Analyzing NCLH Stock: What Are Hedge Funds Saying?

Table of Contents

Recent Hedge Fund Activity in NCLH

Analyzing hedge fund activity offers valuable clues about market sentiment. One primary source of information is 13F filings.

Analyzing 13F Filings

13F filings are quarterly reports submitted by institutional investment managers with over $100 million in assets under management. These filings disclose their equity holdings, providing a snapshot of their investment strategies. Analyzing these filings for NCLH can reveal significant insights into hedge fund sentiment. However, it's crucial to remember that 13F filings have limitations. They typically lag by several weeks, and they don't disclose short positions (bets against a stock's price).

- Note: Due to the constantly changing nature of financial markets and the confidential nature of some hedge fund strategies, specific hedge fund positions and percentage changes in NCLH holdings are not consistently publicly available in real-time. Therefore, specific examples of hedge fund activity would require access to constantly updating premium financial databases, which is beyond the scope of this article. To get the most recent and detailed information, you'll need to consult dedicated financial news sources and databases.

Interpreting Hedge Fund Sentiment

While precise details on individual hedge fund movements are dynamic and require specialized resources, we can generally observe overall trends. By monitoring news reports and analyzing available data from financial news sites, we can gauge whether the prevailing sentiment towards NCLH is positive, negative, or neutral. For instance, a significant increase in NCLH holdings across multiple hedge funds might suggest a positive outlook on the cruise industry's recovery and the company's future prospects. Conversely, a widespread decrease in holdings might indicate concerns about the company's financial performance or the overall economic climate. Several factors could contribute to this sentiment, such as:

- Positive outlook on the cruise industry's recovery from the pandemic.

- Concerns about lingering economic uncertainty impacting travel spending.

- NCLH's specific financial performance, including revenue growth and debt levels.

- Competitor analysis, comparing NCLH's performance to Carnival and Royal Caribbean.

NCLH Stock Performance and Future Outlook

To assess NCLH's investment potential, examining its financial health and the broader industry landscape is crucial.

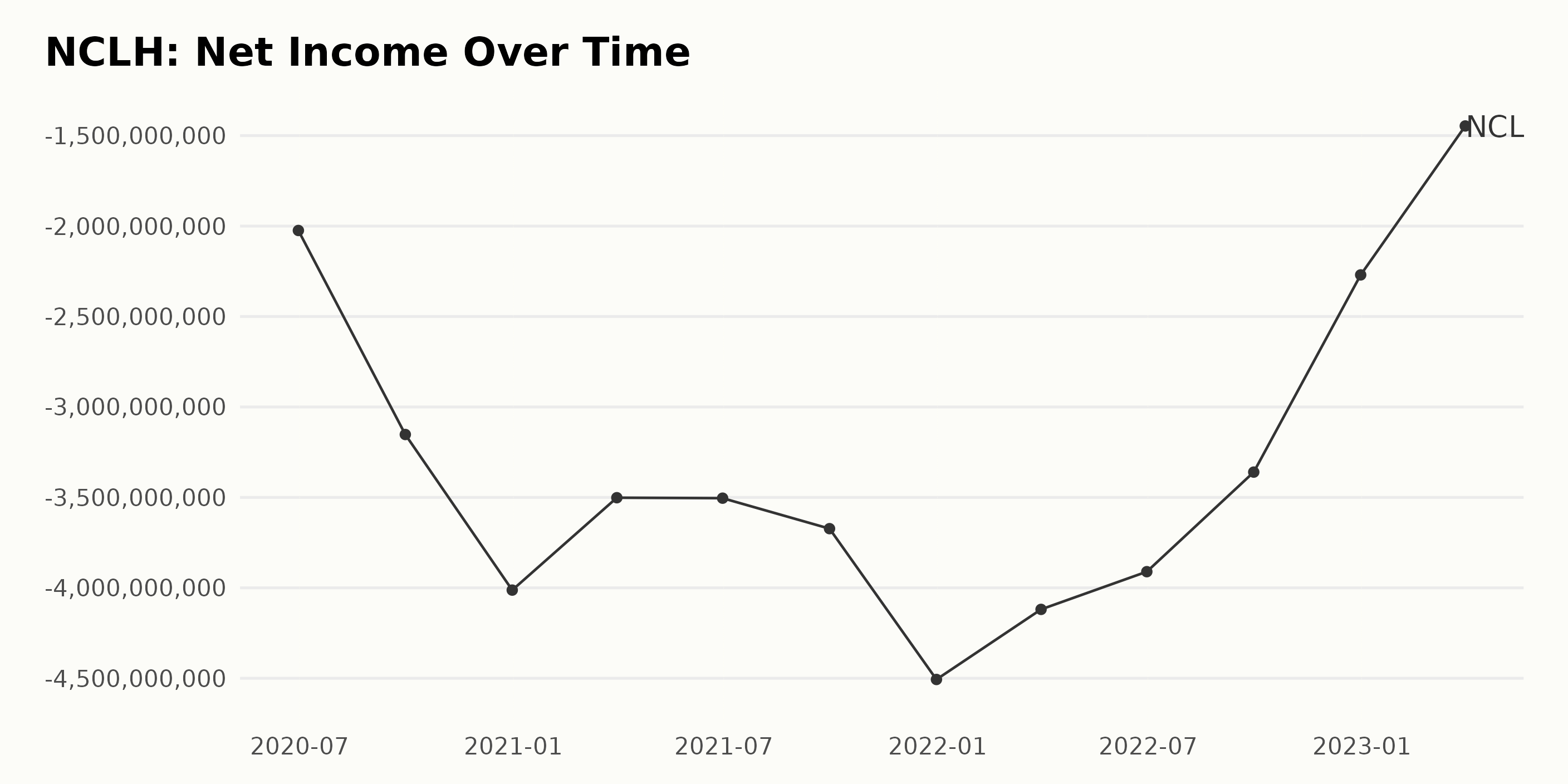

Analyzing Key Financial Metrics

Analyzing NCLH's key financial metrics provides insights into its performance and future prospects. Essential metrics include:

- Revenue Growth: Examining year-over-year and quarter-over-quarter revenue growth reveals the company's ability to attract passengers and generate sales.

- Earnings Per Share (EPS): EPS indicates profitability, showing how much profit the company generates for each outstanding share.

- Debt Levels: High debt levels can pose a significant risk, especially in an uncertain economic environment.

- Cash Flow: Strong positive cash flow indicates the company's ability to generate funds for operations, investments, and debt repayment.

Comparing these metrics to industry averages and previous periods helps assess NCLH's performance relative to its competitors and its own historical trends. Accessing this information requires reviewing NCLH's quarterly and annual reports, readily available on the company's investor relations website.

Industry Trends and Competitive Landscape

The cruise industry's recovery is a key factor influencing NCLH's performance. Analyzing industry trends and the competitive landscape is crucial. Key considerations include:

- Industry-wide recovery: The pace of the industry's recovery from the pandemic significantly impacts NCLH's prospects.

- Fuel prices: Fluctuations in fuel prices directly impact operating costs for cruise lines.

- Tourism trends: Overall tourism patterns and consumer spending heavily influence demand for cruises.

- Geopolitical events: Global events can affect travel patterns and consumer confidence.

- Competition: Analyzing the performance of key competitors like Carnival and Royal Caribbean provides valuable context for assessing NCLH's market position and competitive advantages.

Risks and Opportunities for NCLH Investors

Investing in NCLH stock presents both potential upside and downside risks. A comprehensive analysis requires considering both aspects.

Potential Upside

Several factors could drive NCLH stock price appreciation:

- Strong booking numbers: Increased passenger bookings indicate strong demand and revenue growth potential.

- Successful cost-cutting measures: Efficient cost management improves profitability and shareholder value.

- Expansion into new markets: Entering new markets diversifies revenue streams and reduces reliance on existing regions.

- Innovative offerings: Introducing new onboard experiences and services can enhance the customer experience and attract new passengers.

Potential Downsides

Investing in NCLH also involves risks:

- Economic downturn: A recession could significantly reduce discretionary spending on leisure activities like cruises.

- Renewed pandemic concerns: The emergence of new variants or unexpected outbreaks could again disrupt travel and negatively impact demand.

- Increased competition: Intense competition from other cruise lines could put pressure on pricing and profitability.

- Operational challenges: Unexpected operational issues, such as ship maintenance or accidents, can disrupt operations and negatively impact the company's reputation.

Conclusion

Analyzing NCLH stock requires a thorough evaluation of hedge fund activity, the company's financial performance, and the broader industry landscape. While the specific actions of individual hedge funds are not always publicly available in real-time, observing overall trends in 13F filings and news reports can offer valuable insights. The cruise industry's recovery presents both significant opportunities and considerable risks for investors. Understanding these dynamics and conducting thorough due diligence are crucial before making any investment decisions. Remember to always conduct your own due diligence before investing in NCLH stock or any other security. Further analysis of NCLH stock and hedge fund activity is crucial for informed investment strategies.

Featured Posts

-

Tanner Bibees First Pitch Homer Guardians Comeback Win Against Yankees

May 01, 2025

Tanner Bibees First Pitch Homer Guardians Comeback Win Against Yankees

May 01, 2025 -

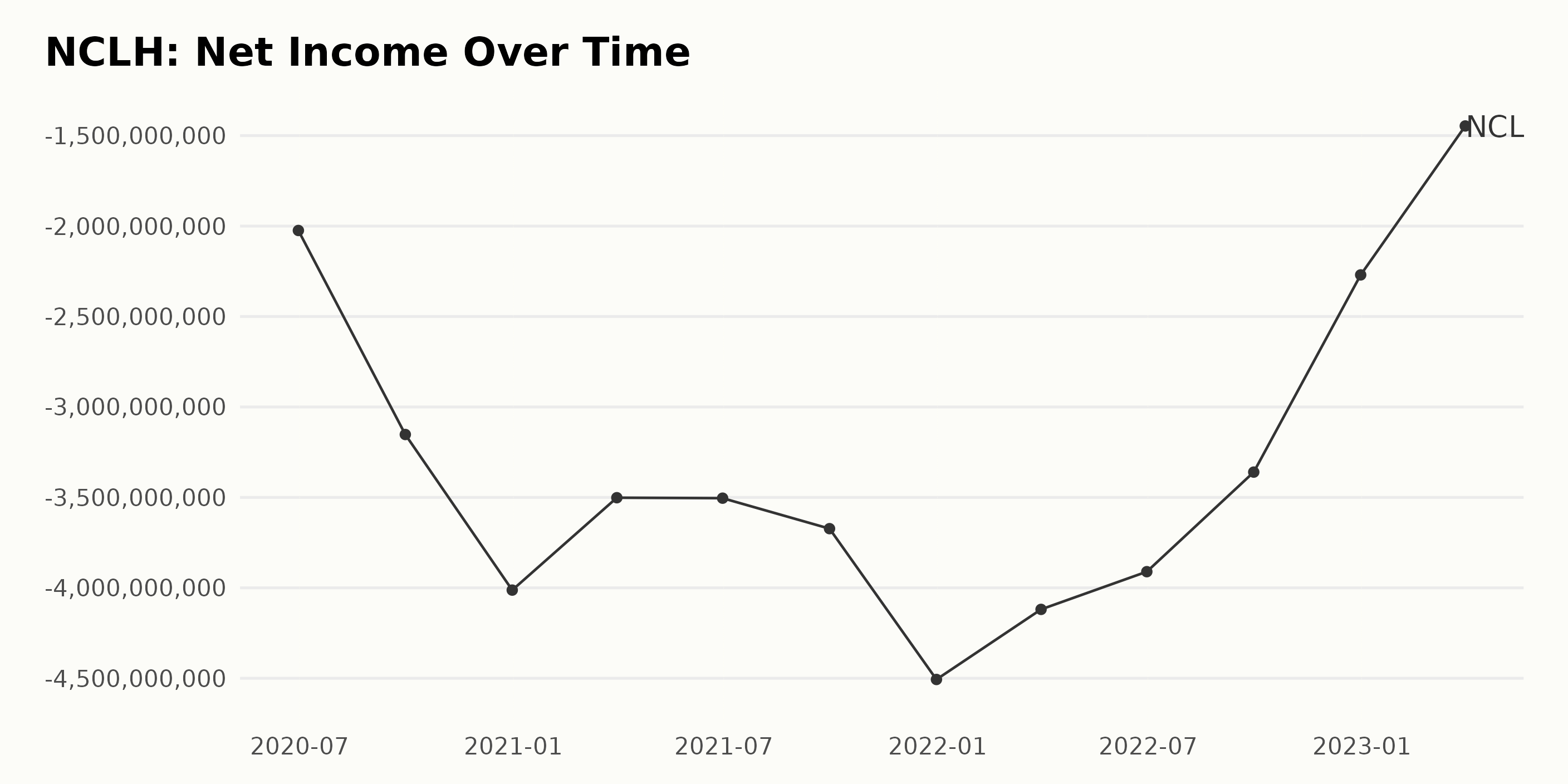

Rising Global Defense Spending A Focus On Europes Security Concerns

May 01, 2025

Rising Global Defense Spending A Focus On Europes Security Concerns

May 01, 2025 -

Idant Ryys Shbab Bn Jryr Tfasyl Alqdyt W Ewaqbha

May 01, 2025

Idant Ryys Shbab Bn Jryr Tfasyl Alqdyt W Ewaqbha

May 01, 2025 -

Six Nations Rugby 2024 A French Victory Englands Powerful Performance And Setbacks For Scotland And Ireland

May 01, 2025

Six Nations Rugby 2024 A French Victory Englands Powerful Performance And Setbacks For Scotland And Ireland

May 01, 2025 -

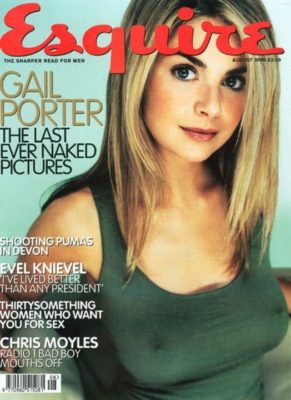

Royal Support For The Homeless Prince Williams Scottish Visit With Gail Porter

May 01, 2025

Royal Support For The Homeless Prince Williams Scottish Visit With Gail Porter

May 01, 2025