Analyzing Market Swings: Professional Vs. Individual Investor Behavior

Table of Contents

Professional Investor Behavior During Market Swings

Professional investors, such as fund managers and institutional traders, approach market swings with a vastly different mindset than individual investors. Their strategies are built upon sophisticated methodologies and a long-term perspective.

Sophisticated Risk Management Strategies

Professional investors utilize a robust arsenal of tools and techniques to mitigate risk during market volatility. This proactive approach minimizes potential losses and maximizes opportunities.

- Utilize advanced analytical tools and models: They employ quantitative analysis, econometric modeling, and scenario planning to forecast market movements and assess potential risks. This data-driven approach allows them to anticipate and react to market swings more effectively than those relying on gut feeling.

- Employ hedging techniques: Hedging strategies, such as using options and futures contracts, are frequently employed to offset potential losses in one investment by taking an opposite position in another. This helps to neutralize some of the impact of negative market movements.

- Diversify portfolios across asset classes and geographies: Professional investors rarely put all their eggs in one basket. They diversify across stocks, bonds, real estate, and other asset classes, geographically spreading their risk to reduce the impact of localized market downturns.

- Implement stop-loss orders: These orders automatically sell a security when it reaches a predetermined price, limiting potential losses. This is a crucial risk management tool employed by professionals to prevent significant capital erosion during market corrections.

- Regularly rebalance portfolios: Maintaining a target asset allocation is paramount. Professional investors regularly rebalance their portfolios to ensure they remain aligned with their long-term investment strategy, adjusting to changing market conditions.

- Detail: Professional investors often have access to proprietary research and data, providing a significant advantage during volatile periods. This includes in-depth fundamental analysis, access to expert networks, and cutting-edge technological tools that allow for early identification of potential market shifts.

Long-Term Investment Horizon

A defining characteristic of professional investors is their focus on the long term. They view market corrections not as crises but as opportunities.

- Focus on long-term growth rather than short-term gains: Their investment decisions are primarily driven by fundamental analysis and long-term market trends, rather than short-term price fluctuations.

- Tend to remain disciplined and avoid impulsive reactions: They resist the urge to panic sell during downturns or chase performance in bull markets. Their disciplined approach allows them to capitalize on market inefficiencies and long-term growth prospects.

- View market corrections as opportunities to buy undervalued assets: They see dips in the market as a chance to acquire high-quality assets at discounted prices, enhancing their long-term returns.

- Their investment decisions are based on fundamental analysis and long-term market trends: This contrasts sharply with individual investors who may be swayed by short-term news and sentiment.

- Detail: The ability to maintain a long-term perspective is a key differentiator between professional and individual investors during market swings. This patience and discipline are crucial for achieving superior long-term investment results.

Individual Investor Behavior During Market Swings

Individual investors, while potentially savvy, often lack the experience, resources, and emotional detachment of their professional counterparts. This can lead to suboptimal decisions during market swings.

Emotional Decision-Making

Fear and greed are powerful emotions that often drive individual investor behavior, leading to impulsive actions and poor investment choices.

- Often driven by fear and greed: Market downturns trigger fear, prompting panic selling, while bull markets fuel greed, leading to impulsive buying at inflated prices.

- Prone to herd behavior: They often mimic the actions of others without conducting independent analysis, exacerbating market swings.

- May panic sell during market downturns, locking in losses: This is a common mistake that significantly reduces overall returns.

- May chase performance in bull markets, buying at inflated prices: This can result in substantial losses when the market corrects.

- Detail: Behavioral biases heavily influence individual investor decisions, often resulting in suboptimal outcomes. These biases can be mitigated through education and a conscious effort to make rational investment choices.

Limited Risk Management

Individual investors often lack the sophisticated risk management tools and knowledge possessed by professionals. This vulnerability increases significantly during market volatility.

- Often lack the sophisticated tools and knowledge to effectively manage risk: This includes a lack of understanding of hedging techniques, diversification strategies, and risk assessment models.

- May have concentrated portfolios, increasing vulnerability to market fluctuations: Over-reliance on a few investments magnifies the impact of negative market movements.

- Limited understanding of diversification and asset allocation strategies: This lack of knowledge increases exposure to individual stock or sector risks.

- May fail to rebalance their portfolio regularly: Neglecting rebalancing allows portfolios to drift away from their target asset allocation, amplifying risk.

- Detail: A lack of proper risk management practices significantly increases individual investors' vulnerability during market swings. Education and planning are crucial for mitigating this risk.

Short-Term Focus

The tendency to focus on short-term price movements rather than long-term growth is another common pitfall for individual investors.

- Tend to focus on short-term price movements, leading to frequent trading: This increases transaction costs and reduces overall returns.

- May be easily influenced by market noise and short-term news: They may react impulsively to news headlines without considering the underlying fundamentals.

- High transaction costs can erode returns over time: Frequent trading increases brokerage fees and taxes, significantly diminishing profits.

- May miss out on long-term growth opportunities: Short-term focus can cause investors to sell assets prematurely, missing out on significant long-term gains.

- Detail: The short-term focus often results in missed opportunities and increased transaction costs, impacting overall investment performance negatively.

Conclusion

Analyzing market swings reveals significant differences in the behavior of professional and individual investors. Professionals typically employ sophisticated risk management techniques, maintain a long-term perspective, and make data-driven decisions. Conversely, individual investors are often susceptible to emotional biases, limited risk management, and a short-term focus. Understanding these differences is crucial for both professional and individual investors to develop effective strategies for navigating market volatility. By learning from the approaches of professional investors and acknowledging your own behavioral biases, you can improve your ability to analyze market swings and make more informed investment decisions. Continue to learn about analyzing market swings and refine your investment approach for better long-term outcomes. Start improving your understanding of market volatility today and build a more resilient investment strategy.

Featured Posts

-

Max Frieds Yankee Debut 12 3 Victory Over Pirates

Apr 28, 2025

Max Frieds Yankee Debut 12 3 Victory Over Pirates

Apr 28, 2025 -

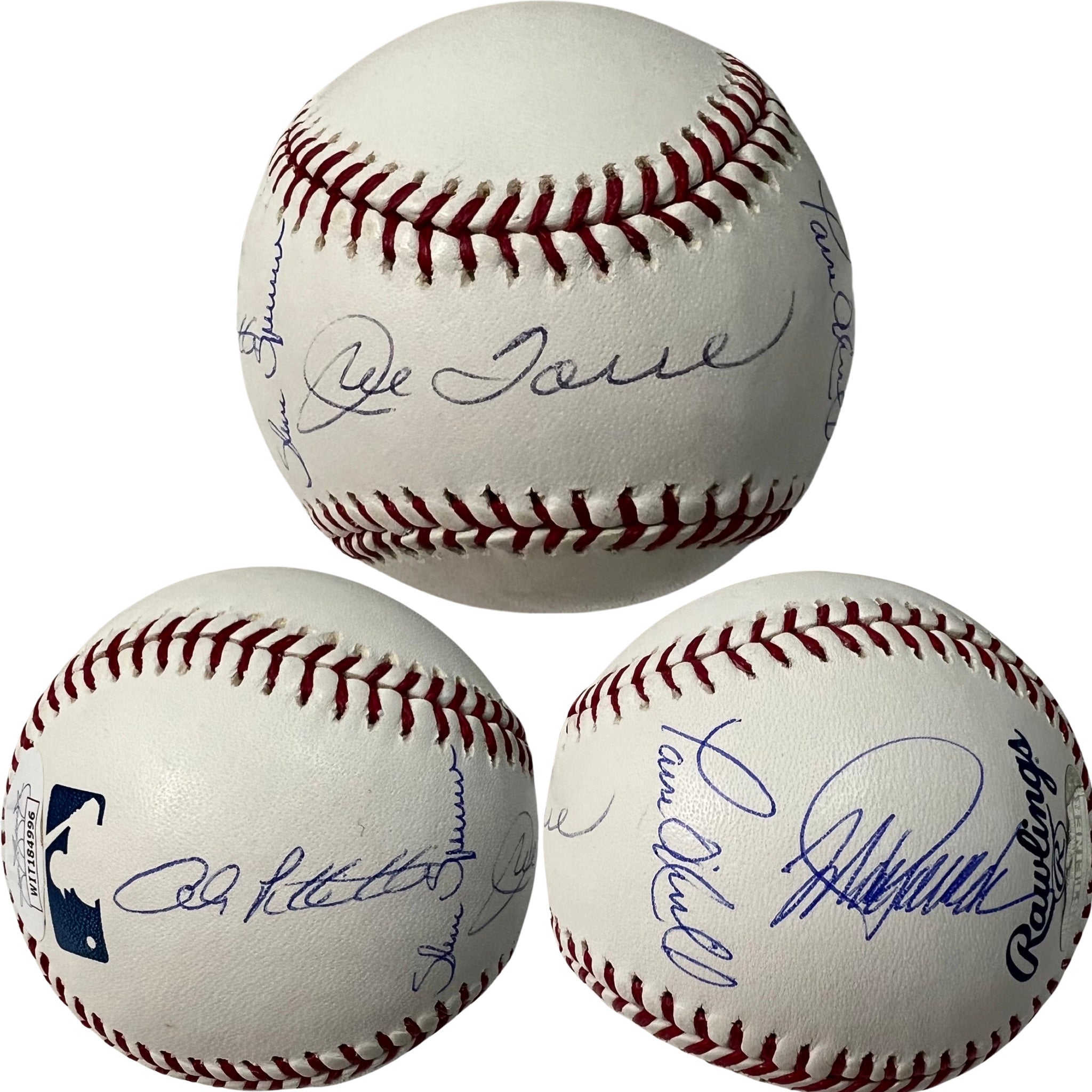

A Look Back The 2000 Yankees Joe Torre And Andy Pettittes Key Performances

Apr 28, 2025

A Look Back The 2000 Yankees Joe Torre And Andy Pettittes Key Performances

Apr 28, 2025 -

Chinoiserie And Feminism The Metropolitan Museum Of Arts Monstrous Beauty Exhibition

Apr 28, 2025

Chinoiserie And Feminism The Metropolitan Museum Of Arts Monstrous Beauty Exhibition

Apr 28, 2025 -

Pirates Defeat Yankees In Extra Innings With Walk Off

Apr 28, 2025

Pirates Defeat Yankees In Extra Innings With Walk Off

Apr 28, 2025 -

Aaron Judge And Samantha Bracksieck Announce Babys Arrival

Apr 28, 2025

Aaron Judge And Samantha Bracksieck Announce Babys Arrival

Apr 28, 2025