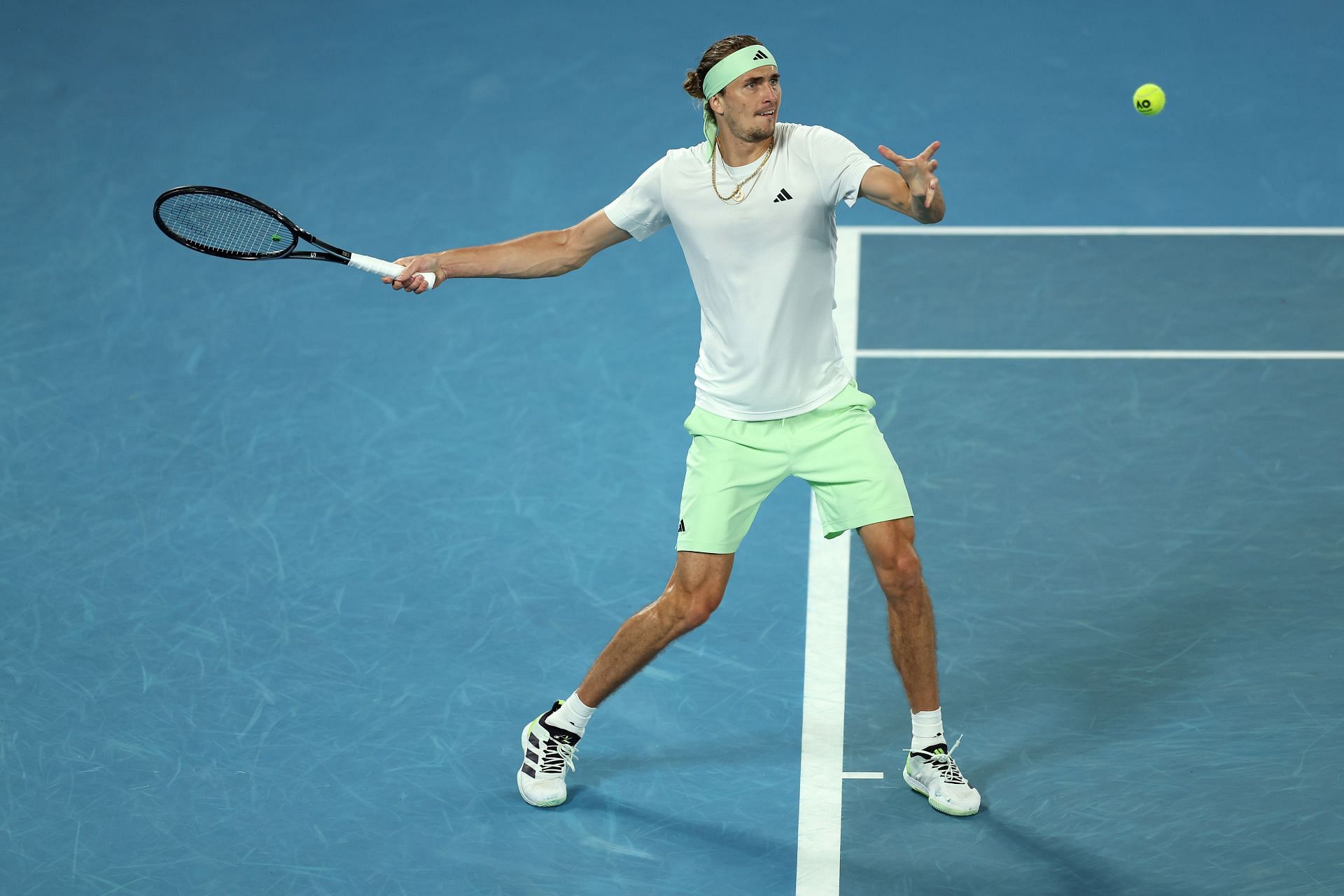

Indian Wells 2024 Zverevs Tournament Cut Short By Griekspoor

May 31, 2025

Indian Wells 2024 Zverevs Tournament Cut Short By Griekspoor

May 31, 2025 -

Zverevs Indian Wells Campaign Ends Early Griekspoor Upsets Top Seed

May 31, 2025

Zverevs Indian Wells Campaign Ends Early Griekspoor Upsets Top Seed

May 31, 2025 -

Zverevs Indian Wells Loss A Griekspoor Masterclass

May 31, 2025

Zverevs Indian Wells Loss A Griekspoor Masterclass

May 31, 2025 -

Upset In The Desert Griekspoor Defeats Top Seeded Zverev At Indian Wells

May 31, 2025

Upset In The Desert Griekspoor Defeats Top Seeded Zverev At Indian Wells

May 31, 2025 -

Alexander Zverev Loses To Tallon Griekspoor At Indian Wells

May 31, 2025

Alexander Zverev Loses To Tallon Griekspoor At Indian Wells

May 31, 2025